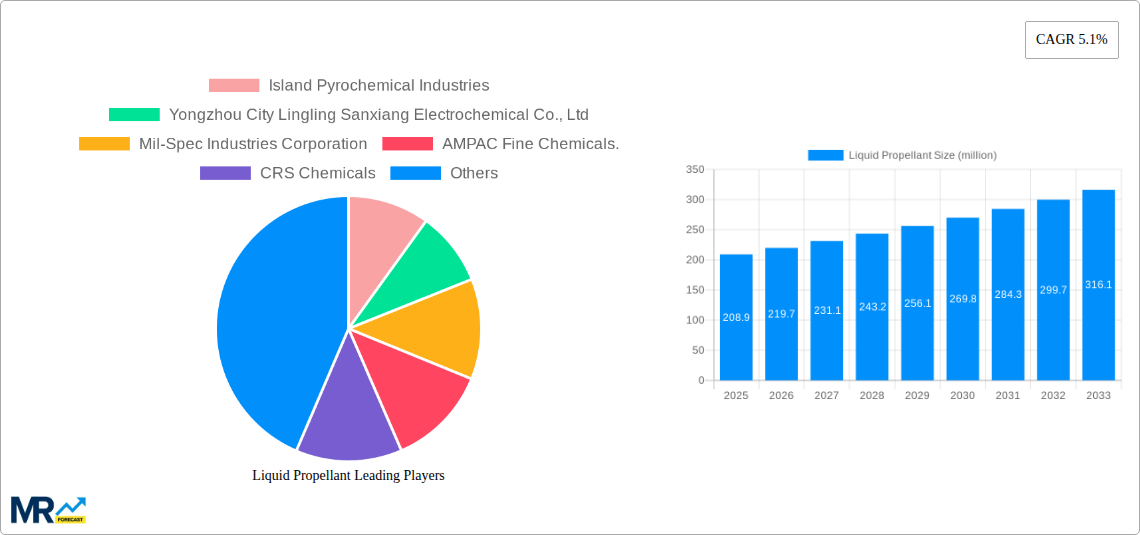

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Propellant?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Liquid Propellant

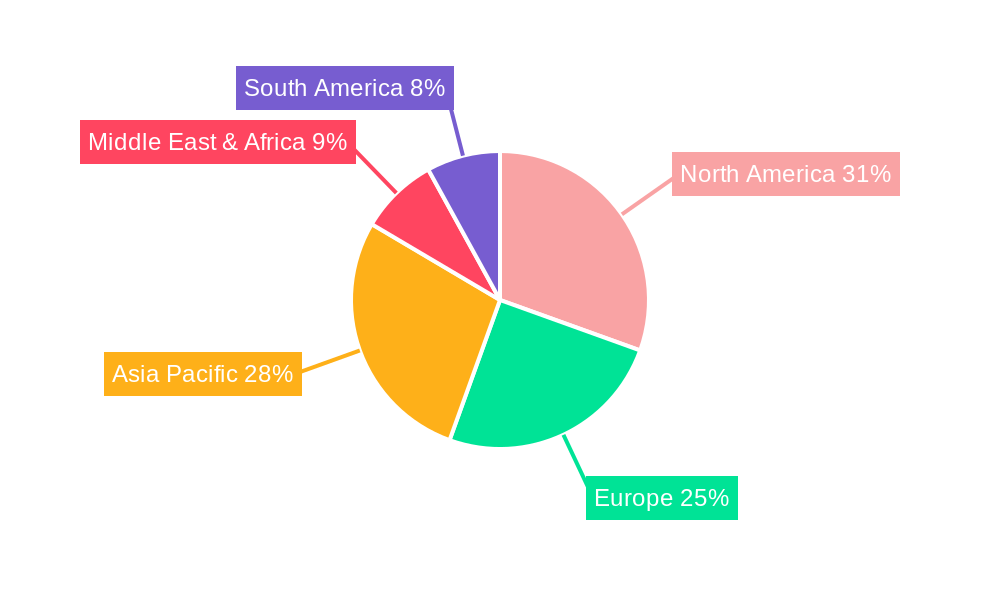

Liquid PropellantLiquid Propellant by Type (Petroleum, Cryogens, Hypergols), by Application (Military, National Defense, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Liquid Propellant market is poised for robust expansion, projected to reach an estimated USD 208.9 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.1% anticipated to propel it through 2033. This significant growth trajectory is primarily fueled by the escalating demand from the military and national defense sectors, where the reliability, power, and controlled burn characteristics of liquid propellants are paramount for advanced aerospace and defense systems. The commercial space sector is also emerging as a potent driver, with the burgeoning satellite launch industry and the increasing interest in private space exploration creating new avenues for propellant utilization. Advancements in propellant formulation, focusing on higher energy density, improved safety profiles, and reduced environmental impact, are further bolstering market confidence and adoption.

