1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium-ion Pouch Cell Pilot Line?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lithium-ion Pouch Cell Pilot Line

Lithium-ion Pouch Cell Pilot LineLithium-ion Pouch Cell Pilot Line by Type (Polymer, Lithium Iron Phosphate, Other), by Application (Consumer Electronics, Electric Vehicles, E-bikes, Energy Storage Systems, Medical Devices, Others, World Lithium-ion Pouch Cell Pilot Line Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

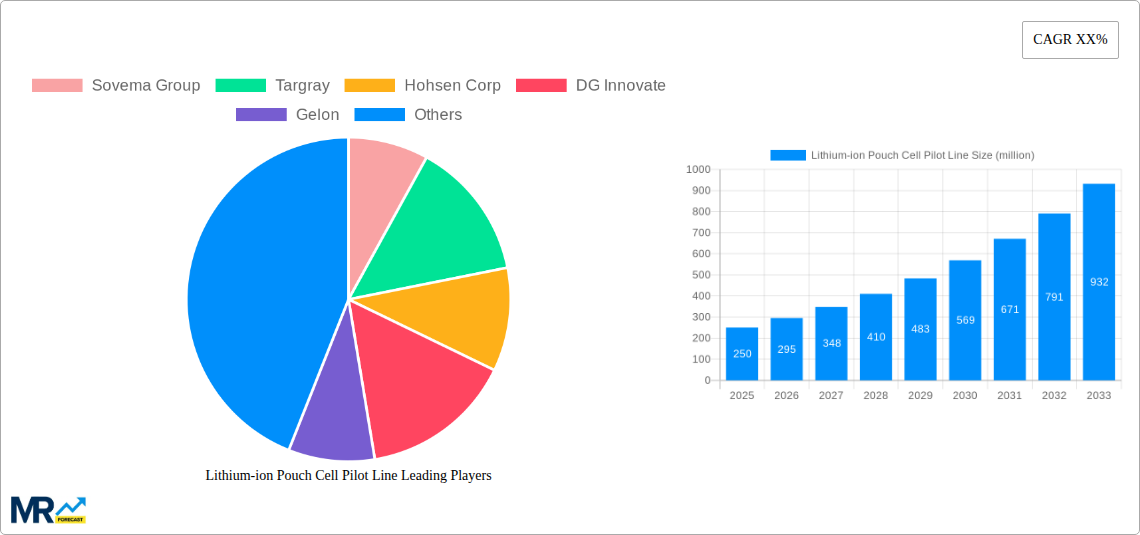

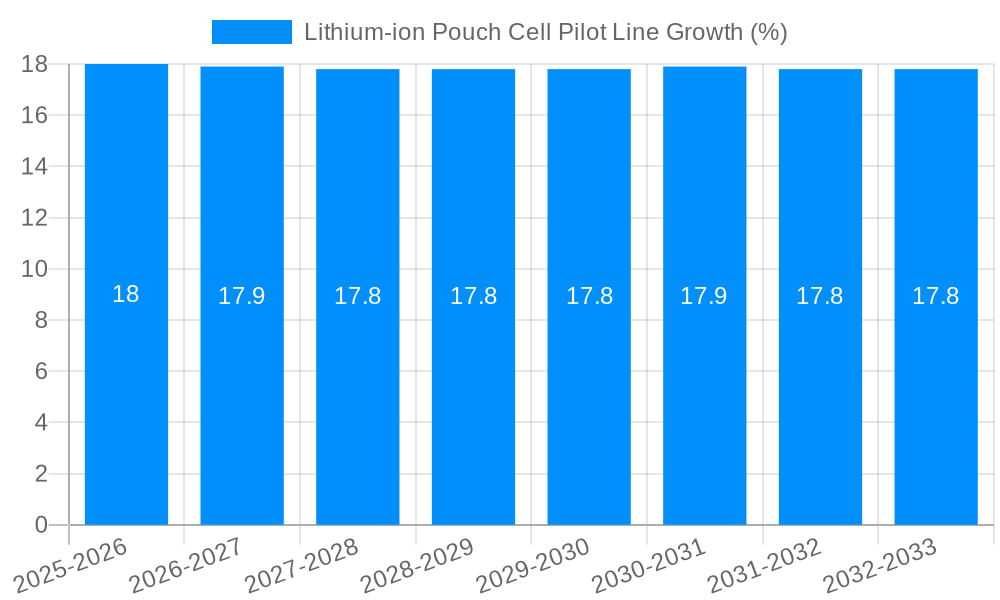

The global Lithium-ion Pouch Cell Pilot Line market is experiencing robust expansion, driven by the escalating demand for advanced battery technologies across burgeoning sectors. With a current market size estimated to be around USD 250 million in 2025, the sector is poised for significant growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 18% over the forecast period spanning from 2025 to 2033. This impressive trajectory is primarily fueled by the rapid adoption of electric vehicles (EVs) and the concurrent need for sophisticated energy storage solutions to support renewable energy integration. Furthermore, the burgeoning consumer electronics market, with its insatiable appetite for more powerful and compact batteries, alongside the increasing utilization of lithium-ion pouch cells in e-bikes and medical devices, are key accelerators. The inherent advantages of pouch cells, such as their flexibility in design, lightweight nature, and superior energy density compared to traditional cylindrical cells, are making them the preferred choice for manufacturers looking to innovate and optimize their product offerings.

