1. What is the projected Compound Annual Growth Rate (CAGR) of the Load Cell Transmitter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Load Cell Transmitter

Load Cell TransmitterLoad Cell Transmitter by Type (Wireless Load Cell Transmitter, USB Load Cell Transmitter, Others, World Load Cell Transmitter Production ), by Application (Industrial, Transportation, Construction, Others, World Load Cell Transmitter Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

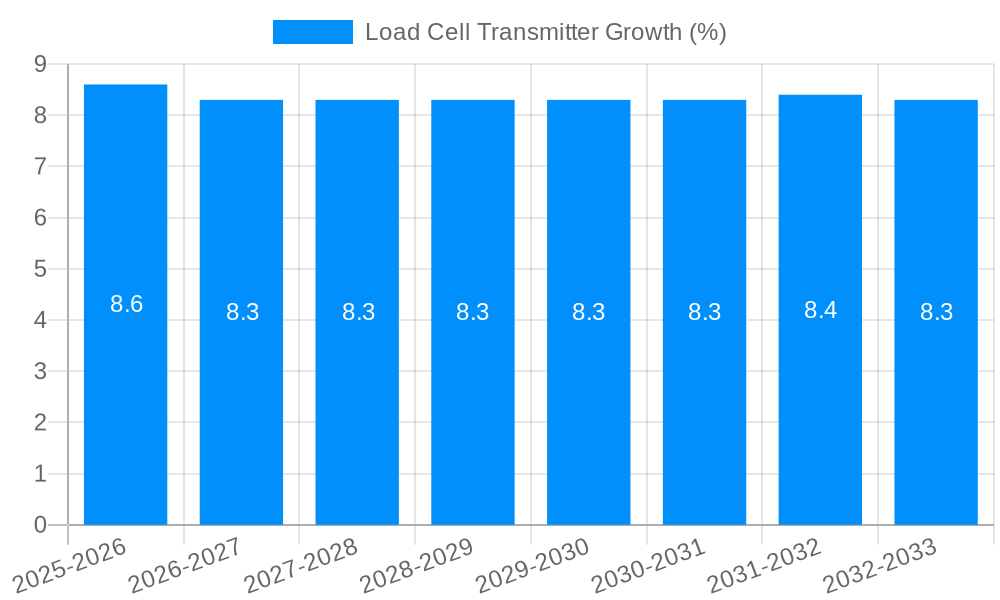

The global Load Cell Transmitter market is experiencing robust growth, projected to reach approximately $500 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is primarily fueled by the increasing demand for precise and reliable force measurement solutions across a wide spectrum of industrial applications, including manufacturing, automation, and quality control. The continuous evolution of smart manufacturing and the Industrial Internet of Things (IIoT) is a major driver, necessitating advanced load cell transmitters capable of seamless data integration and wireless connectivity for real-time monitoring and analysis. Furthermore, the growing adoption of automated systems in sectors like transportation and construction, coupled with stringent quality standards and safety regulations, is propelling the market forward. The rising investments in infrastructure development globally also contribute to sustained demand for accurate weighing and force monitoring equipment.

