1. What is the projected Compound Annual Growth Rate (CAGR) of the Kids Clothes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Kids Clothes

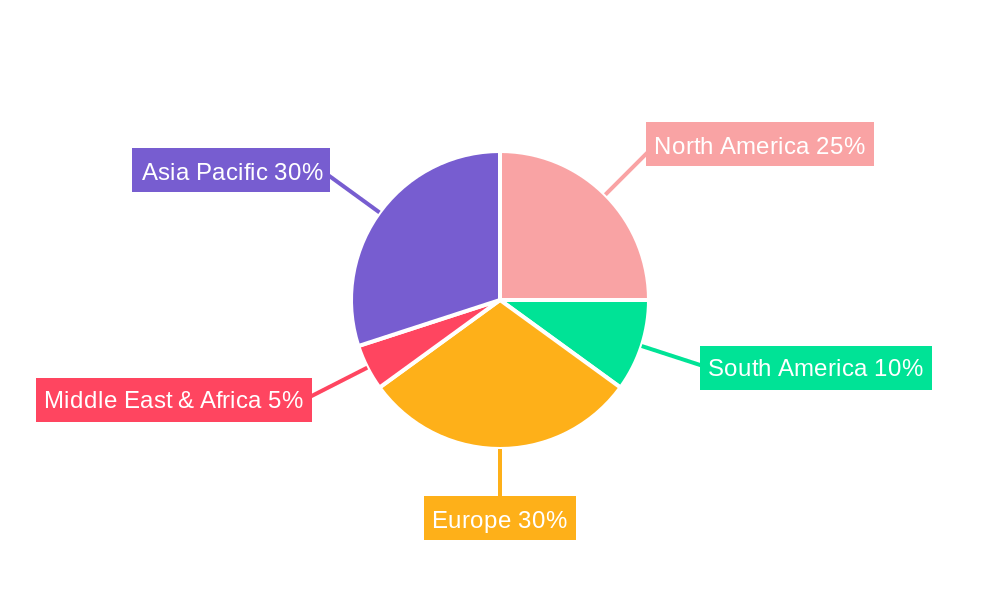

Kids ClothesKids Clothes by Type (Cotton, Wool and Fur, Silk and Linen, Others, World Kids Clothes Production ), by Application (6-14 Years Old, 3-6 Years Old, Under 3 Years Old, World Kids Clothes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

