1. What is the projected Compound Annual Growth Rate (CAGR) of the Infant Formula Testing?

The projected CAGR is approximately 8.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Infant Formula Testing

Infant Formula TestingInfant Formula Testing by Type (NMR Spectroscopy, Chromatography, Mass Spectrometry, Polymerase Chain Reaction, Immunoassay, Others), by Application (Allergens Testing, Adulteration testing, Nutritional Analysis, Microbiology Testing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

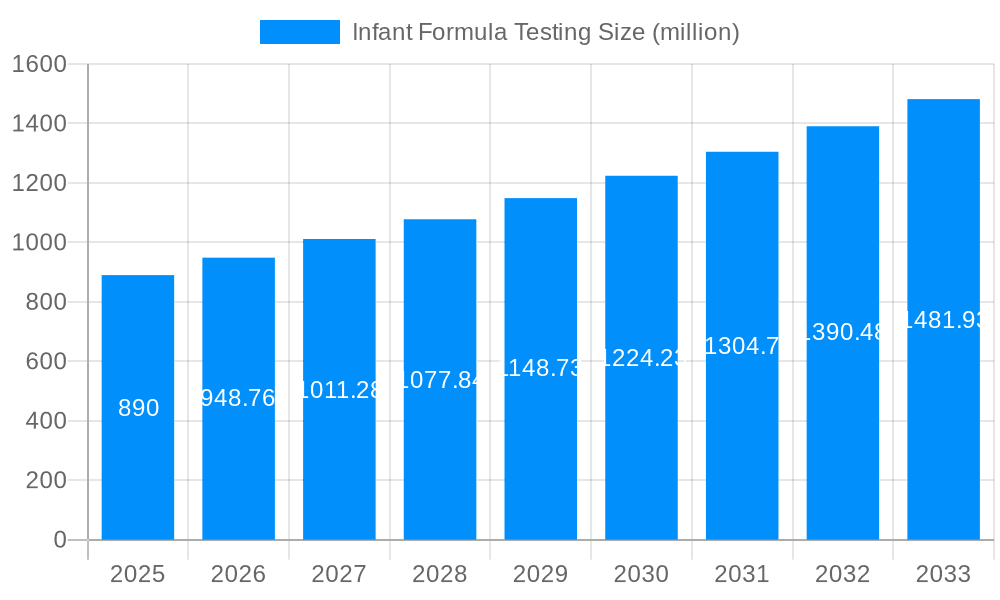

The infant formula testing market, valued at $890 million in 2025, is projected to experience robust growth, driven by stringent regulatory requirements for ensuring product safety and quality. Increasing consumer awareness regarding infant nutrition and health, coupled with rising incidences of food allergies and intolerances, further fuels market expansion. Technological advancements in analytical techniques, such as mass spectrometry and chromatography, are improving the accuracy and speed of testing, leading to more efficient quality control processes. The demand for comprehensive testing encompassing allergens, adulterants, nutritional components, and microbiological contaminants is significantly bolstering market growth. Key players like Agilent Technologies, Thermo Fisher Scientific, and Eurofins are investing heavily in R&D and expanding their testing capabilities to cater to this growing demand. Geographic expansion, particularly in developing economies with rising birth rates and increasing disposable incomes, presents substantial opportunities for market players. While challenges like high testing costs and the need for skilled personnel exist, the overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033.

