1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium-Ion Battery Pack for Consumer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lithium-Ion Battery Pack for Consumer

Lithium-Ion Battery Pack for ConsumerLithium-Ion Battery Pack for Consumer by Type (Below 100Wh, 100 ~ 200Wh, 201 ~ 400Wh, 401 ~ 600Wh, Above 600Wh, World Lithium-Ion Battery Pack for Consumer Production ), by Application (Electrical Tools, Garden Tools, Household Appliances, Electric Cehicle, Medical Instruments, World Lithium-Ion Battery Pack for Consumer Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

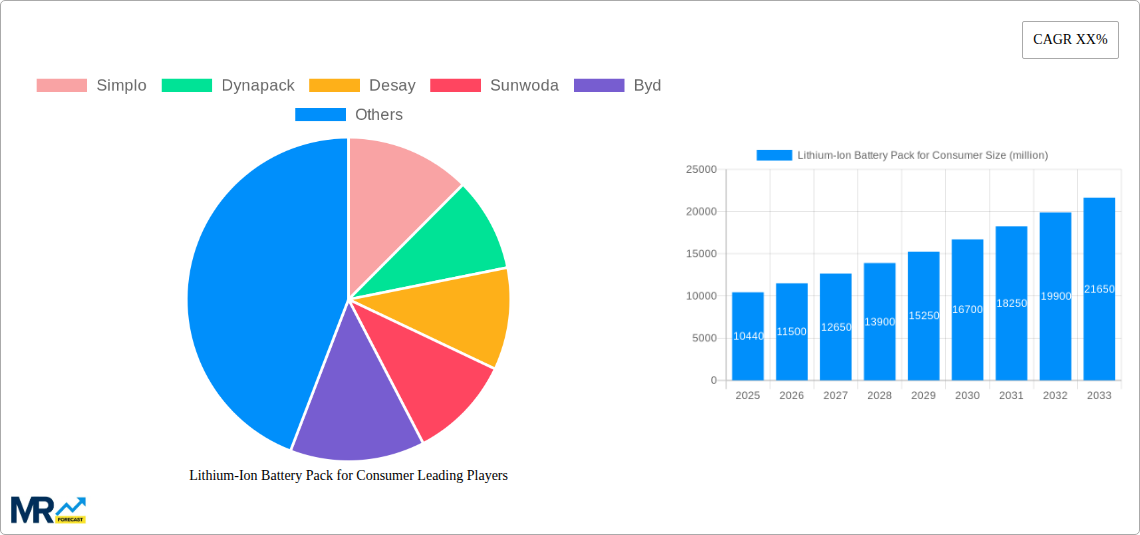

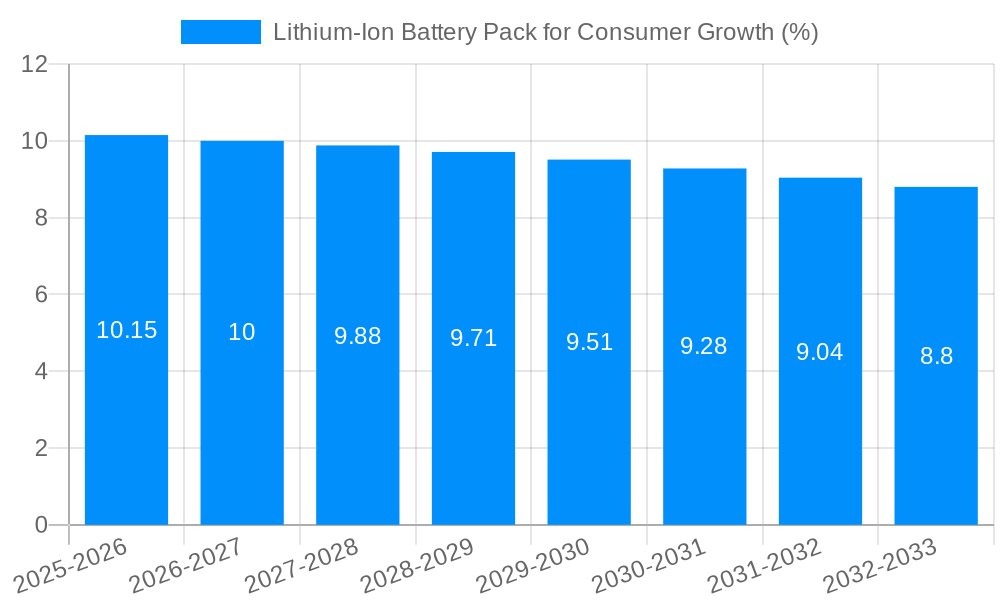

The global Lithium-Ion Battery Pack for Consumer market is poised for significant expansion, projected to reach an estimated $10,440 million by 2025. This robust growth is fueled by escalating demand across diverse consumer applications, from portable electronics and power tools to electric vehicles and medical devices. The increasing adoption of electric vehicles (EVs) stands as a primary driver, with ongoing advancements in battery technology and declining costs making EVs more accessible to a broader consumer base. Furthermore, the proliferation of smart home devices, wearable technology, and portable power solutions continues to bolster demand. The market is segmented by battery pack capacity, with the "100 ~ 200Wh" and "201 ~ 400Wh" segments likely to dominate due to their suitability for a wide