1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Software Outsourcing Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IT Software Outsourcing Service

IT Software Outsourcing ServiceIT Software Outsourcing Service by Type (Application Development Outsourcing, Testing And Quality Assurance (QA) Outsourcing, Software Maintenance And Support, Others), by Application (Finance, Health Care, Retail And E-Commerce, Aerospace And Defense, Telecommunications And Media, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

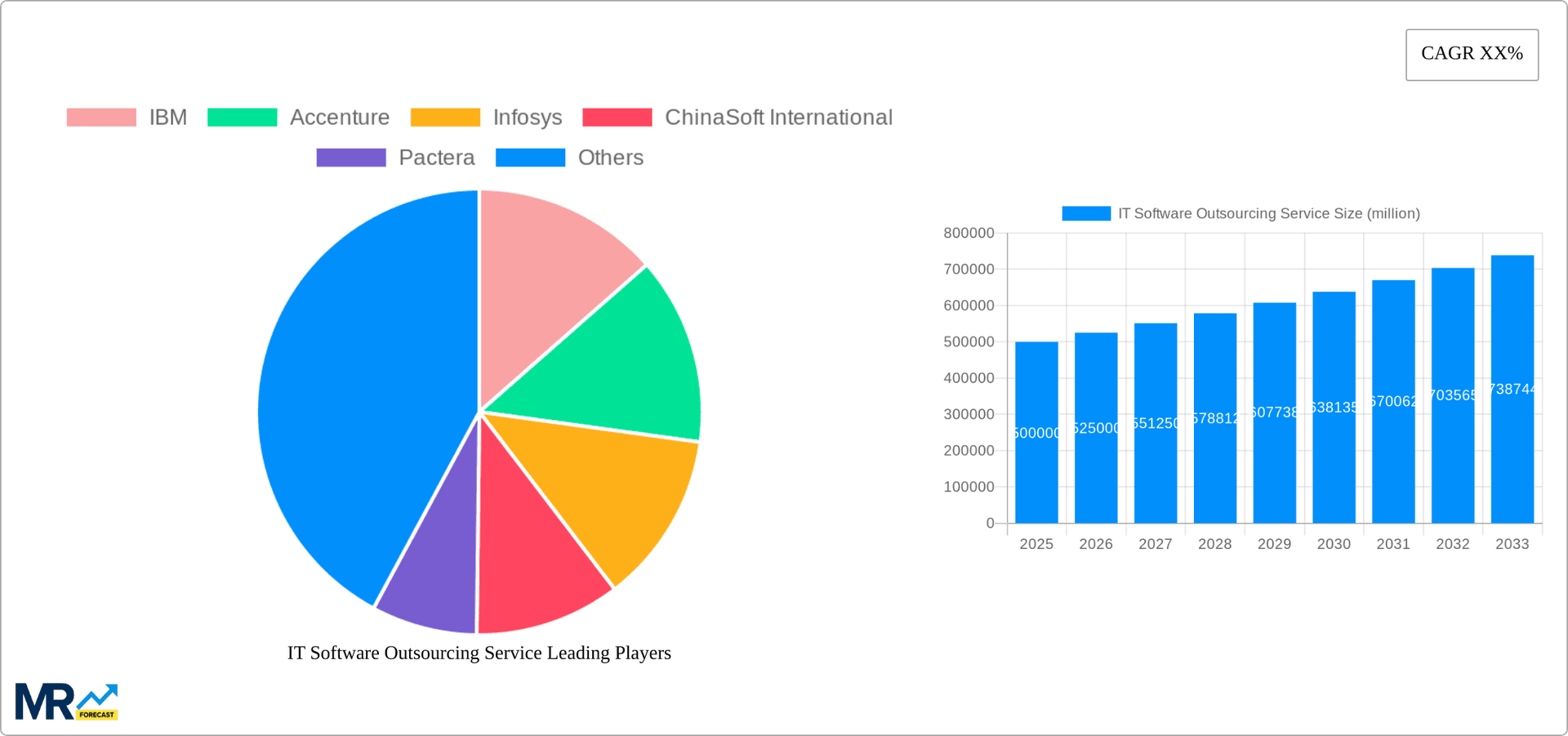

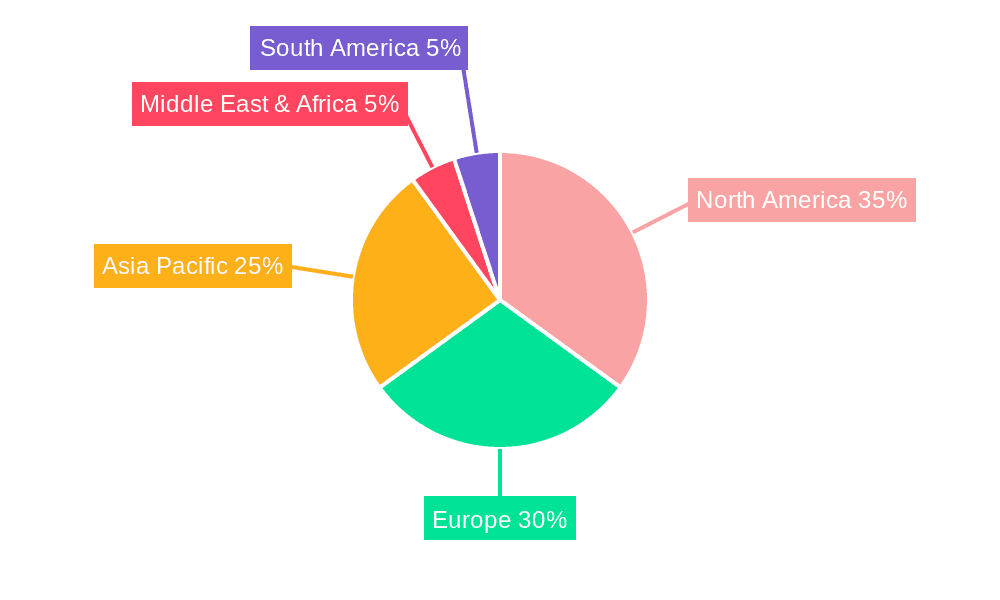

The global IT software outsourcing services market is experiencing robust growth, driven by the increasing adoption of cloud computing, digital transformation initiatives across various industries, and the rising demand for cost-effective and efficient software solutions. The market, segmented by service type (Application Development Outsourcing, Testing & QA Outsourcing, Software Maintenance & Support, and Others) and application (Finance, Healthcare, Retail & E-commerce, Aerospace & Defense, Telecommunications & Media, and Others), exhibits a diverse landscape with significant opportunities across regions. North America and Europe currently hold a substantial market share, fueled by established technological infrastructure and a high concentration of multinational corporations. However, the Asia-Pacific region, particularly India and China, is witnessing rapid growth due to a large pool of skilled IT professionals and competitive pricing. This dynamic shift is reshaping the competitive landscape, with established players like IBM, Accenture, and Infosys facing competition from emerging regional players. The ongoing trend towards agile methodologies, DevOps practices, and the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) are further shaping market evolution. Challenges include managing cybersecurity risks, ensuring data privacy, and navigating geopolitical uncertainties. Overall, the market's trajectory indicates sustained growth throughout the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) influenced by technological advancements and the continuous need for businesses to optimize their IT infrastructure and software development lifecycles.

