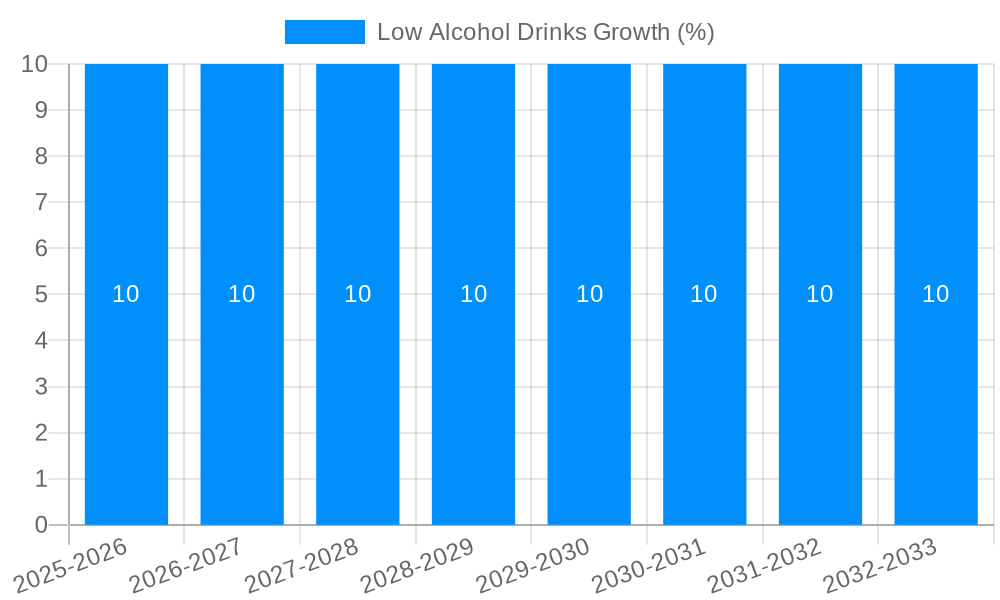

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Alcohol Drinks?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Low Alcohol Drinks

