1. What is the projected Compound Annual Growth Rate (CAGR) of the Legal Cannabis?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Legal Cannabis

Legal CannabisLegal Cannabis by Type (Buds, Oils, Others), by Application (Chronic Pain, Mental Disorders, Cancer, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

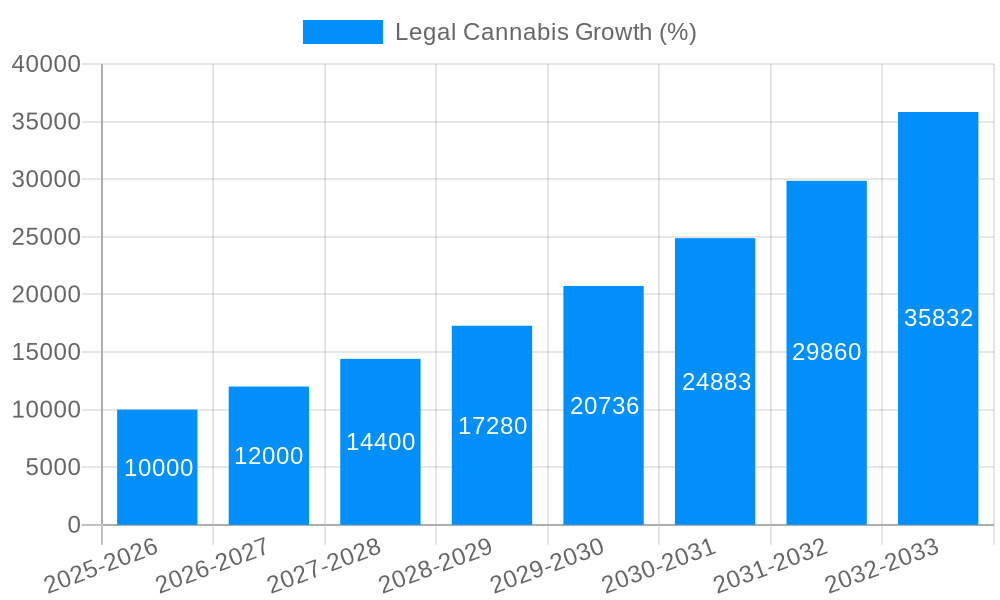

The legal cannabis market is experiencing explosive growth, driven by increasing consumer acceptance, evolving regulations, and expanding product offerings. While precise figures for market size and CAGR are not provided, a reasonable estimate, considering the rapid expansion observed in various regions and the significant investments in the sector, suggests a market size exceeding $50 billion in 2025, with a compound annual growth rate (CAGR) potentially exceeding 20% during the forecast period (2025-2033). This growth is propelled by several key drivers: increasing legalization efforts across numerous jurisdictions globally, the rising popularity of cannabis-infused products (edibles, beverages, topicals), and the growing acceptance of cannabis for medicinal purposes. Significant trends include the increasing sophistication of product development, focusing on specific cannabinoid profiles and tailored effects, and a shift towards sustainable and ethical cultivation practices.

