1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared Cut-off Filter Glass?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Infrared Cut-off Filter Glass

Infrared Cut-off Filter GlassInfrared Cut-off Filter Glass by Type (IRCF-white Glass, IRCF-blue Glassx, Others, World Infrared Cut-off Filter Glass Production ), by Application (Smart Phone, Security Monitor, Car Camera, Computer Camera, Projector, Others, World Infrared Cut-off Filter Glass Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

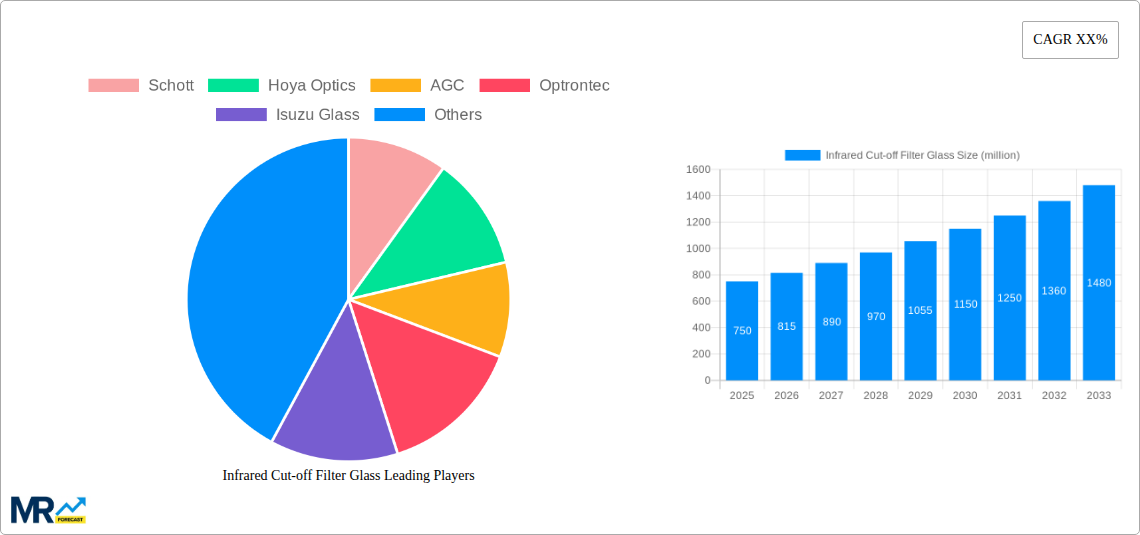

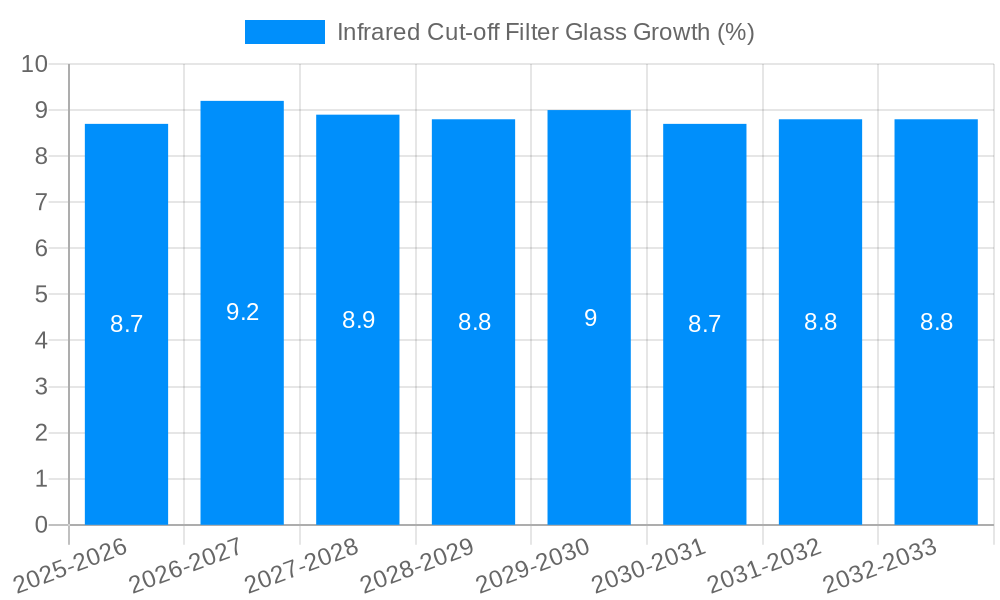

The global Infrared Cut-off Filter Glass market is projected to reach a substantial size of approximately USD 750 million by 2025, driven by a compound annual growth rate (CAGR) of roughly 8.5% between 2025 and 2033. This robust expansion is primarily fueled by the escalating demand for advanced imaging technologies across a multitude of applications. The burgeoning smartphone industry, with its increasing integration of multi-camera systems and enhanced low-light performance capabilities, represents a significant growth engine. Furthermore, the proliferation of high-definition security monitors and the growing adoption of sophisticated driver-assistance systems and autonomous driving technologies in the automotive sector, necessitating advanced car cameras, are also key contributors. The expanding use of projectors in both professional and home entertainment settings, along with the persistent need for high-quality