1. What is the projected Compound Annual Growth Rate (CAGR) of the Livestock Vaccines and Poultry Vaccines?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Livestock Vaccines and Poultry Vaccines

Livestock Vaccines and Poultry VaccinesLivestock Vaccines and Poultry Vaccines by Application (Direct Selling, Distribution, World Livestock Vaccines and Poultry Vaccines Production ), by Type (Live Attenuated Vaccine, Inactivated Vaccine, Recombinant Vaccine, World Livestock Vaccines and Poultry Vaccines Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

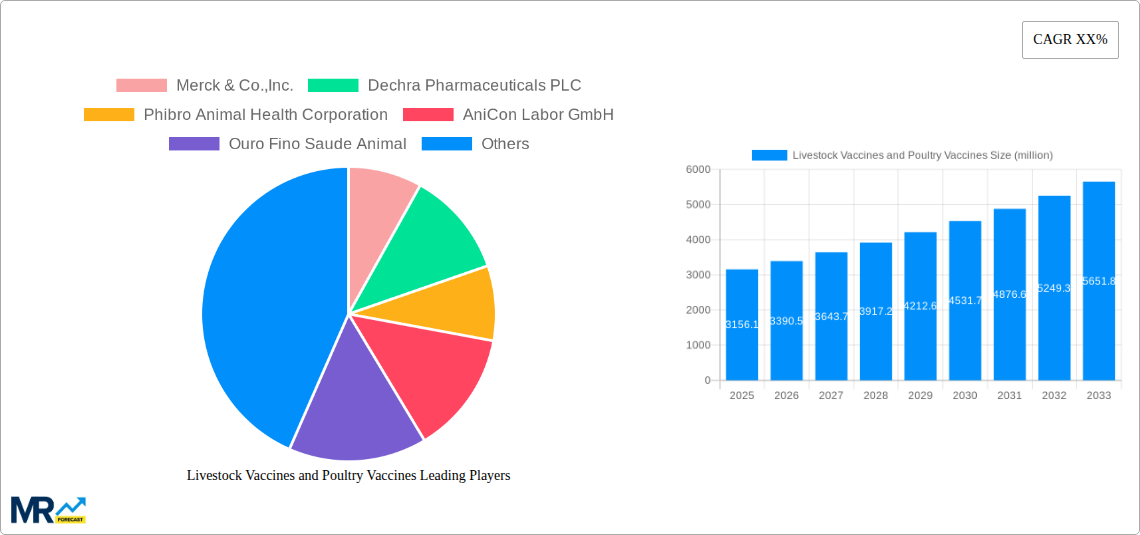

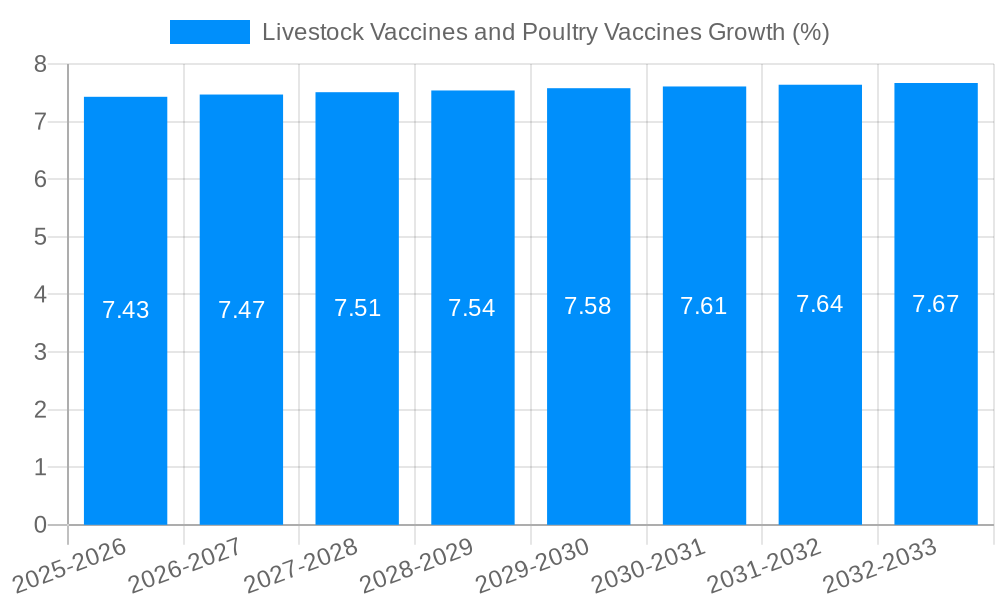

The global Livestock Vaccines and Poultry Vaccines market is poised for substantial growth, projected to reach a significant valuation of USD 3156.1 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 7.5%. This expansion is primarily fueled by the increasing global demand for animal protein, necessitating enhanced disease prevention and control in livestock and poultry farming to ensure food security and herd health. The burgeoning trend of intensified animal farming practices, while improving efficiency, also presents a greater risk of disease outbreaks, thus driving the demand for effective vaccination strategies. Furthermore, rising awareness among farmers regarding the economic impact of animal diseases, coupled with government initiatives promoting animal health and biosecurity, are key catalysts for