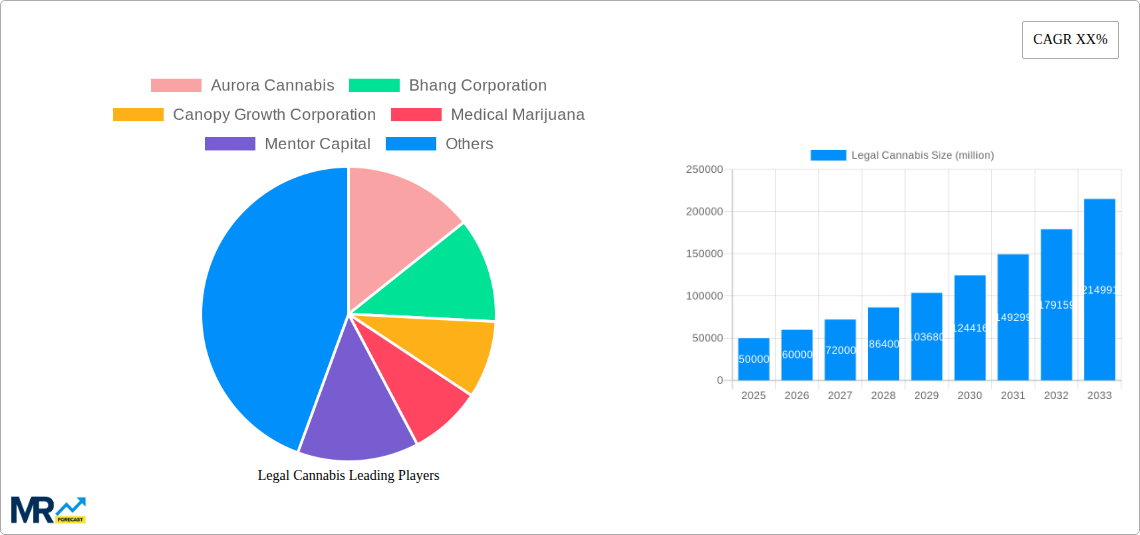

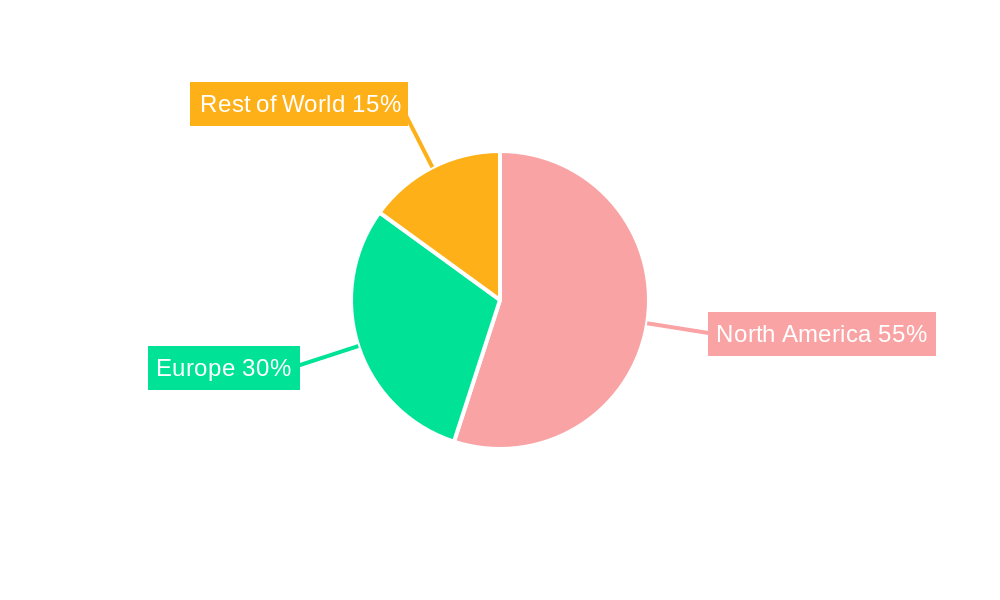

However, the market faces certain restraints, including the ongoing complexities surrounding regulations, varying legal frameworks across different geographies, and concerns surrounding potential health implications and public safety. Furthermore, the cannabis market is experiencing a period of consolidation, with larger companies acquiring smaller players, creating an increasingly competitive landscape. Segmentation within the market is significant, with key distinctions existing between medicinal and recreational cannabis, different product formats (flower, oils, edibles), and cultivation methods (indoor, outdoor, greenhouse). Leading companies, such as Aurora Cannabis, Canopy Growth Corporation, and Curaleaf, are vying for market share through innovation, strategic acquisitions, and brand building, while smaller players are focusing on niche markets and specialized product offerings. The geographic distribution of the market is expected to vary significantly, with North America and Europe anticipated to hold the largest market shares due to early legalization and robust consumer demand, but emerging markets in Latin America and Asia-Pacific are demonstrating increasing potential for growth.

The legal cannabis market experienced explosive growth throughout the historical period (2019-2024), driven by shifting public perception, legislative changes across numerous jurisdictions, and increasing consumer acceptance. This trend is projected to continue and accelerate throughout the forecast period (2025-2033). By the estimated year 2025, the market is expected to reach a valuation of XXX million, representing a significant jump from previous years. This growth is fueled by expanding product offerings, from traditional flower to sophisticated edibles, concentrates, and topicals, catering to a diverse range of consumer preferences and medical needs. The increasing sophistication of cannabis-infused products, coupled with innovative delivery methods, has broadened the appeal and accessibility of cannabis, further bolstering market expansion. Furthermore, the rise of cannabidiol (CBD) products, with their perceived health benefits and legal availability in more regions compared to tetrahydrocannabinol (THC)-dominant products, has contributed substantially to overall market volume. The industry is also witnessing a surge in investment, attracting significant capital from both established and emerging players. This influx of funds fuels innovation, expansion into new markets, and the development of more efficient cultivation and processing techniques, ultimately contributing to the overall growth trajectory. The market's evolution is not solely driven by consumer demand; technological advancements and improved regulatory frameworks are also vital components. Advanced cultivation techniques are leading to higher yields and improved product quality, while evolving regulatory frameworks are providing greater clarity and legitimacy to industry operations, thus encouraging further investment and innovation. The increasing integration of technology across the supply chain, from seed-to-sale tracking to point-of-sale systems, is improving transparency and efficiency, further driving market growth. The estimated market value reflects the culmination of these factors, signaling a sustained period of expansion for the legal cannabis industry.

