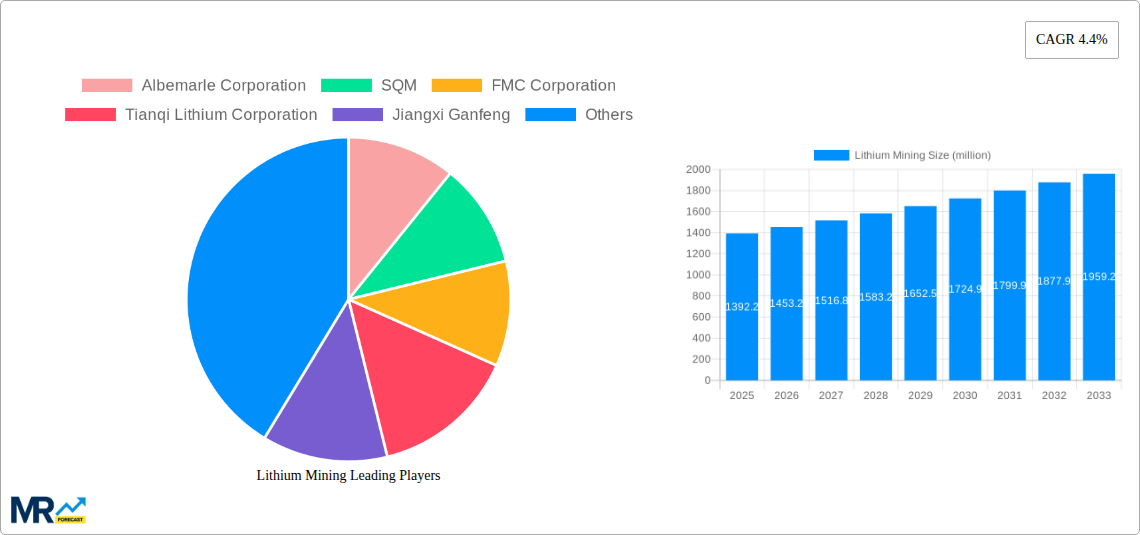

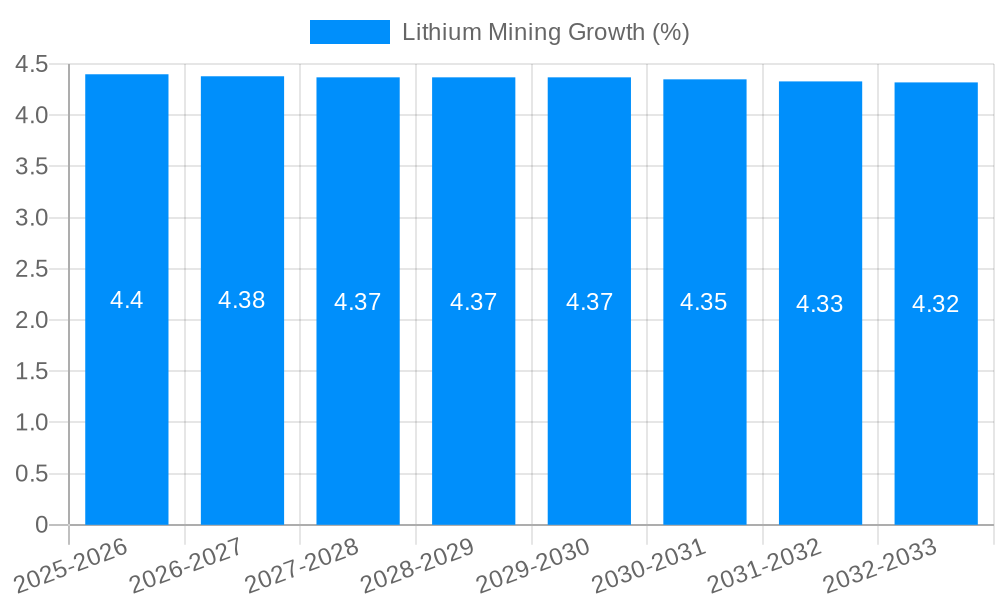

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium Mining?