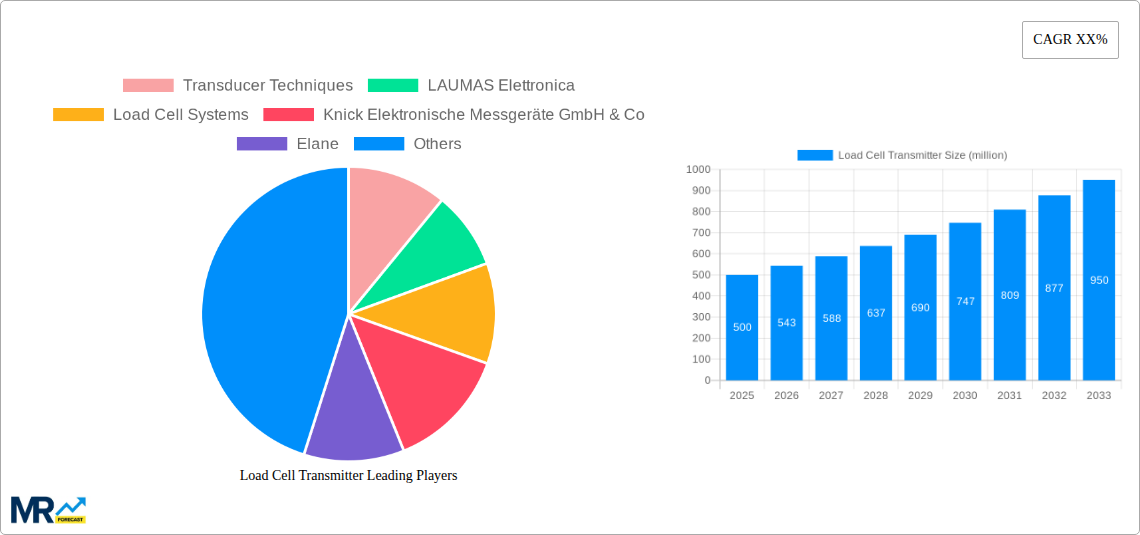

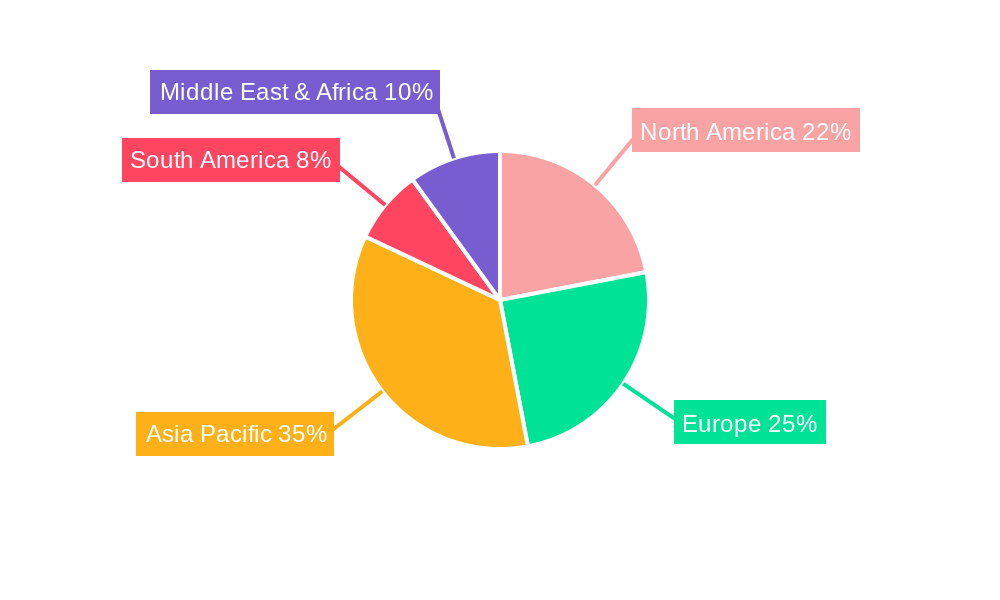

The market is segmented into various types, with Wireless Load Cell Transmitters emerging as a dominant force due to their flexibility, ease of installation, and suitability for harsh or remote environments. USB Load Cell Transmitters also hold a significant share, offering direct connectivity for data acquisition. In terms of applications, the Industrial sector accounts for the largest market share, encompassing a broad range of uses from material handling and process control to packaging and assembly lines. The Transportation sector, driven by the need for accurate weighing in logistics and vehicle load monitoring, and the Construction sector, where precise load management is critical for safety and efficiency, are also key growth areas. Leading companies like Transducer Techniques, LAUMAS Elettronica, and Load Cell Systems are at the forefront, innovating with enhanced accuracy, durability, and connectivity features to cater to the evolving needs of this dynamic market. The Asia Pacific region, particularly China and India, is expected to witness the fastest growth due to rapid industrialization and infrastructure development.

This comprehensive report delves into the intricate dynamics of the global Load Cell Transmitter market, spanning the historical period of 2019-2024, the base and estimated year of 2025, and projecting a robust growth trajectory through the forecast period of 2025-2033. The market is expected to witness substantial expansion, with projections indicating a market size reaching into the hundreds of millions of dollars by 2025, and further escalating into the low billions by 2033. This analysis meticulously examines the industry's evolution, technological advancements, and the strategic maneuvers of key stakeholders.

