1. What is the projected Compound Annual Growth Rate (CAGR) of the Lift Gate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lift Gate

Lift GateLift Gate by Type (Foldable, Column Type, Standard, Other), by Application (Trucks, Trailer, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

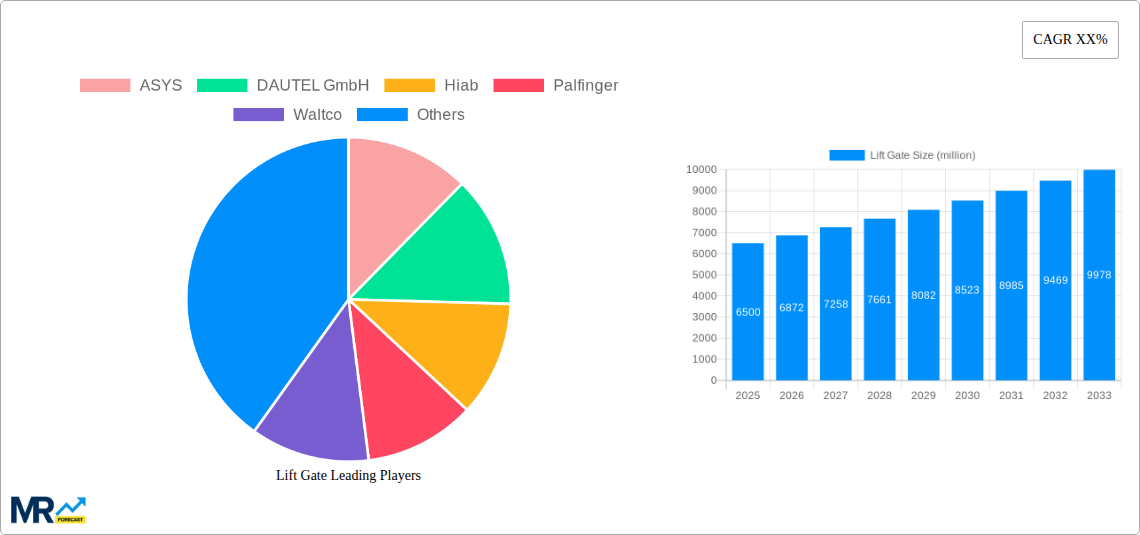

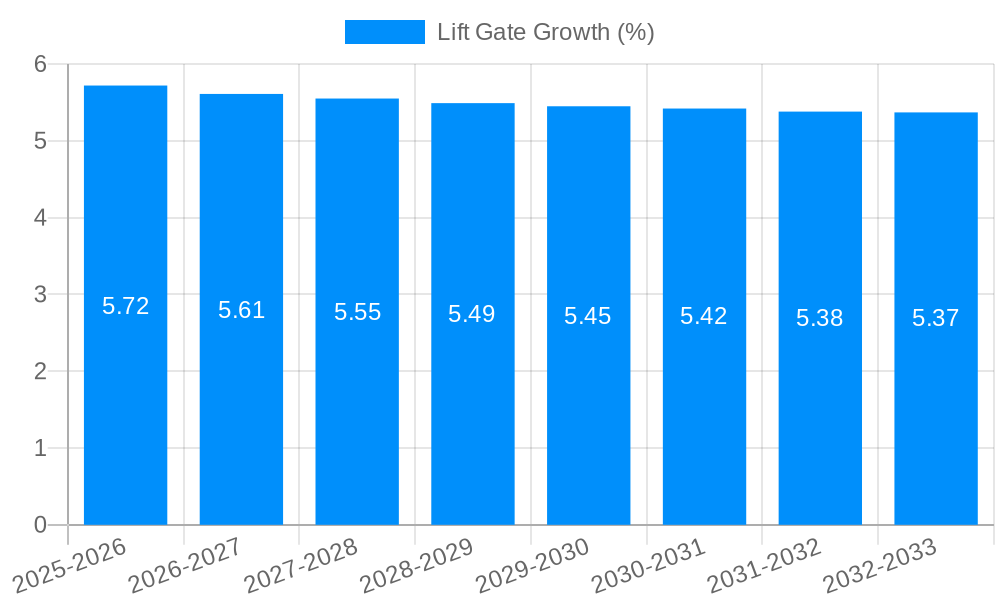

The global lift gate market is poised for significant expansion, projected to reach a market size of approximately $6,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 5.5% extending through 2033. This robust growth is underpinned by several key drivers, most notably the escalating demand for enhanced logistics efficiency and the growing e-commerce sector, which necessitates faster and more flexible last-mile delivery solutions. Furthermore, increasing adoption of lift gates in vocational trucks, construction equipment, and specialized utility vehicles, coupled with a focus on improving worker safety and reducing manual labor, will continue to fuel market expansion. The rise in the number of trucks and trailers operating globally, driven by increased trade and infrastructure development, also directly contributes to the demand for lift gates as essential attachments.