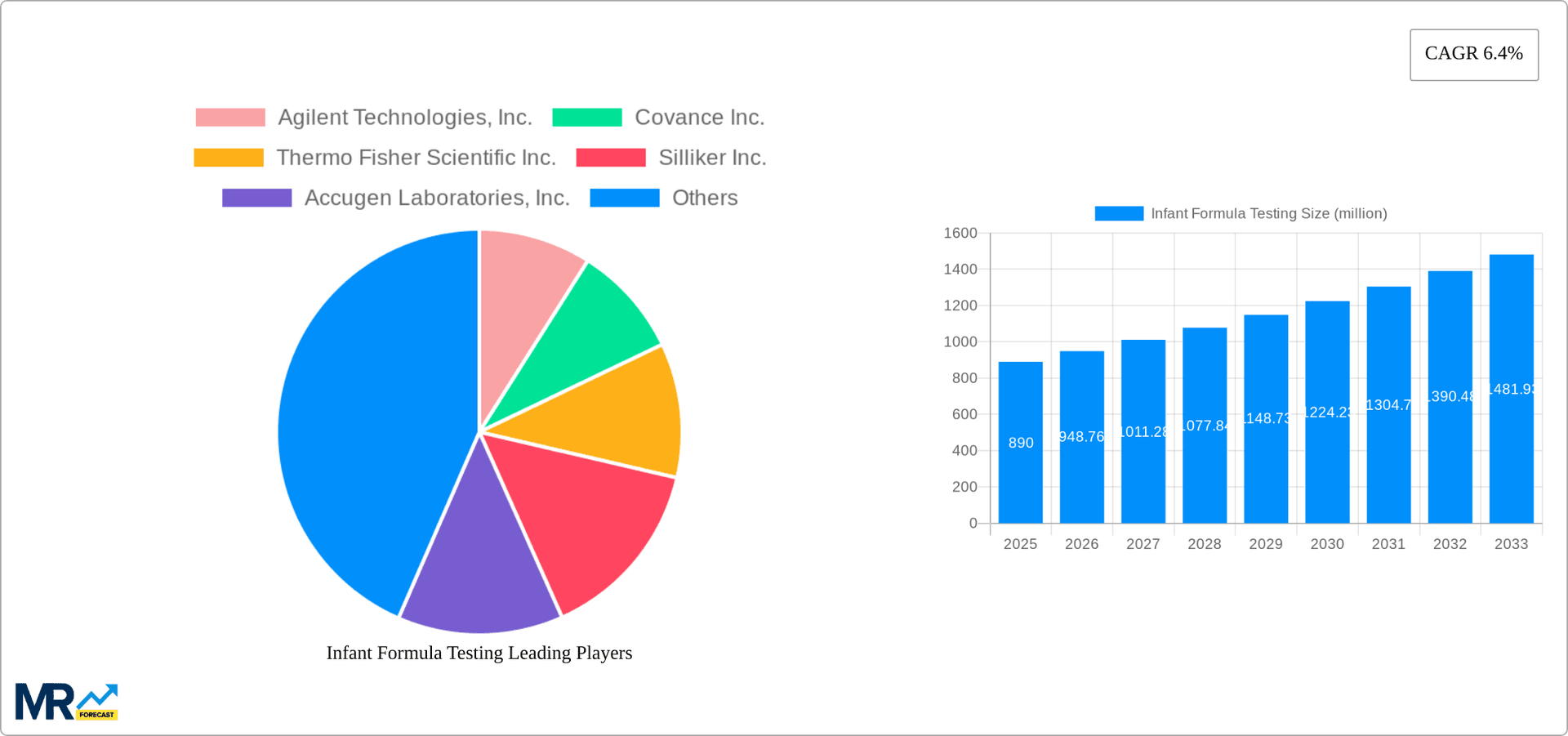

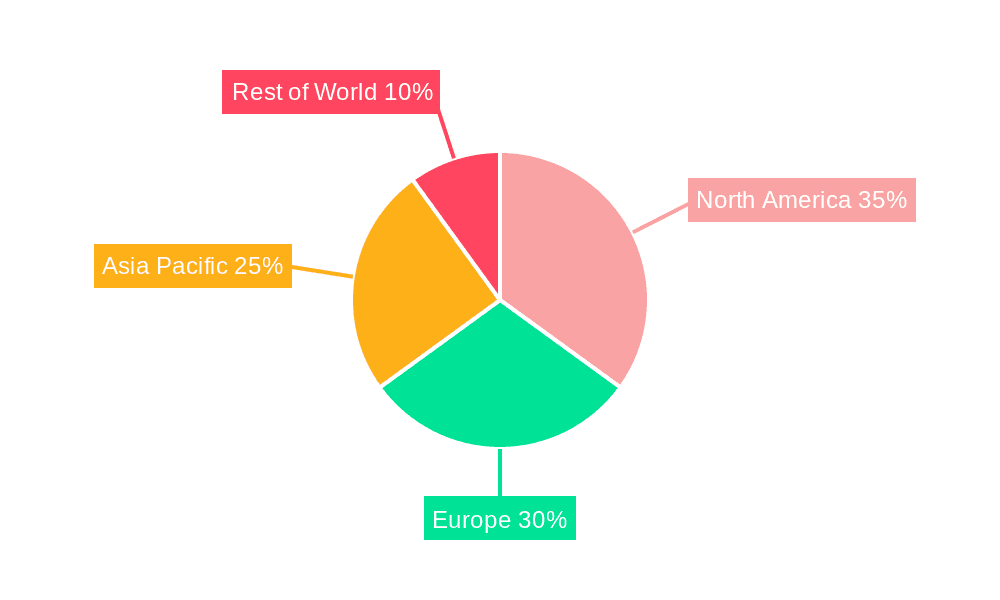

The market segmentation reveals that NMR Spectroscopy, Chromatography, and Mass Spectrometry dominate the techniques used for testing. Allergen testing and nutritional analysis constitute the largest application segments, reflecting consumer concerns about food safety and infant development. North America and Europe currently hold significant market shares, but Asia-Pacific is poised for rapid growth, driven by increasing urbanization, rising disposable incomes, and the expansion of the middle class in regions like China and India. The competitive landscape is characterized by the presence of both large multinational corporations and specialized testing laboratories, suggesting a dynamic market with considerable potential for consolidation and innovation. The ongoing focus on improving infant health and safety regulations will remain a major driver for continued market growth throughout the forecast period.

The infant formula testing market is experiencing robust growth, driven by escalating consumer awareness regarding infant health and safety, stringent government regulations, and the rising prevalence of infant allergies and intolerances. The market size, valued at USD XX million in 2024, is projected to reach USD YY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This growth is fueled by the increasing demand for safe and nutritious infant formulas, leading to a surge in testing activities across various parameters. The historical period (2019-2024) witnessed a steady expansion, primarily driven by advancements in testing technologies and a growing focus on quality control within the infant formula manufacturing sector. The estimated market size for 2025 is pegged at USD ZZ million, indicating a significant upward trajectory. The forecast period (2025-2033) promises even stronger growth, propelled by factors such as the expanding global population and increasing disposable incomes in developing economies. Technological advancements like the incorporation of rapid and sensitive detection methods are further contributing to the market expansion. Furthermore, the increasing adoption of sophisticated