The market segmentation reveals a dynamic landscape. Within Type, Petroleum-based propellants continue to hold a substantial share due to their established infrastructure and cost-effectiveness, particularly in legacy systems. However, Cryogens are witnessing remarkable growth, driven by their high performance in space applications. Hypergols, known for their instant ignition capabilities, remain critical for specific military and spacecraft maneuvering systems. In terms of Application, the Military and National Defense segments are the dominant forces, owing to the continuous need for advanced missile systems, launch vehicles, and strategic defense platforms. The Commercial segment, though smaller currently, is exhibiting the fastest growth rate, underscoring the transformative potential of private space endeavors. Key players like Northrop Grumman, Eurenco, and AMPAC Fine Chemicals are at the forefront of innovation, developing next-generation propellants and propulsion systems that will shape the future of this vital market.

The global liquid propellant market is poised for significant expansion over the study period of 2019-2033, with the base year of 2025 highlighting a critical juncture for market dynamics. Projections for the estimated year of 2025 indicate a robust growth trajectory, further amplified by the forecast period of 2025-2033, building upon the historical performance from 2019-2024. The market is witnessing a confluence of factors, including escalating investments in space exploration and a heightened demand for advanced propulsion systems in both defense and commercial sectors. The increasing complexity of satellite missions, coupled with the nascent but rapidly developing commercial spaceflight industry, is driving innovation in liquid propellant formulations and engine technologies. Particularly, the pursuit of higher specific impulse and improved storage capabilities is a persistent theme. Cryogenic propellants, while posing logistical challenges, are gaining traction due to their superior energy density, essential for long-duration space missions. Concurrently, hypergolic propellants, renowned for their ignition reliability and ease of handling in certain applications, continue to hold a significant share, especially in military and national defense contexts where immediate readiness is paramount. Petroleum-based propellants, often a more cost-effective option, are also finding their niche in specific industrial and smaller-scale commercial applications. The market is also observing a trend towards the development of more environmentally benign propellants, addressing growing concerns about the atmospheric impact of rocket launches. This push for sustainability, coupled with the imperative for enhanced performance, is shaping research and development efforts worldwide. The expected market size, measured in the millions, reflects the substantial investments being made by both governmental agencies and private enterprises in this critical sector. The interplay between technological advancements, cost considerations, and stringent regulatory frameworks will be pivotal in defining the market's evolution in the coming years. The competitive landscape, dotted with established players and emerging innovators, is characterized by strategic collaborations and a continuous drive for patentable technologies. The report will delve into the nuances of these trends, providing an in-depth analysis of market segmentation, regional dominance, and the economic forces at play, offering a comprehensive outlook for stakeholders invested in the future of liquid propulsion.

Several key drivers are fueling the expansion of the global liquid propellant market. The most prominent among these is the burgeoning space economy, fueled by both government agencies and private companies. The proliferation of satellite constellations for communication, Earth observation, and scientific research necessitates advanced and reliable propulsion systems, with liquid propellants often being the preferred choice for their high thrust and controllability. Furthermore, the reemergence of governmental interest in lunar and Martian exploration, as well as the ambitious plans for crewed missions to deep space, directly translate into increased demand for high-performance liquid propellants capable of meeting the stringent requirements of these complex endeavors. The defense sector remains a steadfast contributor, with nations prioritizing the development of advanced missile systems, strategic defense platforms, and reconnaissance satellites, all of which rely heavily on liquid propellant technology for their operational efficacy. The military's need for propellants that offer a balance of performance, safety, and readiness, particularly hypergolic variants, ensures a consistent market. Beyond space and defense, the growing commercialization of space travel, including suborbital and orbital tourism, is opening up new avenues for liquid propellant applications, demanding scalable and cost-effective solutions. This evolving demand spectrum, from intricate scientific missions to mass-market space tourism, is collectively creating a powerful impetus for innovation and market growth within the liquid propellant industry.