The projected CAGR is approximately 4.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lithium Mining

Lithium MiningLithium Mining by Type (Brine, Hard Rocks), by Application (Batteries, Glass, Grease, Air Conditioning Equipment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global lithium mining market is poised for substantial growth, projected to reach $1392.2 million by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of 4.4% from 2019 to 2033. This expansion is primarily fueled by the escalating demand for lithium-ion batteries, which are central to the burgeoning electric vehicle (EV) industry and the rapidly growing portable electronics sector. As governments worldwide implement policies to promote clean energy and reduce carbon emissions, the reliance on EVs is set to increase, directly translating into a higher demand for lithium. Beyond batteries, the glass and grease industries also represent significant consumption avenues, further bolstering market prospects. Emerging economies are increasingly adopting advanced technologies, contributing to the diverse application base for lithium products.

Navigating the market landscape, the lithium mining sector faces several key trends and challenges. The dominance of brine extraction methods, particularly in South America's "Lithium Triangle," is a significant trend, offering cost-effective production. However, the increasing focus on hard rock mining, especially in regions like Australia, reflects a diversification of supply sources. Environmental concerns and stringent regulatory frameworks surrounding mining operations, coupled with geopolitical risks and supply chain disruptions, present considerable restraints. Nonetheless, technological advancements in extraction and processing are continually being explored to improve efficiency and sustainability, offering pathways to overcome these challenges. Companies like Albemarle Corporation, SQM, and Tianqi Lithium Corporation are at the forefront, strategically investing in exploration and production to capitalize on the robust demand, ensuring a steady supply to meet the global appetite for this critical mineral.

This comprehensive report delves into the dynamic global lithium mining industry, analyzing market trends, driving forces, challenges, and future outlook. The study encompasses a historical period from 2019-2024, a base year of 2025, and a forecast period extending from 2025-2033. With an estimated market value expected to reach $145,500 million by 2033, this report provides in-depth insights for stakeholders seeking to understand and capitalize on this critical sector. The report will meticulously examine various segments, including lithium extraction types (Brine and Hard Rocks), applications (Batteries, Glass, Grease, Air Conditioning Equipment, and Others), and key industry developments.

XXX The global lithium mining market is experiencing an unprecedented surge, driven by the insatiable demand for electric vehicles (EVs) and the broader energy transition. This surge has transformed lithium from a niche commodity into a cornerstone of modern technological advancement and sustainable energy solutions. The historical period (2019-2024) witnessed significant price volatility and a ramp-up in production to meet burgeoning demand, particularly from the burgeoning EV battery sector. As we move into the base year (2025) and the forecast period (2025-2033), the market is projected to maintain a robust growth trajectory, with the estimated market size reaching an impressive $145,500 million by 2033. This growth is not merely quantitative but also qualitative, characterized by advancements in extraction technologies, increasing diversification of supply sources, and a heightened focus on sustainable and ethical mining practices.

The Brine segment has historically dominated the market due to its cost-effectiveness, particularly in regions like South America. However, Hard Rocks mining is gaining traction, especially with the development of new projects in Australia and Canada, contributing to a more balanced supply chain. The primary application, Batteries, is projected to continue its dominance, accounting for a substantial portion of the global lithium consumption. The rise of advanced battery chemistries and the continuous innovation in battery technology further fuel this demand. Beyond batteries, the report will explore the significant, albeit smaller, contributions of lithium to the Glass and Grease industries, as well as its specialized uses in Air Conditioning Equipment and various "Others" applications. Market intelligence gathered during the study period (2019-2033) indicates a growing awareness and investment in lithium exploration and development across both established and emerging mining regions, signaling a long-term commitment to securing sufficient supply to meet future energy needs. The report will provide detailed insights into regional production capacities, market share analyses of leading companies, and the impact of geopolitical factors on lithium supply chains. Furthermore, it will analyze the evolving regulatory landscape and the increasing emphasis on environmental, social, and governance (ESG) factors within the lithium mining sector, which are becoming critical considerations for investors and consumers alike.