computer cameras for remote work and virtual collaboration, further solidify the market's upward trajectory. This sustained demand underscores the critical role of infrared cut-off filters in enhancing image clarity and performance by effectively blocking unwanted infrared light.

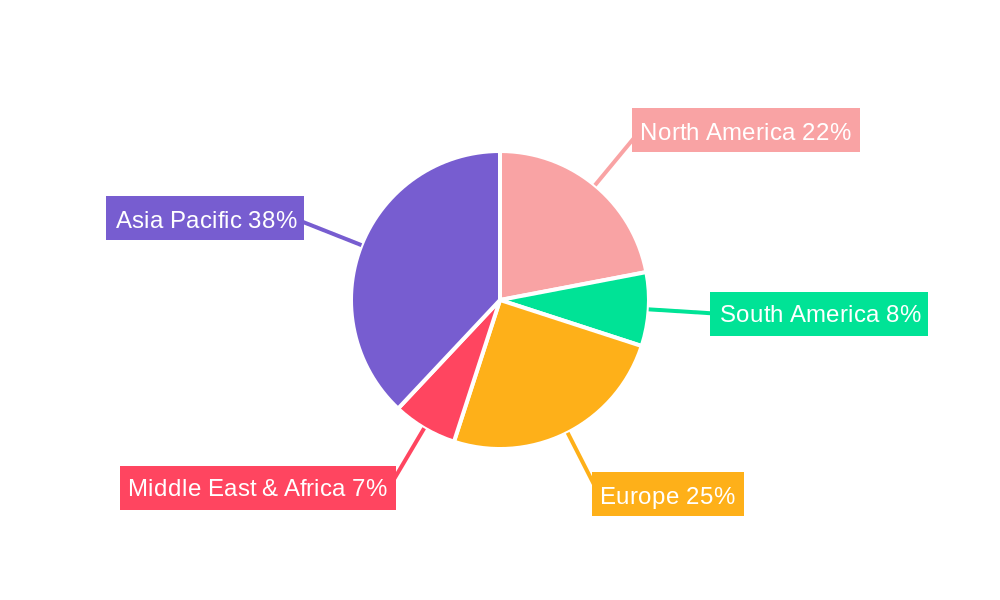

The market dynamics are further shaped by distinct segmentations and strategic regional influences. Within the "Type" segment, IRCF-white Glass and IRCF-blue Glass collectively dominate, catering to varied optical performance requirements across different devices. The "Application" segment clearly illustrates the market's reliance on consumer electronics and automotive sectors. Leading global players such as Schott, Hoya Optics, and AGC are at the forefront of innovation and production, leveraging their expertise in optical glass manufacturing. Geographically, the Asia Pacific region, led by China, is expected to maintain its dominant position due to its extensive manufacturing base for electronic components and devices, coupled with increasing domestic demand for advanced imaging solutions. North America and Europe also represent substantial markets, driven by technological advancements and the adoption of sophisticated surveillance and automotive imaging systems. While the market enjoys strong growth drivers, potential challenges include the complex manufacturing processes and the need for continuous innovation to keep pace with rapidly evolving technological demands.