Despite the promising growth, the liquid propellant market encounters several significant challenges and restraints. A primary concern is the inherent complexity and cost associated with the production, storage, and transportation of many liquid propellants, particularly cryogenics. These substances often require specialized infrastructure, including cryogenic tanks and dedicated launch facilities, which represent substantial capital investments and can limit accessibility. The highly reactive and often hazardous nature of some liquid propellants, such as hypergols, necessitates stringent safety protocols and highly trained personnel, further adding to operational costs and regulatory hurdles. Environmental concerns also play a crucial role; while efforts are underway to develop greener propellants, the environmental impact of traditional formulations remains a point of scrutiny, potentially leading to stricter regulations and the need for costly R&D into sustainable alternatives. Furthermore, the development and testing of new liquid propellant formulations and propulsion systems are time-consuming and expensive, with lengthy qualification processes required for aerospace and defense applications. This can slow down the adoption of innovative solutions and prolong the reliance on established, albeit sometimes less optimal, technologies. Geopolitical factors and supply chain vulnerabilities can also pose risks, as the global sourcing of certain raw materials and specialized components can be subject to disruptions, impacting production and pricing. Finally, the high cost of research and development for novel propellant combinations and engine designs, coupled with the long lead times for new technology integration, can act as a deterrent for smaller market players and slow down the overall pace of advancement.

The Military and National Defense segment, particularly within the United States, is projected to continue its dominance in the global liquid propellant market over the study period of 2019-2033. This preeminence is underpinned by a confluence of factors including robust government funding for defense programs, a highly advanced aerospace industry, and a strategic emphasis on maintaining technological superiority in space and missile capabilities. The United States government, through agencies like NASA and the Department of Defense, consistently invests billions of dollars in space exploration, satellite development, and advanced weapon systems, all of which are significant consumers of liquid propellants. This sustained investment fuels the demand for a wide array of propellant types, from high-performance cryogenics for deep space missions to reliable hypergols for strategic missile systems.

Within the Type segmentation, Cryogens are expected to witness substantial growth and command a significant market share, particularly in the latter half of the forecast period. This is primarily driven by the increasing demands of long-duration space missions, where propellants like Liquid Oxygen (LOX) and Liquid Hydrogen (LH2) offer superior specific impulse, enabling greater payload capacity and extended mission durations. The development of reusable launch vehicles, such as those being pioneered by SpaceX and Blue Origin, also favors cryogenic propellants due to their efficiency and the potential for on-orbit refueling. However, Hypergols will continue to hold a strong position, especially in the military and national defense applications, due to their inherent reliability and ease of use in scenarios requiring immediate ignition without complex ignition systems. Their stability at ambient temperatures also makes them ideal for long-term storage in strategic defense assets. Petroleum-based propellants, while smaller in market share for high-end applications, will remain relevant in niche commercial and industrial uses, where cost-effectiveness and established infrastructure are key considerations. The interplay between these propellant types will be shaped by specific mission requirements, technological advancements, and evolving regulatory landscapes.

The liquid propellant industry is experiencing significant growth catalysts, primarily driven by the escalating global interest in space exploration and the continuous modernization of defense capabilities. The increasing number of satellite launches for communication, navigation, and Earth observation, coupled with ambitious governmental and private space programs aimed at lunar and Martian exploration, are creating a robust demand for high-performance liquid propellants. Furthermore, advancements in propulsion technology, leading to more efficient and reliable rocket engines, are enabling new mission possibilities and reducing launch costs, thereby acting as a further impetus for market expansion.

This comprehensive report will offer an in-depth analysis of the global liquid propellant market, meticulously examining its trajectory from the historical period of 2019-2024 through to the forecast period of 2025-2033, with 2025 serving as the base and estimated year. The report delves into the intricate trends shaping the market, exploring the driving forces behind its expansion and dissecting the challenges and restraints that players must navigate. It provides a detailed regional and segmental analysis, highlighting key dominant areas and segments, including the crucial Military and National Defense application and the evolving role of Cryogens and Hypergols in terms of type. Furthermore, the report identifies critical growth catalysts and profiles the leading companies contributing to the industry's advancement. The significance of recent and upcoming developments within the sector is also thoroughly documented, offering stakeholders a holistic and strategic understanding of the liquid propellant landscape for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Island Pyrochemical Industries, Yongzhou City Lingling Sanxiang Electrochemical Co., Ltd, Mil-Spec Industries Corporation, AMPAC Fine Chemicals., CRS Chemicals, SAE Manufacturing Specialties Corp, Ultramet, Northrop Grumman, Eurenco, EOS GmbH, SKYRORA, .

The market segments include Type, Application.

The market size is estimated to be USD 208.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Liquid Propellant," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Liquid Propellant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.