1. What is the projected Compound Annual Growth Rate (CAGR) of the LEO Satellite?

The projected CAGR is approximately 20.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

LEO Satellite

LEO SatelliteLEO Satellite by Type (Below 50 Kg, 50-500 Kg, Above 500 Kg), by Application (Commercial, Military, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Low Earth Orbit (LEO) satellite market is experiencing explosive growth, projected to reach $20.41 billion by 2041, fueled by a remarkable Compound Annual Growth Rate (CAGR) of 20.2%. This expansion is driven by several key factors. Increased demand for high-speed broadband internet access, particularly in underserved regions, is a primary catalyst. The proliferation of Internet of Things (IoT) devices necessitates robust and low-latency communication networks, which LEO constellations excel at providing. Furthermore, advancements in satellite technology, miniaturization, and reduced launch costs are making LEO constellations more economically viable and accessible. Government initiatives focused on national security and space exploration are also contributing to this growth trajectory. Key players like SpaceX, Thales Alenia Space, and Lockheed Martin are heavily investing in expanding their LEO satellite capabilities, leading to increased competition and innovation within the market.

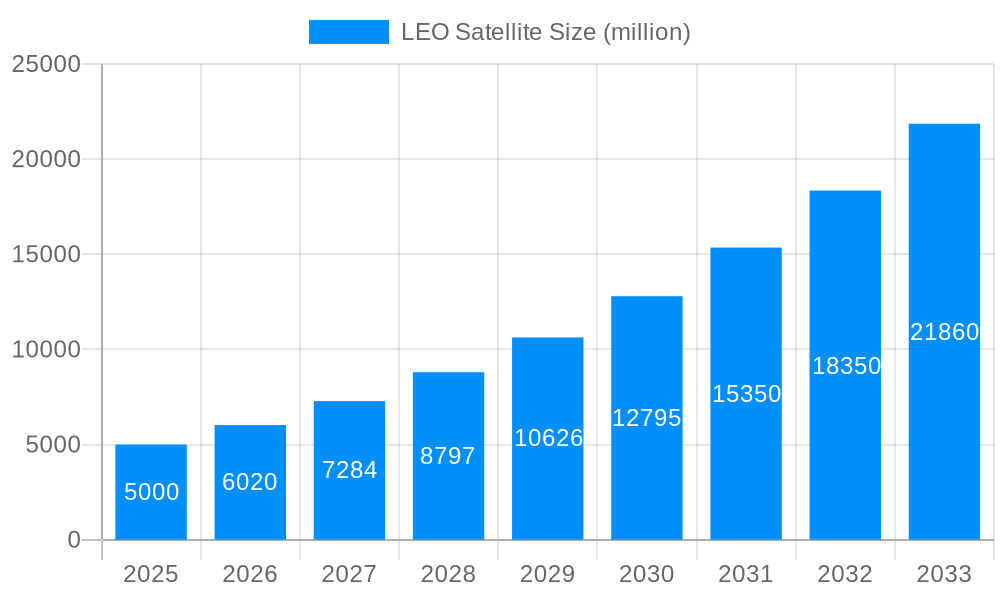

The market's segmentation likely includes various applications such as broadband internet, Earth observation, navigation, and defense applications. The regional distribution is expected to be largely influenced by the level of technological advancement, investment in infrastructure, and regulatory frameworks in place. North America and Europe will likely hold significant market share, but rapidly developing economies in Asia-Pacific are also poised for considerable growth. Challenges include regulatory hurdles related to spectrum allocation, orbital debris management, and the need for robust cybersecurity measures to ensure the reliability and security of LEO satellite networks. Despite these challenges, the long-term outlook for the LEO satellite market remains exceptionally positive, promising significant technological advancements and economic opportunities in the coming years. The substantial CAGR suggests consistent and significant market expansion throughout the forecast period (2025-2033), indicating a rapidly evolving landscape with strong future potential.

The Low Earth Orbit (LEO) satellite market experienced explosive growth during the historical period (2019-2024), exceeding expectations. Driven by mega-constellations and increasing demand for high-bandwidth, low-latency connectivity, the market is poised for continued expansion throughout the forecast period (2025-2033). By the estimated year (2025), the market is projected to be worth several billion USD, with a Compound Annual Growth Rate (CAGR) significantly exceeding 10% during the forecast period. This growth is not uniformly distributed; certain segments, like broadband communication and Earth observation, are experiencing particularly rapid expansion, fueled by technological advancements and substantial investments from both private and public sectors. The historical period saw significant advancements in miniaturization, increased reliability, and cost reductions in satellite manufacturing and launch services, enabling the deployment of larger constellations with reduced overall costs. This trend is expected to accelerate, leading to further market penetration and the expansion of LEO satellite applications into new areas such as the Internet of Things (IoT), environmental monitoring, and navigation. The entry of numerous new players, alongside established aerospace giants, is contributing to increased competition and innovation, pushing down costs and improving service offerings. However, this competitive landscape also presents challenges in terms of securing regulatory approvals and managing orbital debris, discussed in detail below. This report analyses the key market insights, trends, and future projections for the LEO satellite industry, covering the study period (2019-2033). The base year for the analysis is 2025.

