1. What is the projected Compound Annual Growth Rate (CAGR) of the LED-Backlit Liquid Crystal Display?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

LED-Backlit Liquid Crystal Display

LED-Backlit Liquid Crystal DisplayLED-Backlit Liquid Crystal Display by Type (Curved Screen, Flat Screen), by Application (Electronics, Automotive, Aerospace, Consumer Goods, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

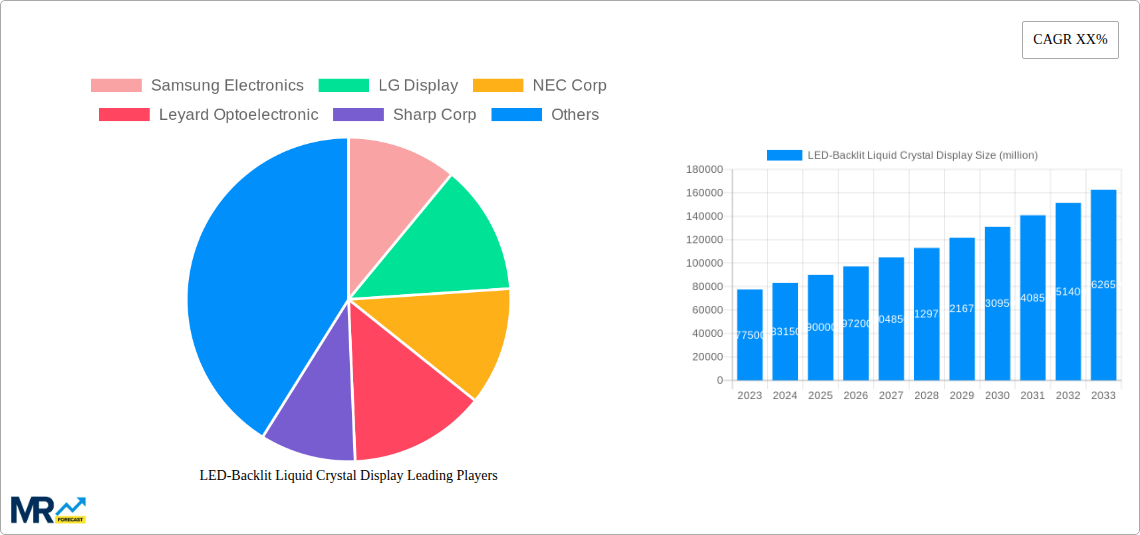

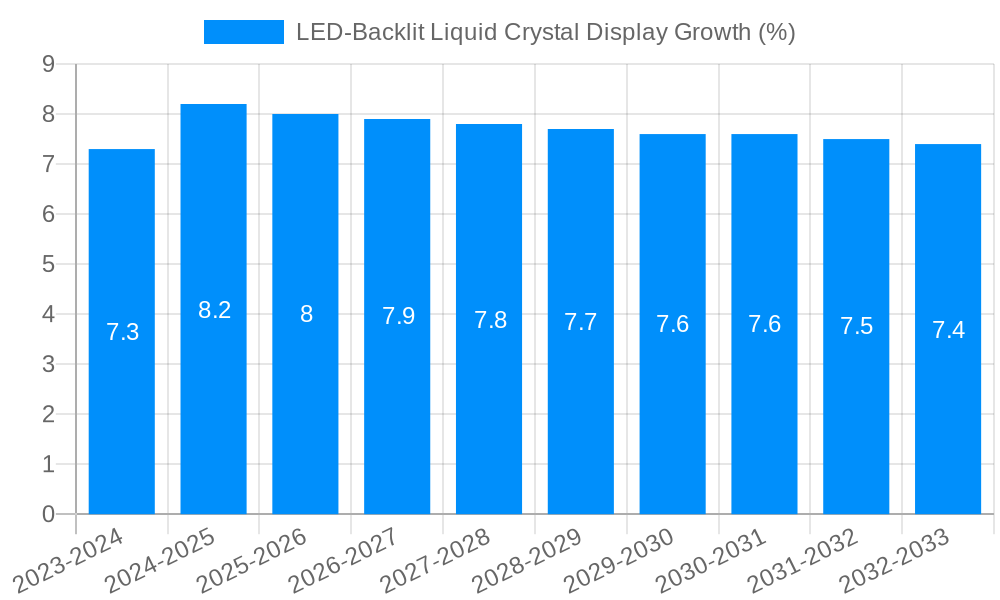

The global LED-backlit liquid crystal display (LCD) market is experiencing robust growth, projected to reach an estimated USD 90,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This expansion is primarily fueled by the insatiable demand for high-quality displays across a multitude of consumer electronics, including smartphones, televisions, and laptops. The persistent need for advanced display technologies, characterized by enhanced brightness, improved energy efficiency, and superior color reproduction, continues to drive innovation and market penetration. Furthermore, the automotive sector is increasingly integrating sophisticated LED-backlit LCDs for infotainment systems, digital dashboards, and advanced driver-assistance systems (ADAS), representing a significant growth avenue. The aerospace industry also contributes to this demand with its requirement for durable and high-performance displays for aircraft cockpits and passenger entertainment.

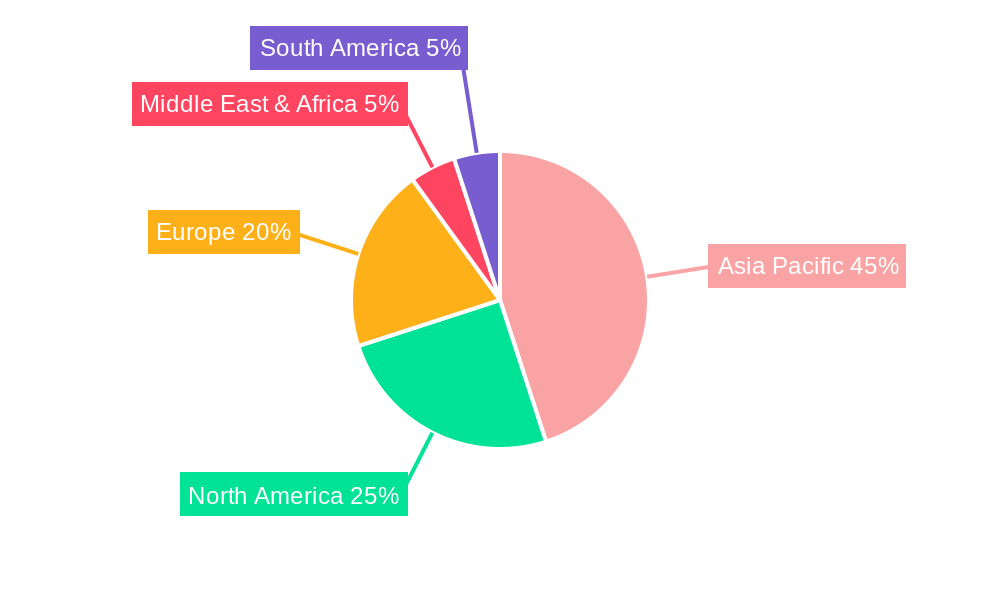