The market's expansion is further influenced by several factors. Businesses are increasingly outsourcing to access specialized skills and reduce operational costs, especially in areas like AI and big data analytics. The growing adoption of cloud-based solutions necessitates ongoing maintenance and support, bolstering the demand for related outsourcing services. While regulatory changes and talent acquisition remain challenges, the market's resilience stems from the inherent need for efficient and scalable software solutions across diverse industries. The competitive landscape is characterized by both global giants and niche players catering to specific industry verticals or geographic regions. The continued emphasis on digital transformation initiatives, coupled with the rising complexity of software applications, will ensure the IT software outsourcing market remains a dynamic and profitable sector for years to come. Strategic partnerships, mergers, and acquisitions are anticipated to further consolidate the market, leading to more robust service offerings and potentially impacting pricing dynamics.

The global IT software outsourcing service market exhibited robust growth during the historical period (2019-2024), exceeding $XXX million in 2024. This expansion is projected to continue throughout the forecast period (2025-2033), reaching an estimated value of $XXX million by 2033. Several factors contribute to this upward trajectory. The increasing complexity of software development, coupled with the rising demand for specialized skills, pushes businesses to leverage external expertise. Cost optimization remains a significant driver, as outsourcing allows companies to access skilled professionals at potentially lower costs than maintaining in-house teams. Furthermore, the globalized nature of the IT industry facilitates seamless collaboration across geographical boundaries, enabling access to a wider talent pool. The market is witnessing a shift toward cloud-based solutions and agile methodologies, further fueling the adoption of outsourcing services. Businesses are increasingly outsourcing not only application development but also critical functions like testing and quality assurance, software maintenance, and data analytics. The competitive landscape is characterized by both established multinational corporations like IBM and Accenture and agile, specialized players, leading to ongoing innovation and service diversification. The market also sees regional variations, with certain regions demonstrating faster growth due to factors like infrastructure development, government initiatives promoting digitalization, and a burgeoning pool of IT professionals. Competition is intensifying with companies constantly striving for differentiation through specialization, technological advancements, and enhanced client services.

