1. What is the projected Compound Annual Growth Rate (CAGR) of the Isobutyl Quinoline?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Isobutyl Quinoline

Isobutyl QuinolineIsobutyl Quinoline by Application (Perfumes, Aromatherapy, Cosmetic, Others, World Isobutyl Quinoline Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

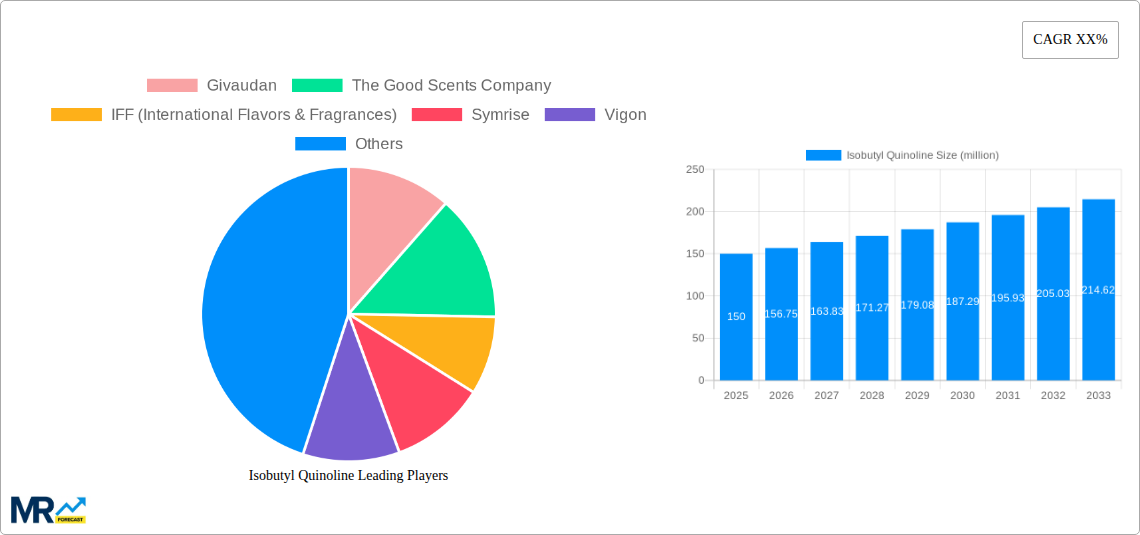

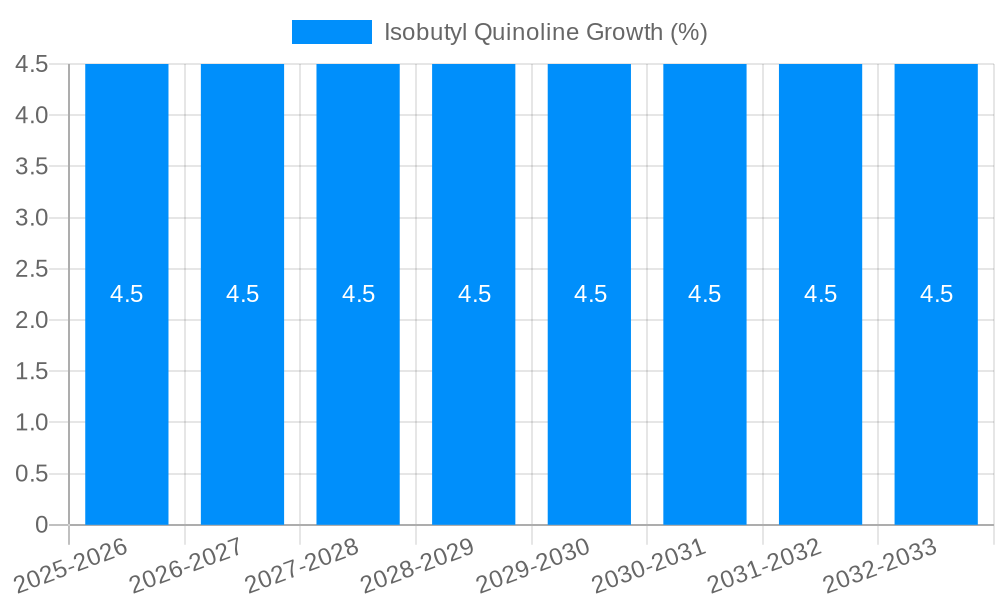

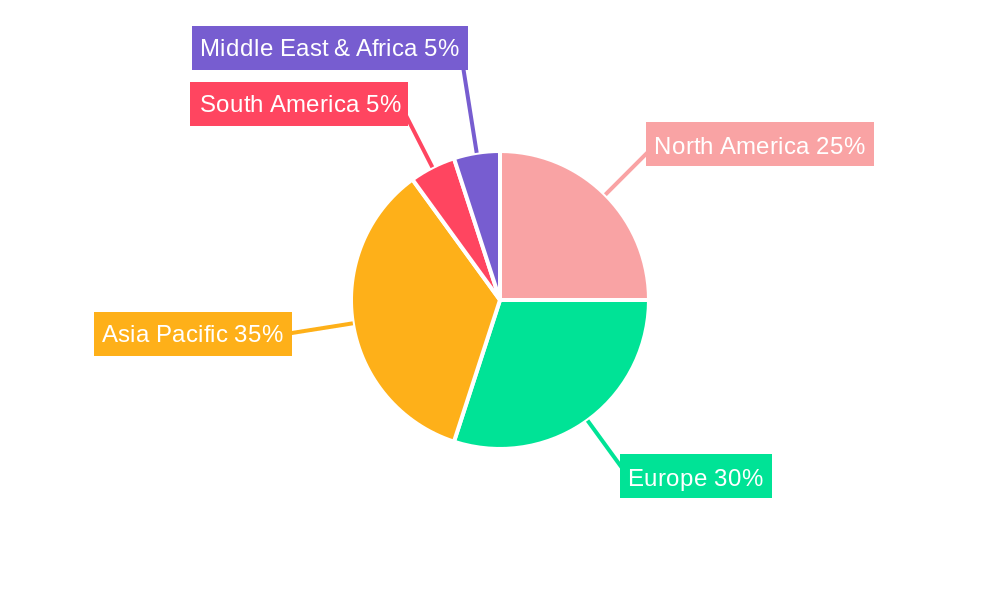

The global Isobutyl Quinoline market is poised for significant expansion, projected to reach approximately USD 150 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 4.5% anticipated through 2033. This robust growth is primarily fueled by the escalating demand for sophisticated fragrance compounds in the burgeoning perfume industry, driven by consumer preferences for unique and long-lasting scents. Furthermore, the increasing adoption of aromatherapy for its therapeutic and wellness benefits is creating substantial opportunities for Isobutyl Quinoline, as its distinctive olfactory profile contributes to calming and uplifting aroma blends. The cosmetic sector also plays a pivotal role, incorporating Isobutyl Quinoline into various personal care products to impart desirable fragrances. Emerging economies, particularly in Asia Pacific, are expected to be key growth engines, owing to rising disposable incomes and a growing middle class with a penchant for premium personal care and fragrance products.

However, the market faces certain restraints that could temper its full potential. Fluctuations in the prices of raw materials, coupled with the complex manufacturing processes involved in Isobutyl Quinoline production, can impact profitability and supply chain stability. Stringent regulatory frameworks concerning chemical safety and environmental impact in various regions may also introduce compliance challenges and necessitate significant investment in research and development for sustainable alternatives. Despite these hurdles, continuous innovation in fragrance formulation and a growing appreciation for niche and artisanal perfumery are expected to sustain a positive market trajectory. The market's future landscape will likely be shaped by the ability of key players to navigate regulatory complexities, optimize production costs, and capitalize on the expanding application spectrum of Isobutyl Quinoline across diverse consumer goods.