array of consumer electronics and smaller EVs. The "Above 600Wh" segment is anticipated to witness substantial growth, driven by the increasing battery requirements for higher-performance electric vehicles and energy storage systems.

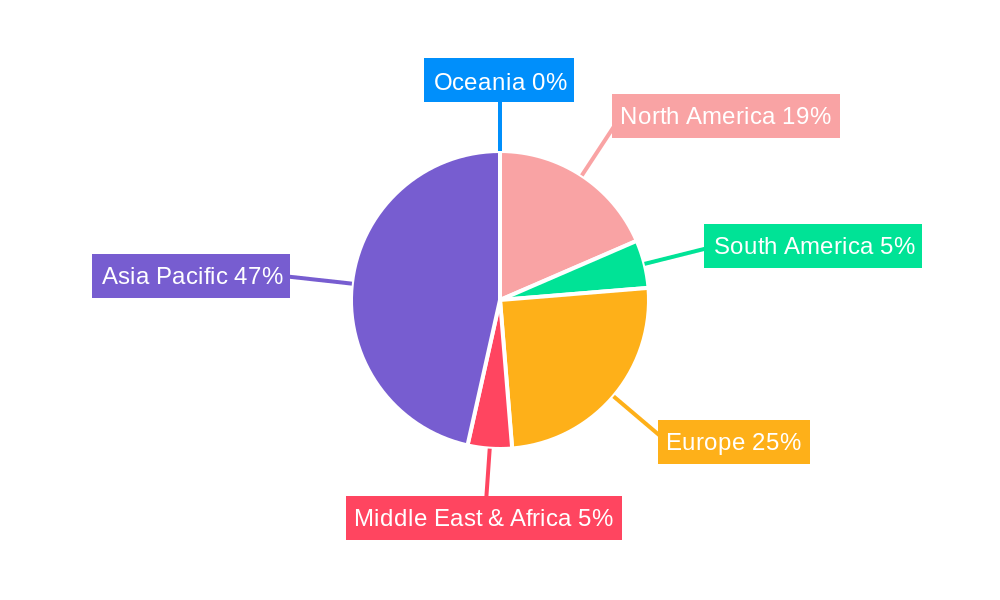

The market's trajectory is characterized by several key trends, including the continuous pursuit of higher energy density, faster charging capabilities, and enhanced safety features in lithium-ion battery packs. Innovations in battery chemistries, such as the development of solid-state batteries, hold the potential to further revolutionize the market by offering improved performance and safety profiles. Regional dynamics indicate Asia Pacific, particularly China, as a dominant force in both production and consumption, owing to its extensive manufacturing infrastructure and a rapidly growing middle class driving demand for consumer electronics and EVs. North America and Europe also represent substantial markets, driven by government initiatives supporting EV adoption and a strong consumer appetite for advanced technology. While the market exhibits immense potential, restraints such as the fluctuating prices of raw materials, particularly lithium and cobalt, and the complexities of battery recycling present ongoing challenges. However, technological advancements in battery management systems and sustainable sourcing practices are expected to mitigate these concerns over the forecast period.