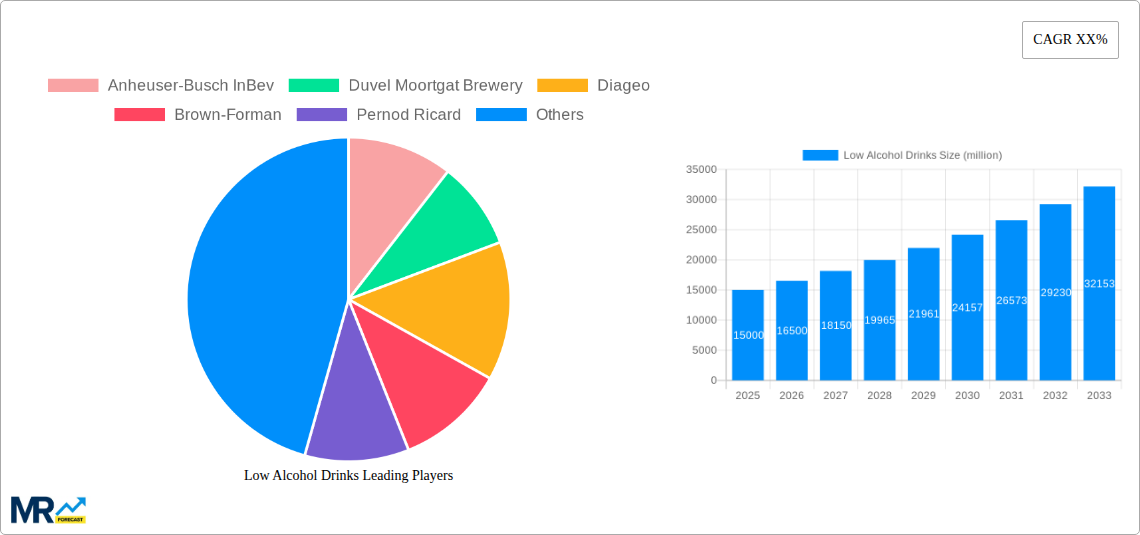

Low Alcohol DrinksLow Alcohol Drinks by Application (Supermarkets, Convenience Store, Liquor Stores, Online Stores, Others, World Low Alcohol Drinks Production ), by Type (Beer, Rice Wine, Fruit Wine, Ready-to-Drink, Others, World Low Alcohol Drinks Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global low alcohol drinks market is experiencing robust growth, projected to reach a substantial Market Size of approximately $XXX million by 2033, driven by a compound annual growth rate (CAGR) of XX% between 2025 and 2033. This expansion is fueled by evolving consumer preferences towards healthier lifestyles, a desire for reduced alcohol consumption without sacrificing taste, and an increasing awareness of the potential health implications of high-alcohol beverages. The market is seeing a significant surge in demand across various applications, with supermarkets and online stores leading the charge in product accessibility. Ready-to-drink (RTD) low alcohol options, in particular, are gaining traction due to their convenience and appeal to a younger demographic seeking sophisticated yet lighter alcoholic choices. The burgeoning popularity of rice wine and fruit wine segments within the low alcohol category further underscores the diversification of consumer palates and the industry's innovative response.

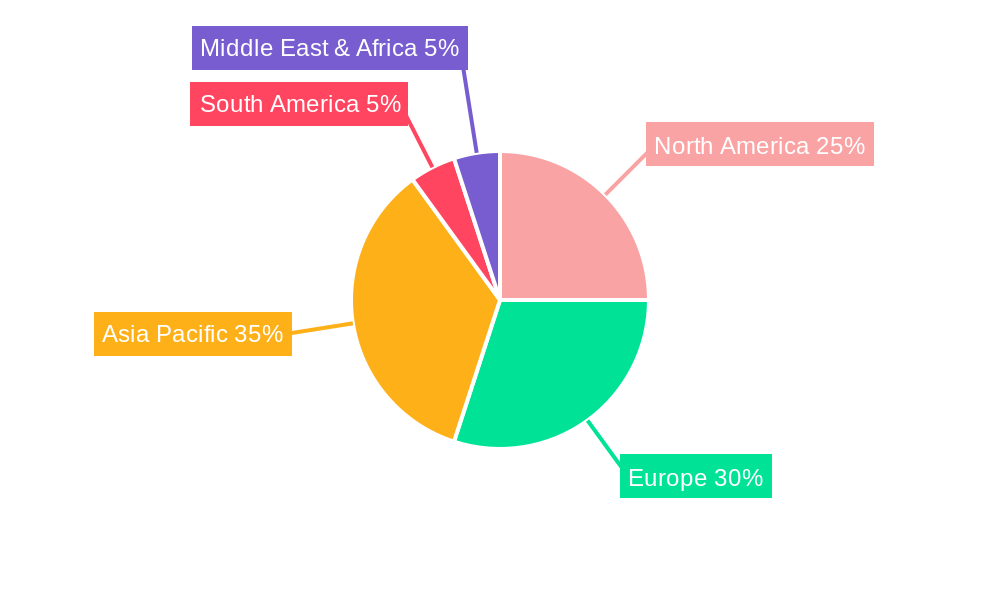

Key players such as Anheuser-Busch InBev, Diageo, and Suntory are actively investing in product development and expanding their portfolios to cater to this growing segment. Asia Pacific, particularly China and India, is emerging as a significant growth region, buoyed by a rising middle class and increasing disposable incomes. However, the market faces certain restraints, including stringent regulations in some regions regarding alcohol production and marketing, and the challenge of price competition from traditional alcoholic beverages. Despite these hurdles, the overall outlook for the low alcohol drinks market remains exceptionally positive, with continuous innovation in flavors, formats, and production methods set to sustain its upward trajectory. The increasing global focus on moderation and well-being positions low alcohol drinks as a category poised for sustained expansion and significant market penetration in the coming years.

Here's a unique report description for Low Alcohol Drinks, incorporating your specified elements:

The global low alcohol drinks market is experiencing a seismic shift, driven by a confluence of evolving consumer preferences and an increasingly health-conscious global populace. Our comprehensive report, spanning the crucial Study Period of 2019-2033, with a Base Year of 2025, unveils a dynamic landscape projected to witness significant expansion. The Estimated Year of 2025 marks a pivotal point, where initial robust growth trends solidify. During the Historical Period (2019-2024), the market demonstrated a consistent upward trajectory, fueled by nascent awareness and early adoption of lower-ABV alternatives. Looking ahead to the Forecast Period (2025-2033), we anticipate this momentum to accelerate, with an estimated global production volume reaching XXX million units by the end of the forecast. This surge is not merely about reduced alcohol content; it's a broader movement encompassing mindful consumption, a desire for lighter social experiences, and an appreciation for nuanced flavor profiles without the often-associated drawbacks of high-ABV beverages. The proliferation of innovative product formulations, from sophisticated non-alcoholic spirits to lower-ABV craft beers and wine spritzers, has broadened the appeal beyond traditional abstainers. Consumers are actively seeking alternatives that align with their wellness goals, dietary restrictions, and a desire for greater control over their intake, without sacrificing enjoyment or social engagement. This report meticulously analyzes these evolving trends, providing unparalleled insights into consumer behavior, product innovation, and the strategic maneuvers of key industry players as they navigate this transformative market. The increasing demand for diverse flavor profiles, from botanical infusions to naturally flavored fruit wines, further solidifies the market's growth potential, indicating a move towards premiumization within the low and no-alcohol category.

