1. What is the projected Compound Annual Growth Rate (CAGR) of the Isomaltulose?

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Isomaltulose

IsomaltuloseIsomaltulose by Type (Food Grade, Pharmaceutical Grade, World Isomaltulose Production ), by Application (Candy, Drinks, Baked Goods, Drugs, Others, World Isomaltulose Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

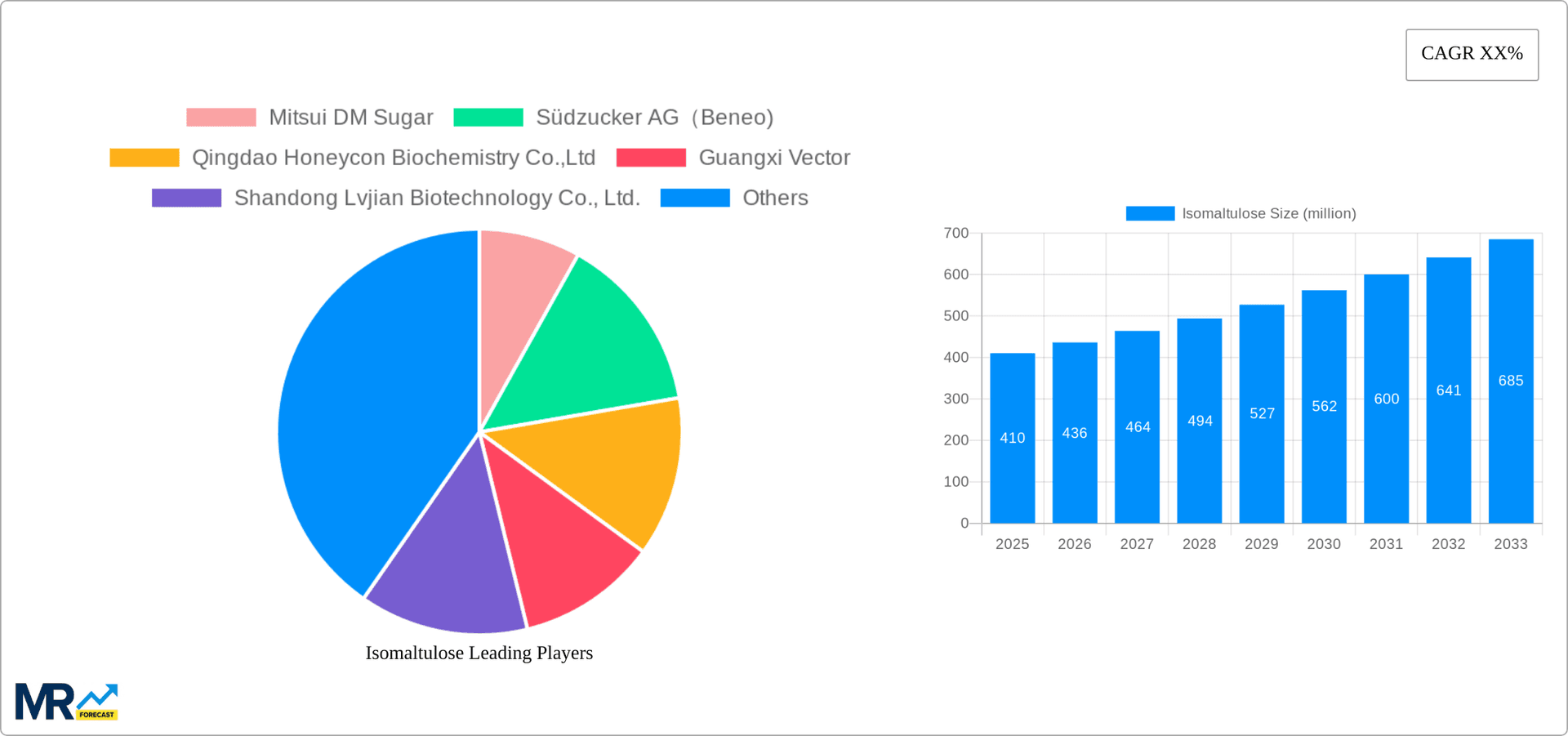

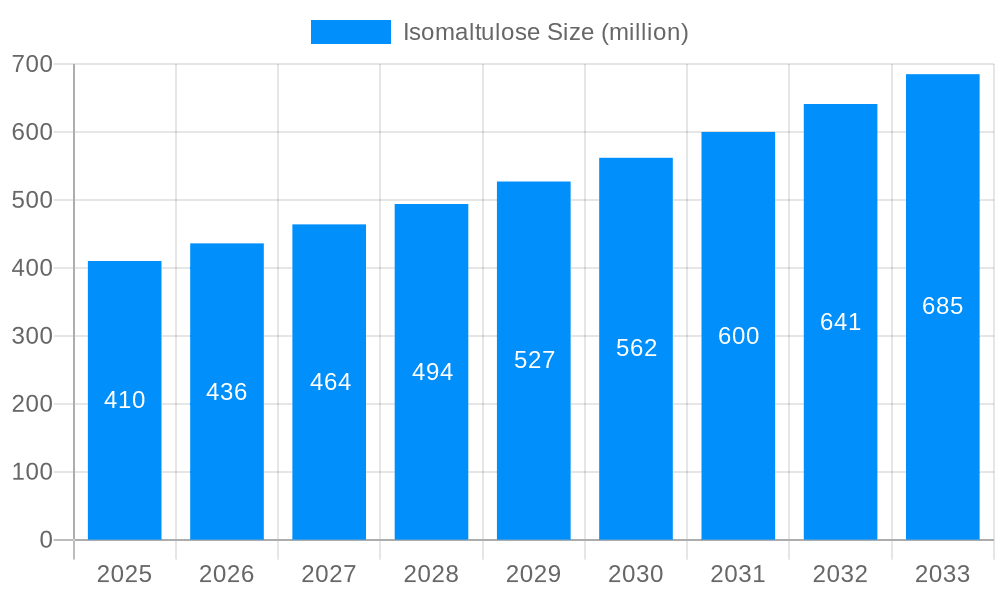

The global isomaltulose market, valued at $957.99 million in 2025 (base year), is projected for substantial expansion. Fueled by escalating demand for low-calorie sweeteners in food and beverages, alongside burgeoning pharmaceutical applications, the market is anticipated to achieve a CAGR of 6.1%. The food-grade segment leads, driven by isomaltulose's low glycemic index and appealing taste in confectionery, baked goods, and beverages. Pharmaceutical-grade isomaltulose is also set for robust growth due to its utility in drug formulations. Key market contributors include Mitsui DM Sugar, Südzucker AG (Beneo), and prominent Chinese manufacturers. Geographic expansion, particularly in Asia Pacific driven by emerging economies like China and India, is a significant growth factor. Potential challenges include isomaltulose's higher cost relative to other sweeteners and specific market regulatory landscapes. Future growth will be shaped by advancements in production technology, aiming for cost reduction and wider accessibility.