The market is characterized by dynamic trends, with a notable shift towards curved screen displays offering a more immersive viewing experience, particularly in the television and gaming monitor segments. Conversely, flat screens continue to dominate in numerous applications due to their cost-effectiveness and versatility. Key market restraints include intense price competition among manufacturers and the ongoing development and adoption of alternative display technologies like OLED, which pose a threat in certain premium segments. However, the cost-effectiveness and mature manufacturing processes of LED-backlit LCDs ensure their continued dominance in mainstream markets. Geographically, the Asia Pacific region, led by China and South Korea, is the largest market and is expected to maintain its lead, driven by strong manufacturing capabilities and a vast consumer base. North America and Europe also represent substantial markets, with significant demand from the electronics and automotive sectors.

This comprehensive report delves into the intricate landscape of the LED-backlit Liquid Crystal Display (LCD) market, offering a detailed analysis of trends, driving forces, challenges, and the competitive environment. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides valuable insights for stakeholders navigating this dynamic sector.

The LED-backlit LCD market is characterized by a robust upward trajectory, projected to reach an estimated US$ 150 million in revenue by 2025. This growth is underpinned by a confluence of factors, including ongoing technological advancements, increasing adoption across diverse applications, and a sustained demand from both consumer and industrial sectors. During the historical period of 2019-2024, the market witnessed steady expansion, driven by the widespread integration of LED backlighting technology into televisions, monitors, and mobile devices, which significantly enhanced display quality, energy efficiency, and slim profile designs.