Several factors are driving the phenomenal growth of the LEO satellite market. Firstly, the insatiable global demand for high-speed broadband internet access, particularly in underserved regions, is a major impetus. LEO constellations offer a compelling solution by providing low-latency, high-throughput connectivity where traditional terrestrial infrastructure is either unavailable or prohibitively expensive. Secondly, the substantial reduction in launch costs, largely due to the rise of reusable launch vehicles and increased competition in the launch services market, has made deploying large-scale LEO constellations economically viable. Thirdly, technological advancements in miniaturization and the development of more efficient and robust satellite components have significantly reduced the cost and complexity of satellite manufacturing, further accelerating the deployment of LEO constellations. Fourthly, the increasing adoption of advanced data analytics and artificial intelligence (AI) allows for better utilization of the data generated by LEO satellite constellations, improving the overall value proposition. Finally, government support and regulatory frameworks that encourage the development and deployment of LEO satellite technology play a crucial role in market expansion. These combined factors create a positive feedback loop, with each advancement further accelerating the overall market growth.

Despite the immense potential, several challenges and restraints hinder the growth of the LEO satellite market. One of the major concerns is the increasing amount of space debris in LEO, posing a significant threat to operational satellites and future missions. Mitigation strategies and international cooperation are crucial to address this escalating issue. Regulatory hurdles, including spectrum allocation and licensing requirements, can slow down deployment and create uncertainty for investors. The high upfront capital expenditure required for developing and launching LEO constellations presents a significant barrier to entry for many companies. Furthermore, the need for advanced ground segment infrastructure, including robust communication networks and data processing capabilities, adds to the overall cost and complexity of the operation. Maintaining operational integrity and ensuring the long-term sustainability of these large constellations is a technological and logistical challenge. Finally, potential interference between different LEO constellations and existing satellite systems requires careful planning and coordination.

North America (USA): The USA holds a dominant position due to significant investments from private companies like SpaceX and established aerospace players, coupled with strong government support for space exploration and technological advancements. Its advanced technological infrastructure and a large pool of skilled engineers contribute to its leadership. The region also houses major launch facilities and has robust regulatory frameworks, although navigating these can still be challenging. The significant investments from both private and public sectors are driving the expansion of LEO satellite-based services in various segments, including broadband internet access, Earth observation, and navigation.

Europe: European countries, particularly France and the UK, are major players, with companies like Thales Alenia Space and Eutelsat Group driving the development and deployment of LEO satellites. European government funding and support for space initiatives, combined with strong expertise in satellite technology, contribute significantly. However, the European market faces the challenge of competing with the larger scale of investments in North America.

Asia-Pacific (China): China’s space program is rapidly expanding, with increasing investments in its LEO satellite capabilities. The country is aiming to become a major player in providing global broadband access and advanced Earth observation services, leveraging its significant manufacturing capabilities and large domestic market. However, geopolitical considerations and potential regulatory complexities could present challenges.

Broadband Communication: This segment is anticipated to hold the largest market share due to the growing demand for ubiquitous high-speed internet access, particularly in underserved areas. LEO constellations are well-positioned to deliver this connectivity, driving significant growth in this segment.

Earth Observation: The use of LEO satellites for Earth observation, including environmental monitoring, agriculture, and disaster management, is steadily expanding. High-resolution imagery and precise data analysis derived from LEO constellations are valuable for various applications, fueling market expansion. Smaller, more specialized Earth-imaging constellations are also making considerable impact.

The combined effect of these regional and segmental drivers is shaping the future of the LEO satellite market. While North America holds a clear lead due to technological advancements and private investment, the rapid development in other regions promises a more balanced and dynamic competitive landscape in the years to come. Several million USD have been invested in this segment and several more are expected to come.

Several factors are catalyzing growth in the LEO satellite industry. The decreasing cost of launching satellites combined with advancements in miniaturization technology have significantly lowered the barrier to entry for new players. This is leading to increased competition and innovation, resulting in better services and affordability. Government support for space exploration and investment in related technologies provide further impetus for growth. Furthermore, growing demand for high-speed internet access, particularly in remote and underserved regions, is a key driver for the expansion of LEO satellite-based communication networks.

This report provides a comprehensive overview of the LEO satellite market, offering insights into its current status, growth drivers, challenges, and future outlook. By examining various segments, key players, and regional trends, this detailed analysis offers valuable information for investors, industry professionals, and policymakers seeking to understand and participate in this dynamic and rapidly evolving sector. The report's meticulous data collection and in-depth analysis allow for informed decision-making concerning the future direction and potential of the LEO satellite industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.2%.

Key companies in the market include SpaceX, Thales Alenia Space, Eutelsat Group, Lockheed Martin, Boeing, Planet Labs, Kepler Communications, Northrop Grumman, ISS-Reshetnev, SSL (Space Systems Loral).

The market segments include Type, Application.

The market size is estimated to be USD 20410 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "LEO Satellite," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the LEO Satellite, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.