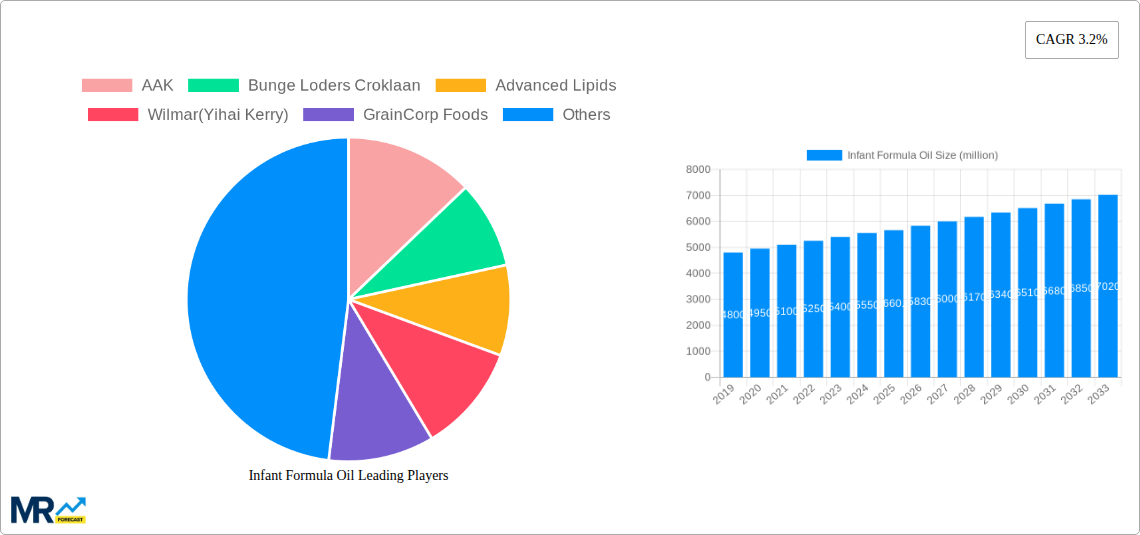

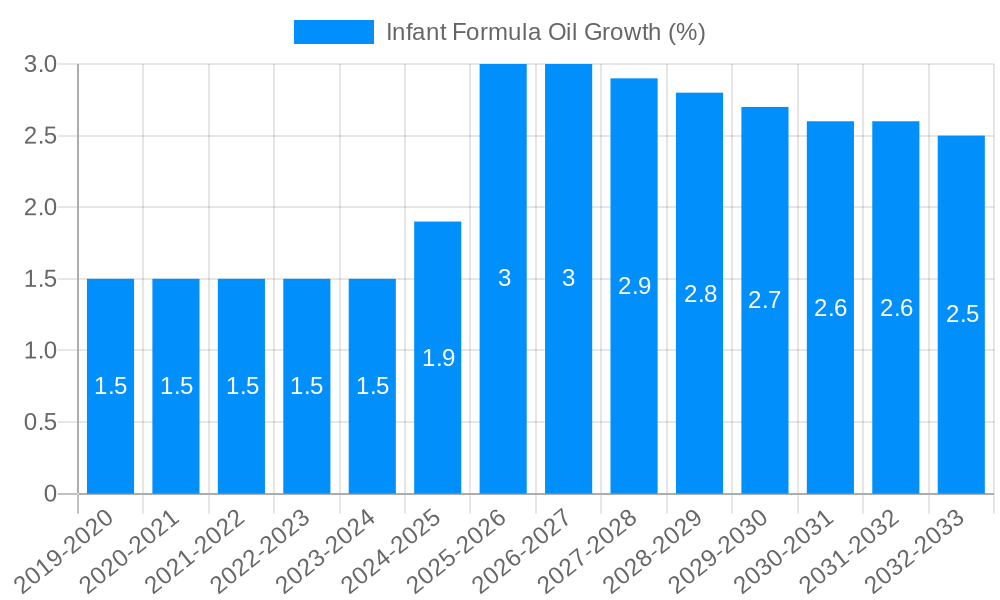

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infant Formula Oil?