Key trends shaping the Lithium-ion Pouch Cell Pilot Line market include advancements in manufacturing processes leading to increased efficiency and reduced production costs, as well as the development of novel materials to enhance battery performance and safety. The emphasis on sustainable manufacturing practices and the circular economy is also gaining traction, influencing the design and operation of pilot lines. However, the market faces certain restraints, including the high initial capital investment required for setting up advanced pilot lines, the complex supply chain for raw materials, and stringent regulatory compliance, particularly concerning battery safety and disposal. Despite these challenges, the concerted efforts by leading players like Sovema Group, Targray, and Hohsen Corp in research and development, coupled with strategic collaborations and expansions, are expected to mitigate these restraints and propel the market towards sustained, high-value growth in the coming years. The Asia Pacific region, particularly China, is anticipated to dominate the market due to its established manufacturing infrastructure and strong government support for the battery industry.

This report offers a deep dive into the global Lithium-ion Pouch Cell Pilot Line market, meticulously analyzing trends, drivers, challenges, and growth opportunities from the historical period of 2019-2024 through to a comprehensive forecast period of 2025-2033. The base year of 2025 serves as a critical benchmark for understanding current market conditions and future projections. Our analysis leverages extensive data, including projected production volumes in the tens of millions of units, to paint a detailed picture of this dynamic sector. We explore the technological advancements, strategic collaborations, and evolving application demands that are shaping the landscape of lithium-ion pouch cell pilot line manufacturing.

The global Lithium-ion Pouch Cell Pilot Line market is experiencing a profound transformation driven by an escalating demand for advanced battery technologies across a spectrum of applications. The historical period (2019-2024) witnessed a significant surge in investment and development, primarily fueled by the burgeoning electric vehicle (EV) sector and the increasing adoption of portable electronic devices. During this time, the average pilot line capacity for pouch cells has seen a steady increase, with many advanced facilities now capable of producing several million units annually, a figure expected to grow substantially by the estimated year of 2025 and beyond. The market is characterized by a continuous pursuit of higher energy densities, faster charging capabilities, enhanced safety features, and improved lifespan for lithium-ion batteries. This pursuit directly influences the design and capabilities of pilot lines, pushing manufacturers to adopt more sophisticated automation, precision manufacturing techniques, and advanced quality control systems.

Furthermore, the trend towards miniaturization and flexible form factors in consumer electronics, alongside the growing need for reliable energy storage solutions for renewable energy integration, is creating distinct market niches. This diversification necessitates pilot lines that can cater to a wider range of cell chemistries, including but not limited to Lithium Iron Phosphate (LIFePO4), enabling the production of batteries tailored for specific performance requirements. The study period of 2019-2033 highlights a clear trajectory towards the scaling up of pilot line operations, transitioning from R&D-focused setups to commercially viable, albeit still developmental, production facilities. This evolution is critical for bridging the gap between laboratory innovations and mass manufacturing, allowing for rapid iteration and optimization of battery designs before full-scale industrialization. The market also observes a growing emphasis on sustainable manufacturing practices, including the development of more efficient material utilization and waste reduction techniques within pilot line operations. As we move into the forecast period of 2025-2033, the ability of pilot lines to adapt to evolving regulatory landscapes and to facilitate the production of next-generation battery chemistries will be paramount. The increasing complexity and customization demands from application sectors like Electric Vehicles and Energy Storage Systems are pushing pilot line providers to offer highly modular and adaptable solutions. The market is also seeing an increased focus on the development of in-situ monitoring and diagnostic capabilities within pilot lines to gather crucial data for process optimization and quality assurance, aiming to achieve production efficiencies that translate to millions of defect-free units. The strategic integration of advanced materials, such as solid-state electrolytes, into pouch cell designs will further necessitate the evolution of pilot line technologies.

