1. What is the projected Compound Annual Growth Rate (CAGR) of the Life Insurance for Seniors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Life Insurance for Seniors

Life Insurance for SeniorsLife Insurance for Seniors by Application (Seniors over 80, Seniors over 70, Seniors over 60, Others), by Type (Term Life Insurance, Whole Life Insurance, Burial Insurance, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

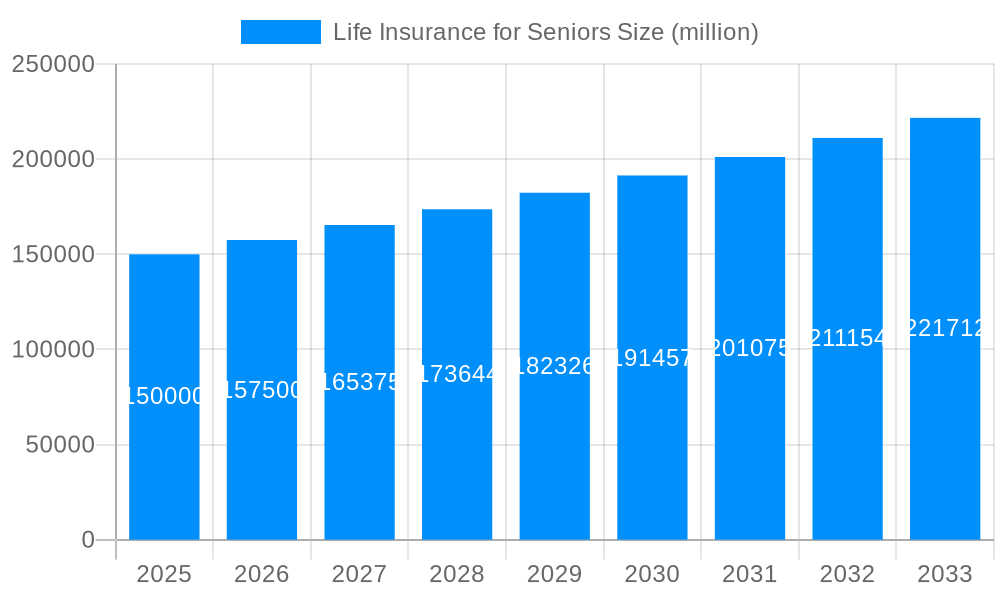

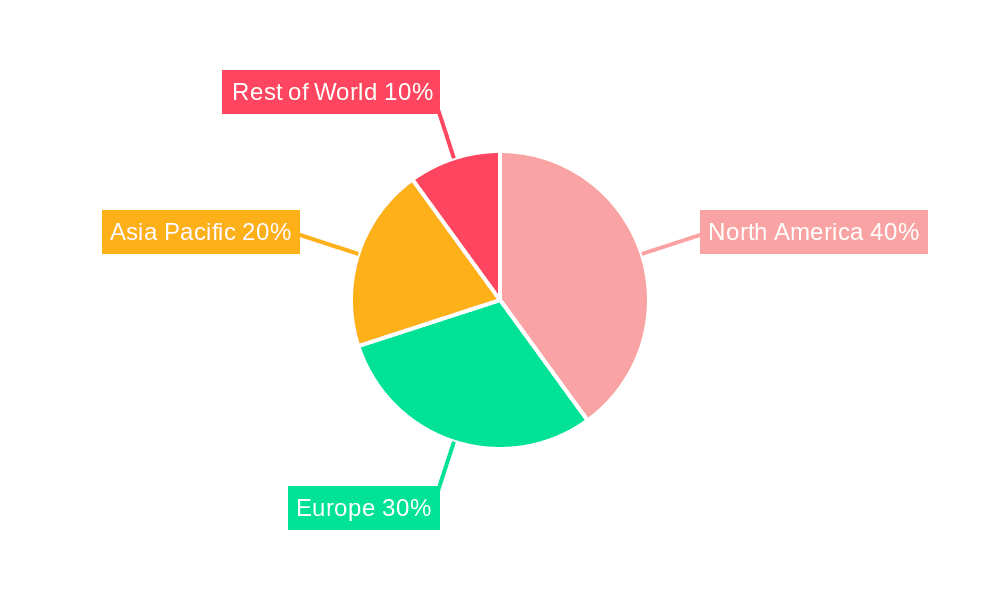

The senior life insurance market, encompassing various policy types like term, whole, and burial insurance, is experiencing robust growth, driven by an aging global population and increasing awareness of end-of-life financial planning. The market size in 2025 is estimated at $150 billion, considering the substantial number of seniors globally and the average policy value. A Compound Annual Growth Rate (CAGR) of 5% is projected from 2025 to 2033, fueled by factors like rising healthcare costs, increasing disposable incomes among older adults in developed nations, and the proliferation of innovative insurance products tailored to specific senior needs. The segment catering to seniors over 80 demonstrates the highest growth potential, driven by rising longevity and the associated need for comprehensive financial protection. However, factors such as economic uncertainty, potentially impacting affordability, and the complexity of insurance policies might act as restraints. Geographic variations exist, with North America and Europe holding significant market shares due to their aging populations and established insurance infrastructure. The competitive landscape features major players like AIG, Prudential, and Allianz, each vying for market dominance through strategic product innovation and distribution channels. Furthermore, increasing technological advancements such as online platforms and AI-driven services are transforming the sales and customer service aspects of this sector.

The diverse range of products offered, including term life insurance (offering temporary coverage), whole life insurance (providing lifelong protection), and burial insurance (specifically for funeral expenses), caters to varying senior needs and financial situations. Growth is further fueled by the expansion of insurance coverage to emerging markets and increased government initiatives promoting financial inclusion amongst older populations. Companies are adapting by offering flexible payment plans, personalized risk assessment