1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Television?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Laser Television

Laser TelevisionLaser Television by Type (4K, 1080P, World Laser Television Production ), by Application (Residential, Commercial, World Laser Television Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

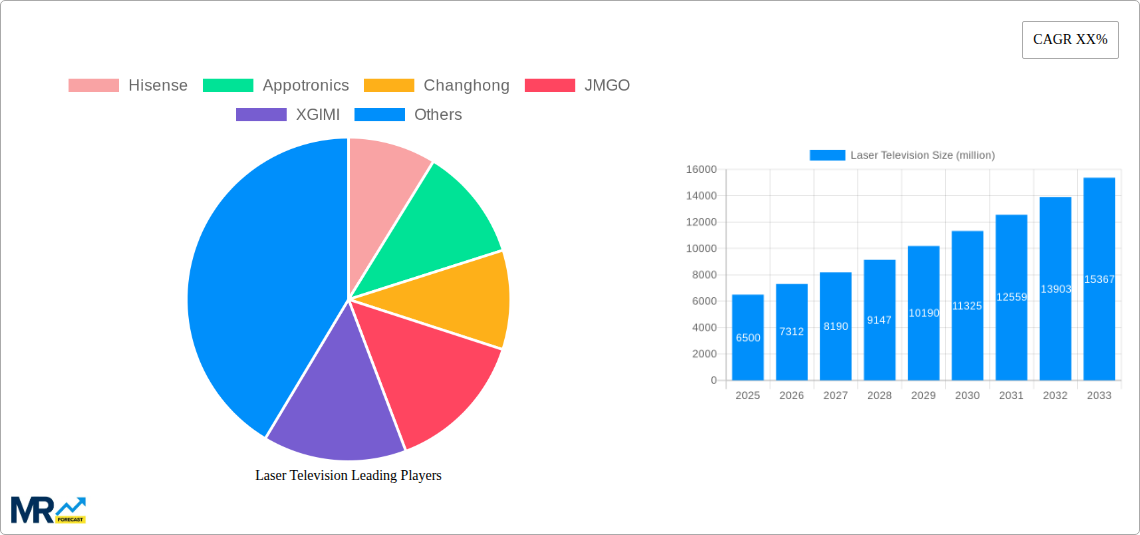

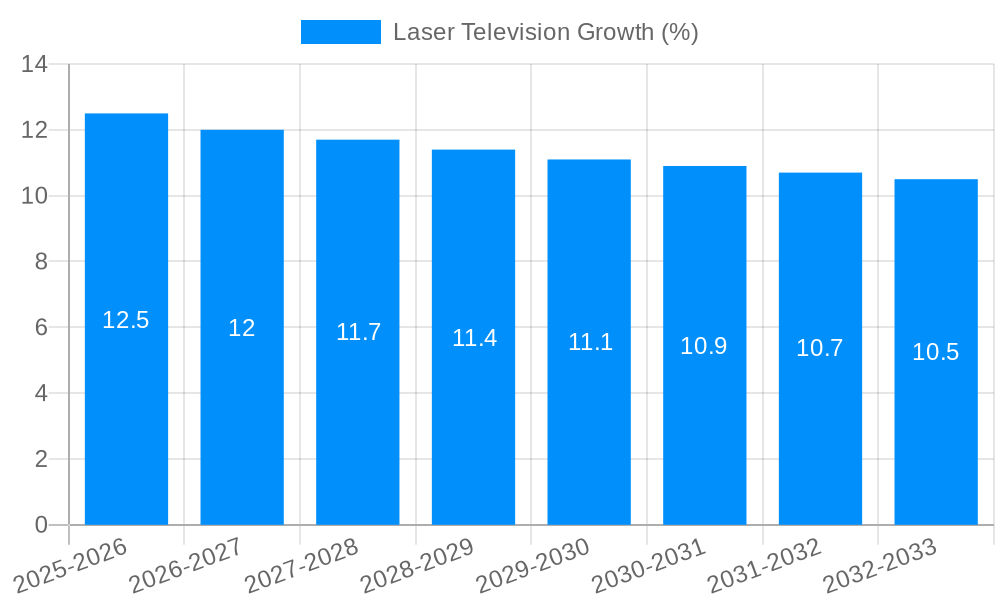

The global Laser Television market is poised for substantial growth, projected to reach an estimated market size of approximately $6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% anticipated between 2025 and 2033. This expansion is primarily fueled by the increasing consumer demand for immersive home entertainment experiences, driven by advancements in picture quality, color accuracy, and contrast ratios offered by laser technology. The adoption of 4K and even higher resolutions is becoming the norm, pushing the boundaries of visual fidelity and appealing to a tech-savvy demographic seeking premium viewing solutions. Furthermore, the declining costs of laser projection components, coupled with enhanced energy efficiency compared to traditional displays, are making laser televisions a more accessible and attractive option for a wider consumer base. The residential segment is expected to dominate, propelled by the desire for large-screen entertainment that rivals cinema-like quality within the home.