The global Lithium-ion Pouch Cell Pilot Line market is experiencing robust growth, propelled by several interconnected driving forces that underscore the critical role of these developmental production facilities. Foremost among these is the insatiable demand for electrification across key industries, with the Electric Vehicles (EVs) segment leading the charge. As governments worldwide implement ambitious targets for EV adoption and automakers accelerate their transition away from internal combustion engines, the need for efficient, scalable, and cost-effective battery production becomes paramount. Pilot lines are essential for developing and refining the manufacturing processes for pouch cells, which offer advantages in terms of flexibility, safety, and energy density, making them a preferred choice for many EV manufacturers. The projected production capacity of these pilot lines, reaching tens of millions of units, directly supports this burgeoning EV ecosystem.

Secondly, the rapid expansion of the Renewable Energy Storage Systems (ESS) sector is a significant growth catalyst. The increasing integration of solar and wind power necessitates advanced battery storage solutions to ensure grid stability and reliable energy supply. Pouch cells, with their modular design and scalability, are well-suited for ESS applications, driving demand for pilot lines capable of producing these batteries in large volumes. Furthermore, the continuous innovation in Consumer Electronics, including smartphones, laptops, wearables, and increasingly, advanced portable medical devices, demands smaller, lighter, and more powerful batteries. Pilot lines play a crucial role in developing and optimizing the production of these highly customized pouch cells, enabling manufacturers to meet the evolving needs of tech-savvy consumers. The historical period (2019-2024) has shown a consistent upward trend in the adoption of lithium-ion pouch cells, and this momentum is expected to accelerate through the forecast period (2025-2033), further solidifying the importance of pilot line development. The ability of these lines to experiment with novel materials and manufacturing techniques also fuels innovation across the entire battery value chain, from material suppliers to end-product manufacturers.

Despite the considerable growth potential, the Lithium-ion Pouch Cell Pilot Line market faces several significant challenges and restraints that can impede its full realization. One of the primary hurdles is the substantial capital investment required to establish and operate advanced pilot lines. The sophisticated machinery, specialized cleanroom environments, and rigorous quality control systems demand significant upfront expenditure, which can be a barrier for smaller companies or those with limited access to funding. This high cost of entry can limit the number of players in the market, potentially concentrating innovation within a few well-capitalized entities. The complexities of scaling up production from lab-scale to pilot line operations also present considerable technical challenges. Ensuring consistency, yield, and performance across millions of manufactured units requires meticulous process engineering and optimization. Any missteps during this critical scaling phase can lead to significant delays and increased costs.

Moreover, the rapid pace of technological advancement in battery chemistry and design poses a continuous challenge for pilot line operators. What is cutting-edge today may become obsolete tomorrow. Pilot lines must be agile and adaptable to incorporate new materials and manufacturing techniques, such as solid-state electrolytes or advanced anode/cathode materials, to remain relevant. This necessitates ongoing investment in research and development and the ability to reconfigure or upgrade existing equipment. The global supply chain for specialized battery manufacturing equipment and raw materials can also be a point of vulnerability. Disruptions, such as geopolitical tensions, trade restrictions, or shortages of critical minerals, can impact the availability and cost of essential components for pilot lines, leading to production bottlenecks. Regulatory hurdles and evolving safety standards for battery manufacturing and usage also add another layer of complexity. Companies must ensure their pilot line operations and the cells produced adhere to a growing number of international and regional regulations, which can necessitate additional testing and validation processes, further increasing costs and timelines.

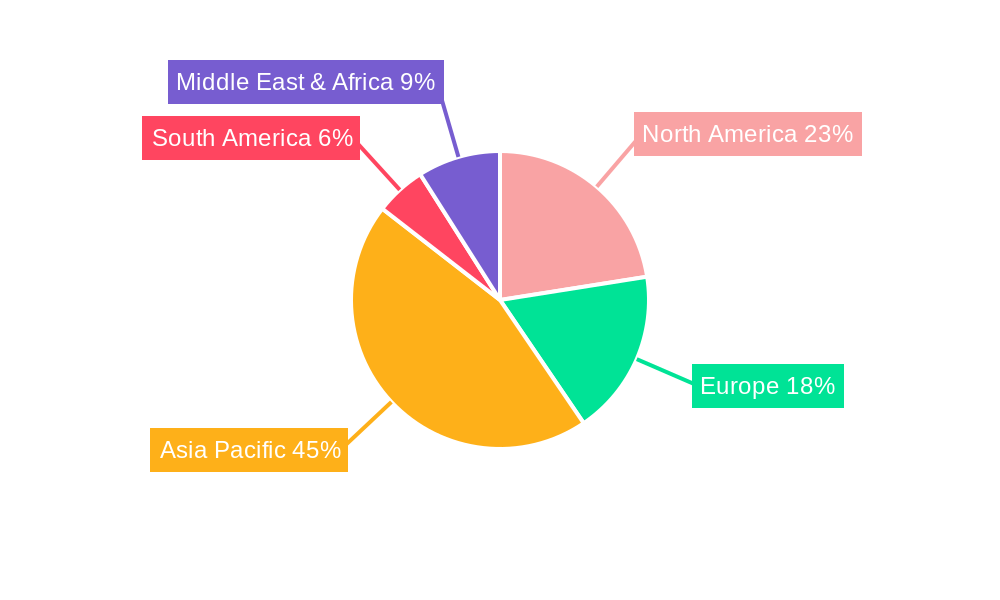

Dominant Region: Asia Pacific (APAC)