market growth. The advent of advanced vaccine technologies, including recombinant and subunit vaccines offering improved safety and efficacy profiles, is also contributing to market dynamism and widespread adoption across diverse applications like direct selling and distribution channels.

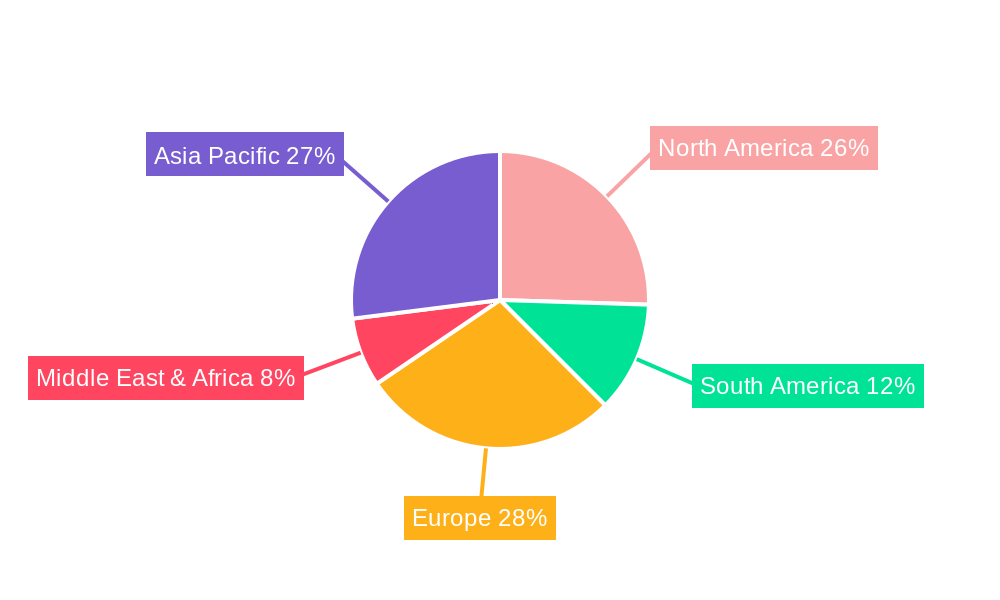

The market segmentation reveals a strong emphasis on both types of vaccines, with live attenuated and inactivated vaccines continuing to dominate current applications, while recombinant vaccines are gaining traction due to their targeted efficacy and reduced side effects. In terms of applications, the production of world livestock and poultry vaccines remains the core segment, with a growing focus on innovative solutions for a broader spectrum of diseases. Geographically, Asia Pacific is emerging as a high-growth region, driven by its large and expanding livestock population, increasing disposable incomes, and significant investments in animal husbandry modernization. North America and Europe remain mature yet substantial markets, characterized by stringent regulatory frameworks and a well-established demand for high-quality animal health products. Key players are actively involved in research and development to introduce novel vaccines and expand their product portfolios to cater to the evolving needs of the global animal health sector, making this a dynamic and critical market for agricultural sustainability.

