1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Exam Light?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

LED Exam Light

LED Exam LightLED Exam Light by Type (Fixed, Mobile, World LED Exam Light Production ), by Application (Hospitals, Clinics, Others, World LED Exam Light Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

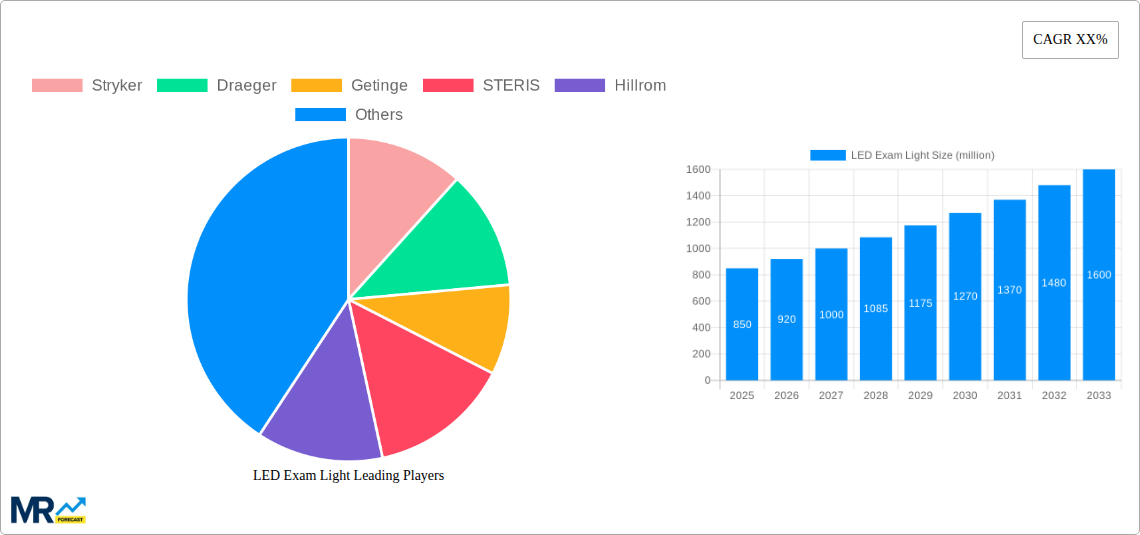

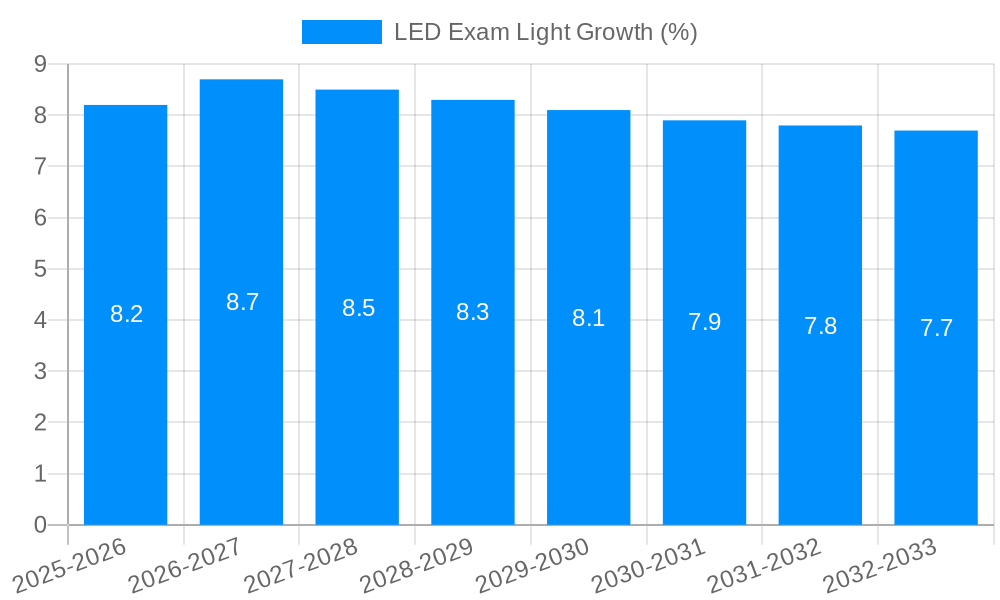

The global LED exam light market is experiencing robust expansion, projected to reach a substantial market size in the coming years, driven by a consistent Compound Annual Growth Rate (CAGR) of approximately 8-10%. This upward trajectory is underpinned by several critical factors. Foremost among these is the increasing adoption of advanced medical lighting solutions in healthcare facilities worldwide, necessitated by the growing demand for precision and improved patient care. The transition from traditional halogen or fluorescent exam lights to energy-efficient, long-lasting LED technology is a significant driver. LED lights offer superior illumination quality, reduced heat emission, and lower power consumption, making them a cost-effective and practical choice for hospitals and clinics. Furthermore, the expanding healthcare infrastructure, particularly in emerging economies, and the continuous upgrade of existing medical equipment are fueling market growth. The rising prevalence of diagnostic procedures and the increasing emphasis on creating conducive examination environments further bolster the demand for high-performance LED exam lights.

