1. What is the projected Compound Annual Growth Rate (CAGR) of the Inorganic Chemical Packaging?

The projected CAGR is approximately 3.61%.

Inorganic Chemical Packaging

Inorganic Chemical PackagingInorganic Chemical Packaging by Application (Polymers, Specialty Chemicals, Petrochemicals, Others, World Inorganic Chemical Packaging Production ), by Type (100-250 Liters, 250-500 Liters, Over 500 Liters, World Inorganic Chemical Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

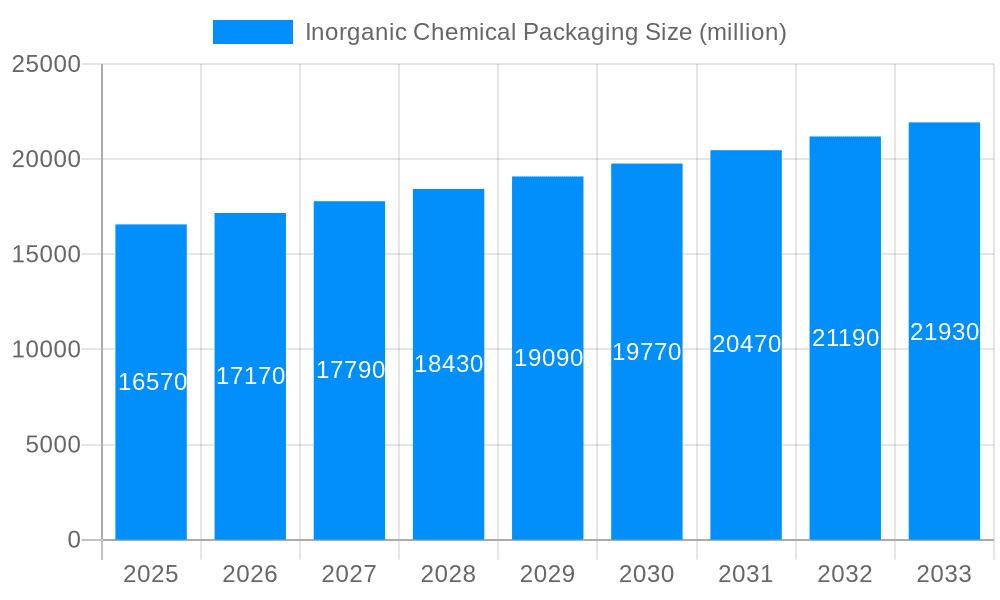

The global inorganic chemical packaging market is poised for steady growth, projected to reach an estimated USD 16.57 billion by the end of 2025. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 3.61% during the forecast period of 2025-2033. A significant driver for this market is the increasing demand from the petrochemical and specialty chemicals sectors, both of which rely heavily on robust and safe packaging solutions for their diverse product ranges. As industrial activities expand globally, so does the need for reliable containment of inorganic chemicals, ranging from acids and alkalis to salts and oxides. The market is further propelled by stringent regulatory frameworks that emphasize safety, containment, and environmental protection in chemical handling and transportation, pushing manufacturers towards advanced and compliant packaging options.