This comprehensive report offers an in-depth analysis of the global Lithium-Ion Battery Pack for Consumer market, spanning from 2019 to 2033. With a base year of 2025 and an estimated year also of 2025, the forecast period from 2025 to 2033 provides critical insights into future market trajectories. The historical period from 2019 to 2024 lays the foundation for understanding past performance and evolving dynamics. The report meticulously examines production volumes in millions of units, dissecting key applications and segmentations to provide a granular view of market opportunities and challenges.

The global Lithium-Ion Battery Pack for Consumer market is experiencing an unprecedented surge, driven by an insatiable demand for portable power solutions across a myriad of applications. From the ubiquitous smartphones and laptops to increasingly electrified tools and vehicles, the reliance on compact, high-energy-density battery packs has become a defining characteristic of modern consumerism. The Below 100Wh segment, encompassing the power needs of personal electronics, continues to be a cornerstone, with projections indicating consistent growth. However, a significant trend emerging is the rapid expansion of higher capacity segments, particularly the 100-200Wh and 201-400Wh categories. This is directly attributable to the proliferation of electric bicycles, high-performance drones, and advanced portable medical devices, all of which necessitate longer operational times and greater power output. The 401-600Wh and Above 600Wh segments, while currently smaller in volume, are witnessing exceptional growth rates, largely fueled by the burgeoning electric vehicle (EV) market, even those considered "consumer" EVs like scooters and compact cars, and the increasing adoption of cordless electric garden tools.

Furthermore, a pronounced trend is the relentless pursuit of enhanced battery performance. Manufacturers are investing heavily in research and development to improve energy density, enabling smaller and lighter battery packs without compromising on power. This translates to longer runtimes for devices and a more convenient user experience. Simultaneously, safety and longevity are paramount concerns. The industry is witnessing a shift towards more sophisticated Battery Management Systems (BMS) that optimize charging, discharging, and temperature control, thereby extending the lifespan of battery packs and mitigating potential hazards. The increasing integration of smart technologies within battery packs, allowing for real-time performance monitoring and diagnostics, is another significant trend. This not only benefits the end-user by providing greater control and awareness but also assists manufacturers in understanding usage patterns and improving future designs. The circular economy is also beginning to influence trends, with growing emphasis on recyclability and sustainable sourcing of materials. While still in its nascent stages for consumer battery packs, this aspect is poised to become a critical differentiator in the coming years, impacting production methodologies and material choices. The overall market sentiment points towards sustained, robust growth, underpinned by technological advancements and expanding application landscapes, with production volumes anticipated to climb significantly in millions of units throughout the forecast period.

The exponential growth of the Lithium-Ion Battery Pack for Consumer market is propelled by a confluence of powerful driving forces. Foremost among these is the unstoppable proliferation of portable electronic devices. Smartphones, tablets, laptops, wearables, and countless other gadgets are now indispensable to daily life, each requiring a reliable and long-lasting lithium-ion battery pack. This sustained demand forms the bedrock of the market. Complementing this is the rapid evolution and adoption of electric vehicles (EVs), not just in the automotive sector but also in personal mobility solutions like electric bicycles, scooters, and even personal recreational vehicles. As governments worldwide push for cleaner transportation, the demand for high-capacity, efficient battery packs for these applications is skyrocketing. The development of more powerful and efficient cordless power tools and garden equipment is another significant catalyst. Consumers are increasingly opting for the convenience and freedom offered by battery-powered alternatives to their traditional corded counterparts, demanding battery packs that can deliver extended runtimes and robust performance for demanding tasks.

