1. What is the projected Compound Annual Growth Rate (CAGR) of the Inflight Entertainment and Connectivity?

The projected CAGR is approximately 8.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Inflight Entertainment and Connectivity

Inflight Entertainment and ConnectivityInflight Entertainment and Connectivity by Type (Audio Entertainment, Video Entertainment, Satellite Telephone, Data Connection, Others), by Application (Passenger Entertainment, Crew Communication, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

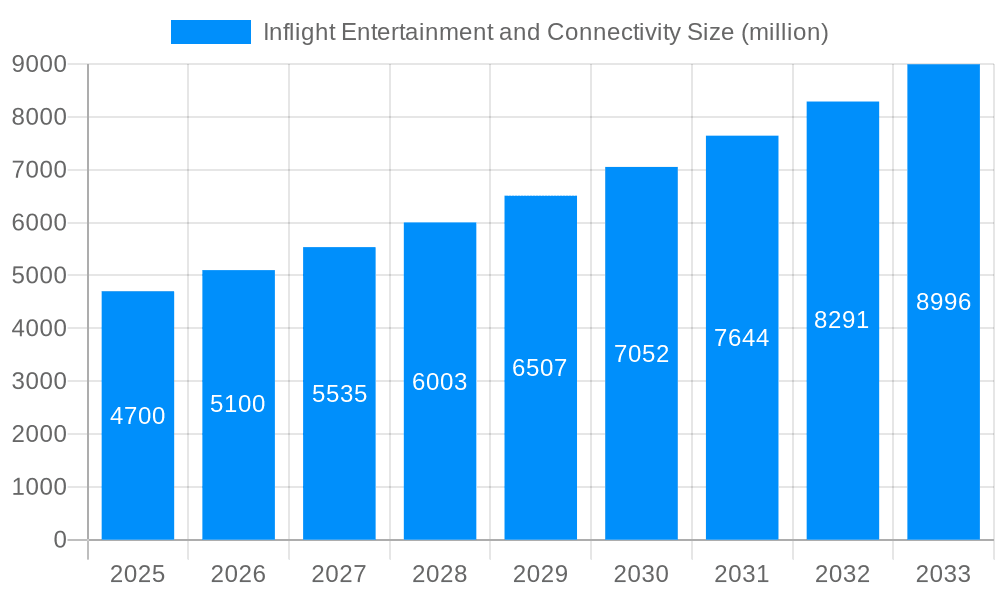

The Inflight Entertainment and Connectivity (IFEC) market is experiencing robust growth, projected to reach \$4330.5 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.7% from 2025 to 2033. This expansion is fueled by several key drivers. Increased passenger demand for high-speed internet access and diverse entertainment options during flights is a primary factor. Airlines are recognizing the competitive advantage of offering superior IFEC services, leading to significant investments in upgrading their onboard systems. Technological advancements, such as the adoption of high-throughput satellite (HTS) technology and improved Wi-Fi capabilities, are further accelerating market growth. Furthermore, the rise of streaming services and the increasing availability of personalized content are enhancing the overall passenger experience, driving demand for advanced IFEC solutions. The market is segmented by service type (internet connectivity, entertainment content), technology (satellite-based, terrestrial-based), and aircraft type (narrow-body, wide-body). Competitive pressures among IFEC providers are driving innovation and pushing down prices, benefiting airlines and passengers alike.