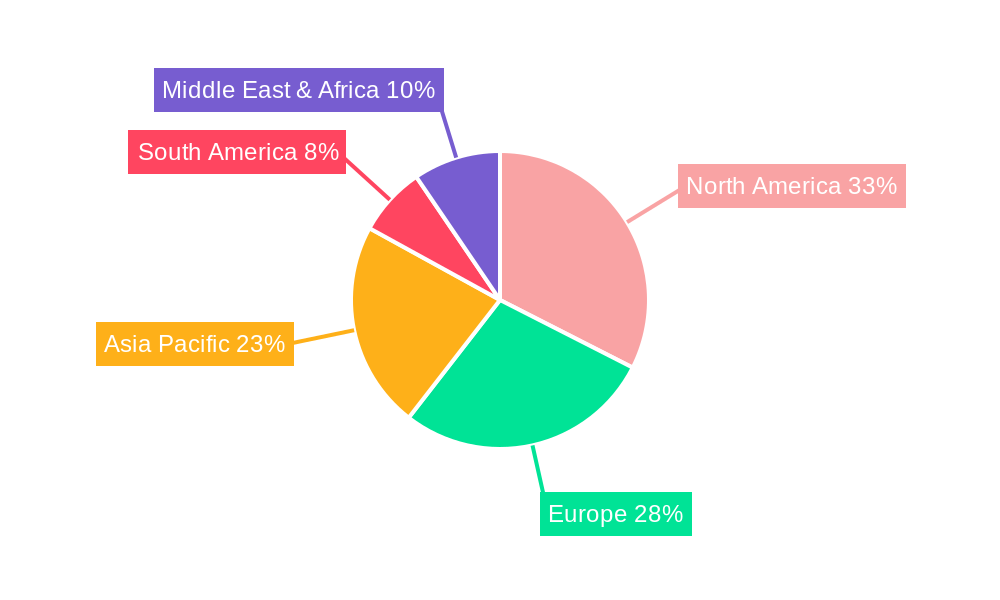

Segment-wise, the "Foldable" and "Column Type" lift gates are expected to witness the most dynamic growth, owing to their superior space-saving designs and versatility, particularly in urban delivery scenarios and for specialized vehicle applications. The "Trucks" segment is anticipated to dominate the application landscape, reflecting the sheer volume of commercial trucking operations. Geographically, North America and Europe are currently leading the market, driven by established logistics infrastructure and stringent safety regulations. However, the Asia Pacific region, led by China and India, is projected to exhibit the fastest growth rate, fueled by rapid industrialization, burgeoning e-commerce, and significant investments in transportation and logistics networks. Restraints such as the high initial cost of advanced lift gate systems and the availability of alternative loading solutions may temper growth in certain segments, but the overarching benefits of improved operational efficiency and safety are expected to outweigh these challenges.

