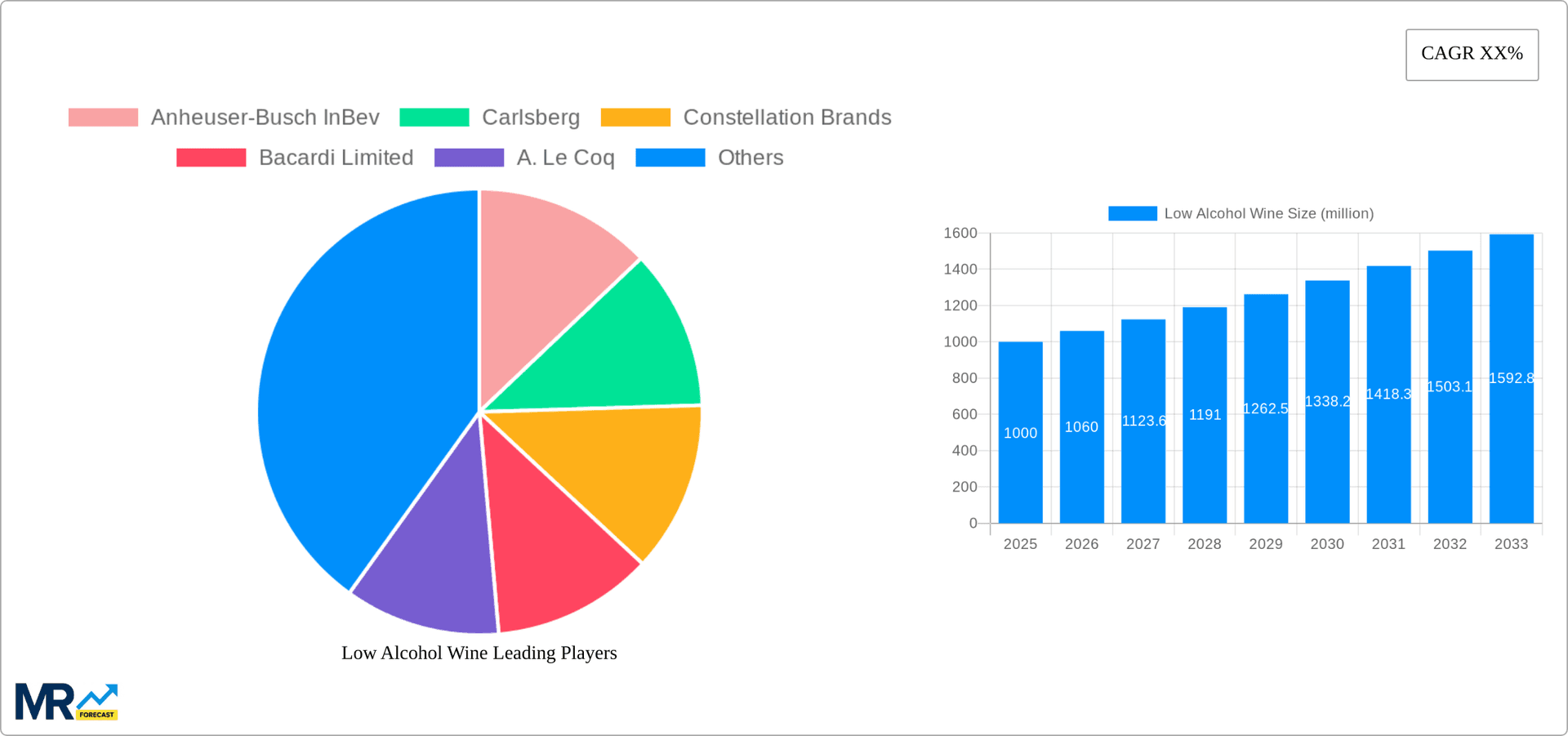

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Alcohol Wine?

The projected CAGR is approximately 16.05%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Low Alcohol Wine

Low Alcohol WineLow Alcohol Wine by Type (Low-Alcohol Beer, Low-Alcohol Wine, Low-Alcohol Cider, Low-Alcohol Spirits, Others), by Application (Supermarkets and Hypermarkets, Independent Retailers, Specialist Retailers, Online Retailers, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The low-alcohol wine market is projected for substantial expansion, driven by heightened consumer health awareness and the growing trend of mindful consumption. The market encompasses various product types and is distributed across numerous channels including supermarkets, independent and specialist retailers, and online platforms. Based on the broader low-alcohol beverage market trends, the low-alcohol wine segment is estimated to reach a size of $6.56 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 16.05%.