Here's a report description for Isobutyl Quinoline, incorporating your specified requirements:

The global Isobutyl Quinoline market is poised for significant expansion, driven by a confluence of evolving consumer preferences and advancements in the fragrance and flavor industries. Throughout the Study Period (2019-2033), and particularly within the Base Year (2025) and Estimated Year (2025), a notable trend has been the increasing demand for sophisticated and nuanced scent profiles in both personal care and household products. Isobutyl Quinoline, with its characteristic woody, leathery, and slightly smoky aroma, offers perfumers a versatile ingredient for creating complex and long-lasting fragrances. This has led to its elevated use in premium perfumes and colognes, where consumers are willing to invest in unique olfactory experiences. Furthermore, the growing awareness and adoption of aromatherapy for its purported therapeutic benefits have opened new avenues for Isobutyl Quinoline. Its grounding and comforting scent makes it a desirable component in diffusers, candles, and massage oils, catering to a market increasingly focused on well-being and stress reduction. The Forecast Period (2025-2033) anticipates this sustained demand, as manufacturers continue to innovate and integrate Isobutyl Quinoline into a wider array of consumer goods.

The market's trajectory is also influenced by a growing appreciation for naturally derived or nature-identical ingredients. While Isobutyl Quinoline is often synthesized, its olfactory characteristics are highly valued for their ability to mimic natural scents. This has spurred research into more sustainable production methods and a deeper understanding of its sensory impact. The Historical Period (2019-2024) has laid the groundwork for this by showcasing initial market growth and the establishment of key players. Industry reports suggest that Isobutyl Quinoline's ability to impart a sense of luxury and naturalness will continue to be a defining characteristic of its market presence. The interplay between perfumery trends, the expanding aromatherapy sector, and ongoing product innovation across various applications will be crucial in shaping the market's future growth, with projections indicating a strong upward trajectory in global production, potentially reaching several million units by the end of the study period. The World Isobutyl Quinoline Production and Industry Developments section will delve deeper into the quantitative aspects of this growth.

Several potent forces are collectively driving the robust growth of the Isobutyl Quinoline market. Foremost among these is the escalating global demand for sophisticated and luxurious fragrances. Consumers, particularly in emerging economies, are increasingly seeking premium personal care and cosmetic products that offer unique and memorable scent experiences. Isobutyl Quinoline, with its distinctively rich, leathery, and woody notes, serves as a vital component for perfumers looking to craft such complex and alluring olfactory profiles. This is further amplified by the burgeoning aromatherapy sector. As wellness and self-care become paramount, the demand for natural and functional ingredients that enhance mood and promote relaxation has surged. Isobutyl Quinoline’s grounding and comforting aroma makes it a favored ingredient in various aromatherapy applications, including essential oil blends, candles, and diffusers. The versatility of Isobutyl Quinoline also plays a significant role. It is not confined to high-end perfumes but finds application in a broader spectrum of products, from household cleaners that aim to provide a pleasant scent experience to functional fragrances designed for specific product benefits. This broad applicability ensures a consistent and expanding market base, underpinning projected production volumes in the millions of units. The continuous innovation by leading chemical and fragrance houses, such as Givaudan and IFF, in developing novel applications and synthesis methods for Isobutyl Quinoline, also acts as a powerful catalyst for market expansion.