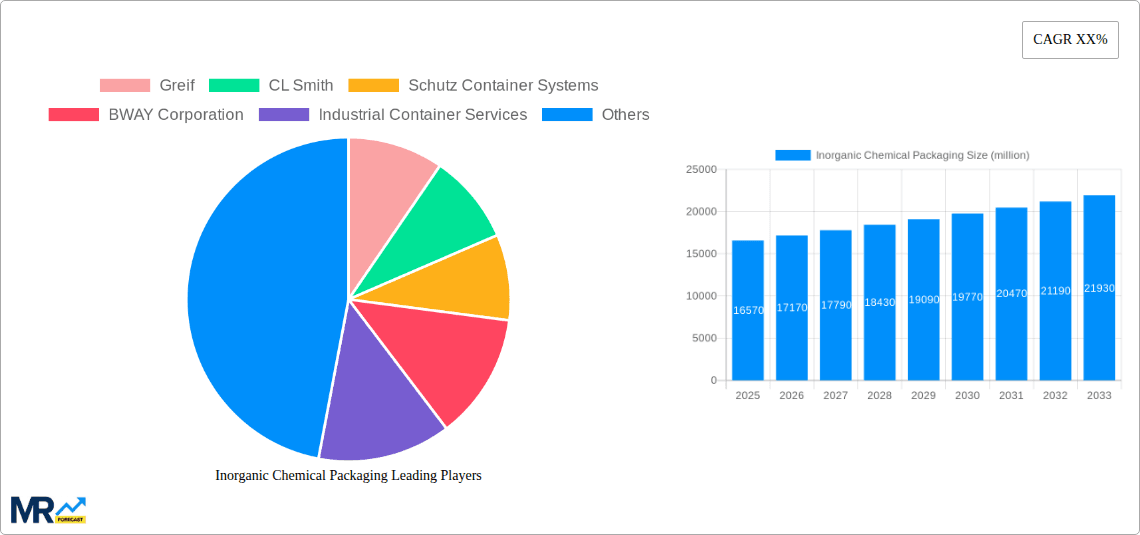

The market for inorganic chemical packaging is characterized by a variety of container types, with a notable focus on capacities between 100-250 liters and 250-500 liters, catering to a broad spectrum of industrial needs. However, the "Over 500 Liters" segment is expected to witness substantial growth as larger-scale industrial operations become more prevalent. Key players like Greif, CL Smith, and Schutz Container Systems are at the forefront, investing in innovation to enhance product durability, chemical resistance, and sustainability. Emerging trends include the adoption of recycled materials and the development of smart packaging solutions that offer enhanced tracking and monitoring capabilities. While the market shows strong growth potential, factors such as fluctuating raw material prices for plastic and metal, and the increasing operational costs associated with stringent safety compliance, present moderate restraints to an even faster growth trajectory. Nevertheless, the fundamental demand for secure and efficient inorganic chemical packaging across various applications and regions ensures a dynamic and evolving market landscape.

Here's a report description for Inorganic Chemical Packaging, incorporating your specified requirements:

The global inorganic chemical packaging market is poised for significant growth and evolution, projected to reach a valuation in the billions by 2033. XXX The historical period from 2019 to 2024 witnessed a steady demand driven by the essential nature of inorganic chemicals across numerous industries. As we move into the base and estimated year of 2025, the market is experiencing a rejuvenation, fueled by increasing industrial output and a growing emphasis on specialized chemical formulations. The forecast period, spanning 2025-2033, anticipates a dynamic landscape characterized by innovation in material science, a heightened focus on sustainability, and a strategic shift towards more efficient and secure packaging solutions. The prevalence of larger container types, particularly the "Over 500 Liters" segment, is expected to grow, reflecting the scale of operations in petrochemical and specialty chemical manufacturing. Simultaneously, the "100-250 Liters" and "250-500 Liters" categories will continue to serve critical roles in the distribution of a broader spectrum of inorganic compounds. The "Polymers" and "Specialty Chemicals" applications are expected to be key drivers, with ongoing research and development in these areas demanding more tailored and protective packaging. The "Petrochemicals" segment, a perennial major consumer, will continue its significant contribution, while the "Others" category encompasses diverse applications that also require robust and reliable containment. Understanding these multifaceted trends is crucial for stakeholders aiming to navigate this evolving market. The increasing need for hazardous material containment, coupled with regulatory compliance, will continue to shape product development and market strategies.

Several potent forces are propelling the inorganic chemical packaging market forward during the study period of 2019-2033. A primary driver is the relentless expansion of end-use industries that heavily rely on inorganic chemicals. The burgeoning petrochemical sector, for instance, requires vast quantities of these compounds for the production of plastics, synthetic fibers, and fuels, thereby necessitating secure and voluminous packaging solutions, especially in the "Over 500 Liters" segment. Furthermore, the ever-increasing demand for specialty chemicals in sectors like pharmaceuticals, electronics, and agriculture fuels the need for specialized packaging that ensures product integrity and safety. This translates to a growing market for packaging types designed for precise dispensing and contamination prevention. The global push towards industrial automation and the increasing complexity of chemical supply chains also play a pivotal role. Manufacturers are seeking packaging that integrates seamlessly with automated handling systems and offers enhanced traceability, thereby reducing logistical costs and minimizing the risk of errors. Moreover, stringent government regulations concerning the transportation and storage of hazardous chemicals are a significant catalyst, mandating the use of high-quality, certified packaging solutions that meet rigorous safety standards.

Despite the promising growth trajectory, the inorganic chemical packaging market faces a set of considerable challenges and restraints that could temper its expansion. Foremost among these is the fluctuating cost of raw materials. The production of various inorganic chemical packaging, particularly those made from plastic derivatives, is susceptible to price volatility in crude oil and natural gas markets. This can directly impact profit margins for packaging manufacturers and potentially lead to increased costs for end-users. Environmental concerns and evolving sustainability mandates present another significant hurdle. While the industry is moving towards more eco-friendly solutions, the disposal and recycling of certain types of inorganic chemical packaging, especially those designed for highly corrosive or hazardous substances, remain complex issues. The development and widespread adoption of truly circular economy models for these materials require substantial investment in infrastructure and technology. Furthermore, the stringent and often diverse regulatory landscape across different regions can create compliance complexities for global packaging suppliers. Adhering to varying international standards for material safety, transport, and labeling necessitates significant expertise and resources, potentially slowing down market entry and product diversification.

