1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Grown Diamonds?

The projected CAGR is approximately 8.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lab Grown Diamonds

Lab Grown DiamondsLab Grown Diamonds by Application (Fashion, Industrial, World Lab Grown Diamonds Production ), by Type (CVD Diamonds, HPHT Diamonds, World Lab Grown Diamonds Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

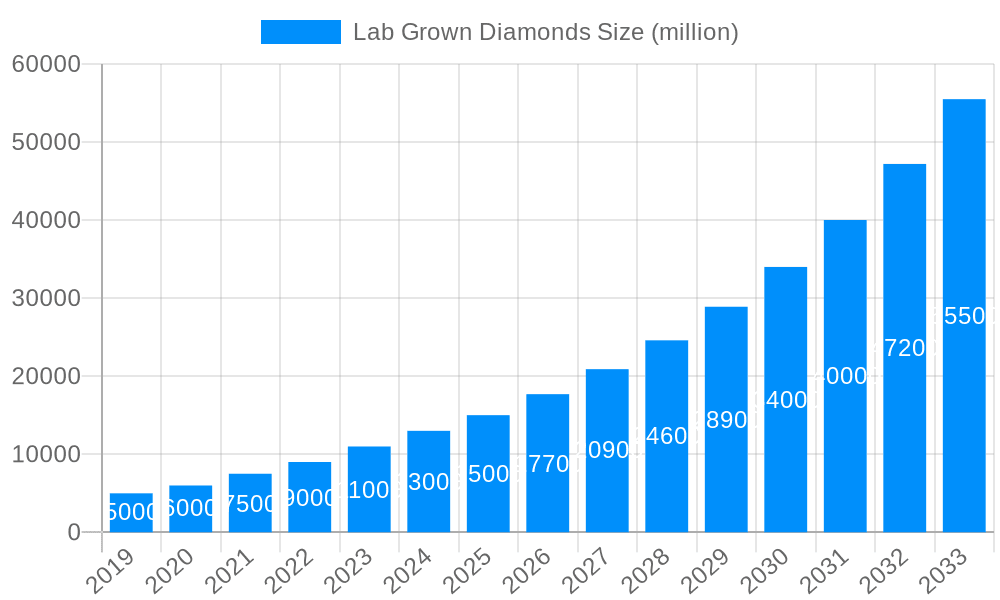

The lab-grown diamond market is experiencing significant expansion, propelled by escalating consumer preference for ethically produced and sustainable alternatives to mined diamonds. This rapidly growing sector, with a market size of $28.27 billion in 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 8.3% from 2025 to 2033. This trajectory positions the market for substantial growth. Key drivers include heightened consumer awareness regarding the ethical and environmental impacts of traditional diamond mining. Consumers are increasingly choosing lab-grown diamonds for their comparable brilliance and quality, often at a more accessible price point. Furthermore, ongoing technological innovations in production processes are reducing costs and enhancing the quality of lab-grown diamonds, thereby stimulating market growth. Leading industry participants such as De Beers, WD Lab Grown Diamonds, and Diamond Foundry are actively influencing market dynamics through strategic research and development investments and pioneering marketing initiatives.

