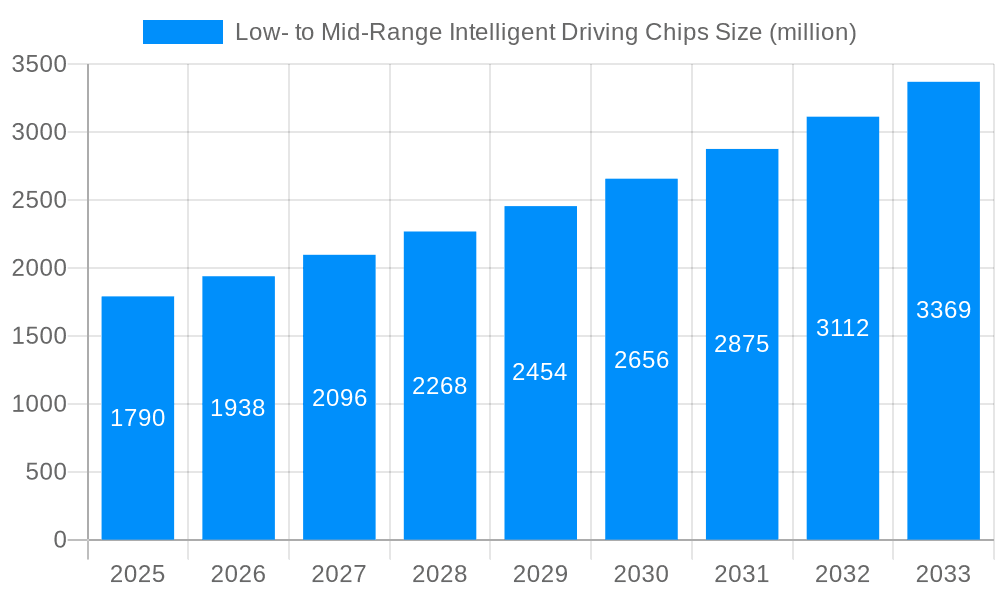

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low- to Mid-Range Intelligent Driving Chips?

The projected CAGR is approximately 8.3%.

Low- to Mid-Range Intelligent Driving Chips

Low- to Mid-Range Intelligent Driving ChipsLow- to Mid-Range Intelligent Driving Chips by Type (Below 30TOPS, 30-100TOPS), by Application (Commercial Vehicle, Passenger Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