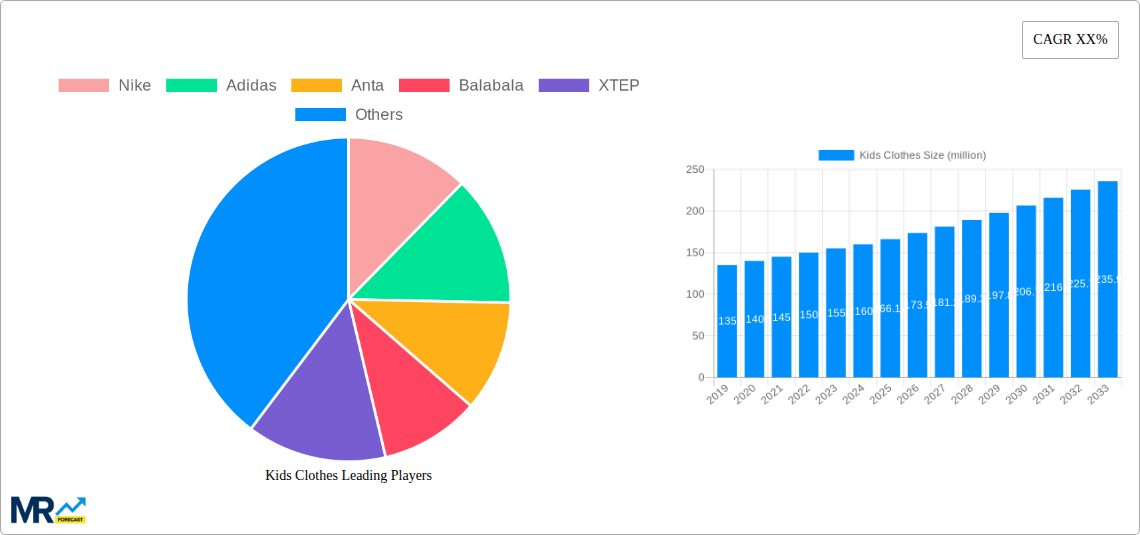

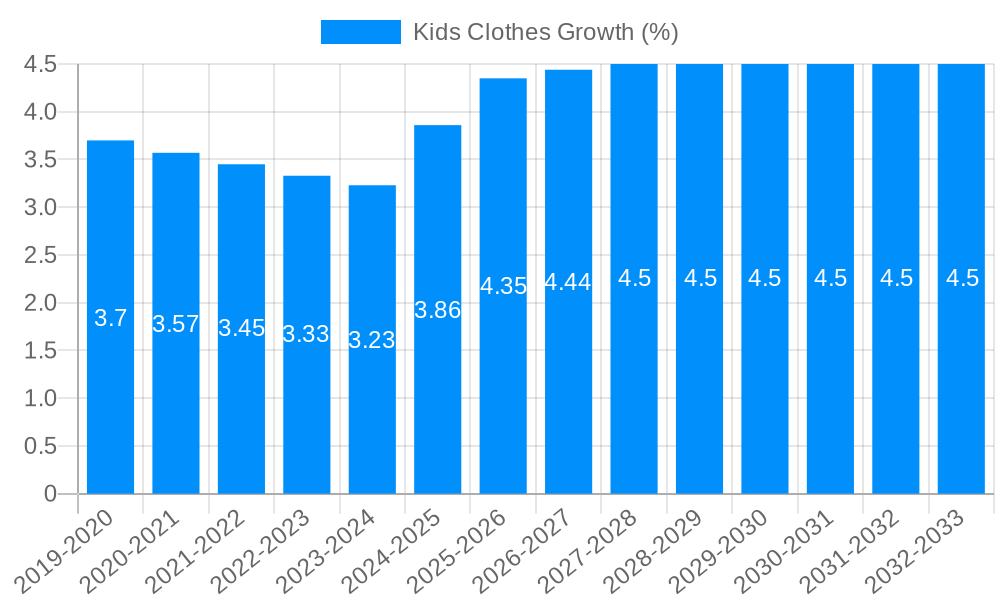

The global kids' clothing market is poised for significant expansion, driven by increasing disposable incomes, a growing awareness of fashion trends among parents, and a rising global birth rate. Projected to reach a substantial market size of USD 166.170 million, this sector is characterized by a healthy Compound Annual Growth Rate (CAGR) that underscores its robust upward trajectory. The market is segmented by material types, including cotton, wool and fur, silk and linen, and others, with cotton remaining a dominant force due to its comfort and affordability. Applications span across various age groups, from under 3 years old to 6-14 years old, reflecting the diverse needs of a growing child population. The "World Kids Clothes Production" itself is a key indicator of the scale and importance of this industry, with significant production concentrated in Asia Pacific, particularly China and India, and robust consumption in North America and Europe.

Several key trends are shaping the kids' clothing landscape. The rise of online retail channels has democratized access to a wider variety of brands and styles, while also fostering the growth of direct-to-consumer (DTC) brands. Sustainability is becoming a paramount concern for modern parents, leading to an increased demand for eco-friendly materials and ethical production practices. Athleisure wear for children, mirroring adult fashion, is also gaining traction, emphasizing comfort and versatility. Despite these promising growth drivers, the market faces certain restraints, including volatile raw material prices and intense competition from both established global players like Nike, Adidas, and Carter's, as well as emerging local brands. Geopolitical uncertainties and supply chain disruptions can also pose challenges, necessitating agile strategies from manufacturers and retailers. The dynamic interplay of these factors will continue to define the evolution of the global kids' clothing market in the coming years.

This report provides an in-depth analysis of the global kids' clothing market, offering crucial insights for stakeholders and decision-makers. The study encompasses a comprehensive historical review of the market from 2019 to 2024, a detailed base year analysis for 2025, and a robust forecast for the period of 2025 to 2033. Leveraging extensive primary and secondary research, this report quanties market size, identifies key trends, and forecasts future growth trajectories. The projected market size is estimated to reach $XXX million by 2033, reflecting a significant expansion driven by evolving consumer preferences and industry dynamics.