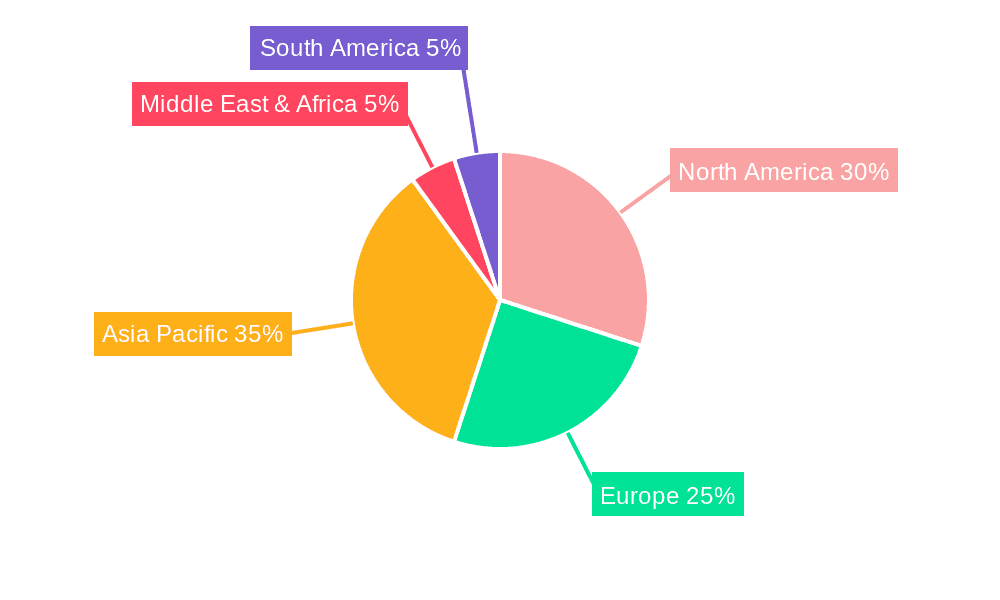

Market segmentation reveals a robust presence across diverse geographical regions, with North America and Europe currently dominating due to elevated consumer awareness and higher disposable incomes. Conversely, the Asia-Pacific region presents considerable untapped potential, demonstrating strong growth projections in the near term. Market expansion is moderated by consumer perceptions, particularly concerns surrounding the perceived lower intrinsic value of lab-grown diamonds compared to their mined counterparts. Mitigating these misconceptions through targeted marketing and educational outreach is vital for sustained market development. The continuous refinement of lab-grown diamond production technology, coupled with an expanding variety of diamond shapes and sizes, is effectively addressing these initial hesitations. In summary, the lab-grown diamond market represents a compelling investment prospect, characterized by robust growth potential fueled by ethical considerations, technological advancements, and evolving consumer preferences.

The lab-grown diamond market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Between 2019 and 2024 (historical period), the industry witnessed a significant surge in production and consumer adoption, driven by increasing awareness of the ethical and environmental benefits compared to mined diamonds. Our analysis indicates a continued, robust expansion during the forecast period (2025-2033), with the estimated market value in 2025 exceeding several hundred million dollars. Key market insights reveal a shift in consumer preferences towards more sustainable and affordable luxury goods, aligning perfectly with the lab-grown diamond proposition. This trend is further fueled by advancements in technology leading to higher-quality, more visually appealing lab-grown diamonds that are virtually indistinguishable from their mined counterparts. The increasing adoption of lab-grown diamonds in jewelry, industrial applications, and investment markets is also a significant contributing factor. Furthermore, strategic partnerships between established jewelry brands and lab-grown diamond producers are expanding market reach and accessibility, contributing to the overall market dynamism and future growth potential, with projections indicating a compound annual growth rate (CAGR) in the double digits throughout the forecast period. This rapid expansion presents both immense opportunities and challenges for industry players, requiring innovative strategies to navigate this evolving landscape. The market's evolution is not solely driven by consumer demand, but also shaped by continuous technological advancements in production methods and the expansion of the distribution channels.

Several factors are propelling the remarkable growth of the lab-grown diamond market. Firstly, the increasing consumer awareness of ethical sourcing and environmental concerns surrounding mined diamonds is a major driver. Lab-grown diamonds offer a conflict-free alternative, minimizing the environmental impact associated with traditional mining operations. Secondly, the price advantage of lab-grown diamonds over mined diamonds is significantly appealing to a broader consumer base, making luxury goods more accessible. Technological advancements continue to enhance the quality and visual appeal of lab-grown diamonds, making them virtually indistinguishable from mined diamonds, thus eroding the traditional perception gap. This improved quality further drives consumer adoption. The expansion of retail channels, including online platforms and collaborations with established jewelry brands, has made lab-grown diamonds more readily available to consumers globally, further accelerating market growth. Finally, the growing acceptance of lab-grown diamonds by consumers, especially among younger generations seeking sustainable and ethically produced luxury goods, represents a powerful and lasting driver for market expansion in the coming years.

Despite the significant growth, several challenges and restraints hinder the widespread adoption of lab-grown diamonds. The persistent perception among some consumers that lab-grown diamonds are "less valuable" or "artificial" compared to mined diamonds presents a key challenge. Overcoming this perception requires continuous education and marketing efforts to highlight the superior qualities and ethical benefits of lab-grown diamonds. Furthermore, intense competition among existing players and the entry of new players into the market creates pressure on pricing and profitability margins. Maintaining consistent high-quality production at scale while managing costs efficiently remains a crucial operational challenge. Regulations and certification standards for lab-grown diamonds vary across different regions, presenting logistical and compliance complexities. The potential for oversupply in the market, especially if production increases significantly faster than demand, poses a risk to pricing stability and industry profitability. Successfully navigating these challenges will require continuous innovation, efficient operations, and targeted marketing strategies to further enhance consumer trust and acceptance.

The global lab-grown diamond market exhibits strong regional variations in growth rates and market penetration.

North America: This region is anticipated to hold a dominant position in the market, driven by high consumer disposable income, increasing environmental consciousness, and a preference for ethically sourced products. The established jewelry retail infrastructure and strong online market also contribute to this dominance.

Asia-Pacific: This region presents immense growth potential, fueled by rapidly expanding middle classes in countries like China and India, creating a larger consumer base for affordable luxury goods.