Several powerful forces are coalescing to propel the low alcohol drinks market into an era of unprecedented growth. Foremost among these is the burgeoning global health and wellness movement. Consumers are increasingly prioritizing their physical and mental well-being, actively seeking to reduce their alcohol consumption without entirely abstaining from social drinking occasions. This has created a fertile ground for low alcohol beverages that offer a guilt-free indulgence. Furthermore, shifting cultural attitudes towards alcohol consumption are playing a significant role. In many regions, there's a growing acceptance and even celebration of moderation, leading to a broader demographic embracing lower-ABV options. Regulatory frameworks in some countries are also subtly encouraging a shift, with potential implications for taxation and marketing. Coupled with this, significant advancements in beverage technology have enabled producers to create low alcohol drinks that rival their full-strength counterparts in terms of taste, complexity, and sensory experience, effectively demystifying the perceived trade-off between reduced alcohol and flavor. This innovation is crucial in appealing to discerning palates and expanding the market's reach beyond niche segments. The rising disposable incomes in emerging economies further contribute, as consumers gain greater purchasing power and access to a wider array of beverage choices, including these evolving low alcohol options.

Despite the robust growth, the low alcohol drinks market is not without its hurdles. A primary challenge lies in the perception of taste and quality. While innovation is rapid, some consumers still associate low alcohol with diminished flavor or a less satisfying drinking experience compared to traditional alcoholic beverages. Overcoming this lingering skepticism requires continuous product development and effective marketing that highlights the nuanced taste profiles now achievable. Another significant restraint is the complexity of regulations surrounding alcoholic beverages, which often extend to low alcohol variants, creating inconsistencies and potential barriers to entry across different markets. Labeling requirements, taxation policies, and age restrictions can be intricate and vary considerably, impacting production and distribution strategies. Furthermore, the established market dominance of traditional alcoholic beverages means that low alcohol options are still vying for shelf space and consumer attention within a crowded beverage landscape. Building brand awareness and educating consumers about the benefits and variety of low alcohol drinks requires substantial investment and strategic marketing efforts. Finally, the cost of production for some sophisticated low alcohol alternatives can sometimes be higher than conventional counterparts, potentially impacting pricing and accessibility for a wider consumer base.

The global low alcohol drinks market is characterized by a dynamic interplay of regional strengths and segment leadership, with specific areas poised for significant dominance.

Dominant Regions/Countries:

Dominant Segments:

The low alcohol drinks industry is being catalyzed by several key factors. The increasing global health and wellness consciousness is paramount, pushing consumers towards moderation. The innovation in product development, leading to superior taste and variety in low-alcohol options, is crucial. Furthermore, the expanding acceptance of mindful drinking occasions and the desire for lighter social experiences are creating significant demand. The convenience offered by Ready-to-Drink formats and the accessibility of online sales channels are also powerful growth enablers.

This report offers an exhaustive examination of the low alcohol drinks market, providing unparalleled depth and breadth. It delves into the intricate market dynamics, consumer trends, and competitive landscape, with meticulous forecasts for the Study Period of 2019-2033. The report’s comprehensive nature ensures that stakeholders gain actionable insights to navigate this evolving sector. It meticulously analyzes production volumes, market segmentation by application and type, and identifies the leading companies shaping the industry. The report also highlights significant historical and projected developments, offering a forward-looking perspective on opportunities and challenges within the global low alcohol drinks market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Anheuser-Busch InBev, Duvel Moortgat Brewery, Diageo, Brown-Forman, Pernod Ricard, Kirin Beer, Becle, AG Barr, Choya, Takara, Hakutsuru, Gekkeikan, Suntory, Shanghai Bacchus Liquor, Chongqing Jiangxiaobai Liquor, MissBerry.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Low Alcohol Drinks," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Low Alcohol Drinks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.