The Asia Pacific (APAC) region is poised to continue its dominance in the Lithium-ion Pouch Cell Pilot Line market due to a confluence of strategic factors. Its established leadership in global battery manufacturing, particularly in countries like China, South Korea, and Japan, provides a robust ecosystem for pilot line development and deployment. These nations are home to major battery manufacturers and a significant concentration of research and development activities in battery technology. The presence of a vast and growing demand from key application segments within the region further bolsters this dominance.

Dominant Segment: Electric Vehicles (EVs) and Energy Storage Systems (ESS)

Within the application segments, Electric Vehicles (EVs) and Energy Storage Systems (ESS) are expected to be the primary drivers of demand for Lithium-ion Pouch Cell Pilot Lines. These sectors represent the largest and fastest-growing markets for lithium-ion batteries, necessitating the development and optimization of large-scale pouch cell production.

Electric Vehicles (EVs): The global push towards decarbonization and the rapid adoption of electric vehicles by consumers and fleet operators worldwide is the single most significant driver for the EV battery market. Pouch cells are increasingly favored in EV designs due to their flexibility in fitting into various chassis designs, their superior energy density which translates to longer driving ranges, and their inherent safety advantages. Pilot lines are crucial for EV manufacturers and battery producers to:

Energy Storage Systems (ESS): The growing need for grid stabilization, integration of intermittent renewable energy sources (solar and wind), and the increasing demand for backup power solutions are fueling the expansion of the ESS market. Pouch cells, with their modularity, scalability, and relatively good energy density, are well-suited for various ESS applications, from utility-scale projects to residential energy storage. Pilot lines are vital for ESS manufacturers and battery developers to:

While Consumer Electronics (e.g., smartphones, laptops, wearables) and E-bikes represent significant markets for pouch cells, their overall demand volume for pilot line development, as compared to EVs and ESS, is comparatively smaller in the context of large-scale production optimization. Medical Devices, while critical, represent a niche segment with highly specialized requirements and typically lower production volumes for pilot lines. "Others" encompasses a broad range of emerging applications, which will contribute to market growth but are not expected to drive pilot line development at the same scale as EVs and ESS in the near to medium term.

The growth of the Lithium-ion Pouch Cell Pilot Line industry is significantly propelled by continuous technological advancements in battery chemistry, leading to higher energy densities and improved safety profiles. The escalating global demand for Electric Vehicles (EVs) and robust expansion of Energy Storage Systems (ESS) are major demand drivers, necessitating the development and refinement of pouch cell manufacturing processes at pilot scales capable of producing millions of units. Government initiatives and subsidies promoting clean energy and EV adoption further catalyze investment in this sector. Moreover, increasing R&D efforts by key players to reduce production costs and enhance manufacturing efficiency are crucial growth catalysts, aiming to bridge the gap between laboratory innovations and commercial viability.

This report provides a holistic view of the Lithium-ion Pouch Cell Pilot Line market, offering in-depth analysis of market dynamics, technological trends, and growth prospects. It covers the historical period from 2019 to 2024 and forecasts market evolution through 2033, with a specific focus on the base and estimated year of 2025. The report details the key drivers, such as the burgeoning demand from Electric Vehicles (EVs) and Energy Storage Systems (ESS), alongside critical challenges like high capital investment and rapid technological evolution. We explore the significant role of the Asia Pacific region, particularly China, in dominating pilot line production and deployment. The report also highlights the vital growth catalysts and lists leading industry players, offering valuable insights for stakeholders seeking to navigate and capitalize on opportunities within this dynamic sector. The comprehensive coverage ensures a thorough understanding of the production capacities, potentially reaching tens of millions of units, and the strategic importance of pilot lines in the battery manufacturing ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sovema Group, Targray, Hohsen Corp, DG Innovate, Gelon, Digitron Systems, MTI Corporation, MSE Supplies, Top New Energy, Lyten, Tmax Battery Equipments, Ador Digatron, JT Battery Equipments, Deregallera, Acey New Energy Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Lithium-ion Pouch Cell Pilot Line," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lithium-ion Pouch Cell Pilot Line, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.