1. What is the projected Compound Annual Growth Rate (CAGR) of the lntimate Wash Care Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

lntimate Wash Care Products

lntimate Wash Care Productslntimate Wash Care Products by Type (Organic, Traditional, World lntimate Wash Care Products Production ), by Application (Supermarket, Laundry Shop, Online Retail, Others, World lntimate Wash Care Products Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

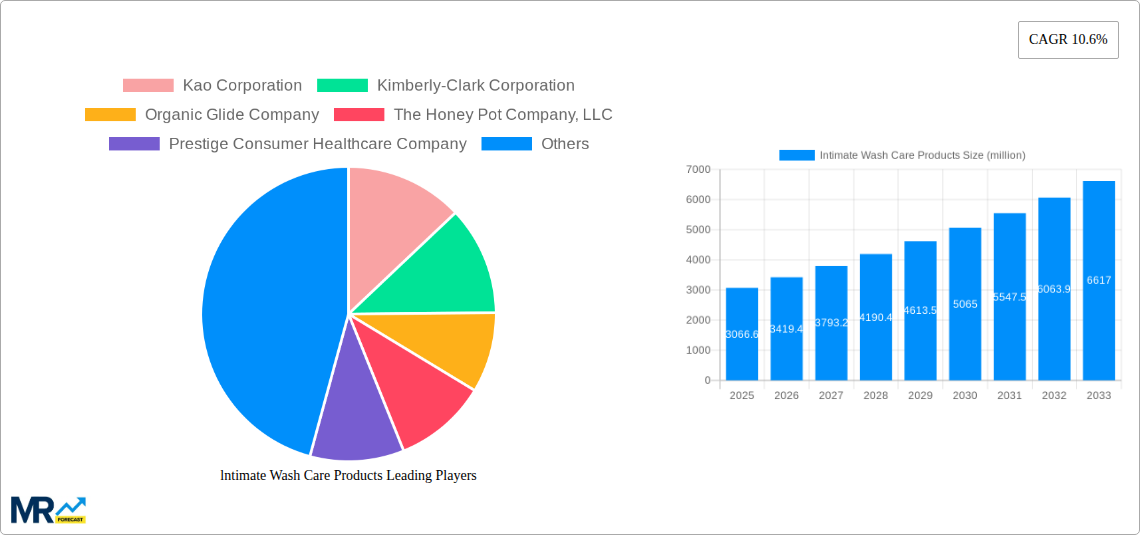

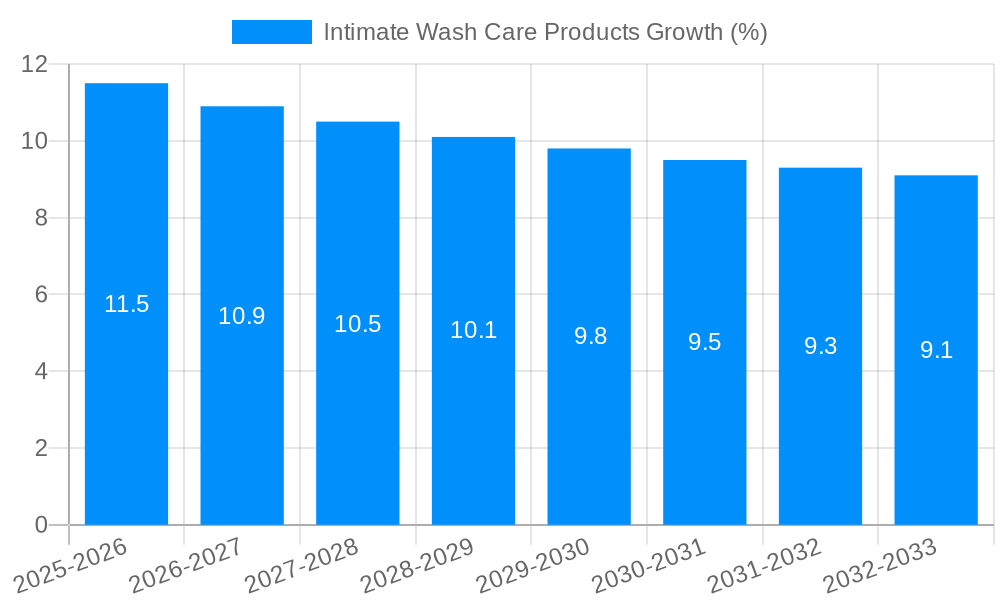

The intimate wash care products market, valued at $6,190.5 million in 2025, is poised for significant growth. Driven by increasing awareness of intimate hygiene and the rising prevalence of vaginal infections, coupled with a growing preference for natural and organic products, the market demonstrates considerable potential. The market's expansion is further fueled by the increasing disposable incomes in developing economies and the expanding distribution channels, including e-commerce platforms. Key players like Kao Corporation, Kimberly-Clark, and others are focusing on product innovation, introducing specialized formulations catering to specific needs and preferences, such as pH-balanced washes and those incorporating natural ingredients. This trend towards specialization is expected to drive premiumization within the market segment, impacting overall market value.