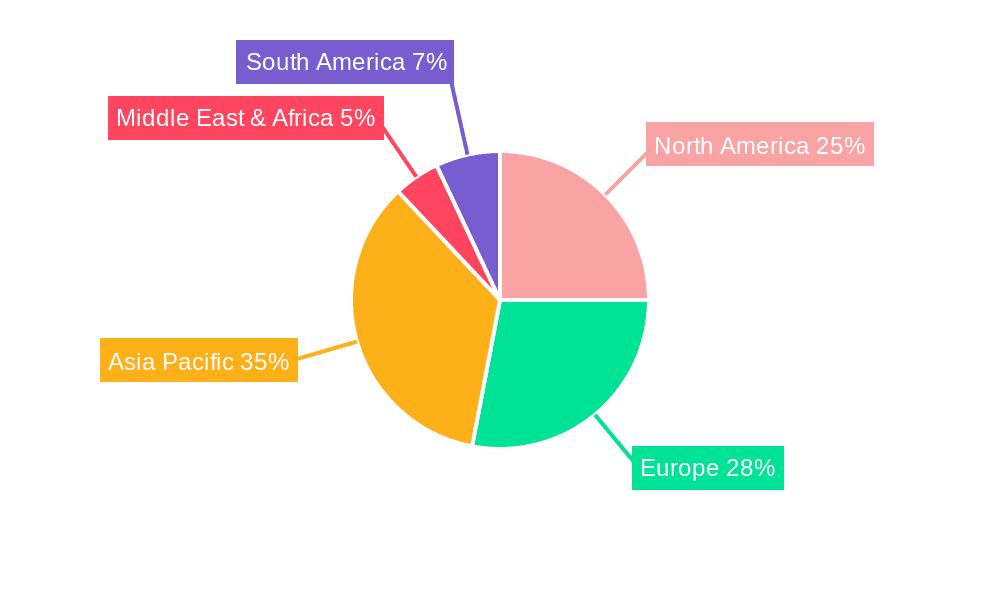

While North America and Europe currently hold significant market shares, the Asia-Pacific region is forecast to experience the most rapid growth during the forecast period (2025-2033). This surge is attributed to rising disposable incomes and evolving consumer preferences in developing nations. Ongoing research into isomaltulose's health benefits is further expanding its potential in functional foods and nutraceuticals. The competitive landscape is expected to remain dynamic, with established players prioritizing R&D for product enhancement and market penetration. Strategic collaborations, mergers, and acquisitions will likely influence market dynamics throughout the forecast period.

The global isomaltulose market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. This upward trajectory is fueled by increasing consumer demand for healthier, low-glycemic index (GI) sweeteners in food and beverages. The historical period (2019-2024) witnessed steady expansion, laying a strong foundation for the estimated market size in 2025. The forecast period (2025-2033) anticipates even more significant growth, driven by several factors detailed in subsequent sections. Key market insights reveal a shift towards functional foods and beverages, with isomaltulose playing a crucial role in catering to this trend. Its slow digestion and low GI profile make it particularly attractive to health-conscious consumers, impacting the food and pharmaceutical segments significantly. Moreover, the rising prevalence of diabetes and related metabolic disorders worldwide further boosts market demand for isomaltulose as a healthier alternative to sucrose and other high-GI sweeteners. This increasing consumer preference for natural and healthier options presents a significant opportunity for manufacturers and suppliers of isomaltulose. The market is not without its challenges, however, as competition and price fluctuations influence market dynamics. Further, the need for regulatory approvals and stringent quality control measures adds to the complexities of this growing industry. The competitive landscape is dynamic, with key players continuously innovating to improve their offerings and expand their market share. The geographical distribution of market share is another crucial aspect, with regions exhibiting high consumption of processed foods and beverages driving increased demand. Ultimately, the market's future hinges on maintaining this momentum by continuous innovation and focusing on consumer preferences.

Several factors contribute to the remarkable growth of the isomaltulose market. The rising prevalence of diabetes and metabolic syndrome globally is a primary driver, pushing consumers towards low-GI sweeteners. Isomaltulose, with its significantly lower GI compared to sucrose, presents a compelling alternative. Furthermore, the increasing awareness of the detrimental effects of high-sugar consumption on overall health fuels the demand for healthier substitutes. The burgeoning functional food and beverage industry actively incorporates isomaltulose for its beneficial properties, further boosting market growth. The expansion of the global food and beverage industry itself creates a larger market for sweeteners like isomaltulose. In addition, the increasing demand for convenient and ready-to-eat products, often containing added sugars, provides opportunities for healthier alternatives like isomaltulose to be incorporated. Growing technological advancements in the production and processing of isomaltulose have resulted in cost efficiencies and improved product quality, making it a more competitive option. Finally, favorable government regulations and policies promoting healthier food choices can indirectly contribute to the growth of the isomaltulose market by encouraging the usage of low-GI sweeteners.