The global lithium mining market is propelled by an undeniable confluence of powerful driving forces, with the most significant being the accelerating transition to electric mobility. The escalating adoption of electric vehicles (EVs) worldwide, spurred by government incentives, growing environmental consciousness, and advancements in battery technology, directly translates into an exponential increase in demand for lithium-ion batteries. This demand forms the bedrock of the lithium mining industry's current and future growth. Furthermore, the broader push towards decarbonization and renewable energy storage solutions, encompassing grid-scale batteries for solar and wind power, further amplifies the need for lithium. As countries and corporations commit to ambitious climate targets, the requirement for efficient and reliable energy storage systems becomes paramount, with lithium playing a central role in their efficacy. The ongoing innovation in battery technology, leading to higher energy densities, longer lifespans, and faster charging capabilities, also contributes to sustained demand, encouraging the development of new and improved lithium extraction and processing techniques.

Despite the robust growth trajectory, the lithium mining industry faces significant challenges and restraints that could temper its expansion. One of the most prominent issues is the environmental impact of lithium extraction. Traditional brine evaporation methods can consume vast amounts of water in arid regions, while hard rock mining can lead to habitat destruction and the generation of substantial waste rock. The growing scrutiny on these environmental concerns necessitates the adoption of more sustainable and less resource-intensive extraction technologies, which can be costly and time-consuming to implement. Another critical restraint is the geopolitical concentration of lithium reserves and production. The majority of economically viable lithium resources and processing capabilities are concentrated in a few countries, leading to potential supply chain vulnerabilities and price volatility due to geopolitical tensions or trade disputes. This reliance on a limited number of suppliers poses a significant risk for downstream industries and governments aiming for energy independence. Furthermore, exploration and development costs for new lithium projects are substantial and carry inherent risks, including the possibility of resource depletion or technical difficulties during extraction. The complex and often lengthy permitting processes in many regions also add to development timelines and costs. Finally, price volatility remains a persistent concern, influenced by fluctuations in supply and demand, technological breakthroughs in battery technology that might reduce lithium intensity, and speculative trading in commodity markets.

The global lithium mining market is characterized by a distinct regional and segmental dominance, with certain areas and specific types of extraction and application poised to lead the industry's growth trajectory.

Dominant Regions/Countries:

Dominant Segments:

The interplay between these dominant regions and segments will shape the future landscape of the lithium mining industry, influencing investment decisions, technological advancements, and supply chain strategies. The report will provide granular data on market share projections for each region and segment, along with detailed analyses of their growth drivers and potential bottlenecks.

The lithium mining industry is propelled by several potent growth catalysts. The relentless expansion of the electric vehicle market, driven by government mandates and consumer preferences for sustainable transportation, is the primary engine. Furthermore, the accelerating global shift towards renewable energy sources necessitates massive investments in battery storage solutions, directly boosting lithium demand. Continuous advancements in battery technology, leading to higher energy densities and improved lifespan, are also critical in sustaining and amplifying this demand. Finally, increasing government support through subsidies, tax incentives, and strategic investments in domestic lithium production is a significant catalyst for the industry's expansion.

This report offers a holistic perspective on the lithium mining industry, providing a detailed exploration of market dynamics, technological advancements, and the intricate interplay of supply and demand. It delves into the critical role of lithium in the energy transition, examining its impact on the automotive, renewable energy, and electronics sectors. The report will meticulously analyze production capacities, reserve estimations, and the evolving global trade flows of lithium compounds. Furthermore, it will assess the influence of regulatory frameworks, environmental considerations, and geopolitical factors on market stability and future growth. With in-depth case studies of key regions and companies, alongside comprehensive market forecasts, this report serves as an indispensable resource for investors, industry professionals, and policymakers seeking to navigate the complexities and capitalize on the opportunities within the burgeoning lithium mining sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.4%.

Key companies in the market include Albemarle Corporation, SQM, FMC Corporation, Tianqi Lithium Corporation, Jiangxi Ganfeng, Orocobre, Nordic Mining, QingHai Salt Lake Industry, .

The market segments include Type, Application.

The market size is estimated to be USD 1392.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Lithium Mining," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lithium Mining, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.