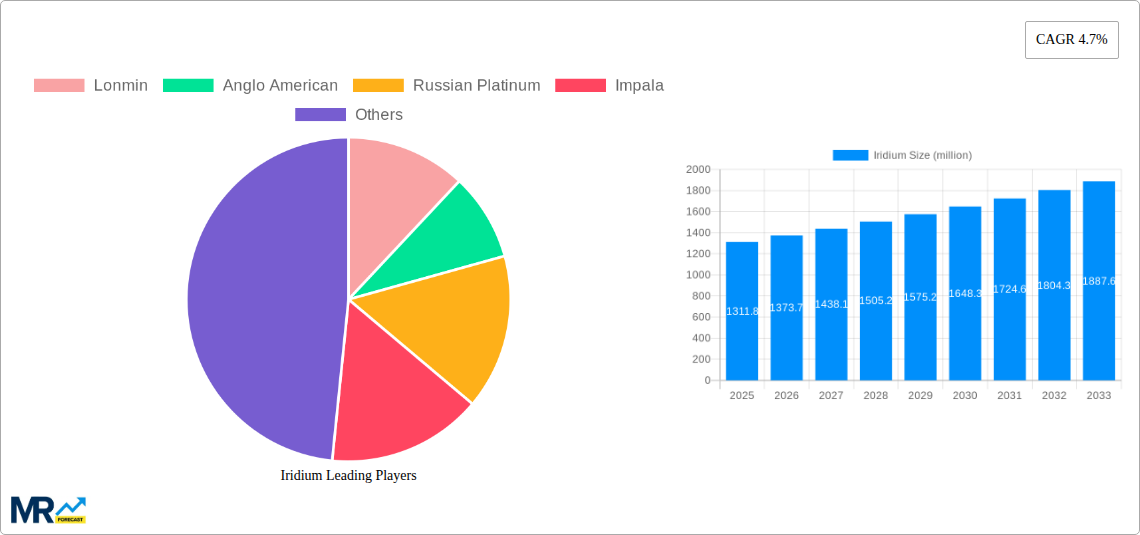

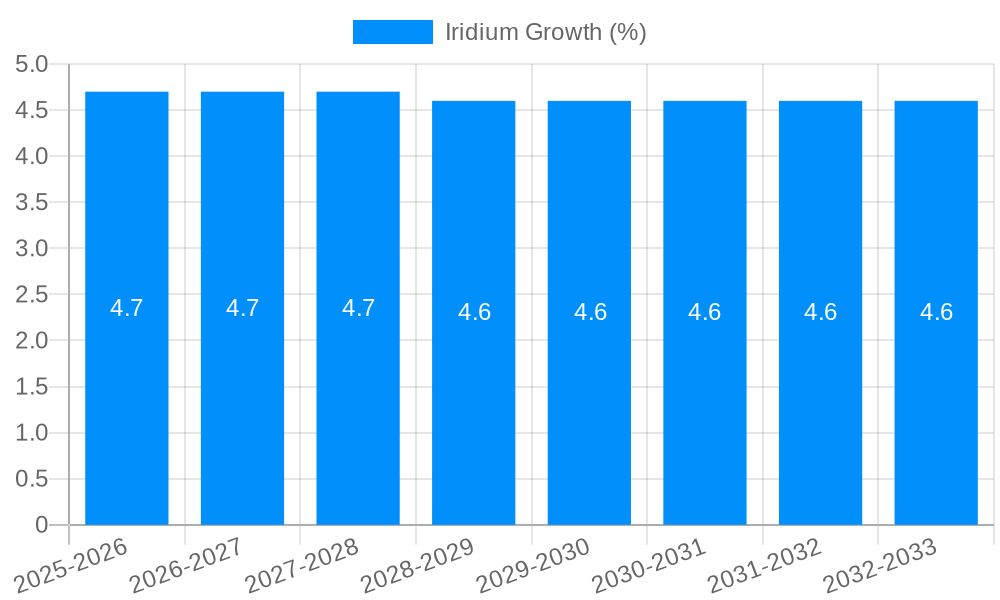

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iridium?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Iridium

IridiumIridium by Type (Mineral Source, Recycling Source), by Application (Catalyst, Chemical Manufacturing, Electricals and Electronics, Jewellery, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Iridium market is poised for steady expansion, projected to reach an estimated market size of $1311.8 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.7% anticipated throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for high-performance catalysts in the automotive and chemical industries. Iridium's exceptional resistance to corrosion and high-temperature applications makes it indispensable in catalytic converters, a segment expected to witness significant uptake driven by stringent emission regulations worldwide. Furthermore, its unique properties are being leveraged in advanced electronic components, particularly in high-end consumer electronics and specialized industrial applications, contributing to market expansion.

