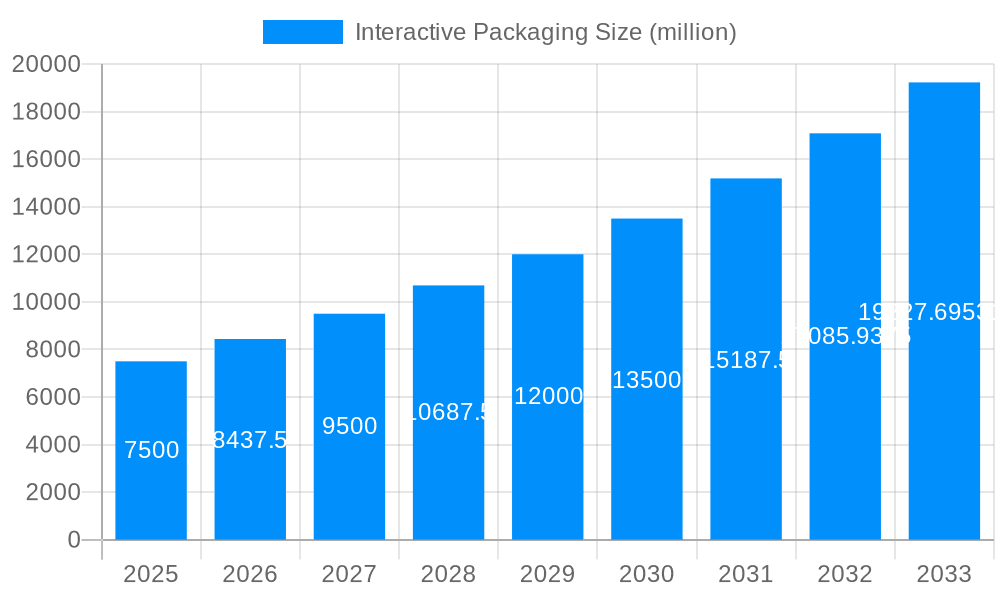

1. What is the projected Compound Annual Growth Rate (CAGR) of the Interactive Packaging?

The projected CAGR is approximately 17.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Interactive Packaging

Interactive PackagingInteractive Packaging by Type (Feel Packaging, Functional Packaging, Smart Packaging, World Interactive Packaging Production ), by Application (Cosmetics, Food & Beverages, Electronics, Telecommunication, Pharmaceuticals, Nutraceuticals, Healthcare, World Interactive Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The interactive packaging market is poised for significant expansion, driven by consumer demand for enriched brand engagement and detailed product insights. This dynamic sector, valued at $106.46 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.9% through 2033. Key growth drivers include the increasing integration of augmented reality (AR) and digital technologies into packaging, the escalating need for robust product traceability and anti-counterfeiting solutions, and a growing preference for sustainable packaging materials. The food and beverage industry currently leads market adoption, utilizing interactive packaging for impactful marketing and consumer information dissemination. Emerging opportunities are also prevalent in the cosmetics, pharmaceuticals, and electronics sectors, where brands are actively seeking innovative ways to enhance consumer interaction.