tools, and telematics-based programs to boost engagement and accessibility among seniors. This competitive landscape ensures continuous improvement of services and offers more accessible and affordable options. While challenges like fraud and regulatory changes persist, the overall growth trajectory of the senior life insurance market remains optimistic, promising substantial opportunities for existing and new market entrants.

The life insurance market for seniors, encompassing individuals aged 60 and above, is experiencing a period of significant transformation, driven by evolving demographics and shifting consumer preferences. The market, valued at XXX million in 2025, is projected to reach XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This growth is largely attributed to the expanding senior population globally, coupled with increased awareness of the need for financial protection in later life. However, the market isn't homogenous. While the demand for traditional whole life insurance remains steady, fueled by its legacy of guaranteed coverage and cash value accumulation, we're witnessing a surge in interest in more specialized products tailored to the unique needs of this demographic. Burial insurance, for instance, is gaining traction due to its affordability and straightforward approach to covering end-of-life expenses. Furthermore, the rise of technology has led to the emergence of innovative online platforms and streamlined application processes, making it easier for seniors to access and compare insurance options. This increased accessibility is a key driver of market expansion, particularly amongst those previously underserved by traditional methods. The market is also responding to increasing demand for products that cater to the specific health needs and financial situations of older adults, with insurers offering tailored coverage and flexible payment options. Competition is intensifying amongst established players and new entrants alike, leading to innovation in product design and pricing strategies. This competitive landscape ultimately benefits consumers with greater choices and potentially lower premiums. The increasing prevalence of chronic illnesses amongst seniors also contributes to the market's growth, pushing the need for reliable financial support for medical and care expenses. The study period of 2019-2033 provides a comprehensive overview of this dynamic market, highlighting its evolution from a traditional landscape to a modern, consumer-centric environment.