This comprehensive report provides an in-depth analysis of the global Livestock Vaccines and Poultry Vaccines market, encompassing a detailed study from 2019 to 2033, with a base year of 2025. The report delves into the intricate dynamics shaping this vital sector, offering invaluable insights for stakeholders, investors, and industry professionals.

XXX The global Livestock Vaccines and Poultry Vaccines market is experiencing a significant upward trajectory, driven by an ever-increasing demand for safe and sustainable animal protein sources. With the human population projected to surge past 9 billion by 2050, the pressure on livestock and poultry production intensifies, making disease prevention through vaccination an economic imperative. The historical period (2019-2024) witnessed a steady rise in vaccination rates, fueled by a growing awareness among farmers and producers regarding the economic benefits of disease control. The base year of 2025 marks a crucial point, with an estimated market value poised for substantial growth. The forecast period (2025-2033) is expected to be characterized by several key trends. Firstly, the adoption of advanced vaccine technologies, such as recombinant and subunit vaccines, will gain momentum. These novel approaches offer enhanced specificity, reduced side effects, and improved safety profiles compared to traditional live attenuated and inactivated vaccines. The market for these advanced types is anticipated to see significant expansion, reflecting investments in research and development by leading companies. Secondly, the increasing prevalence of zoonotic diseases, which can transmit from animals to humans, is a major driver for enhanced biosecurity measures, including widespread vaccination programs. This is particularly evident in the poultry sector, where outbreaks of avian influenza can have devastating economic and public health consequences. The demand for robust poultry vaccines is thus expected to remain consistently high. Furthermore, the growing emphasis on animal welfare and antibiotic reduction strategies is indirectly boosting the demand for vaccines. By preventing diseases, vaccines reduce the need for antibiotic treatments, aligning with global efforts to combat antimicrobial resistance. The report will detail the projected market size in millions of units for both livestock and poultry vaccines, illustrating the scale of this evolving industry.

The growth of the Livestock Vaccines and Poultry Vaccines market is propelled by a confluence of powerful factors. Foremost among these is the escalating global demand for animal protein. As the world's population continues to expand, so does the need for meat, milk, and eggs, placing immense pressure on livestock and poultry farming operations to increase output efficiently and sustainably. Vaccination plays a critical role in achieving this by safeguarding animal health, preventing widespread disease outbreaks that can decimate herds and flocks, and consequently, ensuring consistent production levels. Another significant driver is the increasing awareness among farmers and agricultural enterprises regarding the economic benefits of proactive disease prevention. The cost of a vaccination program is often significantly lower than the financial losses incurred due to disease outbreaks, including reduced productivity, treatment costs, and potential herd or flock depletion. This economic rationale strongly encourages the adoption of vaccines. Furthermore, stringent government regulations and international trade requirements that mandate disease-free status for animals destined for export also contribute to the demand for vaccines. Countries and regions seeking to participate in global trade must adhere to strict veterinary health standards, making comprehensive vaccination programs a necessity. The rising incidence of emerging and re-emerging animal diseases, coupled with the inherent risks of zoonotic diseases that can transfer to humans, further amplifies the importance of robust vaccination strategies for public health and biosecurity.

Despite the robust growth prospects, the Livestock Vaccines and Poultry Vaccines market faces several significant challenges and restraints that could temper its expansion. One primary challenge is the high cost associated with research and development (R&D) for novel vaccines. Developing effective, safe, and market-ready vaccines requires substantial financial investment, extensive clinical trials, and adherence to rigorous regulatory approval processes. This can be a barrier, especially for smaller companies or for vaccines targeting less common diseases. Another considerable restraint is the cold chain management required for many vaccines. Maintaining the efficacy of vaccines often necessitates a continuous, uninterrupted cold chain from manufacturing to administration. This logistical challenge can be particularly difficult to manage in developing regions with inadequate infrastructure, leading to vaccine spoilage and reduced effectiveness. Furthermore, the potential for vaccine hesitancy among some farmers, particularly in cases where the perceived benefits do not immediately outweigh the costs or perceived risks, can hinder widespread adoption. Misinformation or a lack of understanding about vaccine efficacy and safety can contribute to this hesitancy. The emergence of new strains of pathogens can also pose a significant challenge, as existing vaccines may become less effective or entirely obsolete, necessitating the continuous development of updated formulations. Lastly, regulatory hurdles and varying approval processes across different countries can create delays and increase the complexity of bringing new vaccines to market, thereby impacting the pace of innovation and accessibility.

