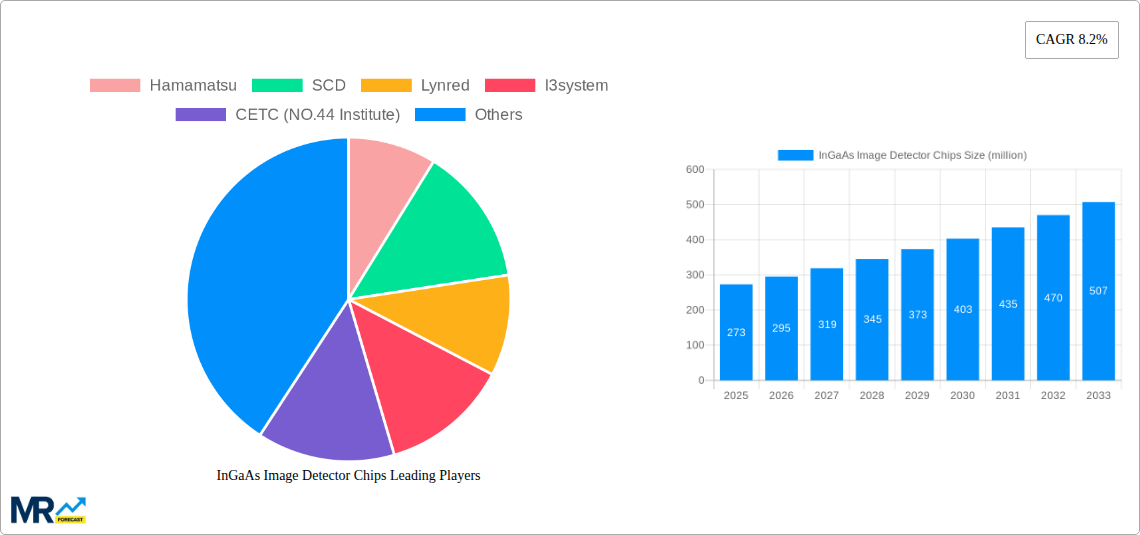

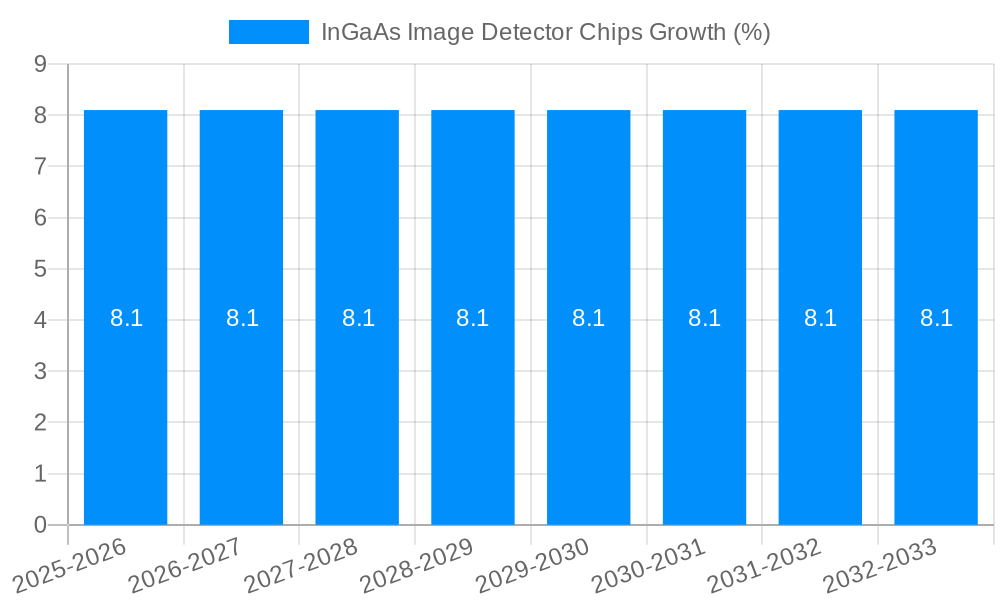

1. What is the projected Compound Annual Growth Rate (CAGR) of the InGaAs Image Detector Chips?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

