1. What is the projected Compound Annual Growth Rate (CAGR) of the Lung Cancer Liquid Biopsy?

The projected CAGR is approximately 11.52%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lung Cancer Liquid Biopsy

Lung Cancer Liquid BiopsyLung Cancer Liquid Biopsy by Type (Exosomes and RNA, CTCs and ctDNA), by Application (Hospitals, Clinics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global lung cancer liquid biopsy market is projected for substantial expansion, driven by escalating lung cancer incidence, rapid advancements in molecular diagnostics, and a growing preference for minimally invasive procedures. Key growth catalysts include the increasing demand for early detection and personalized treatment approaches. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing test sensitivity and specificity, enabling more accurate diagnoses and targeted therapies. The market is segmented by biomarker type (exosomes, RNA, CTCs, ctDNA) and application (hospitals, clinics, research settings).

Despite potential restraints like high initial investment and regulatory challenges, the market outlook is positive, supported by continuous R&D and increasing adoption. A competitive landscape featuring established companies and emerging biotech firms will foster further innovation and accessibility. The market is expected to reach $13.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.52% from the base year 2025.

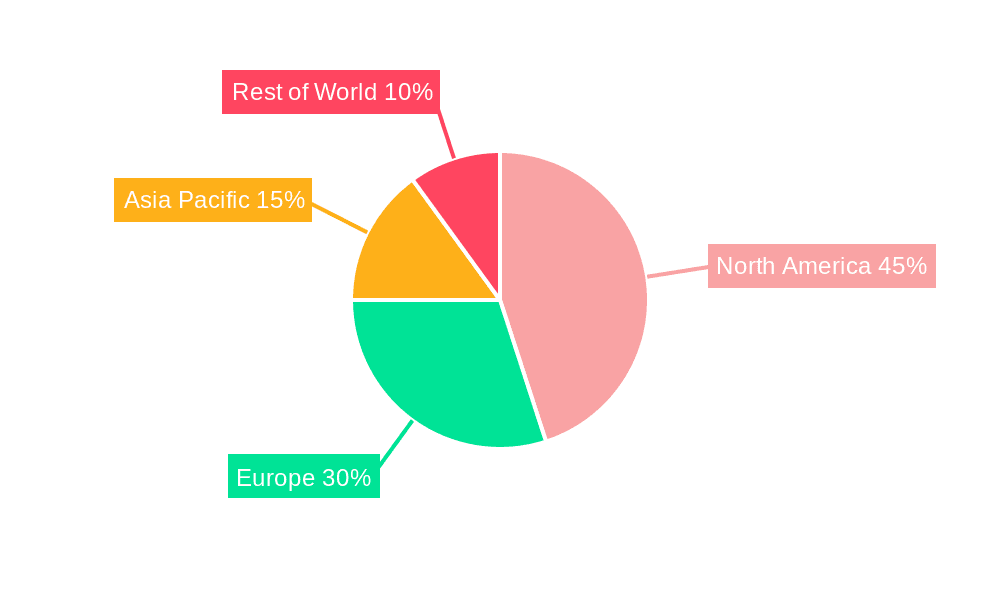

Geographically, North America currently dominates due to advanced healthcare infrastructure and early technology adoption. However, Asia-Pacific and other emerging markets are experiencing significant growth, fueled by increased healthcare spending, heightened awareness, and supportive government initiatives for early cancer detection. The market is evolving towards personalized medicine, with liquid biopsies playing a crucial role in tailoring treatments. This trend, alongside ongoing technological progress, will ensure sustained growth.