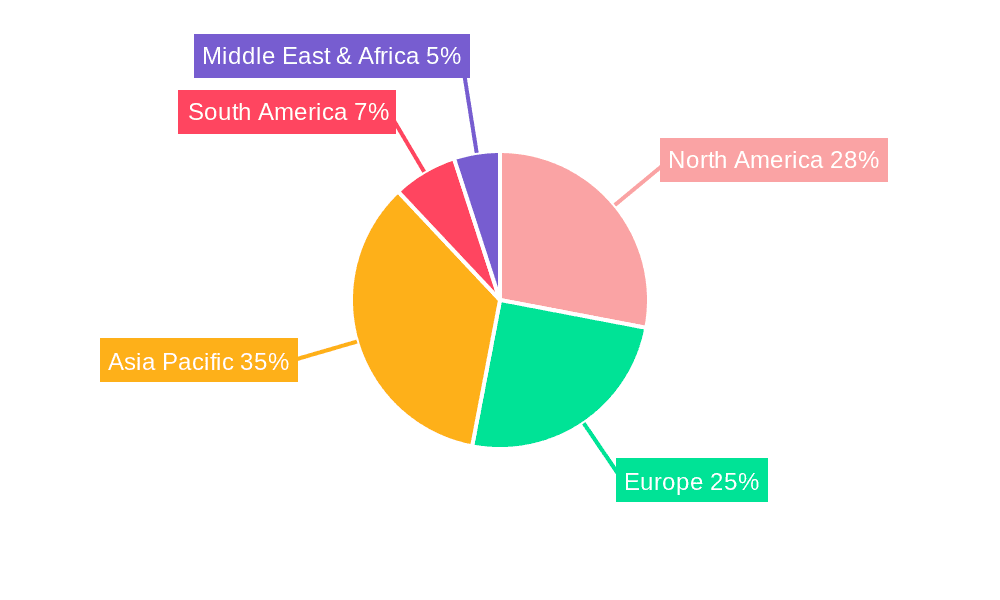

Emerging trends are profoundly influencing the interactive packaging ecosystem. The incorporation of smart technologies such as NFC chips and QR codes facilitates personalized consumer experiences and dynamic product information updates. A strong emphasis on sustainable materials, including recycled paper and biodegradable plastics, is spurring innovation in eco-friendly interactive packaging. The proliferation of e-commerce further amplifies opportunities for interactive packaging to elevate the unboxing experience and foster brand loyalty. Despite this considerable growth trajectory, challenges such as high integration costs and data privacy concerns persist. Industry players are actively mitigating these by adopting cost-effective technologies and implementing transparent data management practices. Geographically, North America and Europe currently lead market share due to high disposable incomes and advanced technological adoption. However, the Asia-Pacific region, particularly China and India, presents substantial future growth potential.

The interactive packaging market is experiencing explosive growth, projected to reach multi-billion-unit sales by 2033. This surge is driven by a confluence of factors, including the increasing consumer demand for enhanced brand experiences, the proliferation of smartphones and ubiquitous internet access, and the innovative capabilities of packaging manufacturers. Key market insights reveal a clear shift towards personalized and engaging packaging solutions that transcend the traditional role of mere product containment. Consumers are actively seeking out brands that offer interactive elements, from augmented reality (AR) experiences that bring products to life, to QR codes providing access to additional information, recipes, or games. This trend is particularly pronounced amongst younger demographics, who are highly receptive to technology-driven marketing strategies. The market's evolution is marked by a growing integration of sustainability concerns, with many brands opting for interactive packaging solutions that incorporate eco-friendly materials and minimize environmental impact. Furthermore, the rise of e-commerce is significantly impacting the interactive packaging landscape. Brands are leveraging innovative packaging designs to enhance the unboxing experience and foster customer loyalty in the absence of a traditional retail environment. The adoption of smart packaging, which incorporates sensors and connected technologies, is also gaining momentum, enabling real-time tracking of products and providing consumers with valuable information about product freshness and authenticity. This trend is expected to further accelerate market growth in the coming years, with millions of units projected to be deployed across diverse sectors. The historical period (2019-2024) laid the groundwork for this expansion, with the estimated year (2025) serving as a pivotal point in the forecast period (2025-2033). The study period (2019-2033) encompasses a transformation in consumer expectations and the capacity of packaging to meet those expectations.

Several powerful forces are propelling the growth of the interactive packaging market. The desire for enhanced brand engagement is a key driver. Consumers are increasingly seeking brands that provide more than just a product; they crave experiences. Interactive packaging offers a unique opportunity to create memorable and personalized interactions, fostering brand loyalty and driving sales. The technological advancements in augmented reality (AR), virtual reality (VR), and near-field communication (NFC) technologies are making sophisticated interactive features more accessible and affordable for businesses of all sizes. This accessibility is further fueling market expansion. The increasing adoption of smartphones and the widespread availability of internet access have created a fertile ground for interactive packaging to flourish. Consumers are always connected and readily engage with digital content, making interactive packaging a highly effective marketing tool. Moreover, the growing emphasis on sustainability is influencing the development of interactive packaging solutions that utilize eco-friendly materials and promote responsible consumption. This aligns with the increasing consumer awareness of environmental issues and their preference for sustainable brands. Finally, the rise of e-commerce has amplified the importance of a positive unboxing experience. Interactive packaging adds a unique layer of excitement and engagement to online orders, helping brands differentiate themselves in a crowded digital marketplace and boost customer satisfaction.