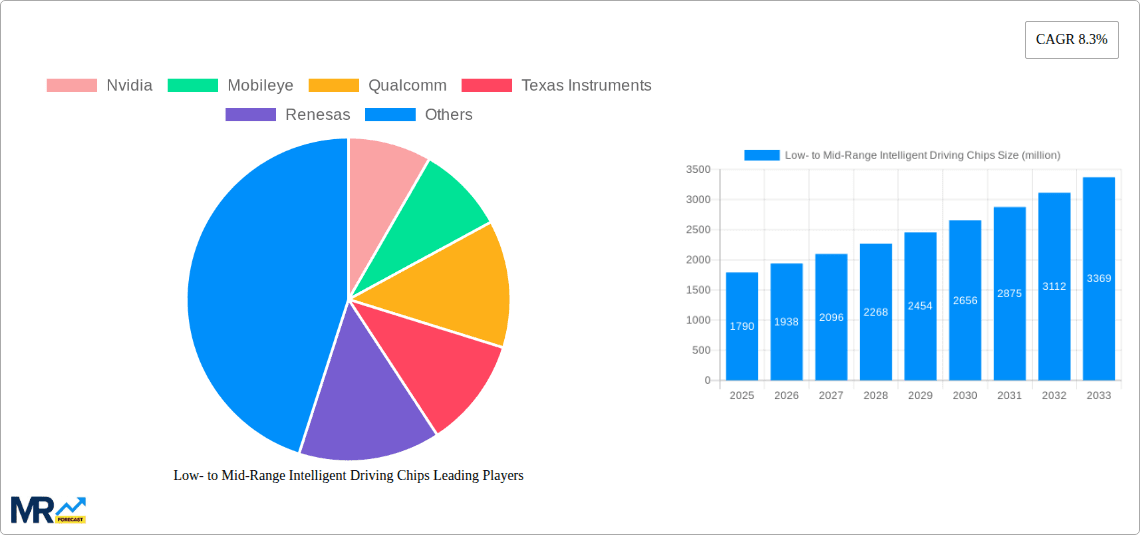

The Low- to Mid-Range Intelligent Driving Chips market is poised for robust expansion, projected to reach an estimated USD 1790 million in 2025 with a significant Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This dynamic growth is fueled by escalating consumer demand for enhanced safety features and advanced driver-assistance systems (ADAS) in passenger vehicles, coupled with the increasing adoption of intelligent solutions in commercial transportation for improved efficiency and operational safety. The market is segmented primarily by chip performance, with the "Below 30 TOPS" and "30-100 TOPS" categories representing the core of this segment, catering to a wide array of ADAS functionalities. Applications are broadly divided into Commercial Vehicles and Passenger Vehicles, both of which are experiencing rapid integration of AI-powered driving capabilities. Key industry players such as Nvidia, Mobileye, Qualcomm, and Texas Instruments are at the forefront, driving innovation and competition to meet the burgeoning needs of automotive manufacturers.

The strategic importance of intelligent driving chips in these mid-range performance segments stems from their ability to democratize advanced automotive technology, making sophisticated ADAS features more accessible across a wider spectrum of vehicle models. This accessibility is crucial for accelerating the broader adoption of autonomous and semi-autonomous driving capabilities. While the market is characterized by strong growth drivers including regulatory mandates for safety, the decreasing cost of processing power, and advancements in sensor fusion and AI algorithms, it also faces certain restraints. These include the complexity of integration, evolving regulatory landscapes across different regions, and the need for robust cybersecurity measures to protect connected vehicles from threats. However, the sustained investment in R&D by leading technology providers and automotive OEMs, coupled with a growing global fleet of vehicles incorporating these technologies, ensures a positive outlook for this critical segment of the automotive semiconductor industry.

This comprehensive report offers an in-depth analysis of the Low- to Mid-Range Intelligent Driving Chips market, focusing on the crucial segment of processing power ranging from Below 30 TOPS to 30-100 TOPS. The study meticulously examines the market dynamics from 2019 to 2033, with a Base Year of 2025 and a detailed Forecast Period spanning 2025-2033. Utilizing a Base Year of 2025 as a benchmark, the report will delve into the Historical Period of 2019-2024 to understand past trends and establish a foundation for future projections. The market size is quantified in millions of units, providing a clear picture of volume-driven growth.

The report explores the adoption of these chips across key applications, including Commercial Vehicles and Passenger Vehicles. It also considers emerging industrial applications where intelligent driving capabilities are gaining traction. Key industry players such as Nvidia, Mobileye, Qualcomm, Texas Instruments, Renesas, Horizon Robotics, and Black Sesame Technologies are analyzed, providing insights into their market strategies, technological advancements, and competitive landscape.

The low- to mid-range intelligent driving chips market is experiencing a significant surge in demand, driven by the accelerating adoption of advanced driver-assistance systems (ADAS) and the nascent stages of autonomous driving. These chips, characterized by processing power typically Below 30 TOPS and extending into the 30-100 TOPS range, are becoming indispensable components in both Passenger Vehicles and Commercial Vehicles. We project a substantial increase in shipments, potentially reaching tens of millions of units annually by 2025, and anticipating a compound annual growth rate (CAGR) of over 15% during the Forecast Period of 2025-2033. This growth is underpinned by increasing regulatory mandates for safety features, a growing consumer awareness and demand for enhanced vehicle safety and convenience, and the declining cost of these sophisticated semiconductor solutions. The market is witnessing a clear bifurcation: entry-level ADAS features like automatic emergency braking and lane keeping assist are increasingly relying on the cost-effective Below 30 TOPS solutions, while more advanced functionalities such as adaptive cruise control with traffic jam assist and basic parking automation are leveraging the capabilities of the 30-100 TOPS segment. The increasing sophistication of sensor fusion and AI algorithms, even at these mid-range processing levels, is enabling a wider array of intelligent features. The Historical Period of 2019-2024 has laid the groundwork, with initial deployments in premium vehicles now cascading down to mainstream models. This trend signifies a democratization of intelligent driving technology, making advanced safety and comfort features accessible to a broader consumer base and a wider spectrum of commercial vehicle fleets. Furthermore, the report will highlight how these chips are crucial for enabling Level 2 and Level 2+ autonomy, which are becoming standard offerings in many new vehicle models. The evolution of software-defined vehicles is also contributing, as these chips provide the necessary processing power for over-the-air updates and feature enhancements, extending the vehicle's lifespan and utility.