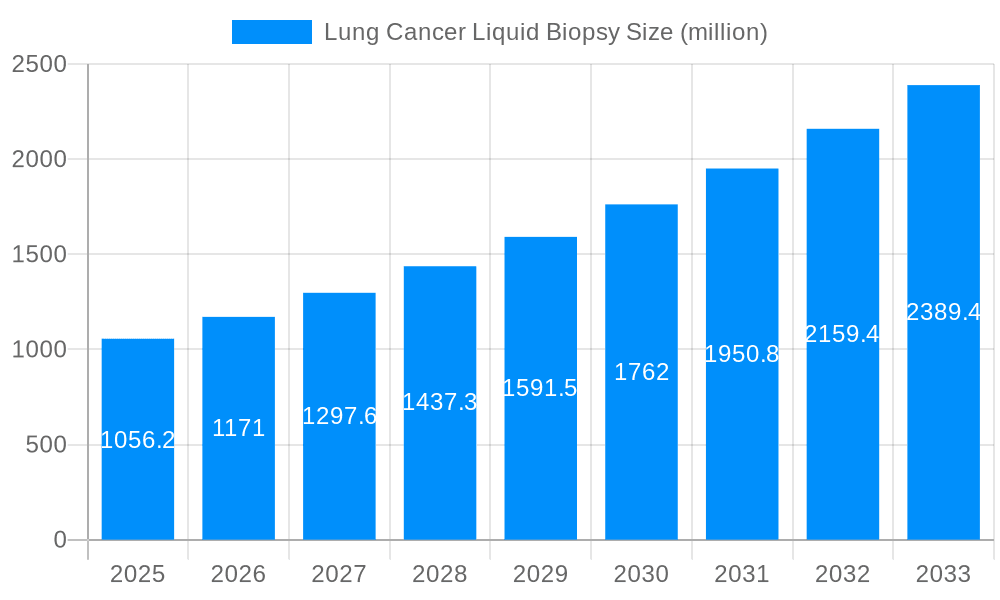

The global lung cancer liquid biopsy market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. Driven by advancements in molecular diagnostics and a rising need for minimally invasive diagnostic tools, the market showcased a significant Compound Annual Growth Rate (CAGR) during the historical period (2019-2024). The estimated market value in 2025 positions this sector as a key player in the oncology diagnostics landscape. This growth is fueled by several factors, including the increasing prevalence of lung cancer globally, the limitations of traditional biopsy methods, and the potential for earlier and more accurate diagnosis using liquid biopsies. The market's expansion is further accelerated by technological innovations leading to increased sensitivity and specificity of liquid biopsy assays, enabling the detection of even minute amounts of circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes. The development of multiplex assays capable of simultaneously analyzing multiple biomarkers further enhances the diagnostic power of liquid biopsies, leading to personalized treatment strategies. The adoption of liquid biopsy is steadily increasing across hospitals and clinics, representing a substantial market segment and contributing to the overall market valuation of several billion dollars. However, regulatory hurdles, reimbursement challenges, and the relatively high cost of liquid biopsy assays compared to traditional methods still pose limitations to wider market adoption. Despite these challenges, continued technological advancements and an increased focus on clinical validation are expected to drive significant growth throughout the forecast period (2025-2033), making liquid biopsy a pivotal tool in the fight against lung cancer.

Several key factors are driving the expansion of the lung cancer liquid biopsy market. The increasing prevalence of lung cancer globally, coupled with its high mortality rate, necessitates the development of more effective diagnostic and monitoring tools. Traditional biopsy methods, such as tissue biopsies, are often invasive, risky, and not always feasible for all patients. Liquid biopsy offers a less invasive alternative, allowing for repeated sampling with minimal patient discomfort. Furthermore, the ability of liquid biopsy to detect minimal residual disease (MRD) after treatment is crucial for monitoring treatment response and detecting recurrence early. The advancements in next-generation sequencing (NGS) and other molecular technologies have significantly improved the sensitivity and specificity of liquid biopsy assays. This means that smaller amounts of cancer-related biomarkers can be detected, enabling earlier and more precise diagnosis. The growing demand for personalized medicine further fuels market growth, as liquid biopsies allow for the identification of specific genomic alterations that guide tailored treatment strategies. The rising investment in research and development activities by both public and private entities is also instrumental in driving innovation and expanding the applications of liquid biopsy in lung cancer management. Finally, the increasing awareness among healthcare professionals and patients regarding the benefits of liquid biopsy is promoting wider adoption and market expansion.