The market is not without its challenges. While drivers like technological innovation and increasing consumer awareness are strong, certain restraints may temper the pace of growth. Initial purchase price, although decreasing, can still be a barrier for some segments of the market. Additionally, the need for dedicated viewing environments, such as darkened rooms, and the potential for perceived complexity in setup and maintenance compared to standard TVs, could slow down widespread adoption. However, ongoing research and development are addressing these concerns, with manufacturers actively working on improving brightness for ambient light conditions and simplifying user interfaces. Emerging trends such as ultra-short-throw projectors and integration with smart home ecosystems are further enhancing the appeal of laser televisions, positioning them as a significant disruptive force in the premium display market. Key players like Hisense, Appotronics, Sony, and Samsung are heavily investing in R&D and strategic partnerships to capture a larger share of this dynamic and evolving industry.

The global laser television market is poised for a significant expansion over the Study Period (2019-2033), with the Base Year of 2025 serving as a pivotal point for observed growth and future projections. During the Historical Period (2019-2024), laser televisions have transitioned from a niche technology to a more mainstream home entertainment solution, driven by increasing consumer awareness and a growing desire for immersive viewing experiences. As we enter the Estimated Year of 2025, the market is projected to reach a substantial value, indicating robust demand and technological advancements. The Forecast Period (2025-2033) is expected to witness an acceleration in this growth trajectory. The increasing adoption of 4K resolution is a dominant trend, with consumers increasingly seeking higher fidelity visuals, and laser projectors are well-positioned to deliver this. This segment is expected to command a significant market share due to its superior picture quality and wider color gamut. Furthermore, the World Laser Television Production is likely to see a substantial increase in output, addressing the growing demand. While 1080P models still hold a presence, particularly in budget-conscious segments, the premiumization of the market points towards 4K as the de facto standard for new installations. The technological evolution of laser light sources, such as advancements in RGB laser and Tri-Color laser technology, is contributing to improved brightness, color accuracy, and longevity, making laser televisions a compelling alternative to traditional displays. The shift towards larger screen sizes, exceeding 100 inches, is another key trend that laser technology is uniquely positioned to fulfill, offering a more cinematic experience at a potentially lower cost per inch compared to comparable-sized OLED or QLED panels. This trend is particularly evident in the Residential application segment, where consumers are investing in home theater setups. The integration of smart features, including advanced operating systems, voice control, and seamless connectivity, is also becoming standard, enhancing the user experience and further driving adoption. The market is also witnessing a growing interest in laser projectors for commercial applications, such as digital signage, professional presentations, and interactive displays, though the residential segment is expected to remain the primary growth driver. The World Laser Television Production is also influenced by the evolving manufacturing capabilities and supply chains. The year 2025 marks a critical juncture, with industry experts anticipating significant market penetration as production scales and prices become more competitive. The overall sentiment for laser televisions is overwhelmingly positive, with continuous innovation and a widening product portfolio expected to solidify its position in the display market.

Several potent factors are propelling the growth of the laser television market, transforming it from a nascent technology to a significant contender in the display industry. The most prominent driver is the unwavering consumer demand for larger, more immersive viewing experiences. As home entertainment becomes increasingly central to modern living, consumers are actively seeking alternatives to traditional large-format televisions that can offer screen sizes of 100 inches and beyond without prohibitive costs or logistical challenges. Laser projectors, capable of easily achieving these expansive screen dimensions, directly address this desire. Complementing this, rapid advancements in laser projection technology are playing a crucial role. Improvements in laser light sources, including higher brightness levels, enhanced color accuracy with wider color gamuts, and increased energy efficiency, are making laser televisions more appealing and competitive against established display technologies. The longevity and reduced maintenance requirements of laser light sources, typically rated for tens of thousands of hours of operation, offer a significant long-term value proposition for consumers. Furthermore, the decreasing cost of laser projection technology, driven by economies of scale in production and ongoing innovation, is making these systems more accessible to a wider consumer base. This price competitiveness, especially when considering the cost per inch for ultra-large displays, is a major catalyst for adoption. The growing popularity of 4K resolution, which laser projectors can deliver with exceptional clarity and vibrancy, aligns perfectly with consumer expectations for high-quality visuals, further fueling demand. Finally, the increasing sophistication of smart features and connectivity options integrated into laser television systems, mirroring those found in traditional smart TVs, is enhancing their usability and appeal, ensuring they meet the modern consumer's desire for a seamless and integrated entertainment experience.