The global Infrared Cut-off Filter (IRCF) glass market is poised for significant expansion, driven by an ever-increasing demand for enhanced image quality and color accuracy across a multitude of electronic devices. This report delves into the intricate dynamics of this market, projecting a robust Compound Annual Growth Rate (CAGR) from 2019 to 2033, with the base year of 2025 serving as a pivotal point for estimations. The historical period of 2019-2024 has witnessed a steady ascent in adoption, largely fueled by the burgeoning smartphone industry. Consumers are increasingly expecting their mobile devices to capture photos and videos with true-to-life colors, free from the undesirable color shifts caused by infrared light contamination. IRCF glass acts as a crucial component in achieving this, effectively blocking unwanted infrared radiation from reaching image sensors. Beyond smartphones, the market is also benefiting from the growing popularity of security monitoring systems, where clear and accurate visual data is paramount for effective surveillance. The sophistication of these systems, ranging from home security cameras to large-scale industrial monitoring, necessitates advanced optical components like IRCF glass to ensure reliable performance under various lighting conditions. Furthermore, the automotive sector is emerging as a significant growth avenue. The integration of advanced driver-assistance systems (ADAS) and in-car cameras for features like driver monitoring and panoramic views is creating a substantial demand for IRCF glass. These applications require cameras to function effectively in both bright sunlight and low-light conditions, where IR interference can degrade image quality. The projected market size, estimated to reach several hundred million units by the end of the forecast period, underscores the critical role IRCF glass plays in modern electronics. The study period of 2019-2033 will likely see innovations in material science and manufacturing processes, leading to more cost-effective and higher-performance IRCF solutions, further accelerating market penetration. The estimated revenue figures and unit shipments within the report will provide a comprehensive outlook on the financial trajectory and production volumes expected.

The infrared cut-off filter glass market is experiencing a powerful surge, primarily propelled by the relentless technological advancements and evolving consumer expectations in the digital imaging landscape. The ubiquitous presence of high-resolution cameras in smartphones, a segment that will continue to be a dominant application, is a primary driver. Users are no longer satisfied with basic image capture; they demand professional-grade quality, which necessitates the precise filtering of infrared light to prevent color cast and enhance detail. This demand is amplified by the increasing popularity of computational photography, where sophisticated algorithms rely on pristine optical input to deliver stunning visual results. Moreover, the escalating adoption of sophisticated surveillance and security systems globally is another major catalyst. From smart home security to commercial and industrial monitoring, the need for accurate, reliable, and clear video feeds under all lighting conditions is non-negotiable. IRCF glass plays a vital role in ensuring that these systems capture true colors and avoid image degradation due to infrared spectrum interference, thereby enhancing their effectiveness and trustworthiness. The automotive industry's rapid embrace of ADAS and in-cabin camera technology presents a substantial growth opportunity. As vehicles become more intelligent and safety-conscious, cameras are increasingly integrated for functions like lane departure warnings, pedestrian detection, and driver fatigue monitoring. The consistent performance of these cameras, irrespective of ambient light, is crucial, making IRCF glass an indispensable component. This convergence of consumer electronics sophistication, safety imperatives in surveillance, and automotive innovation collectively fuels the robust growth trajectory of the IRCF glass market.

Despite the promising growth trajectory, the Infrared Cut-off Filter (IRCF) glass market faces several challenges and restraints that could temper its expansion. One significant hurdle is the increasing commoditization and price pressure within certain segments, particularly for standard IRCF solutions used in high-volume consumer electronics like smartphones. As manufacturing processes become more refined, competition intensifies, leading to a squeeze on profit margins for manufacturers. This necessitates continuous innovation and the development of niche, high-value products to maintain profitability. Another restraint is the complexity and cost associated with advanced IRCF technologies. While demand for higher performance IRCFs, such as those with broader spectral control or integrated functionalities, is rising, their development and production can be capital-intensive. This can be a barrier for smaller players and may slow down the adoption of cutting-edge solutions in price-sensitive markets. Furthermore, the interdependence on other industries poses a potential risk. The IRCF market is heavily reliant on the health and growth of sectors like consumer electronics, automotive, and security. Economic downturns, supply chain disruptions, or shifts in consumer preferences within these end-user industries can directly impact the demand for IRCF glass. For instance, a slowdown in smartphone sales or a reduction in automotive production due to chip shortages could translate to reduced orders for IRCF glass manufacturers. Finally, stringent quality control and manufacturing precision are critical for IRCF glass. Any slight deviation in material composition or coating uniformity can lead to performance degradation, impacting image quality. Maintaining these high standards consistently across large production volumes can be challenging and requires significant investment in research, development, and quality assurance.