InGaAs Image Detector Chips

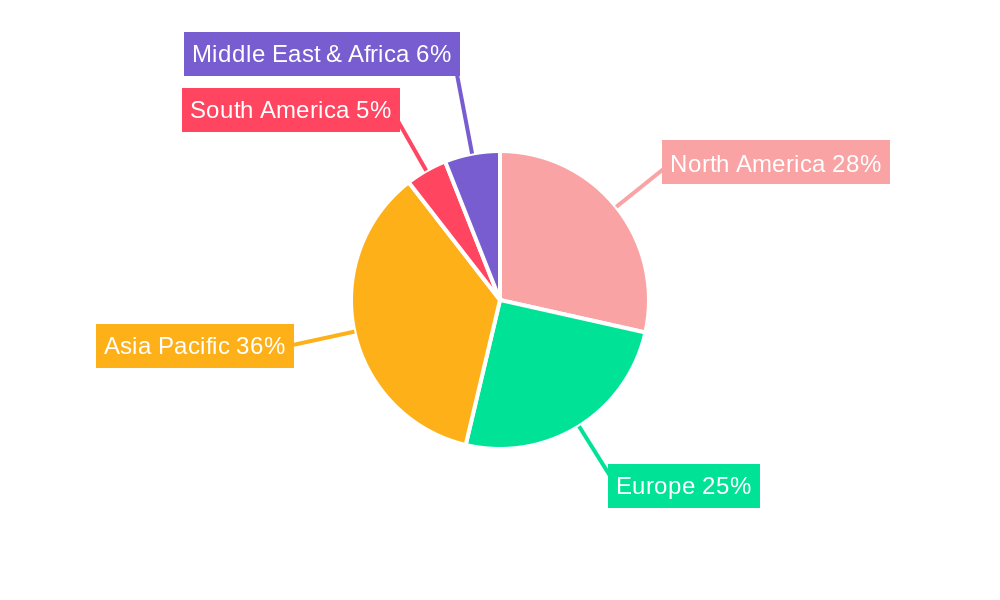

InGaAs Image Detector ChipsInGaAs Image Detector Chips by Type (InGaAs SWIR Linear Arrays, InGaAs SWIR Area Arrays), by Application (Military, Surveillance, Industrial, Medical, Scientific Research, Other Application), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The InGaAs Image Detector Chips market is poised for significant expansion, projected to reach a substantial valuation with a robust Compound Annual Growth Rate (CAGR) of 8.2% from 2019 to 2033. The current market size, estimated at $273 million in 2025, signifies a burgeoning demand driven by critical advancements and widespread adoption across diverse sectors. The primary growth accelerators for this market include the relentless pursuit of enhanced imaging capabilities in defense and security applications, where InGaAs technology offers superior performance in low-light and adverse weather conditions. Furthermore, the escalating need for sophisticated industrial automation, advanced medical diagnostics, and cutting-edge scientific research is fueling the demand for high-resolution and sensitive image detection solutions. Innovations in material science and fabrication techniques are continuously improving the performance and reducing the cost of InGaAs detectors, making them more accessible and attractive for a broader range of applications.

The market landscape for InGaAs Image Detector Chips is characterized by a dynamic interplay of technological evolution and evolving application needs. The classification into InGaAs SWIR Linear Arrays and InGaAs SWIR Area Arrays highlights the specialized functionalities catering to specific imaging requirements, from line-based scanning to full-frame imaging. While the market demonstrates strong growth potential, certain factors could temper its expansion. High manufacturing costs associated with specialized materials and complex fabrication processes, coupled with the ongoing development of alternative imaging technologies, present potential challenges. However, the intrinsic advantages of InGaAs, such as its sensitivity in the Short-Wave Infrared (SWIR) spectrum, enable it to overcome many limitations of traditional imaging. Emerging trends such as the miniaturization of detector modules, integration with artificial intelligence for enhanced image processing, and the expansion into new markets like agriculture and environmental monitoring are expected to further propel market growth and innovation in the coming years.