Despite the promising growth trajectory, the laser television market is not without its challenges and restraints, which could temper its full potential. A significant hurdle remains the perception and awareness among the general consumer population. While the technology is gaining traction, a considerable portion of the market may still associate projectors with the limitations of older technologies, such as the need for darkened rooms and complicated setup procedures. Overcoming this ingrained perception requires substantial marketing and educational efforts. Another key challenge is the initial cost of entry. While prices are decreasing, high-end laser television systems, especially those offering the brightest lumens and premium features, can still represent a significant investment for many households, potentially placing them out of reach for a segment of the market, especially when compared to more established, albeit smaller, flat-panel TV options. The availability and cost of large projector screens, which are crucial for optimal performance, can also add to the overall system expense. Furthermore, ambient light conditions in typical living spaces continue to pose a challenge for projectors. While advancements in brightness and contrast ratios are mitigating this, laser televisions often perform best in environments with controlled lighting, which may require users to adapt their viewing habits or invest in window treatments. The complexity of installation and calibration, though improving, can still be a deterrent for less tech-savvy consumers who are accustomed to the plug-and-play simplicity of flat-panel TVs. Finally, the market faces competition not only from established LCD, OLED, and QLED television manufacturers but also from emerging display technologies, which could offer alternative solutions for immersive viewing experiences. The ongoing innovation in these competing sectors necessitates continuous improvement and differentiation from laser television manufacturers.

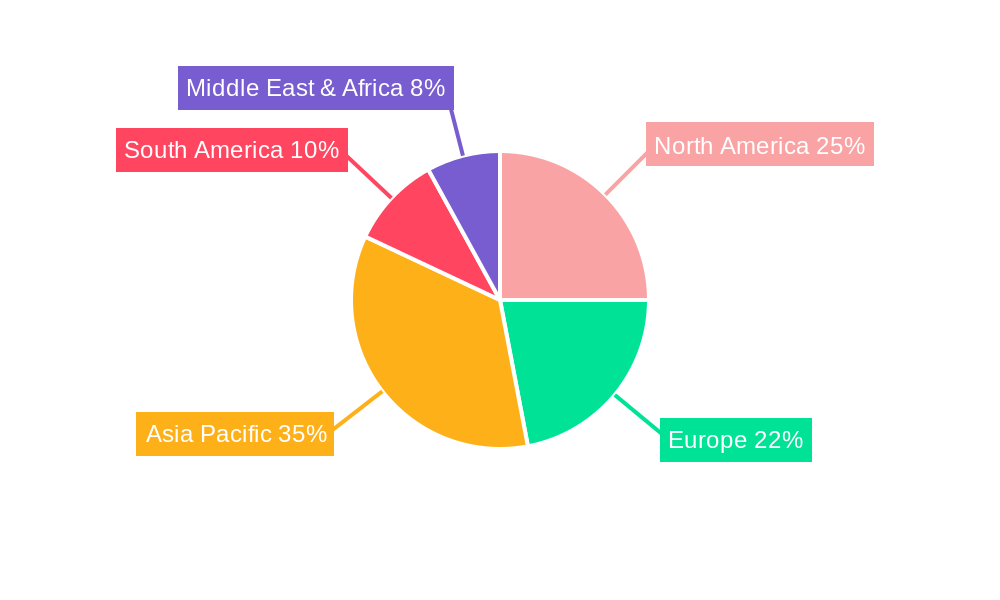

The global laser television market is poised for significant dominance in specific regions and segments, driven by a confluence of economic factors, technological adoption rates, and consumer preferences.

Dominant Segments:

Type: 4K Resolution

Application: Residential

Dominant Regions/Countries:

Asia-Pacific (with a strong focus on China)

North America

The laser television industry is experiencing significant growth catalysts that are reshaping its market dynamics. The escalating consumer desire for larger, more immersive display sizes at home, coupled with the increasing affordability of laser projection technology, is a primary driver. Continuous technological advancements, particularly in laser light source efficiency, brightness, and color reproduction, are enhancing the performance and appeal of laser televisions, making them a more compelling alternative to traditional displays. The growing availability of 4K content and the increasing consumer awareness of its benefits are also propelling the adoption of 4K laser televisions. Furthermore, the development of user-friendly features, smart connectivity, and simplified installation processes is making laser televisions more accessible and attractive to a broader consumer base.

This comprehensive report delves into the multifaceted landscape of the laser television market, providing an in-depth analysis of its current state and future trajectory. The report offers detailed insights into market trends, including the burgeoning demand for 4K resolution and the growing preference for larger screen sizes in residential applications. It meticulously examines the driving forces behind market expansion, such as technological advancements and increasing consumer awareness, while also addressing the challenges and restraints that the industry must overcome. Furthermore, the report identifies key regions and segments poised for dominance, with a particular focus on the Asia-Pacific region and the residential application segment. The report also highlights significant developments and leading players that are shaping the future of this dynamic industry. This comprehensive analysis is essential for stakeholders seeking to understand and capitalize on the evolving opportunities within the global laser television market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hisense, Appotronics, Changhong, JMGO, XGIMI, Sony, BenQ, LG, Samsung, Seiko Epson, Haier, Hualu, Optoma, ViewSonic.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Laser Television," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Laser Television, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.