Despite its promise, the lung cancer liquid biopsy market faces several challenges. The standardization of liquid biopsy assays remains a significant hurdle, leading to inconsistencies in results across different laboratories. Lack of standardization hinders the comparability of data, limiting clinical utility and hindering widespread acceptance. The high cost associated with liquid biopsy testing, compared to traditional methods, can limit accessibility, particularly in resource-constrained settings. Regulatory approvals and reimbursement policies vary across different countries, creating obstacles for market penetration. Furthermore, the interpretation of liquid biopsy results can be complex and requires specialized expertise, which may not be readily available in all healthcare settings. The presence of heterogeneous tumor populations and the potential for false-positive or false-negative results due to technical limitations are also challenges that need to be addressed. Finally, the lack of extensive long-term clinical data to demonstrate the efficacy of liquid biopsy for specific applications, such as early detection or monitoring of treatment response, can limit its widespread adoption. These challenges need to be overcome through continued research, development of standardized protocols, and increased investment in technology.

The North American market, particularly the United States, is expected to hold a significant share of the global lung cancer liquid biopsy market throughout the forecast period. This is attributed to the high prevalence of lung cancer, advanced healthcare infrastructure, increased adoption of innovative diagnostic technologies, and robust regulatory frameworks. Furthermore, the presence of major market players and extensive research activities in the region further contribute to its market dominance. Europe is another key market, with a rapidly growing demand driven by rising awareness of liquid biopsy's advantages and increasing government support for advanced diagnostic tools.

The growth of the ctDNA and CTCs segment and the Hospitals application segment are intertwined, driving significant market value in the millions of dollars. These segments are fueled by several factors, including technological improvements increasing the sensitivity and specificity of the tests, wider reimbursement coverage, and increasing awareness among oncologists of the benefits of liquid biopsy over traditional methods for lung cancer diagnosis and management.

The ongoing technological advancements in next-generation sequencing, coupled with the development of more sensitive and specific assays for detecting cancer-related biomarkers in blood samples, significantly contribute to the market's growth. The increasing prevalence of lung cancer and the limitations of traditional biopsy techniques further accelerate the adoption of minimally invasive liquid biopsy approaches. Furthermore, the growing demand for personalized medicine, driven by the need for tailored cancer therapies, is a major catalyst for market expansion. Favorable regulatory landscapes and reimbursement policies in key markets are also driving growth by making liquid biopsy technologies more accessible. Finally, significant investments in research and development activities are paving the way for continuous innovation and improvements within this sector.

This report provides a comprehensive overview of the global lung cancer liquid biopsy market, analyzing market trends, driving forces, challenges, key players, and significant developments. The report offers detailed market segmentation by type (Exosomes and RNA, CTCs and ctDNA), application (Hospitals, Clinics, Others), and key geographical regions. It provides valuable insights into the market dynamics, highlighting future growth opportunities and potential challenges for stakeholders. The report uses data from the historical period (2019-2024), the base year (2025), the estimated year (2025), and provides forecasts for the period 2025-2033. This comprehensive analysis is invaluable for companies operating in or intending to enter the lung cancer liquid biopsy market, enabling informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.52% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.52%.

Key companies in the market include RainDanceTechnologies, Biocartis, Qiagen, Guardant Health, MDxHealth, Pathway Genomics, NeoGenomics Laboraories, Sysmex Inostics, Cynvenio, Menarini Silicon Biosystems, Adaptive Biotechnologies, Biocept, Angle plc, .

The market segments include Type, Application.

The market size is estimated to be USD 13.6 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Lung Cancer Liquid Biopsy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lung Cancer Liquid Biopsy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.