Dominating Segments in Inorganic Chemical Packaging:

The Petrochemicals application segment is a cornerstone of the inorganic chemical packaging market and is poised for continued dominance throughout the study period of 2019-2033. This segment's significance stems from the inherent nature of petrochemical production, which often involves large-scale manufacturing processes that generate and require substantial volumes of inorganic chemicals as raw materials, catalysts, or by-products. The sheer scale of operations within the petrochemical industry naturally translates into a consistent and high demand for robust and voluminous packaging solutions.

This demand is closely mirrored in the Over 500 Liters type segment. These larger capacity containers, such as intermediate bulk containers (IBCs) and large drums, are indispensable for the efficient and cost-effective transportation and storage of bulk inorganic chemicals utilized in petrochemical refining, synthesis, and downstream processing. The ability to handle greater quantities in fewer shipments significantly reduces logistical overhead and improves supply chain efficiency, making this packaging type a preferred choice for major petrochemical players.

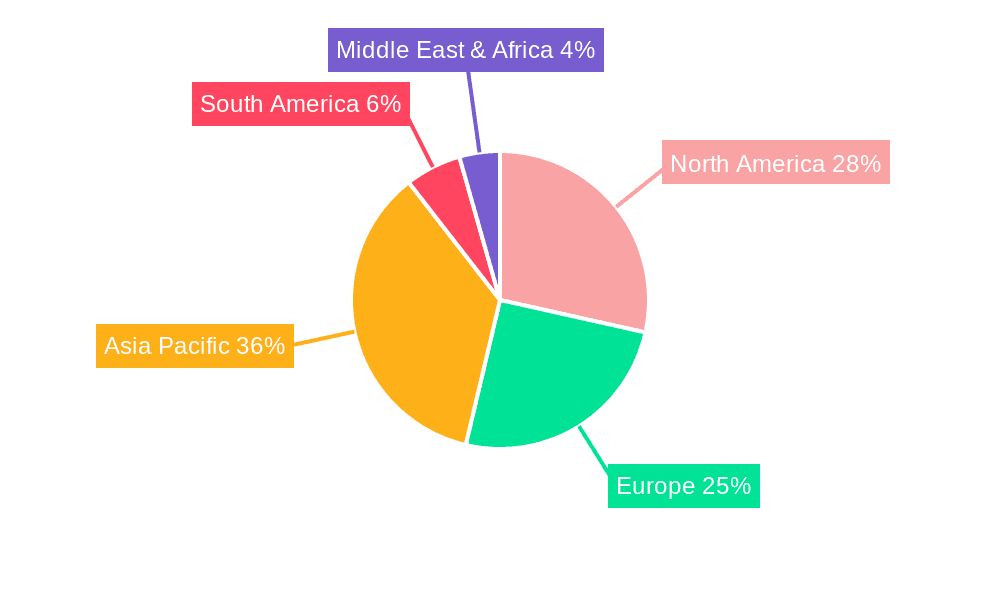

Geographically, the Asia Pacific region is projected to be the dominant force in the inorganic chemical packaging market. This dominance is fueled by several interconnected factors:

The inorganic chemical packaging industry is experiencing substantial growth fueled by several key catalysts. The escalating global demand for downstream products derived from inorganic chemicals, such as plastics and fertilizers, is a primary driver. This demand necessitates larger-scale production and, consequently, more robust and voluminous packaging. Furthermore, continuous innovation in material science is leading to the development of advanced packaging solutions offering enhanced chemical resistance, durability, and safety, which are crucial for handling hazardous inorganic compounds. The increasing focus on supply chain efficiency and cost optimization by chemical manufacturers is also pushing for more integrated and user-friendly packaging designs.

This comprehensive report offers an in-depth analysis of the global inorganic chemical packaging market, spanning the study period of 2019-2033. The report provides a detailed examination of market trends, driving forces, challenges, and key regional dynamics, with a specific focus on the dominance of the Petrochemicals application segment and the Over 500 Liters type, primarily within the Asia Pacific region. It meticulously forecasts market growth based on the estimated value in 2025 and projects future trajectories, offering valuable insights for stakeholders. The report also identifies growth catalysts and provides a detailed overview of leading players, alongside a chronological listing of significant industry developments, ensuring a complete and actionable understanding of this vital market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.61% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.61%.

Key companies in the market include Greif, CL Smith, Schutz Container Systems, BWAY Corporation, Industrial Container Services, Sonoco Products Company, The Cary Company, TPL Plastech, Milford Barrel, Hoover Ferguson Group, Orlando Drum & Container Corporation, International Paper, Berry Global, Sealed Air, DS Smith, Snyder Industries.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Inorganic Chemical Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Inorganic Chemical Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.