The global Load Cell Transmitter market is exhibiting a discernible shift towards enhanced precision, remote monitoring capabilities, and seamless integration within broader industrial automation systems. A significant trend observed during the historical period of 2019-2024 has been the increasing demand for wireless load cell transmitters, driven by the need for flexible installations and reduced cabling costs in complex industrial environments. This segment alone has demonstrated growth rates exceeding 15% annually, accounting for over 30 million units in global production by 2024. The adoption of IoT and Industry 4.0 principles is further accentuating this trend, with load cell transmitters evolving beyond mere measurement devices to become integral components of smart factories and predictive maintenance strategies. The development of miniature and highly robust load cell transmitters capable of withstanding extreme environmental conditions, such as those found in construction and heavy industrial applications, is another pivotal trend. This has led to a diversification of product offerings, catering to a wider array of specialized use cases. Furthermore, the integration of advanced signal processing algorithms within transmitters is enabling higher accuracy and linearity, minimizing the impact of environmental factors like temperature fluctuations and vibration. This focus on enhanced performance is crucial for applications where even minute deviations in load measurement can have significant consequences, such as in pharmaceutical manufacturing or aerospace component testing. The market is also witnessing a growing emphasis on user-friendly interfaces and simplified calibration procedures, reducing the technical barrier to entry and encouraging wider adoption across various industry verticals. The demand for transmitters capable of supporting multiple communication protocols, including Ethernet/IP, Modbus TCP, and MQTT, is also on the rise, facilitating interoperability with existing control systems and cloud platforms. This interconnectedness is a cornerstone of modern industrial operations, and load cell transmitters are playing a vital role in its realization. The competitive landscape is characterized by continuous innovation, with companies investing heavily in R&D to develop next-generation solutions that offer superior performance, enhanced connectivity, and increased application versatility. This pursuit of innovation is expected to continue shaping the market over the forecast period of 2025-2033, leading to even more sophisticated and indispensable load cell transmitter solutions.

The growth of the Load Cell Transmitter market is primarily propelled by the relentless pursuit of industrial efficiency and automation across a multitude of sectors. The increasing adoption of Industry 4.0 principles and the proliferation of the Internet of Things (IoT) have created a significant demand for connected and intelligent sensing solutions. Load cell transmitters, in their advanced forms, are crucial for providing real-time, accurate load data that feeds into these automated systems, enabling better process control, quality assurance, and resource management. The transportation sector, for instance, is increasingly utilizing load cell transmitters in applications such as weigh-in-motion systems for trucks and railcars, optimizing logistics and toll collection, with an estimated 5 million units deployed in this segment by 2024. Similarly, the construction industry is leveraging these devices for critical applications like structural health monitoring, concrete batching, and crane load indication, contributing to safety and efficiency on project sites. The industrial segment remains the largest consumer, encompassing diverse applications from material handling and packaging to process control in chemical plants and food processing facilities. The ever-present need for precision and accuracy in measurement, especially in high-value or safety-critical applications, ensures a consistent demand for reliable load cell transmitters. Furthermore, the growing emphasis on predictive maintenance strategies, where early detection of anomalies can prevent costly downtime, is driving the integration of load cell transmitters as key diagnostic tools. As industries strive to optimize operational costs and enhance productivity, the role of accurate and reliable load measurement becomes paramount, with the market projected to surpass 50 million units in global production by 2030. The inherent advantages of transmitters over direct load cell readouts, such as signal conditioning, amplification, and digital output capabilities, further solidify their position in the market.

Despite the robust growth trajectory, the Load Cell Transmitter market is not without its challenges and restraints. One of the primary concerns is the initial capital investment required for implementing advanced load cell transmitter systems, particularly for small and medium-sized enterprises (SMEs). While the long-term benefits are evident, the upfront cost can act as a deterrent, especially in price-sensitive markets. Furthermore, the complexity of integration with existing legacy systems can pose a significant hurdle. Many industries still operate with older infrastructure, and integrating new, sophisticated load cell transmitters, especially wireless variants, can require substantial retrofitting and technical expertise, leading to project delays and increased implementation costs. The lack of standardization across different manufacturers and communication protocols can also create interoperability issues, forcing users to commit to specific vendor ecosystems, thereby limiting flexibility. Cybersecurity concerns associated with connected wireless load cell transmitters are also becoming increasingly prominent. As these devices become more integrated into networked systems, the risk of data breaches and unauthorized access needs to be meticulously addressed, requiring robust security measures and constant vigilance, which adds another layer of complexity and cost. The availability of skilled personnel capable of installing, calibrating, and maintaining these advanced systems can also be a limiting factor in certain regions. A shortage of trained technicians can impede widespread adoption and efficient utilization. Finally, environmental factors such as extreme temperatures, humidity, dust, and electromagnetic interference can still impact the performance and lifespan of load cell transmitters, necessitating the use of specialized, and often more expensive, ruggedized models. The need for regular calibration and maintenance, while essential for accuracy, also represents an ongoing operational cost that can influence purchasing decisions.