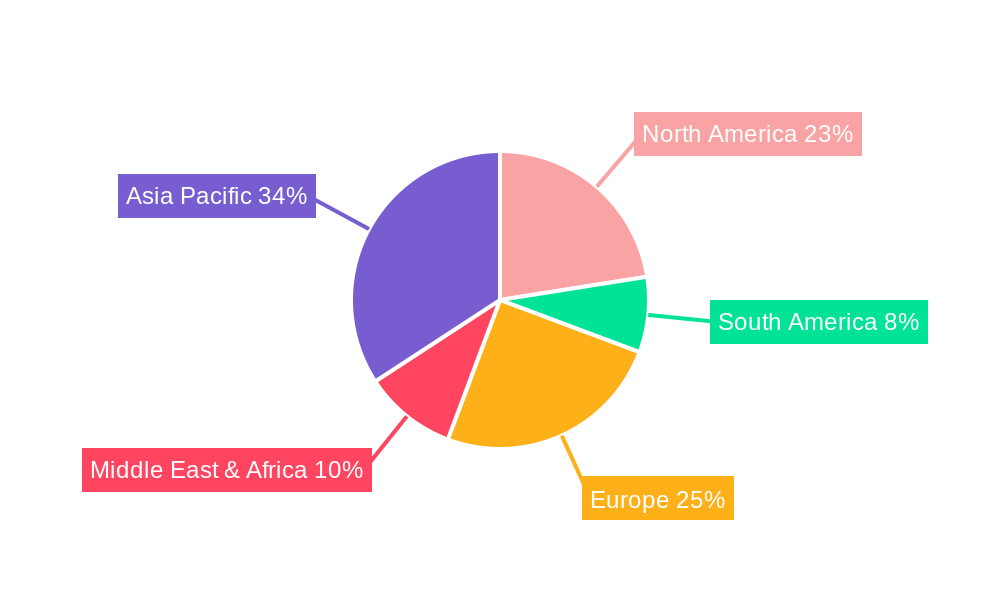

The Iridium market's trajectory is also influenced by evolving industrial landscapes and technological advancements. While the supply of primary mineral sources remains a key driver, the growing emphasis on circular economy principles is propelling the importance of recycling Iridium from spent catalysts and electronic waste. This trend not only enhances supply chain resilience but also presents a more sustainable sourcing option. Key players such as Lonmin, Anglo American, and Russian Platinum are strategically positioned to capitalize on these market dynamics, investing in both exploration and efficient recovery processes. Geographical analysis indicates that Asia Pacific, particularly China and Japan, will emerge as a significant growth engine, driven by their strong manufacturing base in automotive and electronics. North America and Europe will continue to be substantial markets, supported by established industrial infrastructure and ongoing research into new applications for this precious metal.

This comprehensive report delves into the multifaceted Iridium market, offering an in-depth analysis of trends, drivers, challenges, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides critical insights for stakeholders seeking to navigate this high-value platinum group metal. The report leverages a robust methodology to analyze market dynamics, encompassing historical performance (2019-2024), current estimations (2025), and projections for the coming decade. It quantifies market sizes in millions of units, providing a clear financial perspective on Iridium's evolving landscape.

The global Iridium market is characterized by its unique properties and niche applications, leading to a dynamic yet concentrated trend trajectory. Historically, from 2019 to 2024, the market has witnessed moderate fluctuations driven by supply constraints and the steady demand from its primary industrial uses. As we move into the base year of 2025 and the subsequent forecast period of 2025-2033, several key trends are expected to shape the market's evolution. A significant trend is the increasing demand from the Catalyst segment, particularly in automotive applications and chemical processing. The development of advanced catalytic converters, crucial for emission control, continues to be a strong demand driver. Furthermore, the exploration of new catalytic processes in chemical manufacturing, such as in the production of specialty chemicals and pharmaceuticals, is expected to add further impetus.