The InGaAs image detector chip market is experiencing robust growth, driven by an ever-increasing demand for advanced imaging capabilities across a multitude of sectors. Throughout the study period from 2019 to 2033, with a base and estimated year of 2025, this sector has witnessed a transformative evolution. The historical period (2019-2024) laid the groundwork for exponential expansion, projecting a market size reaching several million dollars by the forecast period (2025-2033). Key market insights reveal a significant shift towards higher resolution and sensitivity detectors, fueled by advancements in semiconductor fabrication and materials science. The growing adoption of SWIR (Short-Wave Infrared) imaging technology, enabled by InGaAs chips, is a primary trend. SWIR light penetrates atmospheric obscurants like fog, smoke, and haze far better than visible light, making it indispensable for applications where clear vision is paramount. Furthermore, the miniaturization of these detector chips is another crucial trend, facilitating their integration into increasingly compact and portable systems. This miniaturization, coupled with falling manufacturing costs due to economies of scale and improved production yields, is making InGaAs technology more accessible to a wider range of industries. The market is also seeing a surge in demand for uncooled detector arrays, reducing system complexity and cost. The integration of advanced signal processing capabilities directly onto the detector chip itself is also a notable trend, enabling faster and more efficient data analysis. Looking ahead, the market is poised for continued innovation, with a focus on enhancing quantum efficiency, reducing noise levels, and expanding the spectral range of InGaAs detectors. The increasing prevalence of artificial intelligence (AI) and machine learning (ML) algorithms for image analysis further amplifies the need for high-quality, data-rich imagery provided by these advanced detector chips. The market is projected to witness a compound annual growth rate (CAGR) that will push its valuation well into the hundreds of millions of dollars within the forecast period. The base year of 2025, estimated to be a significant milestone, sets the stage for this impressive expansion, with predictions indicating a market value exceeding several tens of millions of dollars by the end of the forecast period. This growth is not merely incremental; it represents a fundamental paradigm shift in how imaging is perceived and utilized across critical global industries.

The InGaAs image detector chip market is propelled by a confluence of powerful driving forces, each contributing to its escalating demand and technological advancement. Foremost among these is the relentless pursuit of enhanced situational awareness and operational effectiveness in military and defense applications. The ability of InGaAs SWIR detectors to penetrate obscurants and detect targets at longer ranges in all weather conditions provides a significant tactical advantage. Similarly, the surveillance and security sector is witnessing a surge in adoption. InGaAs chips enable advanced night vision, perimeter monitoring, and threat detection systems, significantly improving public safety and security infrastructure. The industrial automation and quality control segment is another major driver. InGaAs detectors are crucial for non-destructive testing, material inspection, process monitoring, and robotic vision, where accurate and detailed imaging is essential for efficiency and defect detection. In the medical field, InGaAs imaging is finding applications in diagnostics, surgery, and drug discovery, offering unique spectral insights. Moreover, scientific research, particularly in fields like astronomy, spectroscopy, and environmental monitoring, heavily relies on the specialized capabilities of InGaAs detectors for capturing faint signals and analyzing complex spectral signatures. The continuous innovation in semiconductor manufacturing processes, leading to higher yields and lower per-unit costs, further fuels the market by making InGaAs technology more economically viable for broader adoption. The increasing demand for hyperspectral imaging, which requires specialized InGaAs sensor arrays capable of capturing detailed spectral information, is also a significant growth catalyst. As these industries continue to invest in advanced imaging solutions to enhance their capabilities and gain a competitive edge, the demand for sophisticated InGaAs image detector chips is set to accelerate, ensuring a sustained upward trajectory for the market, projected to cross the hundred million dollar mark within the study period.