The global kids' clothing market is experiencing a dynamic shift, characterized by a growing emphasis on comfort, sustainability, and personalization. In the historical period (2019-2024), we observed a steady rise in demand for athleisure-inspired wear for children, with brands like Nike and Adidas leading the charge in offering stylish yet comfortable apparel that caters to active lifestyles. This trend continues to be a significant market influencer, as parents increasingly prioritize clothing that allows for freedom of movement and durability. Furthermore, the burgeoning awareness surrounding environmental issues has propelled the demand for sustainable and eco-friendly children's clothing. Brands such as Inditex (Zara Kids) and H&M have been actively investing in organic cotton and recycled materials, responding to consumer calls for responsible fashion. This commitment to sustainability is no longer a niche market but a mainstream expectation, influencing purchasing decisions across all age segments. The "fast fashion" model, while still prevalent, is facing scrutiny, with a growing segment of consumers opting for higher-quality, longer-lasting garments. The forecast period (2025-2033) anticipates a further acceleration of these trends. Personalization and customization are expected to gain significant traction, with advancements in technology enabling brands to offer bespoke clothing options, from custom prints to tailored fits. This aligns with a broader consumer desire for uniqueness and self-expression, even for younger demographics. The influence of social media continues to shape children's fashion, with influencers and viral trends dictating popular styles and brand preferences. Brands that can effectively engage with this digital landscape are poised for greater success. Moreover, the market is witnessing a growing convergence of style and functionality. Parents are seeking clothing that is not only aesthetically pleasing but also practical, incorporating features like easy-to-use closures, stain resistance, and temperature regulation. This holistic approach to children's apparel is a key driver of innovation and market growth. The rise of rental and resale platforms for children's clothing also signifies a shift towards a more circular economy, further impacting traditional retail models and fostering a more conscious consumption pattern.

The global kids' clothing market is being propelled by a confluence of powerful driving forces that are reshaping consumer behavior and industry strategies. A primary catalyst is the increasing disposable income of households in emerging economies. As economies grow, families have more discretionary spending power, a portion of which is allocated to purchasing higher-quality and more fashionable apparel for their children. This demographic shift is particularly evident in regions where the birth rates remain robust, creating a consistent demand for new clothing as children grow. Furthermore, the evolving role of children in family purchasing decisions cannot be understated. Today's children are increasingly exposed to trends through digital media and peer influence, and they often have a say in the clothes they wear. This empowers younger consumers and compels brands to cater to their specific preferences, driving innovation in design and marketing. The penetration of e-commerce and mobile shopping platforms has also been a significant propellant. Online retailers offer unparalleled convenience, a wider selection of brands and styles, and competitive pricing, making it easier for parents to shop for their children's clothing regardless of their location. This digital accessibility has democratized access to a global marketplace of children's fashion. The growing emphasis on branding and the aspirational value attached to certain labels are also contributing factors. Parents often associate specific brands with quality, durability, and social status, leading them to invest in premium children's wear. This brand loyalty, cultivated through effective marketing and product consistency, fuels consistent demand.

Despite the promising growth trajectory, the global kids' clothing market faces several significant challenges and restraints that could impede its full potential. One of the most pervasive challenges is the intense competition within the market. With numerous established global brands like Nike, Adidas, Anta, Balabala, and fast-fashion giants like Inditex and H&M, alongside a plethora of smaller, independent labels, the market is saturated. This fierce competition often leads to price wars, squeezing profit margins for manufacturers and retailers alike. Fluctuating raw material costs also pose a significant restraint. The prices of cotton, a primary component in many children's garments, can be volatile due to factors such as weather conditions, agricultural policies, and global supply chain disruptions. Similarly, the costs associated with synthetic materials can also fluctuate, impacting production expenses. Economic downturns and inflation can significantly affect consumer spending on non-essential items like children's clothing. During periods of economic uncertainty, parents may prioritize essential needs over discretionary purchases, leading to a slowdown in demand. The ethical sourcing and manufacturing of children's clothing is another area of growing concern and potential restraint. Consumers are increasingly demanding transparency in supply chains and are wary of brands associated with exploitative labor practices or unsustainable production methods. Failure to meet these ethical standards can result in significant reputational damage and loss of consumer trust. Regulatory changes related to product safety, labeling, and environmental impact can also introduce compliance costs and operational complexities for businesses. Lastly, the fast-paced nature of children's fashion, with trends evolving rapidly, requires brands to constantly innovate and adapt, which can be a costly and resource-intensive endeavor.