However, factors such as stringent regulatory approvals and potential side effects associated with certain ingredients pose challenges to market growth. Furthermore, the growing consumer awareness about the potential harmful effects of harsh chemicals in intimate washes may lead to a shift in preference towards natural and herbal alternatives. Consequently, companies are investing in research and development to create safer and more effective products, using sustainable and ethically sourced ingredients. The competitive landscape is dynamic, with both established players and emerging brands vying for market share through innovation and targeted marketing campaigns. This competition is expected to further drive product improvements and enhance market penetration. The forecast period (2025-2033) suggests a continued upward trajectory, indicating a substantial opportunity for growth and investment in this sector.

The intimate wash care products market, valued at approximately 200 million units in 2025, is experiencing significant growth, driven by increasing awareness of feminine hygiene and a shift towards personal care products catering to specific needs. The historical period (2019-2024) showcased a steady rise in demand, largely fueled by the expanding middle class in developing economies and increased access to information about vaginal health through digital platforms. Consumers are increasingly seeking products that are gentle, natural, and free from harsh chemicals, creating a strong demand for organic and hypoallergenic options. This trend is further reinforced by a growing preference for products that address specific concerns such as dryness, irritation, and odor. The market is witnessing the emergence of niche products catering to diverse needs, including washes for sensitive skin, post-partum care, and those formulated with natural ingredients like tea tree oil or aloe vera. The forecast period (2025-2033) projects substantial growth, potentially exceeding 300 million units, propelled by factors including increased disposable incomes, expanding distribution networks, and continuous innovation in product formulations and packaging. Market players are focusing on developing sustainable and eco-friendly products to appeal to the growing environmentally conscious consumer base. While the traditional retail channels remain significant, e-commerce is rapidly gaining traction, offering greater convenience and access to a wider range of products. This increased accessibility, coupled with targeted marketing campaigns highlighting the benefits of intimate wash products, is further propelling market expansion. The market is also witnessing a rise in the popularity of subscription services and personalized recommendations, enhancing consumer loyalty and driving repeat purchases.

Several key factors are driving the growth of the intimate wash care products market. Firstly, heightened awareness of vaginal health and hygiene is paramount. Increased access to information through various channels, including digital media and healthcare professionals, has educated consumers about the importance of maintaining proper intimate hygiene. This awareness has led to a significant increase in the adoption of intimate wash products as part of regular personal care routines. Secondly, the rising disposable incomes, particularly in developing economies, are enabling a larger segment of the population to afford specialized intimate care products. This increased purchasing power directly translates to higher demand and market growth. Thirdly, the continuous innovation in product formulations is crucial. Manufacturers are constantly developing products that address specific consumer needs and preferences, such as those formulated for sensitive skin, post-partum care, or containing natural ingredients. This focus on innovation drives product differentiation and enhances market appeal. Finally, the expanding distribution networks, including online channels, are ensuring greater product accessibility. E-commerce platforms are providing consumers with convenient access to a wide variety of products, leading to increased sales and market penetration. The convergence of these factors positions the intimate wash care products market for sustained and robust growth in the coming years.

Despite the significant growth potential, the intimate wash care products market faces certain challenges. One major restraint is the potential for misuse and over-washing. Overuse of intimate washes can disrupt the natural pH balance of the vagina, leading to irritation, infections, and other health problems. This necessitates clear and accurate labeling, consumer education, and responsible marketing to avoid potential health consequences. Furthermore, the presence of misleading or unsubstantiated claims in product marketing poses a challenge. Consumers need reliable information to make informed purchasing decisions. Regulatory bodies play a critical role in ensuring that product claims are accurate and truthful. Another key challenge lies in the varying cultural attitudes towards intimate hygiene. In some regions, there may be limited awareness or acceptance of intimate wash products, hindering market penetration. This requires targeted marketing and educational initiatives tailored to specific cultural contexts. Competition among existing players is also intense, necessitating continuous innovation and differentiation to maintain market share. Finally, the increasing prevalence of counterfeit or substandard products poses a risk to both consumer safety and brand reputation, requiring robust quality control measures.