The forecast period of 2025-2033 is expected to see continued evolution, with key trends shaping the market's future. Mini-LED and Micro-LED technologies, while often considered distinct display technologies, are increasingly being integrated into advanced LCD panels, blurring the lines and offering enhanced contrast ratios and brightness levels comparable to OLED displays. This has fueled demand for premium applications, particularly in high-end televisions and professional displays. Furthermore, the miniaturization of LED components is enabling the development of ultra-thin and flexible displays, opening up new design possibilities for consumer electronics and emerging applications. The automotive sector, in particular, is a significant growth area, with in-car displays becoming more sophisticated and integrated, demanding high-resolution, durable, and energy-efficient LED-backlit LCD solutions. The increasing penetration of smart home devices and the proliferation of digital signage also contribute to the sustained demand for these displays. The industry is also witnessing a growing emphasis on sustainability, with manufacturers focusing on developing more energy-efficient backlighting solutions and reducing the environmental impact of production processes. This includes advancements in materials and manufacturing techniques to minimize power consumption and waste. The market is anticipated to observe a compound annual growth rate (CAGR) of approximately 5.5% during the forecast period, solidifying its position as a dominant display technology for the foreseeable future, despite the emergence of competing display technologies. The overall market size is expected to ascend to an impressive US$ 230 million by 2033, highlighting the enduring appeal and adaptability of LED-backlit LCDs.

The significant growth observed in the LED-backlit LCD market is propelled by several potent driving forces. Foremost among these is the relentless pursuit of enhanced visual experiences. LED backlighting has been instrumental in dramatically improving contrast ratios, color accuracy, and brightness levels of LCD panels, making them increasingly attractive for a wide array of applications, from immersive home entertainment to critical professional displays. This technological advancement directly translates into superior image quality, which is a primary purchasing driver for consumers and a non-negotiable requirement for professional use.

Secondly, the unparalleled cost-effectiveness and scalability of LED-backlit LCD technology remain a significant advantage. Compared to some competing display technologies, the manufacturing processes for LED-backlit LCDs are well-established and highly optimized for mass production. This allows for competitive pricing, making them accessible for a vast global market across various price points. This accessibility, coupled with continuous improvements in efficiency and performance, ensures their continued dominance in high-volume segments like televisions, monitors, and smartphones. The inherent durability and longevity of LED technology also contribute to their appeal, offering a reliable and long-lasting display solution for both consumer and industrial applications. As the demand for smart devices and sophisticated interfaces continues to surge across sectors, the proven reliability and cost-effectiveness of LED-backlit LCDs ensure their sustained adoption.

Despite its robust growth, the LED-backlit LCD market is not without its challenges and restraints. A primary concern is the increasing competition from alternative display technologies, most notably OLED (Organic Light Emitting Diode). OLED displays offer inherent advantages in terms of true blacks, infinite contrast ratios, and faster response times, which are particularly appealing for high-end premium applications. As OLED technology matures and becomes more cost-competitive, it poses a significant threat to the market share of LED-backlit LCDs, especially in premium segments.

Another restraint lies in the ongoing demand for further innovation to match the performance of emerging technologies. While Mini-LED and Micro-LED technologies are enhancing LCD capabilities, achieving the same level of perfect blacks and pixel-level dimming as OLED remains a technical hurdle. Manufacturers are continuously investing in research and development to bridge this gap, but the cost of implementing these advanced backlighting solutions can be substantial, potentially limiting their widespread adoption in mid-range and budget-friendly products. Furthermore, the energy efficiency of some LED-backlit LCDs, particularly those with traditional backlighting, may not always match the efficiency of newer display technologies, which could be a concern in markets with a strong emphasis on power conservation. Supply chain disruptions, geopolitical factors, and fluctuations in raw material prices can also pose short-term challenges to production and profitability within the industry.