The market is characterized by a diverse range of segments, catering to various healthcare needs. The "Type" segmentation highlights the distinction between fixed and mobile LED exam lights, with mobile units offering greater flexibility in various clinical settings. In terms of "Application," hospitals and clinics are the primary end-users, accounting for the largest share of demand due to their extensive use in patient examinations and minor surgical procedures. The "World LED Exam Light Production" aspect indicates a global manufacturing landscape with key players actively innovating and expanding their offerings. Key market restraints, such as the initial cost of high-end LED exam lights and the need for specialized technical expertise for installation and maintenance, are being addressed through technological advancements and service packages. The market's future will likely see a greater focus on smart, connected exam lights with features like adjustable color temperature, intensity control, and integration with EMR systems, further enhancing their utility and market penetration.

This report offers a comprehensive analysis of the global LED exam light market, encompassing production, applications, and industry developments. Leveraging extensive data from the Historical Period (2019-2024), a robust Base Year (2025), and an ambitious Forecast Period (2025-2033), this study provides unparalleled insights into market dynamics. The Study Period (2019-2033) allows for a thorough examination of historical trends and future projections, with an Estimated Year (2025) serving as a pivotal point for current market assessment. The global market is projected to witness significant expansion, with revenues anticipated to reach into the millions of US dollars.

The global LED exam light market is currently experiencing a significant transformation, driven by an escalating demand for advanced medical illumination solutions across a diverse range of healthcare settings. XXX, key market insights reveal a pronounced shift towards LED technology due to its inherent advantages over traditional lighting systems, including superior energy efficiency, extended lifespan, and exceptional light quality. These benefits translate into substantial cost savings for healthcare facilities in terms of reduced energy consumption and lower maintenance expenditures, making LED exam lights an economically attractive choice. Furthermore, the enhanced illumination capabilities of LEDs, characterized by higher lux levels, excellent color rendering index (CRI), and adjustable color temperatures, are crucial for accurate diagnosis and precise medical procedures. This has led to a growing preference for LED exam lights in critical applications such as general examinations, minor surgical procedures, and diagnostic imaging. The market is also witnessing a surge in demand for smart and connected lighting solutions, incorporating features like dimming capabilities, touchless controls, and integration with other medical equipment, reflecting the broader trend towards smart healthcare environments. The increasing adoption of telehealth and remote patient monitoring further bolsters the demand for high-quality examination lighting that can facilitate clear visual assessment even in remote settings. Regulatory initiatives promoting energy-efficient lighting technologies and the growing emphasis on patient safety and comfort are also significant contributors to these evolving trends. The continuous innovation in LED technology, leading to smaller, more powerful, and more versatile lighting units, is opening up new avenues for application and market growth. The global production of LED exam lights is expected to grow exponentially, with revenues projected to reach hundreds of millions of dollars by the end of the forecast period, underscoring the robust market trajectory.

Several potent forces are driving the robust growth of the global LED exam light market. Foremost among these is the undeniable technological superiority of LED lighting. Compared to older halogen or incandescent technologies, LEDs offer significantly higher energy efficiency, consuming substantially less power while delivering superior illumination. This translates into considerable operational cost savings for hospitals and clinics, a critical factor in budget-conscious healthcare environments. Furthermore, LED exam lights boast an exceptionally long lifespan, often lasting tens of thousands of hours, thereby minimizing the frequency of bulb replacements and associated maintenance costs. The demand for enhanced diagnostic accuracy and improved patient care is another significant propellant. LEDs provide excellent color rendering indices (CRIs), meaning they accurately represent the true colors of tissues and other biological materials, which is paramount for accurate diagnosis and treatment planning. The ability to adjust color temperature and intensity also allows medical professionals to tailor the lighting to specific examination needs, reducing eye strain and improving visual comfort. The increasing prevalence of minimally invasive surgical procedures and the growing adoption of advanced diagnostic techniques necessitate precise and focused illumination, areas where LED exam lights excel. Moreover, government initiatives and environmental regulations worldwide are increasingly favoring energy-efficient technologies, further incentivizing the adoption of LED lighting solutions. The expanding global healthcare infrastructure, particularly in emerging economies, is also contributing to increased demand for medical examination equipment, including advanced lighting systems. The continuous innovation in LED technology, leading to more compact, flexible, and feature-rich exam lights, is consistently expanding the market's potential.