The global Infrared Cut-off Filter (IRCF) glass market is characterized by distinct regional strengths and segment dominance. The Asia-Pacific region is poised to be the undisputed leader in both production and consumption of IRCF glass, largely driven by its established position as the manufacturing hub for consumer electronics and a rapidly growing automotive sector. Countries like China, South Korea, and Taiwan are home to a significant concentration of smartphone assemblers, camera module manufacturers, and automotive component suppliers, creating immense local demand. Furthermore, the robust growth of their domestic security and surveillance markets, fueled by urbanization and increasing safety concerns, further bolsters IRCF glass consumption. Within the broader market, the Smart Phone segment is expected to continue its reign as the dominant application, representing a substantial portion of global IRCF glass production and revenue. The sheer volume of smartphone production worldwide, coupled with the continuous drive for improved camera performance and advanced imaging features like augmented reality (AR) and computational photography, ensures sustained demand. Consumers' increasing expectation for professional-grade photos and videos from their mobile devices directly translates into a need for sophisticated IRCF solutions that minimize color distortion and maximize image clarity.

Beyond smartphones, the Car Camera segment is emerging as a high-growth contender, projected to witness significant expansion over the forecast period (2025-2033). The proliferation of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-cabin monitoring systems is driving substantial demand for automotive-grade IRCF glass. These applications require cameras to operate reliably and deliver accurate visual information under diverse and often challenging lighting conditions, from bright sunlight to dusk and night. The stringent safety regulations and the increasing focus on vehicle safety features are compelling automakers to integrate more cameras, thereby fueling the IRCF glass market. The Security Monitor segment also represents a crucial and steadily growing application. The global increase in crime rates and the growing adoption of smart home security and surveillance systems in commercial and public spaces are contributing to a consistent demand for high-quality, reliable camera modules, which in turn require effective IRCF glass. The need for clear, color-accurate footage for evidence and monitoring purposes makes IRCF glass an essential component in this segment. The "Others" segment, which encompasses applications like projectors, computer cameras, and specialized industrial imaging equipment, will also contribute to market growth, albeit at a smaller scale compared to the dominant segments. The increasing use of webcams for remote work and online education, alongside advancements in projector technology for entertainment and business presentations, adds to the diversified demand landscape. The interplay of these dominant regions and application segments will shape the overall market dynamics and growth patterns of the IRCF glass industry throughout the study period.

The Infrared Cut-off Filter (IRCF) glass industry is poised for robust growth, propelled by several key catalysts. The relentless pursuit of enhanced image quality and color fidelity in consumer electronics, particularly smartphones, continues to be a primary growth engine. As computational photography and advanced imaging features become more sophisticated, the demand for precise IR filtering to ensure optimal sensor performance intensifies. The burgeoning automotive sector, with its increasing integration of ADAS and in-car camera systems, presents a significant and rapidly expanding growth avenue. The need for reliable, all-weather camera performance is driving substantial adoption of IRCF glass in vehicles. Furthermore, the growing global emphasis on security and surveillance, across both residential and commercial spaces, necessitates high-quality imaging solutions, thereby fueling demand for IRCFs.

This comprehensive report provides an in-depth analysis of the global Infrared Cut-off Filter (IRCF) glass market, spanning the historical period of 2019-2024 and projecting forward to 2033, with 2025 as the estimated base year. It meticulously details market trends, identifies key driving forces, and examines prevailing challenges and restraints. The report thoroughly analyzes the dominance of key regions and segments, offering insights into the significant growth catalysts propelling the industry forward. Furthermore, it presents a detailed overview of leading market players and significant developments that have shaped and will continue to shape the IRCF glass sector. The estimated market size in millions of units and projected revenue figures provide a clear financial outlook, making this report an indispensable resource for stakeholders seeking a comprehensive understanding of the IRCF glass market's past, present, and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Schott, Hoya Optics, AGC, Optrontec, Isuzu Glass, Sumita Optical Glass, Crystal-Optech, CDGM Glass Company, Hubei Wufang Photoelectric, Unionlight Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Infrared Cut-off Filter Glass," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Infrared Cut-off Filter Glass, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.