analytical techniques such as mass spectrometry and PCR is driving market growth. The market is also witnessing a shift towards outsourcing testing services, creating significant opportunities for contract research organizations (CROs) and independent testing laboratories. The preference for advanced testing solutions capable of detecting a wide range of contaminants, allergens, and nutritional deficiencies is also contributing to the growth. Overall, the trends suggest a bright future for the infant formula testing market, characterized by continuous expansion and innovation.

Several factors are propelling the growth of the infant formula testing market. Firstly, heightened consumer awareness regarding food safety and the potential health risks associated with contaminated infant formula is significantly increasing demand for rigorous testing. Parents are increasingly demanding assurances of product safety, driving manufacturers to invest heavily in robust quality control measures. Secondly, stringent government regulations and quality standards imposed globally are playing a vital role. Regulatory bodies worldwide are enforcing stricter guidelines for infant formula composition, manufacturing practices, and testing procedures, driving the need for comprehensive and accurate testing solutions. Thirdly, the increasing prevalence of infant allergies and intolerances is leading to a growing demand for testing to identify potential allergens and ensure product suitability for diverse infant populations. The need to detect specific allergens, such as milk protein, soy, and nuts, is becoming increasingly critical. Fourthly, advancements in testing technologies such as high-throughput screening, mass spectrometry, and next-generation sequencing are improving the efficiency and accuracy of infant formula testing, making it more accessible and cost-effective. These technologies enable the detection of even trace amounts of contaminants or allergens, ensuring enhanced product safety. Finally, the rising disposable incomes in developing countries are further boosting market growth, as access to infant formula increases, so does the need for comprehensive testing to ensure product quality and safety.