Several potent forces are collectively propelling the growth of the low- to mid-range intelligent driving chips market. Paramount among these is the escalating global emphasis on automotive safety. Governments worldwide are increasingly implementing stringent regulations that mandate the integration of ADAS features such as automatic emergency braking (AEB), lane departure warning (LDW), and blind-spot detection (BSD) as standard equipment in new vehicles. These regulations directly translate into a higher volume demand for the intelligent driving chips that power these systems. Furthermore, consumer perception and demand are playing a significant role. As awareness of the benefits of enhanced safety and driving convenience grows, car buyers are actively seeking vehicles equipped with these intelligent features, thereby influencing automotive manufacturers' product development strategies. The competitive landscape also encourages the integration of such technologies to differentiate vehicle models. Beyond safety, the increasing sophistication and affordability of these chips are democratizing intelligent driving. What was once a premium feature is now becoming accessible in mid-range and even some entry-level passenger vehicles. This expansion into a wider customer base is a primary driver of volume growth. The commercial vehicle sector, particularly for logistics and fleet management, is also a significant contributor. Companies are recognizing the potential for improved efficiency, reduced accident rates, and optimized operations through the deployment of intelligent driving capabilities in trucks and delivery vans. The report will analyze how these forces, collectively, are transforming the automotive industry and solidifying the importance of low- to mid-range intelligent driving chips.

Despite the robust growth trajectory, the low- to mid-range intelligent driving chips market is not without its challenges and restraints. A significant hurdle remains the cost-sensitivity of the target segments. While prices are decreasing, manufacturers are still under pressure to deliver highly integrated and cost-effective solutions, especially for mass-market passenger vehicles. Balancing advanced functionality with affordability remains a delicate act. Another key challenge is the complexity of the automotive supply chain and the lengthy validation processes. Integrating new chip technologies requires extensive testing, certification, and qualification, which can add considerable time and expense to product development cycles. This can slow down the adoption of the latest innovations. Software development and integration also present a significant challenge. The effectiveness of intelligent driving chips is heavily reliant on sophisticated software algorithms and seamless integration with other vehicle systems. Developing and validating this complex software ecosystem demands substantial expertise and investment. Furthermore, cybersecurity concerns are becoming increasingly prominent. As vehicles become more connected and reliant on intelligent processing, they become more susceptible to cyber threats. Ensuring the security and integrity of these systems is paramount and requires ongoing vigilance and robust security measures. Finally, scalability and manufacturing capacity can become constraints as demand escalates. Chip manufacturers need to ensure they can ramp up production to meet the growing global demand, particularly during periods of high automotive production. The report will delve into how these factors are shaping the market and influencing strategic decisions by stakeholders.

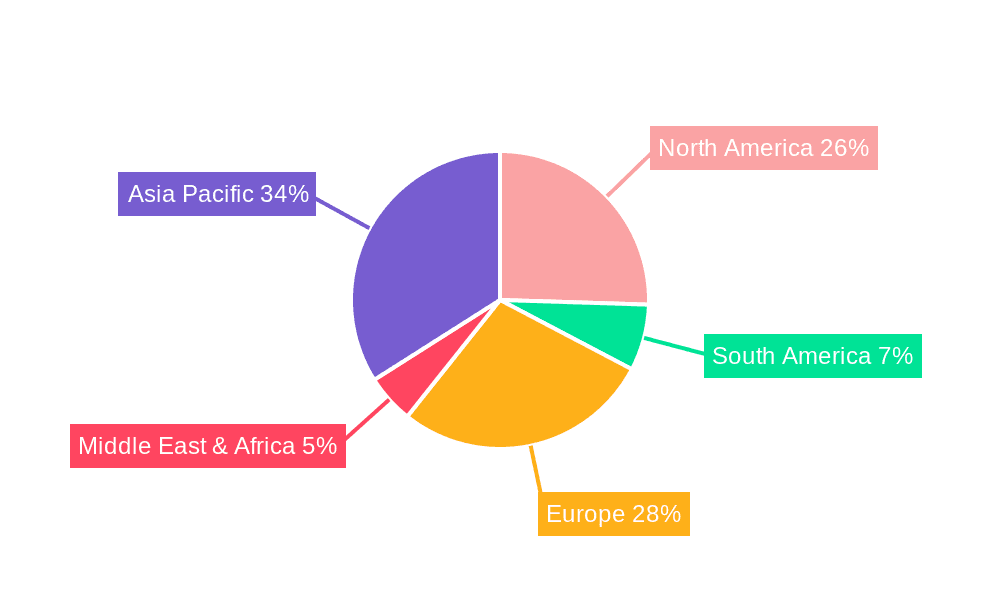

The Passenger Vehicle segment, particularly within the 30-100 TOPS processing power category, is poised to dominate the low- to mid-range intelligent driving chips market, with Asia Pacific, specifically China, emerging as a key region for growth. This dominance is driven by a confluence of factors that make this segment and region particularly fertile ground for these advanced semiconductor solutions.