Europe: While possessing a robust market, Europe's growth may be relatively slower compared to North America and Asia-Pacific due to established preferences for traditional mined diamonds and potentially slower adoption of new technologies and ethical considerations.

Key Segments:

Jewelry: This segment continues to be the primary driver of demand for lab-grown diamonds, with significant potential for growth in engagement rings, wedding bands, and other fine jewelry categories. The high demand for sustainability in this sector strongly benefits lab-grown diamonds.

Industrial Applications: This segment offers a growing avenue for lab-grown diamonds due to their superior hardness, thermal conductivity, and optical properties, finding applications in various high-precision tools and instruments.

Investment: While a nascent market, investments in lab-grown diamonds are slowly gaining traction, presenting an interesting alternative for investors seeking diversification and capital appreciation.

The North American market, particularly its jewelry segment, is projected to lead market share due to its early adoption and established luxury consumer base. However, the Asia-Pacific region is poised for significant future growth, potentially surpassing North America in the later part of the forecast period due to rapidly expanding markets in India and China.

The lab-grown diamond industry’s growth is fueled by several key catalysts. The increasing consumer demand for ethical and sustainable products aligns perfectly with lab-grown diamonds’ conflict-free and environmentally friendly nature. Technological advancements continue to improve the quality and visual appeal of lab-grown diamonds, making them increasingly indistinguishable from mined diamonds. Finally, the expansion of retail channels and strategic partnerships with established jewelry brands make lab-grown diamonds more readily available and accessible to consumers worldwide.

This report provides a comprehensive analysis of the lab-grown diamond market, covering market trends, driving forces, challenges, key players, and future growth projections. It offers valuable insights for businesses, investors, and consumers interested in understanding this dynamic and rapidly evolving sector. The report's detailed market segmentation and regional analysis provides granular insights into specific market dynamics and opportunities. The forecast period extends to 2033, providing a long-term perspective on the anticipated market evolution.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.3%.

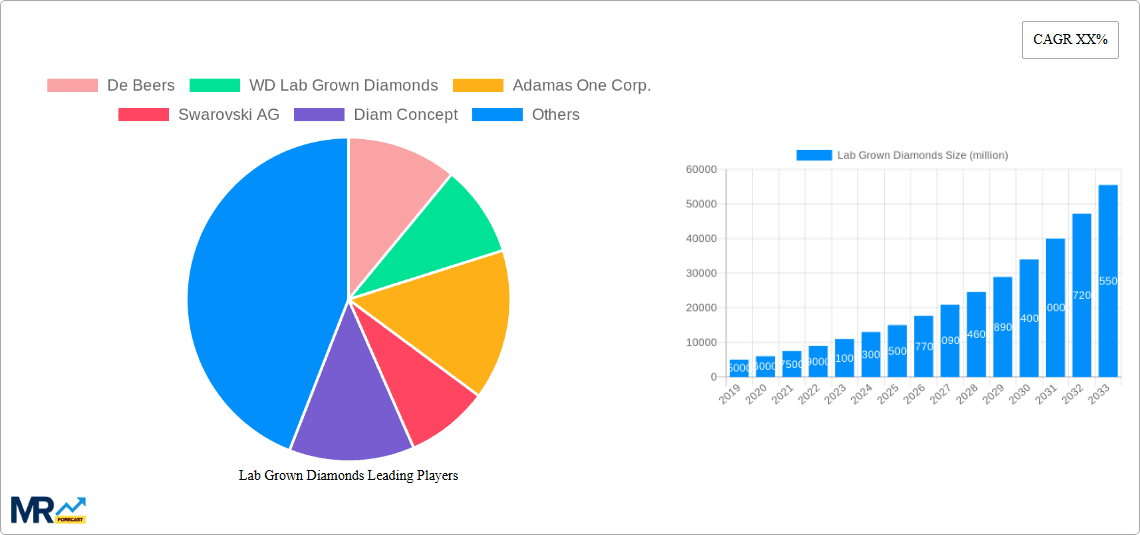

Key companies in the market include De Beers, WD Lab Grown Diamonds, Adamas One Corp., Swarovski AG, Diam Concept, ABD Diamonds, Clean Origin, Diamond Foundry, Mittal Diamonds, New Diamond Technology, Pure Lab Diamond, Henan Province Liliang Diamond Co., Ltd., Zhongnan Diamond Co. Ltd., Henan Huanghe Whirlwind, Sino-Crystal, Crysdiam, Shanghai Zhengshi Technology Co. Ltd..

The market segments include Application, Type.

The market size is estimated to be USD 28.27 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Lab Grown Diamonds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lab Grown Diamonds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.