Several key factors are driving the rapid expansion of the legal cannabis market. Firstly, the evolving social and political landscape has played a crucial role. A growing number of jurisdictions are legalizing cannabis for both recreational and medical purposes, significantly expanding the market's addressable population. This legislative shift is often accompanied by public opinion polls showing increased support for cannabis legalization. Secondly, advancements in cultivation and processing techniques have significantly improved product quality and yield, leading to lower costs and increased consumer appeal. The development of new cannabis strains with specific therapeutic properties further caters to a broader range of consumers. Thirdly, the rise of CBD-infused products has played a significant role, given the wider legal availability and perceived health benefits of CBD compared to THC. This has led to a surge in demand, opening up significant market opportunities. The increased acceptance of cannabis for its potential therapeutic uses, especially in managing chronic pain and other medical conditions, also contributes to growth. This is coupled with a growing body of scientific research supporting the potential health benefits of cannabis and its compounds, boosting consumer confidence and acceptance. Finally, significant investments from venture capitalists and other investors are fuelling innovation, expansion, and the establishment of larger, more efficient cannabis businesses. These funds are being allocated towards research and development, marketing, and expansion into new markets, further driving market growth and overall market maturity.

Despite the significant growth potential, the legal cannabis industry faces several challenges and restraints. One major hurdle is the complex and often inconsistent regulatory landscape. Varying regulations across different jurisdictions can create operational complexities and logistical challenges for companies seeking to expand their reach. The lack of uniform regulations also creates difficulties for interstate commerce and the development of national or international cannabis brands. Secondly, banking remains a significant challenge for many cannabis businesses. Federal regulations in some countries still classify cannabis as a controlled substance, which makes it difficult for banks to provide traditional financial services to cannabis companies. This lack of access to banking services can limit growth and create financial instability. Thirdly, the cannabis industry is often subject to high taxation, which can impact profitability and make it difficult for smaller businesses to compete. In addition, the stigmatization associated with cannabis still persists in many segments of society. While public opinion is shifting, the legacy of negative perceptions continues to impede wider adoption and full market potential. Finally, maintaining product safety and quality is crucial, especially as the industry continues to expand. Strict quality control measures are essential to building consumer trust and ensuring product safety, necessitating substantial investment in research and technological infrastructure. These regulatory, financial, social, and safety concerns create significant challenges that need to be overcome to fully realize the growth potential of the legal cannabis market.

The legal cannabis industry is poised for continued robust growth, driven by several key catalysts. These include increasing consumer acceptance, fueled by changing social norms and a growing body of scientific evidence supporting its therapeutic potential; legislative advancements at both state and federal levels further expand market access and legitimize industry operations; continuous innovation in product development leads to more appealing and refined products, catering to diverse needs and preferences; finally, substantial investments propel industry maturation, bolstering infrastructure and driving technological advancement, ensuring efficient and sustainable operations. The convergence of these factors indicates a sustained period of significant market expansion.

This report provides a detailed analysis of the legal cannabis market, encompassing its historical performance, current trends, future projections, and key drivers. It offers a comprehensive overview of the industry's leading players, significant market developments, and the challenges and opportunities that lie ahead. The report's findings are based on extensive research and analysis, providing valuable insights for businesses, investors, and policymakers involved in this rapidly evolving sector. The forecast period extending to 2033 offers a long-term perspective, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Aurora Cannabis, Bhang Corporation, Canopy Growth Corporation, Medical Marijuana, Mentor Capital, Cannoid, CBD American Shaman, CV Sciences, Elixinol, Folium Biosciences, IRIE CBD, Meadow Care, mCig, NuLeaf Naturals, Pharmahemp, Terra Tech, United Cannabis.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Legal Cannabis," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Legal Cannabis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.