The global Load Cell Transmitter market is poised for significant growth, with a clear indication that the Industrial segment will continue to dominate market share, both in terms of production and application. This dominance is attributed to the sheer breadth and depth of applications within various industrial verticals. For instance, within the industrial segment, material handling and logistics, which encompasses automated warehousing, conveyor systems, and robotic arms, accounts for a substantial portion of demand, estimated to be over 15 million units by 2025. Similarly, process industries, including chemical, pharmaceutical, and food and beverage manufacturing, rely heavily on precise load measurement for recipe control, batching, and quality assurance, contributing an additional 10 million units to the global production. The increasing automation in these sectors, driven by the need for enhanced efficiency, reduced waste, and improved safety, directly translates to a higher demand for reliable load cell transmitters.

In terms of geographical dominance, Asia-Pacific is emerging as the leading region, driven by rapid industrialization, a burgeoning manufacturing base, and significant investments in infrastructure development. Countries like China and India are at the forefront, with their expansive manufacturing sectors creating a massive demand for industrial automation solutions, including load cell transmitters. The region is projected to account for approximately 35-40% of the global market share by 2025, with continued expansion expected throughout the forecast period. The presence of major manufacturing hubs and a growing emphasis on adopting advanced technologies positions Asia-Pacific as a critical growth engine for the Load Cell Transmitter market.

Among the various types of load cell transmitters, Wireless Load Cell Transmitters are experiencing the most dynamic growth and are projected to capture an increasingly significant market share. The inherent advantages of wireless technology – eliminating the need for extensive cabling, facilitating easier installation in complex or hazardous environments, and enabling greater flexibility in system design – are highly attractive to industries seeking to modernize their operations. The market for wireless variants alone is expected to reach an estimated 25 million units by 2025, with a compound annual growth rate (CAGR) projected to exceed 18% during the forecast period of 2025-2033. This surge in demand is fueled by the increasing adoption of IoT and the need for scalable and adaptable sensing solutions in smart factories and remote monitoring applications. The convenience and cost savings associated with wireless deployments are making them the preferred choice for new installations and upgrades across various industrial, transportation, and construction applications.

Several key factors are acting as significant growth catalysts for the Load Cell Transmitter industry. The relentless drive for automation and Industry 4.0 adoption across all sectors is a primary enabler. As businesses strive for greater efficiency, precision, and reduced operational costs, the demand for intelligent sensing solutions like load cell transmitters escalates. Furthermore, the burgeoning IoT ecosystem is creating a fertile ground for connected devices, with load cell transmitters playing a crucial role in providing real-time data for smart applications. The increasing focus on predictive maintenance and remote monitoring strategies is also a significant driver, enabling early fault detection and preventing costly downtime.

This report offers an exhaustive analysis of the Load Cell Transmitter market, providing in-depth insights into market sizing, segmentation, and regional dynamics. It meticulously examines the historical trends, current market landscape, and future projections spanning the period of 2019 to 2033, with a key focus on the base year 2025. The report details the key drivers, challenges, and opportunities that shape the industry's trajectory, alongside a comprehensive competitive analysis of leading players. It delves into the technological advancements and the impact of emerging trends, offering a holistic view of the market's evolution and its significance across diverse application segments. The report aims to equip stakeholders with the critical intelligence needed to navigate this dynamic and growing market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Transducer Techniques, LAUMAS Elettronica, Load Cell Systems, Knick Elektronische Messgeräte GmbH & Co, Elane, Laureate, Massload Technologies, Mantracourt, Utilcell, Acromag, Scale-Tron.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Load Cell Transmitter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Load Cell Transmitter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.