Furthermore, the advancements in battery technology itself are a critical driver. Continuous innovation in materials science and battery design is leading to higher energy densities, improved charging speeds, enhanced safety features, and longer cycle lives. This technological progress makes lithium-ion battery packs more attractive and capable for an ever-wider array of applications. The declining cost of lithium-ion battery production, driven by economies of scale and manufacturing efficiencies, is also making these power solutions more accessible to a broader consumer base. This cost reduction, coupled with increasing performance, creates a powerful virtuous cycle of demand and supply. Finally, increasing consumer awareness and preference for sustainable and eco-friendly products is indirectly boosting the market. While the production process has its environmental considerations, lithium-ion batteries are often perceived as a more sustainable option compared to older battery chemistries, especially when paired with renewable energy sources for charging and robust recycling programs.

Despite the remarkable growth trajectory, the Lithium-Ion Battery Pack for Consumer market faces several significant challenges and restraints that could temper its expansion. The volatility of raw material prices, particularly for key components like lithium, cobalt, and nickel, poses a persistent threat. Fluctuations in global supply chains and geopolitical factors can lead to unpredictable cost increases, impacting profitability for manufacturers and potentially driving up consumer prices. Supply chain disruptions, exacerbated by recent global events, can lead to shortages of critical materials or components, hindering production and delivery timelines. This unpredictability can erode consumer confidence and delay product launches.

Safety concerns and regulatory hurdles remain a critical restraint. While lithium-ion battery technology has advanced significantly, incidents of thermal runaway and fire, though rare, can have devastating consequences and lead to stricter regulations. Manufacturers must continuously invest in safety enhancements and navigate a complex web of evolving safety standards and certifications across different regions, which can be costly and time-consuming. The environmental impact of battery production and disposal is another growing concern. The mining of raw materials can be environmentally intensive, and the effective recycling of end-of-life lithium-ion battery packs is still a developing field. Public scrutiny and the demand for more sustainable practices could lead to increased regulatory pressure and a need for significant investment in recycling infrastructure and greener manufacturing processes. Furthermore, rapid technological obsolescence can create challenges. The pace of innovation means that older battery technologies can quickly become outdated, leading to potential write-offs for manufacturers and a need for continuous R&D investment to stay competitive, which can be a significant financial burden. Finally, geopolitical tensions and trade restrictions can disrupt international trade flows and impact the availability and cost of raw materials and finished battery packs, creating uncertainty for market players.

The global Lithium-Ion Battery Pack for Consumer market is characterized by the dominance of specific regions and segments, driven by a combination of manufacturing capabilities, consumer demand, and supportive industrial policies.

Dominant Segments:

Below 100Wh: This segment, encompassing battery packs for smartphones, laptops, tablets, wearables, and other personal electronics, consistently holds a substantial share of the market in terms of unit volume. The sheer ubiquity of these devices worldwide ensures a perpetual and massive demand. Billions of units are produced annually to cater to this segment alone. The continuous innovation in miniaturization and power efficiency within this category further solidifies its dominant position.

100 ~ 200Wh: This segment is witnessing explosive growth, largely driven by the burgeoning electric bicycle (e-bike) and electric scooter markets. As urban mobility shifts towards sustainable and convenient personal transportation, the demand for battery packs in this capacity range has surged. Furthermore, the increasing sophistication of portable power banks and certain medical devices also contributes significantly to this segment's expansion. Production in millions of units is projected to climb rapidly, challenging the dominance of the smaller capacity segments.

Application: Electrical Tools: The cordless revolution in power tools has fundamentally reshaped the industry. Consumers and professionals alike are increasingly favoring battery-operated drills, saws, sanders, and other equipment due to their portability and convenience. This has led to a massive demand for robust and high-capacity lithium-ion battery packs within the 201 ~ 400Wh and even 401 ~ 600Wh categories to ensure sufficient runtime for demanding tasks. The global market for cordless electrical tools, and consequently their battery packs, is projected to see significant production volume increases in millions of units.