Another prominent trend revolves around Electricals and Electronics. While Iridium's high cost limits its widespread use, its exceptional properties like corrosion resistance and high melting point make it indispensable in specific high-performance applications, including specialized spark plugs for aircraft engines and components in advanced electronic devices where reliability is paramount. The report anticipates a gradual, albeit small, increase in demand from this segment as technological advancements necessitate materials with Iridium’s unique capabilities.

The Recycling Source of Iridium is also emerging as a critical trend. Given the scarcity and high price of virgin Iridium, efficient recycling processes are gaining traction. This trend is supported by environmental regulations and the growing emphasis on circular economy principles. The report will analyze the contribution of recycled Iridium to the overall market supply, highlighting its increasing importance in mitigating supply volatility and reducing reliance on primary mining. The Jewellery segment, while a smaller contributor, exhibits a trend towards niche luxury items where the rarity and distinctiveness of Iridium are valued. However, its high cost and limited aesthetic versatility compared to precious metals like gold and platinum restrict its mass-market appeal.

The market is also influenced by Industry Developments. Innovations in mining and refining technologies are crucial for improving the efficiency and cost-effectiveness of Iridium extraction, impacting its availability and price. Furthermore, research into novel applications, particularly in areas like advanced energy storage and medical devices, could unlock significant future demand. Overall, the Iridium market is projected to experience a steady growth trajectory, driven by its indispensable role in critical industrial applications and the evolving landscape of material science and environmental regulations. The estimated market size in 2025, measured in millions, will serve as a baseline for understanding the projected expansion throughout the forecast period.

The Iridium market, despite its niche status, is propelled by a confluence of powerful driving forces that ensure its continued relevance and growth. Foremost among these is the unparalleled catalytic activity of Iridium. Its ability to facilitate a wide range of chemical reactions at efficient rates makes it an indispensable component in various industrial processes. This is particularly evident in the automotive sector, where advanced catalytic converters rely heavily on Iridium to reduce harmful emissions, a demand that is set to grow with stricter environmental regulations globally. Beyond emissions control, Iridium's catalytic prowess is being increasingly leveraged in the synthesis of complex chemicals and pharmaceuticals, driving demand from the Chemical Manufacturing segment.

Another significant driver is the exceptional durability and resistance of Iridium to corrosion and high temperatures. These properties make it the material of choice for applications where extreme conditions are a norm. This is crucial for the Electricals and Electronics sector, especially in specialized components like high-performance spark plugs for aerospace and other demanding engines, where failure is not an option. The reliability and longevity offered by Iridium in such critical systems ensure a consistent demand.

The increasing emphasis on sustainability and resource efficiency is also acting as a subtle yet important driver. As the global focus shifts towards a circular economy, the value of recycled Iridium is becoming more pronounced. The development of advanced recycling technologies allows for the recovery of this precious metal from end-of-life products, contributing to supply and reducing the environmental impact of mining. This trend is particularly relevant in offsetting the inherent scarcity of virgin Iridium.

Finally, ongoing research and development into novel applications are poised to unlock new avenues of growth. While currently limited, explorations into areas such as advanced battery technologies, medical implants, and even cutting-edge scientific equipment could significantly expand the demand landscape for Iridium in the coming years. These drivers collectively paint a picture of a market driven by essential performance characteristics and emerging technological needs.

Despite its desirable properties, the Iridium market faces significant challenges and restraints that temper its growth potential. The most prominent of these is its exorbitant price. Iridium is one of the rarest metals on Earth, and its extraction and refining processes are complex and costly. This high cost inherently limits its widespread adoption across various industries, confining it to applications where its unique performance is absolutely essential and the cost can be justified. This price sensitivity is a major restraint for sectors like Jewellery, where alternative precious metals offer a more accessible and economically viable option.