Several factors are converging to propel the growth of the life insurance market for seniors. The most significant driver is the global aging population. The number of individuals aged 60 and above is rapidly increasing, creating a larger pool of potential customers needing financial security during their retirement years. Furthermore, increased longevity translates to a longer period for which individuals require life insurance coverage to safeguard their families' financial future. Rising healthcare costs are also a significant factor, as seniors often face substantial medical bills. Life insurance can help offset these expenses, ensuring that families are not burdened with debt during a difficult time. Growing awareness about the importance of estate planning is another factor. More seniors are realizing the necessity of having a comprehensive plan in place to protect their assets and ensure a smooth transfer of wealth to their heirs. Life insurance plays a vital role in this planning process. The increasing adoption of technology is facilitating market growth by improving the accessibility and affordability of life insurance products. Online platforms and digital tools allow seniors to research, compare, and purchase insurance policies more efficiently, bypassing traditional intermediaries. Finally, the changing regulatory environment in many regions is creating a favorable climate for market expansion, with governments implementing policies to encourage and protect seniors' access to financial protection.

Despite the positive trends, several challenges impede the growth of the life insurance market for seniors. One significant hurdle is the increasing prevalence of age-related health issues, which can make it difficult for seniors to qualify for affordable policies. Many insurers impose stringent health requirements and higher premiums for older applicants, leading to exclusion for a significant segment of the target population. This issue is particularly pertinent for seniors over 80. Another challenge lies in the complexity of insurance products. The terminology and intricate details of life insurance policies can be confusing for many seniors, leading to hesitancy or a lack of understanding of the coverage they are purchasing. Furthermore, affordability remains a crucial concern. Many seniors are on fixed incomes and may find the premiums unaffordable, even for basic coverage. Competition from alternative financial products also presents a challenge, as seniors may choose to invest their funds in other avenues, such as annuities or retirement accounts, instead of purchasing life insurance. Moreover, concerns about fraud and scams targeting vulnerable seniors cast a shadow on the market, impacting trust and participation. Addressing these challenges requires a multi-pronged approach involving product innovation, clear and accessible communication, and targeted outreach to seniors and their families.

The segment projected to dominate the market is Whole Life Insurance for Seniors over 60.

Whole Life Insurance: Its appeal lies in its guaranteed lifelong coverage, cash value accumulation, and the potential for tax advantages. These features are especially attractive to seniors seeking long-term financial security and legacy planning. The consistent premiums also offer peace of mind in a period where financial stability is paramount.

Seniors over 60: This age group represents a significant portion of the senior population and possesses the financial resources and awareness to invest in whole life insurance. They are more likely to be proactively seeking solutions for estate planning and legacy preservation, leading to higher demand. While the cost of premiums might be higher than for younger individuals, the longer-term financial security and guaranteed coverage outweigh the costs for many in this age bracket. The growing awareness of the importance of estate planning among this demographic further fuels the demand. Compared to Seniors over 70 or 80, this group often has a better health profile, making them more likely to qualify for favorable policies.

Geographic Dominance: While specific regional data would require further analysis, regions with a high concentration of aging populations and robust economies (like North America, Western Europe, and parts of Asia) are likely to drive the most significant market growth. Developed nations with extensive social security programs and health insurance systems might indirectly influence the demand for additional coverage.

The life insurance market for seniors is poised for continued expansion due to several key catalysts. The increasing awareness of the need for financial protection in old age, especially among the growing senior population, is a major driver. Technological advancements, including online platforms and simplified application processes, make access to insurance easier and more convenient. Tailored products, such as burial insurance, specifically designed for the financial and healthcare needs of seniors, are also boosting market growth. Finally, innovative pricing models and payment options cater to the diverse financial situations of older adults, making life insurance more accessible and affordable for a wider segment of the population.

This report provides a comprehensive analysis of the life insurance market for seniors, covering key trends, growth drivers, challenges, and leading players. It offers valuable insights into the various segments of the market, including different age groups and policy types, providing a detailed understanding of the market dynamics and future growth potential. The projections for the period 2025-2033, based on historical data and market trends, offer a valuable tool for businesses and stakeholders operating in or intending to enter this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