In terms of segments, the Passenger Vehicle market is witnessing an unprecedented surge in the adoption of ADAS and semi-autonomous driving features. As vehicle electrification accelerates, many manufacturers are leveraging this transition to integrate advanced digital cockpits and intelligent driving functionalities. The 30-100 TOPS range is critical here, as it enables a broader array of features beyond basic safety, including advanced adaptive cruise control, highway driving assist, automated parking systems, and even early forms of Level 2+ autonomy. These capabilities are no longer confined to luxury vehicles; they are increasingly becoming standard or optional offerings in mid-range and mainstream passenger cars, significantly expanding the addressable market for these chips. The demand for a more convenient and safer driving experience among a burgeoning middle class is a strong pull factor.

Geographically, Asia Pacific, with China leading the charge, is set to be the dominant region. China's automotive market is the largest globally, characterized by rapid technological adoption, strong government support for the automotive and semiconductor industries, and a highly competitive domestic automotive landscape. Chinese automakers are aggressively pursuing innovation in intelligent driving, often leapfrogging traditional automotive powers in adopting new technologies. The Below 30 TOPS segment is also seeing significant penetration in China, driven by a vast domestic market and the need for cost-effective safety solutions across a wide spectrum of vehicles. However, the rapid advancement of Chinese domestic chip manufacturers like Horizon Robotics and Black Sesame Technologies, alongside the presence of global players, is driving the adoption of the 30-100 TOPS solutions. These domestic players are particularly adept at tailoring solutions to the local market's specific needs and cost requirements, fostering rapid adoption.

Furthermore, the Chinese government's strategic initiatives, such as its "Made in China 2025" plan and significant investments in AI and semiconductor research, create a supportive ecosystem for the growth of intelligent driving chip manufacturers. The sheer volume of vehicle production in China, coupled with government mandates and consumer demand for advanced features, ensures that the Passenger Vehicle segment, powered by 30-100 TOPS chips, will be a primary engine of growth for the low- to mid-range intelligent driving chips market in the coming years. The report will provide detailed unit shipment projections for these segments and regions, highlighting their projected market share within the broader intelligent driving chip landscape.

Several key growth catalysts are propelling the low- to mid-range intelligent driving chips industry forward. The escalating global demand for enhanced automotive safety, driven by regulatory mandates and consumer awareness, is a primary driver. The increasing affordability and integration of ADAS features into mainstream vehicles, making them accessible to a wider consumer base, acts as another significant catalyst. The rapid advancements in AI and sensor technologies are enabling more sophisticated intelligent driving functionalities at these mid-range processing levels, further fueling adoption.

This report provides an exhaustive overview of the low- to mid-range intelligent driving chips market. It meticulously dissects market dynamics, including segmentation by processing power (Below 30 TOPS, 30-100 TOPS) and application (Commercial Vehicle, Passenger Vehicle). The study offers detailed historical data (2019-2024), a robust base year analysis (2025), and comprehensive future projections (2025-2033) with specific CAGR estimates. It identifies key growth catalysts, such as evolving safety regulations and increasing consumer demand, while also acknowledging critical challenges like cost sensitivity and supply chain complexities. The report provides in-depth regional analysis, highlighting the dominance of Asia Pacific, particularly China, in the passenger vehicle segment. Leading market players, including Nvidia, Mobileye, Qualcomm, Texas Instruments, Renesas, Horizon Robotics, and Black Sesame Technologies, are profiled with their strategic insights. Furthermore, significant recent and projected developments in the sector are outlined, offering a forward-looking perspective on technological advancements and market trends. This report is an indispensable resource for stakeholders seeking a deep understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.3%.

Key companies in the market include Nvidia, Mobileye, Qualcomm, Texas Instruments, Renesas, Horizon Robotics, Black Sesame Technologies.

The market segments include Type, Application.

The market size is estimated to be USD 1790 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Low- to Mid-Range Intelligent Driving Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Low- to Mid-Range Intelligent Driving Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.