The global kids' clothing market is poised for significant growth, with certain regions and segments exhibiting a stronger potential for dominance. From a geographical perspective, Asia-Pacific is anticipated to emerge as a leading region, driven by its massive population, rising disposable incomes, and a growing middle class with a strong propensity to spend on children's apparel. Countries like China, India, and Southeast Asian nations are experiencing burgeoning birth rates and an increasing demand for quality and branded children's clothing. E-commerce penetration in this region is also rapidly expanding, making it easier for consumers to access a wide array of brands and products. Furthermore, the presence of prominent local players like Anta and Balabala, who understand the nuances of the regional market, further solidifies Asia-Pacific's dominant position.

Among the segments, the Cotton segment is expected to continue its reign as a dominant force within the global kids' clothing market. Cotton's inherent properties – its breathability, softness, hypoallergenic nature, and durability – make it the preferred material for children's clothing, especially for infants and toddlers (Under 3 Years Old application segment). The affordability and widespread availability of cotton also contribute to its consistent demand. Parents prioritize comfort and safety for their young children, and cotton consistently meets these expectations. The forecast period (2025-2033) is likely to see an increased emphasis on organic and sustainable cotton, driven by growing environmental awareness among consumers. This will further bolster the dominance of the cotton segment.

Another segment poised for significant growth and potential dominance, particularly in terms of value, is the 6-14 Years Old application segment. This age group is characterized by an increased awareness of fashion trends, a greater influence from peer groups and media, and a desire for more sophisticated and branded apparel. As children in this age bracket grow, they often outgrow their clothing more frequently, leading to continuous purchasing cycles. Brands that effectively cater to the style preferences and performance needs of this demographic, often through athleisure wear and trendy casual clothing, are likely to capture a substantial market share. The influence of social media and celebrity endorsements plays a crucial role in shaping the purchasing decisions for this age group, making it a highly lucrative segment for fashion-forward brands.

The World Kids Clothes Production aspect itself, as a segment, represents the overarching manufacturing and supply chain ecosystem. Regions with strong manufacturing capabilities, favorable labor costs, and efficient logistics networks will play a pivotal role in fulfilling the global demand for kids' clothing. Countries that can effectively manage the production of diverse materials and adhere to international quality and safety standards will be key contributors to market dominance. The report will delve into how advancements in manufacturing technologies and supply chain optimization within this segment will influence the overall market dynamics and the competitive landscape.

The kids' clothes industry is experiencing several growth catalysts that are fueling its expansion. The increasing urbanization and rise of the global middle class are significant drivers, leading to higher disposable incomes and a greater demand for branded and quality children's apparel. Furthermore, the growing influence of digital media and social media platforms is shaping fashion trends and consumer preferences, compelling brands to innovate and stay ahead of the curve. The rising awareness among parents about the importance of sustainable and eco-friendly fashion is also creating new market opportunities for brands committed to ethical production.

The global kids' clothing market is highly competitive, with a diverse range of players vying for market share. The leading companies in this sector include:

The kids' clothes sector has witnessed several key developments over the study period, shaping market dynamics and consumer behavior:

This comprehensive report offers an exhaustive analysis of the global kids' clothing market, providing invaluable insights into market size, segmentation, trends, and future projections. The report delves into the intricate details of market dynamics, examining the interplay of various drivers and restraints that shape the industry landscape. It offers a granular breakdown of market segments, including product types like Cotton, Wool and Fur, Silk and Linen, and Others, as well as application segments such as Under 3 Years Old, 3-6 Years Old, and 6-14 Years Old. The report also analyzes the global kids' clothes production landscape and industry developments. With a detailed forecast from 2025 to 2033, based on a thorough study period from 2019 to 2033 and a base year of 2025, this report equips stakeholders with the knowledge to navigate this evolving market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nike, Adidas, Anta, Balabala, XTEP, Carter's, GAP, Inditex, H&M, Gymboree, V.F. Corporation, Fast Retailing, C&A, NEXT, ID Group, MOtherscare, Orchestra, BESTSELLER, Under Armour, Benetton, MIKI HOUSE, .

The market segments include Type, Application.

The market size is estimated to be USD 166170 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Kids Clothes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Kids Clothes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.