The global lift gate market, valued at over $750 million in 2025, is poised for significant expansion, projected to reach over $1.2 billion by 2033. This growth is being shaped by a confluence of evolving logistics demands, technological advancements, and an increasing emphasis on operational efficiency across various industries. The historical period (2019-2024) witnessed a steady uptake, driven by the fundamental need for ergonomic and safe material handling solutions. The base year of 2025 marks a pivotal point, with an estimated market size reflecting robust demand and initial recovery from any potential historical disruptions. Looking ahead into the forecast period (2025-2033), the market is expected to accelerate, fueled by both incremental innovation and the adoption of more sophisticated lift gate technologies. The "Standard" type segment, representing the traditional and widely adopted configurations, currently holds a dominant share, but is anticipated to see increasing competition from "Foldable" and "Column Type" alternatives, which offer enhanced space utilization and specialized functionality. Application-wise, "Trucks" remain the primary installation base, accounting for a substantial portion of the market due to their ubiquitous presence in freight transportation and delivery services. However, the "Trailer" segment is expected to witness faster growth as logistics providers optimize their trailer fleets for greater versatility and efficiency in loading and unloading operations. The overarching trend points towards a market increasingly characterized by intelligent features, enhanced safety protocols, and solutions tailored for specific industry needs, moving beyond basic lifting mechanisms to integrated cargo management systems. The market is also experiencing a shift towards lighter, more durable materials, improving fuel efficiency and extending product lifespans. Furthermore, regulatory landscapes concerning workplace safety and ergonomic standards are indirectly influencing the adoption of advanced lift gate solutions, as companies strive to comply with and exceed these mandates. The increasing complexity of supply chains and the demand for faster, more reliable last-mile delivery are also indirectly contributing to the demand for efficient and dependable lift gate systems. The study period (2019-2033) encompasses these dynamic shifts, providing a comprehensive view of the market's evolution from its foundational stages to its technologically advanced future. The estimated year of 2025 serves as a crucial benchmark within this period, offering insights into the current market standing and the immediate trajectory of growth.

The lift gate market's upward trajectory is being propelled by several key forces, primarily centered around the escalating demands of the logistics and transportation sectors. The surge in e-commerce has significantly amplified the volume of goods requiring efficient handling, particularly in the last-mile delivery segment. Lift gates are indispensable for ensuring timely and safe unloading of packages from delivery vehicles directly to the customer's doorstep, reducing reliance on manual labor and minimizing the risk of damage. Furthermore, evolving workplace safety regulations and a growing corporate responsibility towards employee well-being are driving the adoption of lift gates. These devices drastically reduce the physical strain associated with lifting and carrying heavy loads, thereby decreasing the incidence of workplace injuries and associated costs. The increasing complexity of supply chains, with a greater emphasis on just-in-time delivery and optimized inventory management, also plays a crucial role. Lift gates facilitate quicker turnaround times for vehicles at loading docks and customer locations, contributing to overall supply chain efficiency. Finally, technological advancements in material science and engineering are enabling the development of lighter, more durable, and more energy-efficient lift gate systems, making them a more attractive investment for fleet operators.

Despite the promising growth outlook, the lift gate market is not without its challenges. One of the primary restraints is the significant upfront cost associated with purchasing and installing lift gate systems. For small and medium-sized businesses or those operating on tight margins, this initial investment can be a substantial barrier to adoption, particularly when compared to traditional manual loading methods. Maintenance and repair costs also represent a consideration; while lift gates improve efficiency, they are mechanical devices that require regular servicing, and unexpected repairs can lead to costly downtime. Another challenge lies in the varying operational environments and infrastructure. In some regions or for specific applications, the physical space or the condition of loading areas might not be conducive to the optimal use of certain lift gate types, limiting their applicability. Furthermore, the availability of skilled technicians for installation, maintenance, and repair can be a bottleneck in certain geographical areas, impacting the overall ownership experience. Regulatory hurdles related to vehicle modifications and safety certifications can also add complexity and cost to the adoption process. The need for driver training to safely operate lift gates, while ultimately beneficial, also represents an operational consideration that can impact implementation timelines and costs.

The global lift gate market is characterized by dynamic regional and segmental dominance, with the North America region, specifically the United States, emerging as a significant driver, particularly within the Trucks application segment and the Standard type.