Despite the significant growth potential, the interactive packaging market faces certain challenges and restraints. The high initial investment costs associated with developing and implementing interactive packaging solutions can be a significant barrier to entry for smaller businesses. This cost includes the design, development, and printing of the specialized packaging materials, as well as the integration of necessary technologies. Furthermore, maintaining the security and privacy of consumer data collected through interactive packaging is crucial. Data breaches and privacy concerns can severely damage a brand's reputation and erode consumer trust. The complexity of integrating various technologies into interactive packaging can also pose challenges. Ensuring seamless functionality and compatibility across different platforms and devices is critical for a successful interactive packaging experience. Additionally, there can be a learning curve for both manufacturers and consumers in adopting new technologies, especially for older demographics less comfortable with modern technological applications. Lastly, the lack of standardized regulations and guidelines for interactive packaging across different regions can create complexities in production and distribution. Navigating these varying regulatory landscapes can be costly and time-consuming for businesses operating internationally.

The interactive packaging market is geographically diverse, with significant growth anticipated across several key regions. However, North America and Europe are currently leading the charge, driven by high consumer adoption rates of new technologies and strong brand engagement strategies. Within these regions, the cosmetics and food and beverage sectors are particularly prominent adopters of interactive packaging, leveraging AR experiences and other interactive features to enhance product presentation and consumer engagement.

Dominant Segments:

The interactive packaging market is fueled by several key growth catalysts. The increasing demand for personalized and engaging brand experiences is a significant driver, prompting companies to invest heavily in interactive packaging solutions that go beyond traditional product presentation. Technological advancements in AR, VR, and NFC technologies are constantly improving the functionality and affordability of interactive features. The rise of e-commerce and the need for an enhanced unboxing experience are further driving market growth, as brands seek ways to enhance customer engagement and foster loyalty in a digital landscape. Coupled with the growing emphasis on sustainability and the development of eco-friendly interactive packaging materials, these trends create a synergistic effect that propels market expansion and adoption.

This report provides a comprehensive overview of the interactive packaging market, encompassing market size and forecasts, key trends, driving forces, challenges, and leading players. The report analyzes various segments, including type (Feel, Functional, Smart), application (Cosmetics, Food & Beverages, etc.), and geographical regions, providing detailed insights into market dynamics and growth opportunities. It also examines the impact of technological advancements and sustainability concerns on the market, offering valuable perspectives for businesses operating in or considering entering this dynamic and rapidly expanding sector. The detailed analysis of the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033) provide a robust understanding of the market trajectory and potential for continued high growth in the coming decade, all within the context of millions of units produced and sold.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.9%.

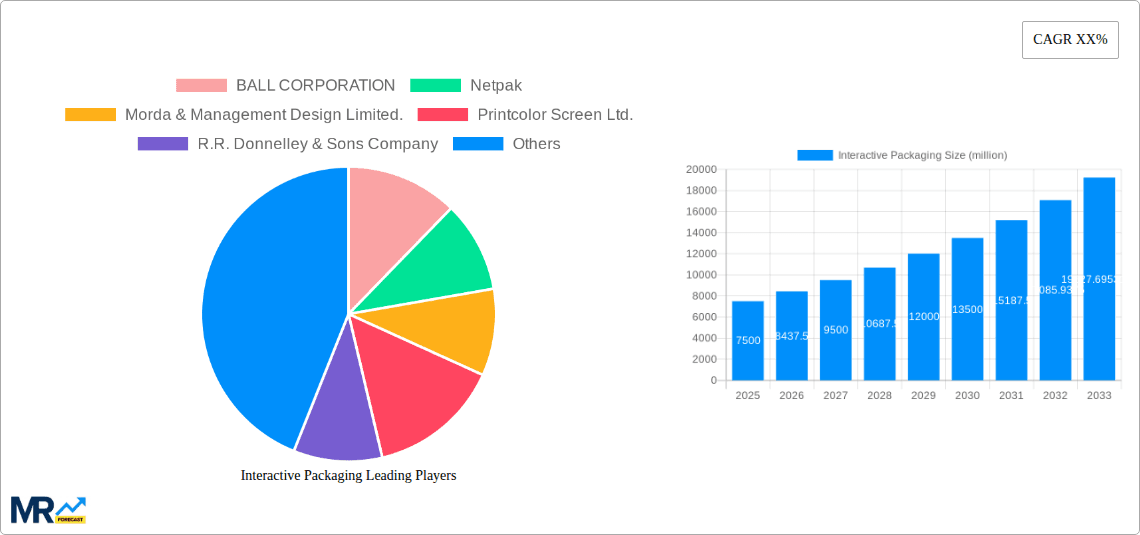

Key companies in the market include BALL CORPORATION, Netpak, Morda & Management Design Limited., Printcolor Screen Ltd., R.R. Donnelley & Sons Company, .

The market segments include Type, Application.

The market size is estimated to be USD 106.46 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Interactive Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Interactive Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.