Dominant Regions and Countries:

Asia-Pacific: This region stands as the undisputed leader in the LED-backlit Liquid Crystal Display market, driven by its robust manufacturing capabilities, significant consumer base, and extensive technological advancements. Countries like China, South Korea, and Taiwan are at the forefront of production and innovation. China, in particular, boasts a massive manufacturing infrastructure, catering to both domestic and international demand for displays across various applications. South Korea, home to giants like Samsung Electronics and LG Display, consistently pushes the boundaries of display technology, focusing on high-performance and premium offerings. Taiwan also plays a crucial role with companies like AU Optronics Corp, contributing significantly to the global supply chain. The sheer volume of consumer electronics production, coupled with the expanding middle class and their increasing disposable income, fuels a perpetual demand for televisions, smartphones, tablets, and other electronic devices that extensively utilize LED-backlit LCDs. The government’s strong support for the technology sector and substantial investments in research and development further solidify the Asia-Pacific’s dominance. The region is not only a production hub but also a massive consumption market, creating a self-sustaining ecosystem for LED-backlit LCDs.

North America: This region represents a significant market for LED-backlit LCDs, primarily driven by high consumer spending power and a strong demand for premium electronics and automotive applications. The United States, in particular, is a major consumer of high-definition televisions, advanced computer monitors, and sophisticated in-car display systems. The rapid adoption of smart home technologies and the increasing use of digital signage in retail and public spaces also contribute to the sustained demand. The presence of major technology companies and a strong ecosystem for innovation further bolsters the market in this region.

Dominant Segments:

Application: Electronics: The Electronics segment remains the largest and most influential application area for LED-backlit LCDs. This encompasses a vast spectrum of devices, including televisions, smartphones, tablets, laptops, desktop monitors, and wearables. The ubiquity of these devices in modern life ensures a consistent and substantial demand for displays. The continuous evolution of consumer electronics, with a focus on larger screen sizes, higher resolutions (e.g., 4K, 8K), improved refresh rates, and enhanced color reproduction, directly translates to an increased demand for advanced LED-backlit LCD panels. For instance, the global market for large-format televisions, a segment heavily reliant on LED-backlit LCD technology, continues to grow, driven by entertainment and home theater trends. Similarly, the smartphone market, despite intense competition from other display technologies in the premium segment, still relies on LED-backlit LCDs for a significant portion of its volume, especially in mid-range and budget-friendly devices. The ongoing development of foldable and flexible display technologies within the broader electronics category is also creating new avenues for LED-backlit LCD innovation, further cementing its dominance in this segment. The sheer volume of units produced and consumed within the electronics sector makes it the primary engine of growth and revenue for the LED-backlit LCD market. The projected market size for this segment alone is estimated to reach US$ 90 million by 2025, with substantial growth expected throughout the forecast period.

Type: Flat Screen: While curved screens have gained niche traction, Flat Screens continue to dominate the LED-backlit LCD market due to their versatility, cost-effectiveness, and widespread adoption across almost all electronic devices. Their inherent design makes them suitable for a vast range of applications, from personal devices to large public displays. The mass production of flat panels is highly optimized, contributing to their affordability and widespread availability.

Several factors are acting as significant growth catalysts for the LED-backlit LCD industry. The increasing demand for immersive and high-quality visual experiences across entertainment, gaming, and professional applications is a primary driver. Advancements in Mini-LED and Micro-LED backlighting technology are pushing the boundaries of performance, offering enhanced contrast, brightness, and color accuracy, making LCDs competitive with premium display options. Furthermore, the expanding automotive sector, with its growing need for integrated, high-resolution in-car displays, presents a substantial growth opportunity. The ongoing digitalization across industries, leading to increased adoption of digital signage and smart devices, also fuels demand.

This report offers a holistic examination of the LED-backlit Liquid Crystal Display market, providing an in-depth analysis of its current status and future trajectory. We meticulously analyze market trends from 2019 to 2033, with a specific focus on the base year 2025 and the forecast period up to 2033. The report delves into the key driving forces propelling market growth, such as technological innovation and increasing demand across diverse sectors. It also critically assesses the challenges and restraints that the industry faces, including competition from alternative display technologies and the need for continuous innovation. Our comprehensive analysis highlights the dominant regions and segments, offering detailed insights into why they are poised for significant growth. Furthermore, we identify the key players shaping the market and outline the significant developments that are defining the future of LED-backlit LCD technology. This report is designed to equip stakeholders with the knowledge necessary to make informed strategic decisions in this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Samsung Electronics, LG Display, NEC Corp, Leyard Optoelectronic, Sharp Corp, Barco NV, Sony Corp, TPV Technology Ltd, AU Optronics Corp, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "LED-Backlit Liquid Crystal Display," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the LED-Backlit Liquid Crystal Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.