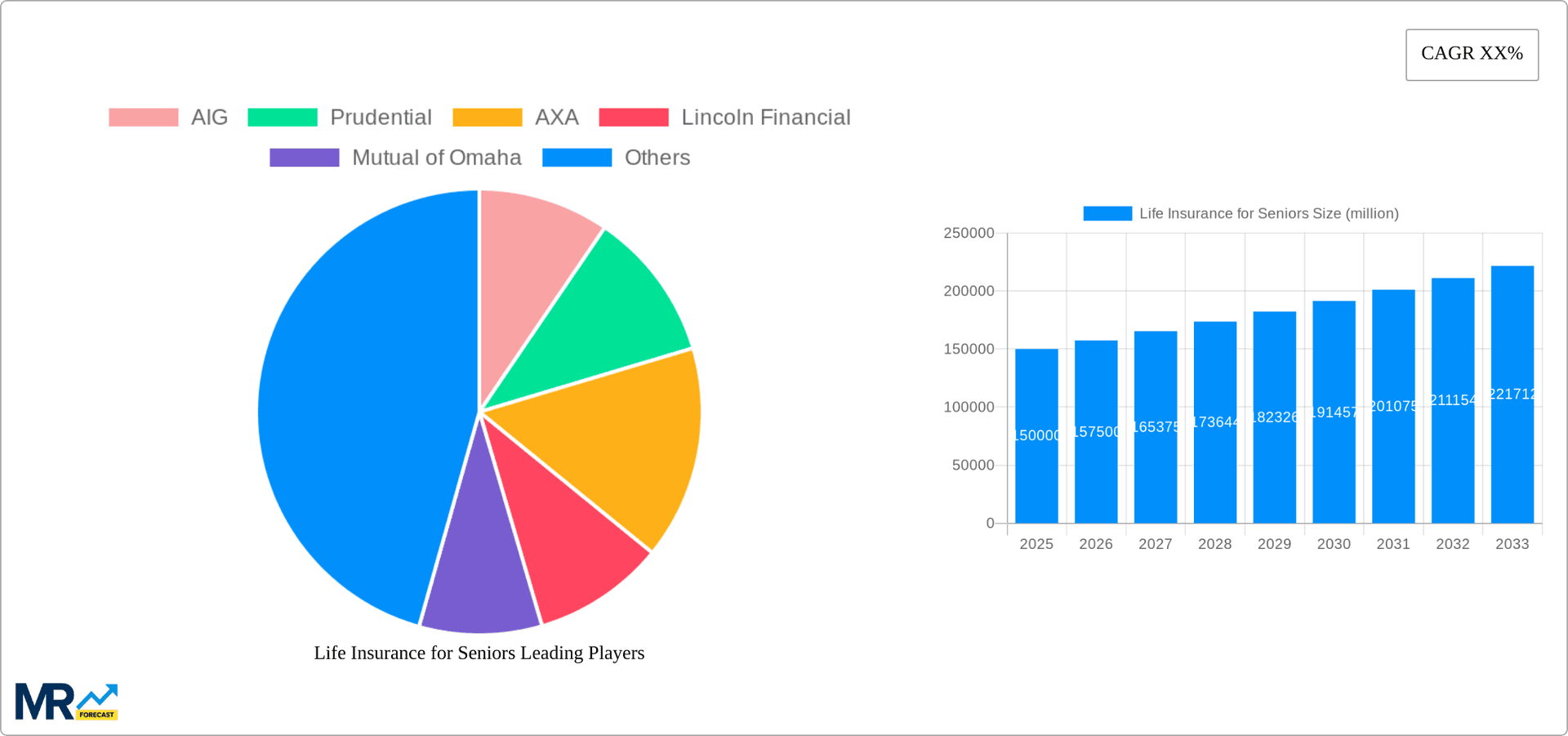

Key companies in the market include AIG, Prudential, AXA, Lincoln Financial, Mutual of Omaha, Pacific Life, Allianz, Aviva, Vitality, Swiss Life, Generali, Zurich, Dai-ichi Life International (Europe) Ltd, Protective, Foresters Financial, Symetra Financial, Legal & General, Guardian Life, MassMutual, Northwestern Mutual, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Life Insurance for Seniors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Life Insurance for Seniors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.