Key growth drivers include the increasing consumer demand for healthier beverage options, aligning with the mindful drinking movement. The proliferation of e-commerce platforms further enhances market accessibility and product variety. Despite these positive trends, challenges such as consumer perceptions regarding taste and quality persist. Leading beverage industry players are actively investing in research and development to refine taste profiles and address these concerns, fostering continuous innovation within this expanding market segment.

The low-alcohol wine market is experiencing significant growth, driven by a confluence of factors including increasing health consciousness, changing consumer preferences, and innovative product development. Over the study period (2019-2033), the market has shown consistent expansion, with estimates suggesting a value exceeding XXX million units by 2025. This upward trajectory is expected to continue throughout the forecast period (2025-2033). Key market insights reveal a burgeoning demand for healthier alcoholic beverages, with consumers seeking options that allow them to moderate their alcohol intake without sacrificing taste or enjoyment. The rise of mindful drinking and the increasing prevalence of health-conscious lifestyles are crucial drivers of this trend. This is particularly noticeable among younger demographics and those in urban areas with higher disposable incomes. Furthermore, the innovation in winemaking techniques has allowed producers to create low-alcohol wines that retain the full-bodied flavor and aroma profiles of traditional wines, addressing a major concern for consumers previously hesitant to switch to lower-alcohol alternatives. The market is witnessing an evolution beyond simply reducing alcohol content; producers are focusing on enhancing the overall experience by offering a wider variety of flavors, grape varietals, and styles to cater to diverse palates. This diversification is attracting a broader consumer base and expanding the market's reach. The success of this market segment is largely dependent on continuous innovation and meeting evolving consumer preferences, highlighting the importance of product development and marketing strategies for sustained growth. The shift in consumer behavior towards healthier lifestyle choices has created a favorable environment for low-alcohol wine, positioning it for continued market penetration.

Several key factors are propelling the growth of the low-alcohol wine market. Firstly, the increasing awareness of the health risks associated with excessive alcohol consumption is pushing consumers toward moderate drinking habits. This shift in consumer mindset is creating a strong demand for lower-alcohol beverages that offer a responsible alternative without compromising taste. Secondly, the rising popularity of mindful drinking and wellness trends significantly contribute to the market's expansion. Consumers are actively seeking healthier lifestyle choices, and low-alcohol wine fits perfectly into this paradigm shift. Thirdly, advancements in winemaking technology have enabled the production of high-quality low-alcohol wines that successfully retain the desired taste and aroma profiles. These innovations overcome previous limitations and eliminate the perception that lower alcohol content automatically implies compromised taste, greatly enhancing consumer acceptance. Finally, effective marketing and branding strategies focusing on the health and wellness aspects of low-alcohol wine are proving successful in attracting a wider consumer base. The industry is actively communicating the benefits of moderation and responsible consumption, while simultaneously highlighting the premium quality and sophisticated taste of these wines. The combined effect of these factors creates a robust and dynamic market, projected to witness substantial growth in the coming years.

Despite the positive growth trajectory, the low-alcohol wine market faces several challenges. One major hurdle is the perception among some consumers that lower alcohol content equates to inferior quality or taste. Overcoming this preconceived notion requires continued innovation and consistent delivery of high-quality products that meet, or even exceed, consumer expectations. Another challenge involves the higher production costs associated with some low-alcohol winemaking techniques. These costs can impact pricing and potentially limit market accessibility, especially for budget-conscious consumers. Furthermore, the relatively nascent nature of the market means that consumer awareness and understanding of low-alcohol wine options remain somewhat limited. Increased educational initiatives and targeted marketing campaigns are necessary to broaden consumer knowledge and acceptance. Competition from traditional full-alcohol wines also presents a significant challenge. The established dominance of traditional wines necessitates innovative strategies to attract and retain consumers, including effective branding and highlighting the unique benefits of low-alcohol options. Addressing these challenges effectively will be crucial for the continued and sustainable expansion of the low-alcohol wine market.