Another critical challenge is supply volatility and concentration. The primary sources of Iridium are limited, with a significant portion of global production concentrated in a few mining regions. This geographical concentration makes the supply chain susceptible to geopolitical instability, labor disputes, and unforeseen operational disruptions, leading to unpredictable price fluctuations and availability issues. Companies operating in this market must contend with the inherent risks associated with such a concentrated supply base.

Furthermore, the environmental impact and ethical considerations of mining present a growing concern. While not unique to Iridium, the extraction of any precious metal can have environmental consequences, and responsible sourcing is becoming increasingly important for consumers and regulatory bodies. This can lead to stricter regulations and increased compliance costs for mining companies, potentially impacting the overall cost and availability of the metal.

The limited number of end-use applications also acts as a restraint. While Iridium excels in its current niches, the development of cost-effective substitutes or alternative technologies in some of its key application areas could pose a threat. Continuous innovation in materials science means that industries are always exploring new options, and while Iridium's properties are difficult to replicate, market dynamics can shift. Lastly, the complexity and cost of recycling processes, while a growing trend, can also be a challenge. Developing and implementing efficient and economically viable recycling infrastructure for such a rare and valuable metal requires significant investment.

The global Iridium market's dominance is shaped by a complex interplay of geographical mining strengths and specific high-value application segments. While several regions contribute to Iridium's availability, South Africa stands out as a dominant force due to its substantial platinum group metal (PGM) reserves, which include significant amounts of Iridium. The country's established mining infrastructure and expertise in PGM extraction provide a consistent and substantial supply, making it a cornerstone of the global Iridium market. Other regions, such as Russia, also play a role, but South Africa's sheer volume of production, particularly from companies like Anglo American and Lonmin (now part of Sibanye-Stillwater), positions it as a key region dictating market supply dynamics.

In terms of market segments, the Catalyst segment is unequivocally poised to dominate the Iridium market throughout the forecast period of 2025-2033. This dominance stems from Iridium's indispensable role in critical catalytic processes.

The Electricals and Electronics segment, while not as large in volume as catalysts, is another significant driver of Iridium demand and is expected to maintain its importance.

The Recycling Source is an increasingly important factor, not necessarily dominating in terms of virgin material extraction but in influencing the overall market balance and price stability. As the cost of virgin Iridium remains high, efficient recycling processes from spent catalysts and electronic waste are becoming economically viable and environmentally desirable. The growth in this segment, driven by sustainability initiatives and cost considerations, will play a crucial role in meeting future demand and potentially moderating price volatility.

The Jewellery segment, while a recognized application, is expected to remain a minor contributor to the overall Iridium market dominance. Its extreme rarity and high price point limit its appeal to a very niche segment of the luxury jewelry market. While some unique pieces are crafted, it cannot compete with more accessible precious metals in terms of market share.

Therefore, the Catalyst segment, encompassing automotive, chemical manufacturing, and other industrial applications, is predicted to be the primary driver and dominator of the Iridium market in terms of demand volume and strategic importance throughout the report's study period.

The Iridium industry is fueled by key growth catalysts. The relentless pursuit of stricter environmental regulations globally acts as a primary driver, pushing demand for advanced catalytic converters in the automotive sector, where Iridium is a crucial element. Furthermore, advancements in chemical manufacturing processes, requiring highly efficient and selective catalysts for producing specialty chemicals and pharmaceuticals, are consistently boosting Iridium consumption. The ongoing research into novel applications in areas like energy storage and advanced electronics also presents significant future growth opportunities, promising to expand Iridium's market reach beyond its traditional strongholds.

This comprehensive report offers an exhaustive exploration of the Iridium market. It meticulously analyzes historical data from 2019-2024 and provides forward-looking projections from 2025-2033, with 2025 serving as the estimated base year. The report quantifies market sizes in millions, detailing trends across mineral sources, recycling, and key applications like catalysts, chemical manufacturing, electricals, and jewelry. It dissects the driving forces, challenges, and the dominance of specific regions and segments, alongside significant industry developments and the leading players. This in-depth analysis ensures stakeholders have the critical information to understand and strategize within the evolving Iridium landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include Lonmin, Anglo American, Russian Platinum, Lonmin, Impala, .

The market segments include Type, Application.

The market size is estimated to be USD 1311.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Iridium," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Iridium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.