Despite the promising growth trajectory, the Isobutyl Quinoline market faces several inherent challenges and potential restraints that warrant careful consideration. One significant factor is the volatile pricing and availability of key raw materials. The synthesis of Isobutyl Quinoline often relies on petrochemical derivatives, whose prices can fluctuate considerably due to geopolitical events, supply chain disruptions, and global economic conditions. Such volatility can impact production costs for manufacturers, potentially leading to increased product prices and affecting market demand, especially in price-sensitive segments. Furthermore, stringent regulatory frameworks governing the use of chemical ingredients in consumer products pose another challenge. While Isobutyl Quinoline is generally considered safe for use within established guidelines, evolving regulations concerning fragrance allergens, potential environmental impacts, and chemical safety standards in different regions can necessitate costly reformulation efforts or restrict its usage in certain applications. The competitive landscape also presents a hurdle. While key players dominate, the presence of alternative aroma chemicals offering similar olfactory profiles can lead to substitutability and price pressure. Consumers' increasing demand for "natural" or "clean" label products can also be a restraint, as Isobutyl Quinoline is typically a synthetic compound, requiring manufacturers to emphasize its safety and sensory benefits to counter this perception. Navigating these complexities is crucial for sustained market growth, with manufacturers needing to balance innovation with compliance and cost-effectiveness.

Dominant Region/Country:

Dominant Segment:

Paragraph Explanation:

North America, spearheaded by the United States, is poised to be a dominant force in the global Isobutyl Quinoline market. This leadership is attributed to a confluence of factors. Firstly, the region boasts a highly developed consumer market with a significant segment that prioritizes luxury and premium personal care products. The demand for unique and sophisticated fragrances is consistently high, making it a fertile ground for ingredients like Isobutyl Quinoline that lend themselves to complex scent profiles. Secondly, the established presence of major global players in the fragrance and flavor industry, including Givaudan, IFF (International Flavors & Fragrances), and Symrise, with their extensive R&D infrastructure and robust distribution channels, ensures a strong foothold for Isobutyl Quinoline in the North American market. These companies are instrumental in driving innovation and creating demand for such ingredients.

The Application: Perfumes segment is expected to lead the market growth trajectory for Isobutyl Quinoline. This is intrinsically linked to the evolving preferences within the fragrance industry. Perfumers globally recognize Isobutyl Quinoline for its ability to impart a distinctive woody, leathery, and subtly animalic character, essential for crafting sophisticated and enduring scents. The trend towards more mature, complex, and niche fragrances, especially within the luxury perfume market, directly translates into increased demand for this ingredient. Consumers are increasingly seeking olfactory experiences that tell a story and offer a sense of individuality, making Isobutyl Quinoline a valuable tool in the perfumer's palette. As the Estimated Year (2025) approaches and moves into the Forecast Period (2025-2033), the demand for high-quality perfumes will continue to drive significant consumption of Isobutyl Quinoline. The World Isobutyl Quinoline Production figures are heavily influenced by the robust demand from this segment, making it the primary economic engine for the Isobutyl Quinoline market.

The Isobutyl Quinoline industry is propelled by several key growth catalysts. The escalating demand for novel and complex fragrances in fine perfumes and personal care products, driven by evolving consumer tastes, is a primary driver. Furthermore, the expanding application of Isobutyl Quinoline in the burgeoning aromatherapy sector, owing to its grounding and comforting olfactory profile, is a significant catalyst. Continuous innovation by leading manufacturers in developing more sustainable and cost-effective synthesis methods also contributes to market expansion.

This comprehensive report provides an in-depth analysis of the global Isobutyl Quinoline market, spanning the Study Period (2019-2033). It offers detailed insights into market dynamics, including trends, driving forces, and challenges, with a particular focus on the Base Year (2025) and Estimated Year (2025). The report meticulously examines the World Isobutyl Quinoline Production landscape and highlights key industry developments. Furthermore, it delves into the market segmentation by application, including Perfumes, Aromatherapy, Cosmetics, and Others, identifying dominant regions and countries. The report also features a robust assessment of leading players and significant sector developments, equipping stakeholders with the strategic intelligence needed to navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Givaudan, The Good Scents Company, IFF (International Flavors & Fragrances), Symrise, Vigon, Ernesto Ventós, BenchChem, BioTek, BOC Sciences, DaYang Chem, HaiRui Chem, .

The market segments include Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Isobutyl Quinoline," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Isobutyl Quinoline, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.