North America (United States): The United States, in particular, holds a commanding position in the lift gate market. This dominance is underpinned by a mature logistics and transportation infrastructure, a robust e-commerce ecosystem, and a strong emphasis on workplace safety. The sheer volume of commercial trucking and delivery operations in the US necessitates efficient and reliable material handling solutions. The widespread adoption of lift gates on delivery vans and trucks for last-mile delivery services is a testament to their indispensable role in the American supply chain. The presence of major lift gate manufacturers, such as Waltco, Maxon, and Tommy Gate Co., headquartered and operating extensively within the US, further solidifies its market leadership. The country's proactive stance on occupational health and safety regulations also directly influences the demand for ergonomic equipment like lift gates, as companies strive to minimize employee injuries and associated liabilities. Furthermore, the vast geographical expanse of the US necessitates efficient cargo handling at numerous points of distribution and delivery, making lift gates a critical component of fleet operations. The study period (2019-2033) reveals a consistent upward trend in lift gate penetration within the US, driven by ongoing fleet modernization and the ever-increasing demand for faster and more flexible delivery services. The base year of 2025 highlights the established market share and the projected continuation of this strong performance.

Segment: Standard Type: Within the types of lift gates, the Standard type continues to be a dominant force. These are the conventional, gravity-down, powered-up lift gates that have been the industry workhorse for decades. Their widespread acceptance is due to their proven reliability, relatively straightforward operation, and versatility across a broad range of applications. They are well-suited for general cargo handling and are compatible with a vast majority of commercial trucks. While newer, more specialized types are gaining traction, the sheer volume of existing fleets equipped with standard lift gates, coupled with their cost-effectiveness for many standard operations, ensures their continued market leadership. The initial investment for standard lift gates is often lower than for more advanced types, making them an accessible option for a wider range of businesses. Their ease of use and readily available parts and service further contribute to their enduring popularity.

Segment: Trucks Application: The Trucks application segment remains the largest contributor to the lift gate market. This is a direct consequence of the omnipresence of trucks in freight transportation, from long-haul trucking to last-mile delivery services. Delivery trucks, box trucks, and straight trucks are routinely equipped with lift gates to facilitate the efficient loading and unloading of goods. The growth of e-commerce, with its reliance on numerous small-to-medium sized deliveries, has further amplified the demand for lift gates on these vehicles. Fleet operators recognize lift gates as essential tools for improving driver productivity, reducing delivery times, and enhancing customer satisfaction by offering convenient curbside delivery. The flexibility and adaptability of lift gates make them suitable for a wide array of cargo types handled by trucks, further cementing their dominance within this application. The forecast period (2025-2033) indicates continued robust growth in this segment, driven by fleet expansion and the ongoing need for efficient material handling in the road transportation industry.

The lift gate industry is experiencing several growth catalysts that are propelling its expansion. The persistent growth of e-commerce, demanding more efficient and frequent last-mile deliveries, is a primary driver. Escalating concerns over workplace safety and ergonomic standards are pushing companies to invest in solutions that reduce manual labor and minimize injury risks. Technological advancements leading to lighter, more durable, and more energy-efficient lift gates are making them a more attractive and sustainable investment. Furthermore, increasing adoption in emerging economies, as these regions develop their logistics infrastructure, presents significant untapped market potential.

This comprehensive coverage lift gate report delves deep into the market's intricacies, offering a holistic understanding of its current landscape and future trajectory. It provides an in-depth analysis of market trends, pinpointing key insights and projections throughout the study period (2019-2033), with a specific focus on the base year (2025) and forecast period (2025-2033). The report meticulously examines the driving forces, such as the burgeoning e-commerce sector and heightened safety regulations, that are propelling market growth. Simultaneously, it addresses the inherent challenges and restraints, including cost considerations and maintenance requirements, that influence market dynamics. A significant portion of the report is dedicated to identifying the key regions, countries, and segments poised for market dominance, offering valuable strategic insights for stakeholders. Furthermore, it highlights the critical growth catalysts and provides an exhaustive list of leading players within the industry. The report concludes with a review of significant developments, charting the technological advancements and market shifts that have shaped and will continue to shape the lift gate sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ASYS, DAUTEL GmbH, Hiab, Palfinger, Waltco, Zepro, Maxon, Anthony Liftgate, SAF-HOLLAND, TOMMY GATE CO., Leyman Lift Gates, Thieman Tailgates, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Lift Gate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lift Gate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.