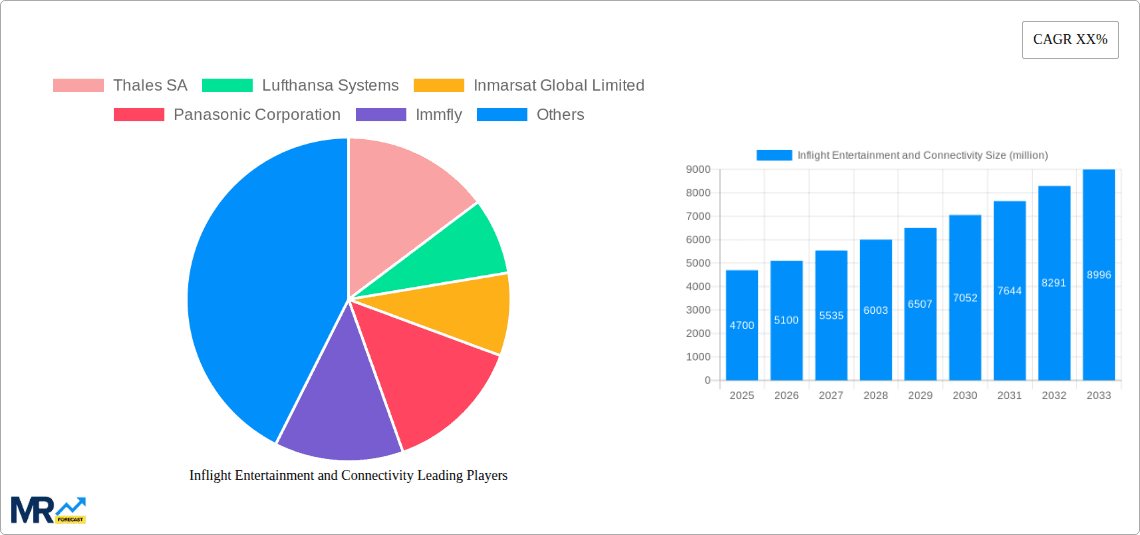

Growth in the IFEC market is expected to continue throughout the forecast period, driven primarily by the ongoing expansion of air travel and a growing preference for enhanced connectivity and entertainment options. However, challenges remain, including the high cost of implementing and maintaining advanced IFEC systems, the need for consistent global regulatory frameworks, and the need to address potential cybersecurity concerns associated with highly connected aircraft. Despite these restraints, the long-term outlook for the IFEC market remains positive, with considerable opportunities for growth in emerging markets and the ongoing development of innovative technologies such as 5G connectivity and personalized entertainment solutions tailored to individual passenger preferences. The competitive landscape is dominated by major players including Thales SA, Lufthansa Systems, and Inmarsat, among others, each vying for market share through product differentiation and strategic partnerships.

The inflight entertainment and connectivity (IFEC) market is experiencing significant transformation, driven by evolving passenger expectations and technological advancements. Over the study period (2019-2033), the market witnessed a substantial surge, exceeding several million units in annual installations. The base year 2025 reveals a mature yet dynamic landscape, with a clear shift towards higher bandwidth connectivity and personalized entertainment options. Passengers increasingly demand seamless streaming capabilities, comparable to their at-home experiences. This demand fuels the adoption of high-throughput satellite (HTS) technologies and the integration of robust onboard Wi-Fi networks. Furthermore, the industry is witnessing a rise in the adoption of personalized entertainment platforms, leveraging data analytics to offer tailored content based on individual passenger preferences. This personalization trend extends beyond simple movie selection to encompass interactive gaming, virtual reality experiences, and even customized shopping opportunities during the flight. The forecast period (2025-2033) projects continued growth, driven by increased air travel, the expansion of low-cost carriers adopting IFEC systems, and the development of innovative technologies like 5G integration for inflight connectivity. The historical period (2019-2024) showcased the foundation for this growth, with significant investments in infrastructure and content development, laying the groundwork for the market's current trajectory. The estimated year 2025 value showcases the culmination of these investments and the market's readiness for further expansion. This report analyzes the market's evolution, exploring the key drivers, challenges, and opportunities shaping its future. The estimated market value for 2025, exceeding tens of millions of units, highlights the widespread adoption of IFEC systems across various airlines and aircraft types.

Several key factors propel the growth of the inflight entertainment and connectivity market. The relentless demand for enhanced passenger experiences is paramount. Passengers, particularly on long-haul flights, expect high-speed internet access to stay connected with work, family, and social media. This expectation directly translates into increased airline investment in IFEC systems capable of delivering a seamless online experience at 30,000 feet. Moreover, the competitive landscape among airlines further fuels this growth. Airlines are increasingly leveraging IFEC systems as a key differentiator, offering premium connectivity and entertainment packages to attract and retain passengers. This competition fosters innovation and leads to the development of more advanced and user-friendly systems. Technological advancements, such as the deployment of HTS networks and the development of more efficient antenna systems, play a crucial role. These advancements enable higher bandwidth capacity and improved signal reliability, ensuring a consistently satisfying passenger experience. Finally, the continuous evolution of content offerings plays a significant role. Airlines are investing in partnerships with major content providers to offer a diverse and engaging catalog of movies, TV shows, music, and games, thereby improving passenger satisfaction and increasing the perceived value of the flight experience. These converging forces are driving the sustained expansion of the IFEC market.

Despite the positive trends, the inflight entertainment and connectivity market faces several challenges. High initial investment costs associated with installing and maintaining advanced IFEC systems pose a significant hurdle, particularly for smaller airlines. The cost of acquiring and licensing high-quality content adds another layer of complexity. Furthermore, the complexity of integrating IFEC systems with existing aircraft infrastructure can lead to delays and unforeseen expenses. Maintaining reliable connectivity while in flight presents another persistent challenge. Factors such as weather conditions, geographical location, and satellite availability can significantly impact connectivity quality, potentially leading to passenger dissatisfaction. Data security and privacy concerns are also increasingly prominent. Airlines need to implement robust security measures to protect passenger data transmitted over their onboard networks. Finally, regulatory compliance and standardization issues vary across different regions, leading to complexities in implementing and maintaining consistent IFEC systems globally. These challenges require ongoing technological advancements and effective regulatory frameworks to address.