Despite the promising growth trajectory, the global LED exam light market faces certain challenges and restraints that could temper its expansion. A primary concern remains the initial cost of adoption. While LED exam lights offer long-term cost savings, their upfront purchase price can be higher than traditional lighting systems, posing a barrier for some smaller healthcare facilities or those with limited capital budgets. This is particularly relevant in price-sensitive markets or regions with less developed healthcare infrastructure. Technological obsolescence is another potential challenge. The rapid pace of LED technology development means that newer, more advanced models are constantly emerging. This can lead to a perception of rapid obsolescence for existing equipment, potentially influencing purchasing decisions and leading to shorter replacement cycles than initially anticipated. Standardization and interoperability issues can also pose hurdles. While there are general standards for medical lighting, the integration of "smart" or connected LED exam lights with existing hospital IT systems can sometimes be complex, requiring significant investment in infrastructure upgrades and specialized software. The availability of skilled technicians for installation, maintenance, and repair of advanced LED systems can also be a limiting factor in certain regions. Furthermore, while LED technology is generally considered safe, concerns regarding potential heat generation in very high-intensity applications, although largely mitigated by modern designs, can still be a consideration for some specialized procedures or sensitive environments. Finally, global supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and components, potentially leading to price fluctuations and delivery delays, thereby affecting market stability.

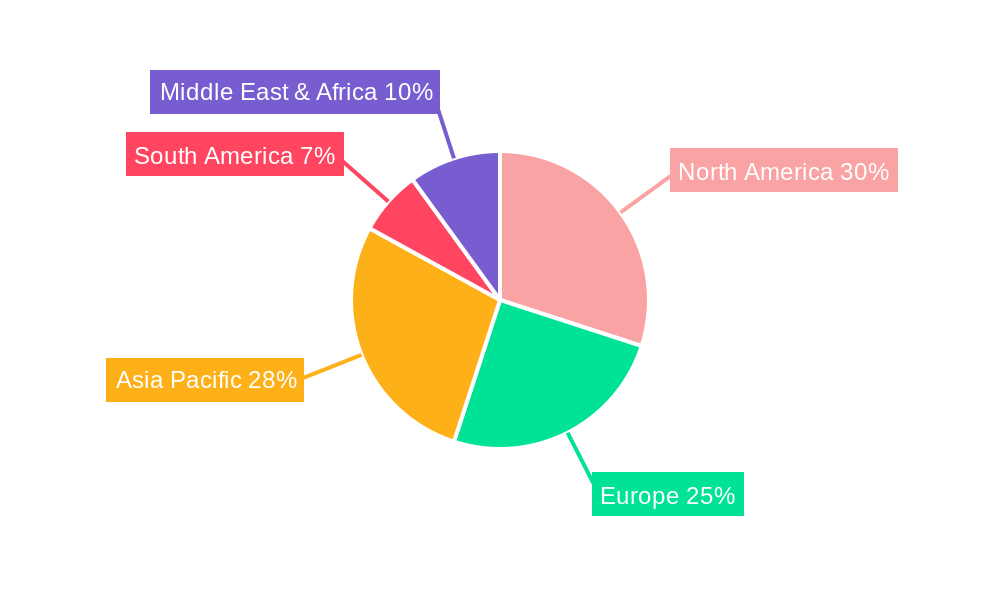

The global LED exam light market is poised for significant growth across various regions and segments, with particular dominance anticipated from North America and the Hospitals segment.

North America (USA & Canada):

Hospitals Segment:

While other regions like Europe and Asia Pacific are also experiencing significant growth, and segments like clinics are important, the sheer scale of healthcare infrastructure and expenditure in North America, coupled with the extensive procedural volume within hospitals, positions these as the key drivers and dominators of the global LED exam light market. The estimated market value for these dominant segments alone is expected to contribute significantly to the overall multi-million dollar valuation of the global market.

Several key growth catalysts are poised to accelerate the expansion of the LED exam light industry. The relentless pace of technological innovation in LED illumination, offering enhanced brightness, superior color rendering, and improved energy efficiency, continues to drive adoption. The increasing global healthcare expenditure, particularly in emerging economies, is expanding access to advanced medical equipment, including LED exam lights. Furthermore, a growing awareness among healthcare professionals about the benefits of precise illumination for diagnostic accuracy and patient safety is a significant driver. The rising demand for minimally invasive procedures and the trend towards smart, connected medical devices also present substantial opportunities for market growth.

This report provides an exhaustive examination of the global LED exam light market, offering a deep dive into historical trends, current market scenarios, and future projections. It meticulously analyzes key market drivers, including technological advancements, increasing healthcare investments, and rising demand for diagnostic accuracy. The report also addresses significant challenges and restraints such as initial cost of adoption and potential technological obsolescence. A detailed regional and segmental analysis highlights dominant markets and applications, providing strategic insights for stakeholders. Furthermore, it identifies crucial growth catalysts and profiles leading industry players, offering a holistic understanding of the competitive landscape. The comprehensive scope ensures that businesses can make informed strategic decisions based on robust data and insightful analysis, covering an estimated market value projected to reach hundreds of millions in revenue.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Stryker, Draeger, Getinge, STERIS, Hillrom, Skytron, Mindray Global, Dr. Mach, SIMEON Medical, Trumpf Medical, Burton Medical, KLS Martin, Waldmann, Merivaara, Bovie Medical, Kenall, Symmetry Surgical, NUVO Surgical.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "LED Exam Light," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the LED Exam Light, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.