The global Livestock Vaccines and Poultry Vaccines market is poised for significant growth, with specific regions and market segments expected to lead this expansion. Among the key regions, Asia-Pacific is anticipated to emerge as a dominant force in the market. This dominance is driven by a confluence of factors including the region's rapidly growing population, which translates to an increasing demand for animal protein, and a burgeoning livestock and poultry industry seeking to meet this demand. Countries like China, India, and Southeast Asian nations are witnessing substantial growth in their animal agriculture sectors, necessitating enhanced disease prevention measures through vaccination. The presence of a large number of smallholder farms alongside increasingly consolidated commercial operations in this region creates a diverse market for various types of vaccines. Furthermore, government initiatives aimed at improving animal health, enhancing food safety, and controlling endemic diseases are further bolstering the demand for vaccines in Asia-Pacific.

Within the market segments, the World Livestock Vaccines and Poultry Vaccines Production segment, particularly focusing on Inactivated Vaccines and Recombinant Vaccines, is expected to witness substantial dominance and growth.

The interplay between the burgeoning production capacity in the Asia-Pacific region and the increasing demand for both established (inactivated) and innovative (recombinant) vaccine types across various animal species will shape the market's future. Companies are strategically investing in production facilities and R&D to capitalize on these trends, further solidifying the dominance of these segments and regions. The application segment of Distribution will also play a pivotal role, ensuring that these vaccines reach diverse farming operations, from large-scale commercial enterprises to smaller holdings, thereby facilitating market penetration and growth. The estimated production of vaccines in millions of units for both livestock and poultry is expected to see substantial year-on-year increases throughout the forecast period, driven by these dominant segments and regions.

Several key factors are acting as growth catalysts for the Livestock Vaccines and Poultry Vaccines industry. A primary catalyst is the increasing global emphasis on food security and the rising demand for animal protein, necessitating enhanced disease prevention to maximize yield. Furthermore, the growing awareness and concern surrounding zoonotic diseases and the need for improved public health are driving demand for effective vaccines. Technological advancements, particularly in the development of recombinant and subunit vaccines, are offering more precise and safer disease prevention solutions, stimulating market growth. Government support through subsidies, research grants, and favorable regulatory frameworks also plays a crucial role in accelerating vaccine adoption.

This report offers a comprehensive examination of the Livestock Vaccines and Poultry Vaccines market, providing a detailed analysis of market size in millions of units, growth projections, and key trends. It delves into the driving forces behind market expansion, such as increasing demand for animal protein and growing awareness of zoonotic diseases. Simultaneously, it critically assesses the challenges and restraints, including R&D costs and cold chain logistics. The report identifies dominant regions and segments, offering strategic insights into areas of high growth potential. It also highlights key growth catalysts, leading industry players, and significant market developments, providing a holistic understanding of this vital sector. The comprehensive coverage ensures that stakeholders are equipped with the knowledge to navigate the evolving landscape of animal health and vaccine innovation.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Merck & Co.,Inc., Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, AniCon Labor GmbH, Ouro Fino Saude Animal, Pfizer(Zoetis), Elanco, Biogénesis Bagó, Jinyu Biotechnology Co.,Ltd., Tianjin Ruipu Biotechnology Co.,Ltd., Pulike Biological Engineering Co.,Ltd., Shanghai Haili Biotechnology Co.,Ltd., Shenlian Biomedicine (Shanghai) Co.,Ltd, Wuhan Keqian Biological Co.,Ltd., Zhongmu Industrial Co.,Ltd..

The market segments include Application, Type.

The market size is estimated to be USD 3156.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Livestock Vaccines and Poultry Vaccines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Livestock Vaccines and Poultry Vaccines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.