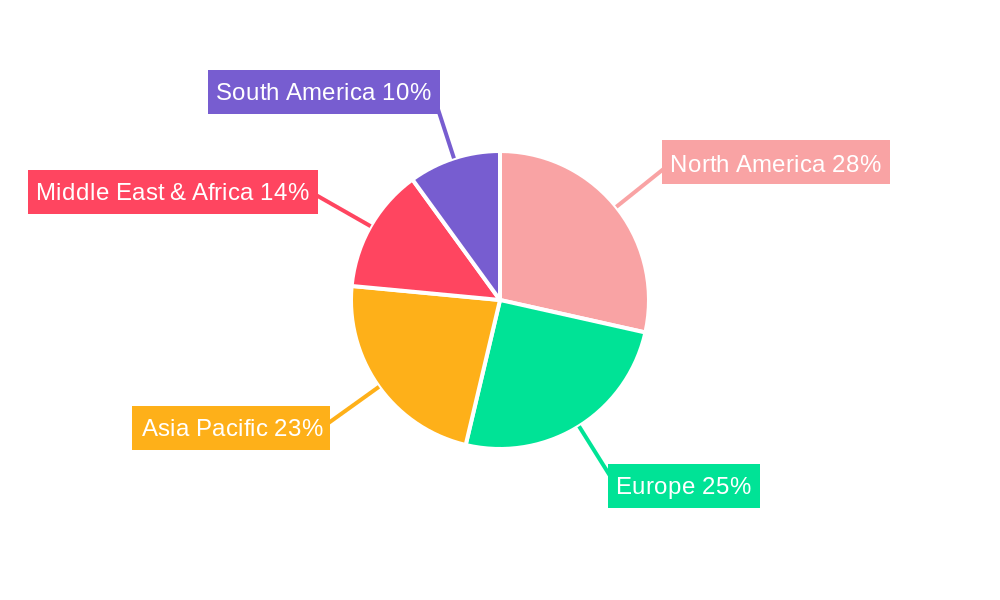

North America: This region is projected to hold a significant market share due to high consumer awareness, disposable incomes, and the prevalence of advanced healthcare infrastructure. The readily available information and sophisticated marketing campaigns further contribute to this dominance.

Europe: The market in Europe is anticipated to grow steadily, driven by increased awareness of feminine hygiene and the presence of established personal care brands. The region’s strong regulatory framework contributes to consumer trust and market stability.

Asia-Pacific: This region exhibits substantial growth potential due to the rapidly expanding middle class, rising disposable incomes, and increasing access to information about feminine hygiene practices. However, varying cultural norms and levels of awareness present both opportunities and challenges for market penetration.

Segments: The segments dominating the market are those offering:

Organic and Natural Products: Consumers are increasingly seeking products free from harsh chemicals, parabens, and sulfates, driving demand for organic and naturally derived formulations. This segment is projected to experience rapid growth due to heightened consumer awareness of the potential negative effects of harsh chemicals on sensitive skin.

Products for Sensitive Skin: Given the sensitivity of the vaginal area, products specifically formulated for sensitive skin are gaining popularity. The demand for hypoallergenic and pH-balanced washes is expected to continue increasing as consumer awareness of sensitive skin conditions grows.

Specialty Products: This includes products for postpartum care, addressing specific concerns like dryness or irritation, or formulated for specific age groups. These specialized offerings cater to unique needs and are driving market segmentation.

The combination of these key regions and rapidly expanding segments suggests a robust future for the intimate wash care products market, with significant growth potential across various geographical areas and product categories.

The intimate wash care products industry is experiencing robust growth fueled by several key catalysts. The rising awareness of intimate hygiene and its impact on overall health is a primary driver, leading to increased adoption of these products. Simultaneously, innovative product formulations, particularly those offering natural ingredients and addressing specific needs like sensitive skin or postpartum care, cater to evolving consumer preferences and enhance market appeal. Furthermore, expanding distribution channels, including e-commerce platforms, ensure wider product accessibility, directly contributing to increased sales and market penetration.

This report provides a comprehensive analysis of the intimate wash care products market, covering historical data (2019-2024), an estimated year (2025), and a detailed forecast (2025-2033). It examines key market trends, driving forces, challenges, and growth catalysts, while also profiling leading players and significant industry developments. The report provides valuable insights for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kao Corporation, Kimberly-Clark Corporation, Organic Glide Company, The Honey Pot Company, LLC, Prestige Consumer Healthcare Company, Imbue, Glenmark Pharmaceuticals Company, Combe Incorporated, Lemisol Corporation, Skin Elements Company, WOW Freedom Company, The Himalaya Drug Company, Makhai, Sirona Hygiene Private Limited, .

The market segments include Type, Application.

The market size is estimated to be USD 6190.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "lntimate Wash Care Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the lntimate Wash Care Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.