Dominant Regions/Countries:

Asia-Pacific (APAC): This region is undeniably the powerhouse of lithium-ion battery pack production for consumer applications. China, in particular, stands out as the undisputed global leader, housing a vast number of manufacturers and controlling a significant portion of the global supply chain for raw materials, cell production, and pack assembly. Companies like BYD, CATL (though more focused on EV packs, their influence is felt), Sunwoda, and Desay are major players originating from this region. South Korea and Japan also play crucial roles, with giants like LG Chem and Panasonic consistently pushing the boundaries of battery technology and production. The sheer scale of manufacturing capacity, coupled with a massive domestic consumer market for electronics and a growing adoption of EVs and e-mobility solutions, positions APAC as the dominant force in both production and consumption of lithium-ion battery packs for consumer use. The production volume in millions of units from this region dwarfs all others. The presence of a robust ecosystem, from material sourcing to advanced manufacturing, further solidifies its lead.

North America: While not a primary manufacturing hub on the same scale as APAC, North America, particularly the United States, is a significant consumer of lithium-ion battery packs. The strong demand for consumer electronics, the rapidly growing EV market, and the increasing adoption of advanced cordless power tools and medical instruments drive substantial consumption. The region is also witnessing increased investment in domestic battery manufacturing capabilities, driven by government initiatives and corporate strategies to secure supply chains.

Europe: Similar to North America, Europe is a major consumer market with a strong appetite for EVs, consumer electronics, and advanced medical devices. Growing environmental consciousness and government mandates are accelerating the transition to electric mobility and cordless technologies, thus boosting the demand for lithium-ion battery packs. Several European countries are also investing heavily in developing their own battery manufacturing and recycling infrastructure to reduce reliance on external supply chains.

In conclusion, the Asia-Pacific region, spearheaded by China, will continue to dominate global production volumes for Lithium-Ion Battery Packs for Consumer, especially within the Below 100Wh, 100-200Wh, and 201-400Wh segments, largely due to its extensive manufacturing infrastructure and the Application of Electrical Tools. However, North America and Europe will remain critical and growing demand centers, particularly for higher capacity packs and in applications like Electric Vehicles and Medical Instruments, prompting increased regional investment in production.

The Lithium-Ion Battery Pack for Consumer industry is experiencing robust growth fueled by several key catalysts. The relentless innovation in battery technology, leading to higher energy density, faster charging, and enhanced safety, is making these packs more appealing and capable for a wider range of applications. The widespread adoption of electric vehicles (EVs) and electric mobility solutions, from personal cars to e-bikes and scooters, is a monumental growth driver. Furthermore, the increasing demand for advanced portable electronics, cordless power tools, and sophisticated medical instruments necessitates the use of reliable and high-performance lithium-ion battery packs. Declining production costs due to economies of scale and manufacturing efficiencies are also making these solutions more accessible and affordable for consumers globally.

This report provides a holistic and granular view of the global Lithium-Ion Battery Pack for Consumer market. It delves into production volumes measured in millions of units, meticulously categorizing them by segment (Below 100Wh, 100-200Wh, 201-400Wh, 401-600Wh, Above 600Wh) and by key application areas such as Electrical Tools, Garden Tools, Household Appliances, Electric Vehicles, and Medical Instruments. The study meticulously analyzes market dynamics from 2019 to 2033, utilizing 2025 as both the base and estimated year, with a detailed forecast period from 2025-2033 and historical data from 2019-2024. It explores the driving forces behind market expansion, identifies critical challenges and restraints, and highlights dominant regions and segments poised for future growth. Furthermore, the report profiles leading industry players and details significant recent developments, offering a comprehensive understanding of the current landscape and future opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Simplo, Dynapack, Desay, Sunwoda, Byd, Scud, Celxpert, JINJUNYE, Highstar, Lishen, Samsungsdi, Evebattery, Murata, Panasonic, LG Chem.

The market segments include Type, Application.

The market size is estimated to be USD 10440 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Lithium-Ion Battery Pack for Consumer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lithium-Ion Battery Pack for Consumer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.