Several key factors are driving the exponential growth of the IT software outsourcing service market. Firstly, the escalating cost of hiring and retaining skilled software developers internally compels businesses to explore more cost-effective solutions. Outsourcing provides access to a global talent pool at competitive rates, enabling companies to manage operational expenses effectively. Secondly, the increasing demand for specialized skills and technologies pushes companies to leverage the expertise of specialized outsourcing firms. These firms possess in-depth knowledge and experience in specific domains and technologies, which might be difficult or expensive to cultivate in-house. Thirdly, the rapid advancements in technology necessitate constant adaptation, which can be facilitated efficiently through outsourcing partnerships. Outsourcing vendors are often at the forefront of technological innovation, enabling clients to quickly integrate cutting-edge technologies into their systems. Fourthly, the focus on agility and speed in software development is propelling the demand for outsourcing. Outsourcing firms often employ agile methodologies, delivering projects faster and more efficiently than traditional in-house teams. Finally, the growing need for 24/7 support and maintenance of software applications adds to the outsourcing market's appeal. Companies can benefit from around-the-clock service, ensuring business continuity and minimizing disruptions.

Despite the significant growth opportunities, several challenges and restraints impede the growth of the IT software outsourcing services market. Data security and intellectual property protection remain paramount concerns. Outsourcing sensitive data and code to third-party vendors necessitates robust security protocols and contracts to mitigate the risk of breaches or unauthorized access. Maintaining consistent quality and communication across geographical boundaries can also be challenging. Time zone differences, language barriers, and cultural disparities can affect project timelines and the overall success of outsourcing ventures. The potential for hidden costs and unexpected delays poses a risk. Contracts must be meticulously crafted to clearly define deliverables, timelines, and payment terms, to avoid conflicts and financial surprises. Managing vendor relationships effectively requires careful selection, monitoring, and continuous communication. Selecting unreliable vendors can result in project delays, quality issues, and significant financial losses. Finally, the regulatory landscape varies across different jurisdictions, creating complexities for businesses engaging in international outsourcing. Compliance with various data protection laws and regulations adds another layer of complexity to the outsourcing process.

The Asia-Pacific region is projected to dominate the IT software outsourcing service market during the forecast period (2025-2033). This is driven by several factors including a large and growing pool of skilled IT professionals, a favorable cost structure, and supportive government policies. India, in particular, is a key player, known for its large and robust IT outsourcing sector.

High Growth in Application Development Outsourcing: This segment is expected to maintain its leading position due to the continuous demand for new software applications across various industries. Businesses increasingly rely on outsourcing partners to develop custom applications tailored to their specific needs and requirements. The complexity and cost of in-house development often drive companies toward outsourcing solutions. Furthermore, the growing adoption of cloud computing and mobile technologies enhances the demand for application development outsourcing services.

North America's Influence in Testing and Quality Assurance (QA) Outsourcing: While the Asia-Pacific region dominates overall volume, North America remains a significant market for QA outsourcing, reflecting a focus on ensuring high quality software for critical applications across multiple industries, particularly finance and healthcare. Companies in this region are willing to pay a premium for advanced testing techniques and expert QA professionals.

India's Dominance in Software Maintenance and Support: The combination of a vast pool of skilled personnel and competitive pricing makes India a preferred destination for software maintenance and support activities.

These segments' growth is further fueled by the increasing adoption of cloud-based solutions, the growing demand for DevOps practices, and the rising complexity of software applications. The continuous need for updates, bug fixes, and ongoing support for existing software applications ensures a sustained demand for software maintenance and support outsourcing.

Several factors are accelerating the growth of the IT software outsourcing service industry. The increasing adoption of cloud-based technologies enables seamless integration and collaboration between businesses and their outsourcing partners. The rising demand for digital transformation initiatives pushes companies to leverage the expertise of specialized outsourcing firms. Automation and AI are improving efficiency and reducing costs, making outsourcing even more attractive. Finally, the growing focus on agility and speed in software development further reinforces the benefits of outsourcing, allowing companies to quickly respond to evolving market needs.

This report offers a comprehensive analysis of the IT software outsourcing service market, providing detailed insights into market trends, driving forces, challenges, and growth opportunities. It offers a granular segmentation of the market by type of service, application area, and geographical region. The report also profiles leading players in the industry, providing an in-depth evaluation of their strategies, market share, and competitive positioning. This allows for a thorough understanding of the current landscape and future prospects for the IT software outsourcing service market, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IBM, Accenture, Infosys, ChinaSoft International, Pactera, Capgemini, Tatvasoft, Neusoft Group, IsoftStong, Northking, Fujitsu, Cognizant, Saigon Technology, Wipro, Arcanys, Inoxoft, eZest, HopeRun Software, Beyondsoft Corporation, Sinosoft, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IT Software Outsourcing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IT Software Outsourcing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.