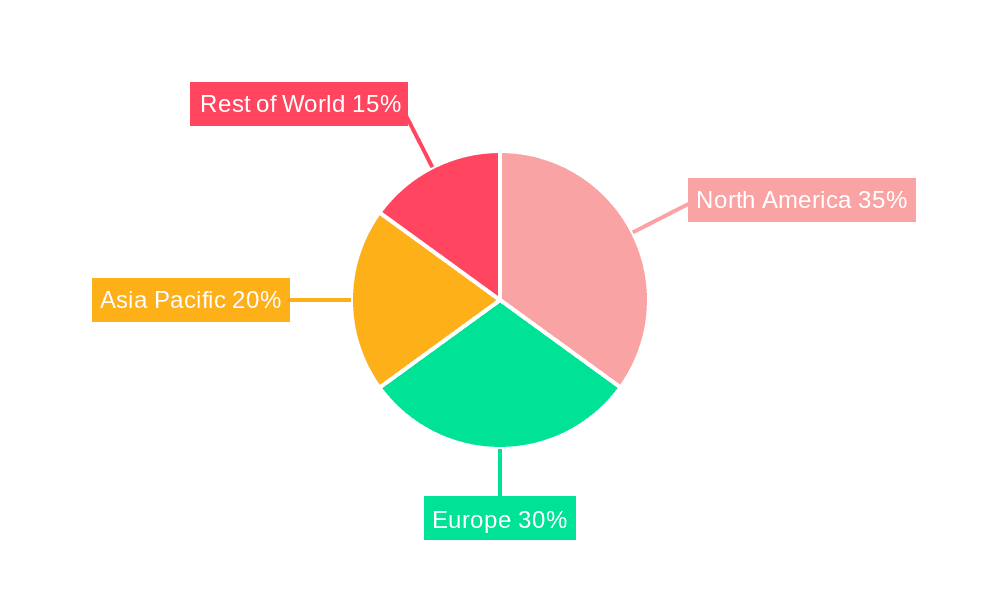

The low-alcohol wine market is experiencing diverse growth patterns across different regions and segments. While a comprehensive analysis would require detailed regional data, we can highlight some potential dominating areas.

Regions: Developed countries with high health consciousness and disposable incomes, such as those in Western Europe (especially France, Italy, and Germany), North America (particularly the US and Canada), and parts of Australasia are likely leading the market. These regions exhibit a strong preference for premium beverages and readily adopt new healthy lifestyle trends. Emerging economies with growing middle classes and a rising interest in premium alcoholic beverages could also show rapid growth.

Segment: Supermarkets and Hypermarkets. This distribution channel provides significant reach and accessibility to consumers. Large retail chains are increasingly incorporating low-alcohol wine into their offerings, leveraging their established infrastructure and customer base. The convenience and wide availability offered by supermarkets and hypermarkets are key drivers for this segment's dominance. This is further supported by their promotional capabilities.

Paragraph Summary: The global distribution of low-alcohol wine is expected to be influenced by factors such as existing alcoholic beverage consumption patterns, purchasing power, and health consciousness levels across different populations. Regions with a higher concentration of health-conscious consumers and a robust retail infrastructure will likely dominate the market. The strategic partnerships between producers and major supermarket chains will further strengthen the market penetration of low-alcohol wines. This will result in increased product visibility and accessibility for consumers, reinforcing the dominance of this distribution channel.

Several factors are fueling growth in the low-alcohol wine industry. The growing awareness of health and wellness, coupled with a shift towards mindful drinking, is a primary driver. Technological advancements in winemaking enable the production of high-quality low-alcohol wines, dispelling the misconception that reduced alcohol content equates to compromised taste. Furthermore, innovative marketing and branding strategies effectively communicate the benefits and appeal of low-alcohol options to a wider consumer base.

This report provides a comprehensive overview of the low-alcohol wine market, encompassing trends, driving forces, challenges, key players, and future growth projections. It offers valuable insights for businesses operating within or planning to enter this dynamic market segment, enabling informed decision-making and strategic planning for sustained success.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.05% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.05%.

Key companies in the market include Anheuser-Busch InBev, Carlsberg, Constellation Brands, Bacardi Limited, A. Le Coq, Asahi Premium Beverages, New Belgium Brewing Company, New Planet Beer, Red Truck Beer, Samuel Adams, Sapporo, Sierra Nevada Brewing, The Smirnoff, Vitis Industries, Bell's Brewery, Blake’s Hard Cider, Blue Moon Brewing Company, Heineken, .

The market segments include Type, Application.

The market size is estimated to be USD 6.56 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Low Alcohol Wine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Low Alcohol Wine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.