Despite the strong growth prospects, several challenges and restraints hinder the infant formula testing market. Firstly, the high cost associated with advanced testing methodologies can be a barrier, particularly for smaller manufacturers in developing nations. The investment in sophisticated equipment and skilled personnel is substantial, potentially limiting access for some companies. Secondly, the complexity of testing procedures and the need for specialized expertise represent another challenge. Accurate and reliable results require highly trained personnel and sophisticated analytical techniques. A shortage of skilled professionals in some regions can limit testing capacity. Thirdly, the evolving regulatory landscape can also create complexities. Different countries and regions have diverse regulations and standards, leading to compliance issues and challenges in harmonizing testing procedures across multiple jurisdictions. Fourthly, the need for robust quality control and stringent quality assurance measures to ensure reliability and credibility of results can pose logistical and operational challenges. Ensuring the quality and validity of the data is critical to maintain the industry's reputation. Finally, the potential for emerging contaminants and allergens that haven't been fully characterized, presents a continued challenge to the industry, requiring constant adaptation and development of new testing methodologies.

Dominant Segments:

Application: Nutritional Analysis holds a significant share of the market, driven by the increasing focus on providing infants with optimal nutrition. This segment's growth is further amplified by the need for precise measurements of essential nutrients and micronutrients, including vitamins, minerals, and fatty acids. Allergens testing is another rapidly growing segment, driven by rising allergies in infants.

Type: Chromatography and Mass Spectrometry techniques are currently dominating the market due to their high sensitivity, specificity, and wide applicability for various analyte detection. These techniques are widely used for detecting contaminants, allergens, and nutritional components in infant formula. The rising popularity of these advanced techniques will accelerate market expansion.

Dominant Regions:

North America: The region is projected to maintain its leading position owing to stringent regulatory frameworks, high awareness of infant health, and a robust healthcare infrastructure. The presence of major players and advanced research capabilities in the region also contributes to its dominance.

Europe: Similar to North America, Europe benefits from established regulatory guidelines, high consumer awareness regarding food safety, and a developed healthcare sector. The region's stringent food safety regulations further enhance the market's growth.

Asia Pacific: This region exhibits substantial growth potential due to a rapidly expanding population, increasing disposable incomes, and rising awareness regarding infant nutrition and health. However, challenges remain related to infrastructure development and regulatory standardization across different countries within the region.

The dominance of these regions and segments is rooted in a combination of factors including strong regulatory frameworks, increased consumer demand for safe and nutritious infant formula, and the availability of advanced testing technologies and skilled professionals. The robust healthcare infrastructure in these regions also provides support for the expansion of testing services.

The infant formula testing industry is experiencing substantial growth fueled by several key catalysts. Firstly, the increasing prevalence of allergies and intolerances in infants is driving a surge in demand for allergen testing. Secondly, stricter government regulations concerning infant formula safety and composition are mandating thorough testing procedures. Thirdly, technological advancements like mass spectrometry and PCR are providing enhanced sensitivity and speed in detection of contaminants, allergens, and nutritional deficiencies. Finally, the rise in disposable incomes globally and increased access to infant formula are leading to greater demand for quality assurance and safety testing.

This report provides a comprehensive analysis of the infant formula testing market, encompassing market size estimations, growth forecasts, key trends, driving forces, challenges, and significant developments. It details leading players and their market strategies, regional market analysis, and a segmentation based on testing type and application. The report offers valuable insights for industry stakeholders, including manufacturers, testing laboratories, regulatory bodies, and investors, providing a complete understanding of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.7%.

Key companies in the market include Agilent Technologies, Inc., Covance Inc., Thermo Fisher Scientific Inc., Silliker Inc., Accugen Laboratories, Inc., Intertek Group PLC, Eurofins Central Analytical Laboratories, ELISA Technologies, Inc., Bureau Veritas S.A., SGS SA, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Infant Formula Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Infant Formula Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.