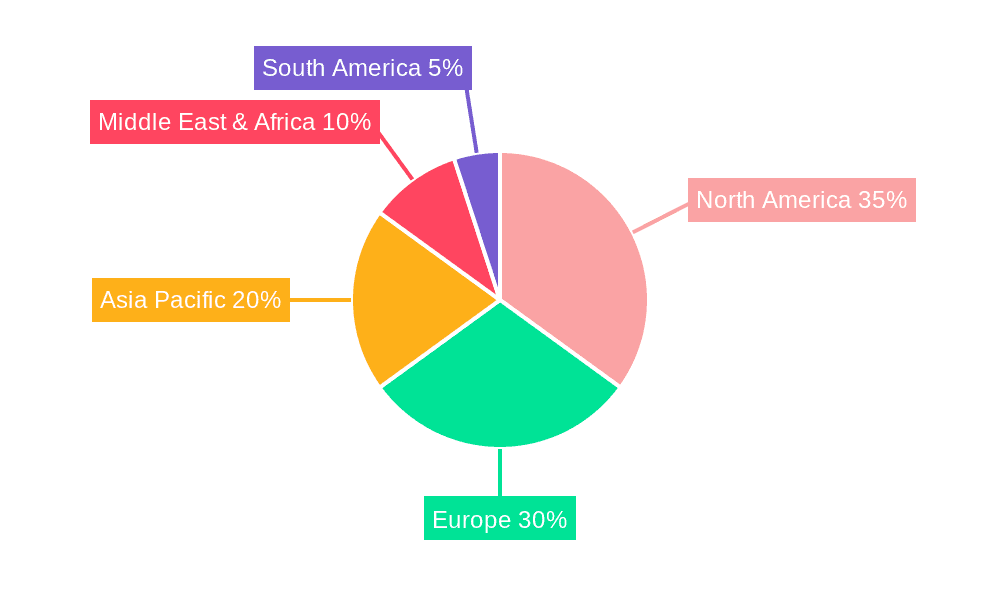

The North American and European markets are expected to dominate the IFEC market, primarily due to high levels of air travel and a greater adoption of advanced IFEC systems by airlines. Within these regions, the segment focusing on high-bandwidth connectivity solutions will experience the most substantial growth.

North America: The region boasts a high concentration of major airlines and aerospace companies actively investing in IFEC technologies. This, coupled with the significant number of long-haul flights, makes it a prime market for advanced solutions. The presence of major IFEC providers in the region also drives growth.

Europe: Similar to North America, Europe's well-established air travel industry, coupled with strong regulatory frameworks supporting technological advancements, creates a fertile ground for IFEC market expansion. The growing demand for enhanced passenger experiences among European travelers further stimulates adoption.

Asia-Pacific: While currently exhibiting lower market penetration, the Asia-Pacific region is poised for significant growth, driven by rapid expansion of low-cost carriers and rising disposable incomes within the region.

High-Bandwidth Connectivity: This segment is experiencing the strongest growth due to passenger demand for seamless streaming and online access. This is leading to investments in newer technologies such as HTS and 5G inflight connectivity.

Personalized Entertainment: The ability to tailor the entertainment experience based on passenger preferences adds significant value and is driving increased adoption of more sophisticated IFEC platforms.

The dominance of these regions and segments reflects the convergence of factors like existing infrastructure, high passenger demand, and significant investment in technological innovation. The forecast period anticipates continued growth in these areas, further solidifying their position in the market. The increasing demand for seamless connectivity in both short and long-haul flights further reinforces this trend.

The inflight entertainment and connectivity industry is experiencing accelerated growth, driven primarily by the increasing demand for improved passenger experiences, fierce competition among airlines, and rapid advancements in satellite and wireless technologies. This has resulted in the development of more affordable and efficient systems, making them accessible to a wider range of airlines. The incorporation of innovative entertainment options like virtual reality and interactive gaming further enhances the passenger journey, driving further market expansion.

This report provides a comprehensive overview of the inflight entertainment and connectivity market, offering insights into key trends, drivers, challenges, and opportunities. It analyzes market segments, key players, and regional dynamics, providing a valuable resource for businesses and stakeholders operating within or seeking to enter this dynamic industry. The report’s in-depth analysis enables informed decision-making, offering strategic recommendations based on market projections and technological advancements.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.5%.

Key companies in the market include Thales SA, Lufthansa Systems, Inmarsat Global Limited, Panasonic Corporation, Immfly, Burrana, ViaSat Inc., Raytheon Technologies Corporations, Safran, Global Eagle Entertainment Inc., Honeywell International Inc., Gogo LLC, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Inflight Entertainment and Connectivity," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Inflight Entertainment and Connectivity, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.