Despite the promising growth trajectory, the isomaltulose market faces several challenges. High production costs compared to traditional sweeteners like sucrose pose a significant barrier, potentially limiting widespread adoption. The relatively high price of isomaltulose can make it less competitive in price-sensitive markets, hindering its penetration among certain consumer segments. Stringent regulatory requirements and approval processes for food and pharmaceutical applications introduce complexities and increase time-to-market. Competition from other low-GI sweeteners and alternative sugar substitutes presents a continuous challenge, requiring constant innovation and differentiation to maintain a competitive edge. The fluctuating prices of raw materials used in isomaltulose production can directly impact profitability and market stability. Furthermore, consumer perception and awareness of isomaltulose, while improving, still lags behind some more established sweeteners, requiring further educational efforts to raise awareness. Finally, potential supply chain disruptions and logistical challenges could impact the availability and affordability of isomaltulose in various regions.

The food grade segment is projected to dominate the isomaltulose market throughout the forecast period (2025-2033), driven by its growing use in various food applications. Within this segment, the applications in candy, baked goods, and drinks are particularly prominent.

Food Grade Segment Dominance: The food grade segment's dominance is a result of growing consumer awareness of healthier food choices and the rising prevalence of chronic diseases. Isomaltulose’s low glycemic index and functional properties make it an attractive sweetener for confectionery, bakery products, and beverages targeting health-conscious consumers. The segment’s growth is further fuelled by the increasing demand for sugar-reduced and low-GI food options.

Geographical Distribution: While precise market share breakdowns require detailed proprietary data, developed economies in North America, Europe, and Asia-Pacific are anticipated to demonstrate higher consumption rates of isomaltulose-containing food products, due to increased disposable income and rising health consciousness. These regions are expected to drive significant market growth.

Candy Application: The candy segment is expected to show substantial growth due to the rising demand for reduced-sugar confectionery products. Manufacturers are actively replacing conventional sugars with healthier alternatives like isomaltulose, broadening their appeal to a health-conscious consumer base.

Drinks Application: The drinks sector demonstrates significant potential due to the increasing demand for sugar-free or low-sugar beverages. The incorporation of isomaltulose in soft drinks, functional drinks, and juices contributes to their improved nutritional profiles without compromising on taste.

Baked Goods Application: The baked goods industry increasingly utilizes isomaltulose as a sweetener to reduce the overall sugar content while maintaining palatability and texture. The segment is projected to experience consistent growth alongside the increasing popularity of healthier bread, cakes, and pastries.

The pharmaceutical grade segment, though currently smaller, is showing promise due to ongoing research into the therapeutic applications of isomaltulose. However, the Food Grade segment currently holds a significantly larger market share and is projected to remain the leading segment during the forecast period. The overall growth trajectory indicates that a substantial increase in production will be required to meet the growing global demand.

Several factors act as powerful catalysts for growth within the isomaltulose industry. Rising consumer demand for healthier, functional foods and beverages directly drives market expansion. Technological advancements in isomaltulose production continuously improve cost-effectiveness and product quality, making it more competitive. Favorable government regulations promoting healthier dietary habits can also stimulate market growth. Finally, the ongoing research into the potential health benefits of isomaltulose continues to open up new application areas and expands market potential across diverse industries.

The isomaltulose market presents a robust investment opportunity, driven by various factors ranging from the global health consciousness to technological advancements in production. The market is poised for significant expansion across diverse segments and geographical areas, presenting opportunities for both existing players and new entrants. A comprehensive report offers a detailed analysis of these factors, providing a clear understanding of the market's dynamic landscape and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

Key companies in the market include Mitsui DM Sugar, Südzucker AG(Beneo), Qingdao Honeycon Biochemistry Co.,Ltd, Guangxi Vector, Shandong Lvjian Biotechnology Co., Ltd., Shandong Bailongchuang Biotech Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD 957.99 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Isomaltulose," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Isomaltulose, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.