Despite its promising growth trajectory, the InGaAs image detector chip market faces several significant challenges and restraints that can temper its expansion. One of the primary hurdles is the inherent cost of manufacturing. InGaAs materials and fabrication processes are inherently more complex and expensive compared to silicon-based technologies. This higher cost can be a deterrent for adoption in cost-sensitive industries or for applications where less specialized imaging solutions suffice. The limited spectral range of standard InGaAs detectors, typically covering 0.9 to 2.5 micrometers, can also be a restraint for applications requiring imaging beyond this range. While advancements are being made, extending the spectral sensitivity further into longer wavelengths (e.g., to mid-wave infrared or even long-wave infrared) often requires more complex material combinations and integration strategies, adding to the cost and complexity. Power consumption and thermal management can also be a concern, particularly for uncooled InGaAs detector arrays in high-performance applications. Managing heat dissipation is crucial to maintain detector performance and longevity, especially in compact or embedded systems. The availability of skilled personnel with expertise in InGaAs technology, from fabrication to application development, can also be a bottleneck. The specialized nature of this field requires a highly trained workforce, and a shortage of such talent can impede innovation and market growth. Furthermore, the competition from alternative imaging technologies also poses a challenge. While InGaAs offers unique advantages in SWIR, other technologies like CMOS and CCD sensors are continuously improving and may offer sufficient performance for certain applications at a lower cost. Finally, geopolitical factors and supply chain disruptions can impact the availability and pricing of raw materials and the overall manufacturing process, leading to market volatility. The successful navigation of these challenges will be crucial for the sustained and accelerated growth of the InGaAs image detector chip market.

The InGaAs image detector chip market exhibits a dynamic interplay between geographical regions and technological segments, with certain areas and product types poised to dominate in the coming years. North America, particularly the United States, is a significant region demonstrating strong market leadership. This dominance is underpinned by substantial investments in defense, aerospace, and advanced industrial automation. The presence of leading companies in these sectors, coupled with robust government funding for research and development, fuels the demand for high-performance InGaAs detectors. The robust ecosystem of technology developers and integrators in the US allows for rapid prototyping and deployment of cutting-edge imaging solutions. Similarly, Europe, with its strong industrial base and significant defense spending, also represents a major market. Countries like Germany, France, and the UK are actively pursuing advanced imaging solutions for industrial inspection, automotive applications, and security. The emphasis on high-quality manufacturing and stringent quality control in European industries further bolsters the demand for InGaAs chips.

Examining the segments, InGaAs SWIR Area Arrays are projected to be a key segment to dominate the market. These array detectors offer two-dimensional imaging capabilities, making them essential for a wide range of applications that require spatial information.

While InGaAs SWIR Linear Arrays also hold significant importance, particularly in spectral imaging and line-scan applications, the broader applicability and higher demand for 2D imaging in critical sectors are expected to give InGaAs SWIR Area Arrays a leading edge in market share and growth during the study period. The continuous improvement in pixel count, sensitivity, and frame rates of area arrays further solidifies their dominant position. The integration of these arrays into compact and cost-effective camera modules is also expanding their reach into new markets. The forecast period of 2025-2033 will likely see the dominance of area arrays solidify further, driven by relentless innovation and the expanding application landscape.

Several factors are acting as significant growth catalysts for the InGaAs image detector chips industry. The increasing demand for advanced imaging solutions in defense and security, driven by evolving geopolitical landscapes, is a major catalyst. Furthermore, the growing adoption of automation and artificial intelligence in industrial sectors necessitates sophisticated vision systems, with InGaAs playing a crucial role in enabling them. The expanding applications in medical diagnostics and scientific research, where SWIR imaging provides unique insights, are also significant drivers. Continuous technological advancements leading to higher performance, lower cost, and miniaturization of InGaAs detectors are further accelerating market penetration across diverse industries.

This comprehensive report offers an in-depth analysis of the InGaAs image detector chips market, encompassing the historical period of 2019-2024 and projecting the market trajectory through 2033, with a specific focus on the estimated year of 2025. It delves into the intricate trends shaping the industry, the driving forces propelling its growth, and the challenges that may restrain its expansion. The report meticulously examines key regions and dominant market segments, providing valuable insights into their market share and growth potential. It also highlights crucial growth catalysts and identifies the leading players and their significant contributions. With a thorough understanding of market dynamics, technological advancements, and application landscapes, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving InGaAs image detector chips sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include Hamamatsu, SCD, Lynred, I3system, CETC (NO.44 Institute), Sensors Unlimited, Jiwu Optoelectronic, Sony, OSI Optoelectronics, GHOPTO, NORINCO GROUP (Kunming Institute of Physics), ZKDX, XenICs, Xi'an Leading Optoelectronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD 273 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "InGaAs Image Detector Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the InGaAs Image Detector Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.