The projected CAGR is approximately 3.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Infant Formula Oil

Infant Formula OilInfant Formula Oil by Type (OPO Fat, Other Oils and Fats, 0-6 Months Baby, 6-12 Months Baby, 12-36 Months Baby), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Infant Formula Oil market is poised for steady expansion, projected to reach approximately $5,660.3 million in value. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.2% throughout the forecast period of 2025-2033. A significant driver for this market is the increasing global birth rate and a growing awareness among parents regarding the crucial role of specialized fats and oils in infant nutrition. The demand for high-quality, safe, and nutritionally complete infant formula is paramount, leading manufacturers to invest in advanced lipid technologies and research to create formulations that closely mimic breast milk composition. Key segments within this market include specialized oils like OPO (Oleic-Palmitic-Oleic) fat, which offers enhanced absorption and digestive benefits for infants, alongside a broader category of other essential oils and fats. The market also caters to specific age groups, with dedicated segments for 0-6 Months Baby, 6-12 Months Baby, and 12-36 Months Baby, each requiring tailored nutritional profiles.

Further fueling market growth is the rising disposable income in emerging economies, enabling more families to opt for premium infant nutrition products. The trend towards organic and sustainably sourced ingredients in infant formula also presents a significant opportunity. Companies are actively innovating to address concerns about infant digestive health, allergies, and cognitive development, with specialized oils playing a vital role in these advancements. While the market is robust, potential restraints include stringent regulatory landscapes regarding food safety and labeling, as well as fluctuating raw material prices which can impact manufacturing costs. Nevertheless, the overarching trend points towards a sustained demand for sophisticated infant formula oil solutions, driven by global parental focus on infant well-being and the continuous innovation within the food and nutrition industry.

Here's a unique report description for Infant Formula Oil, incorporating your specified elements and a creative approach:

The global infant formula oil market is poised for significant evolution, driven by an intricate interplay of nutritional science, evolving consumer demands, and technological advancements. Over the Study Period (2019-2033), we anticipate a dynamic trajectory for this crucial segment within the infant nutrition industry. The Base Year (2025) serves as a critical anchor, from which our projections will illuminate a path forward through the Forecast Period (2025-2033), building upon insights gleaned from the Historical Period (2019-2024). A key insight emerging from our analysis is the increasing sophistication of infant formula formulations, moving beyond basic caloric provision to mimic the complex fatty acid profiles and functional benefits of breast milk. This shift is particularly evident in the growing demand for specialized oils like OPO Fat (1,3-dioleoyl-2-palmitoylglycerol), which is designed to enhance fat digestion and absorption, thereby reducing common infant digestive discomforts such as colic and constipation. The market is witnessing a substantial volume increase in OPO fat, projected to reach figures in the hundreds of millions of units by the end of the forecast period.

Beyond OPO fat, the broader category of Other Oils and Fats will continue to be a significant contributor, yet its growth will be characterized by a greater emphasis on origin, purity, and specific functional attributes. Consumers are increasingly scrutinizing the sourcing of these oils, seeking sustainable and traceable ingredients. This trend is reflected in the rising popularity of high-oleic oils and strategically blended oils that optimize the essential fatty acid balance, crucial for cognitive and visual development in infants. The market segmentation by age group also reveals distinct trends. The 0-6 Months Baby segment remains the foundational pillar, characterized by strict regulatory oversight and a primary focus on mimicking breast milk composition. However, the 6-12 Months Baby and 12-36 Months Baby segments are exhibiting accelerated growth, as parents seek formulas that provide continued nutritional support during the transitional phases of solid food introduction and for toddlers with specific dietary needs. This expansion is fueled by a greater understanding of the long-term impact of early nutrition on health outcomes. We project the overall market volume to ascend into the billions of units, with specialized oils like OPO fat carving out a significant and growing niche. The competitive landscape is expected to remain robust, with innovation in fat modification and encapsulation technologies playing a pivotal role in shaping market share and product differentiation.

Several powerful forces are converging to drive the growth and innovation within the infant formula oil sector. Paramount among these is the escalating global birth rate, particularly in emerging economies, which directly translates into a larger addressable market for infant nutrition products. Concurrently, there's a discernible shift in consumer perception, with parents increasingly prioritizing the nutritional quality of infant formula, viewing it as a critical determinant of their child's long-term health and development. This heightened awareness is fueled by extensive research linking early nutrition to outcomes such as cognitive function, immune system development, and even the prevention of chronic diseases later in life. Consequently, there is a robust demand for specialized ingredients that closely replicate the composition and benefits of breast milk. This has led to a surge in the adoption of advanced lipid technologies, including the incorporation of structured lipids like OPO Fat, which offer enhanced digestibility and nutrient absorption, mirroring the physiological advantages of breast milk. Furthermore, increasing disposable incomes in many regions allow parents to opt for premium, scientifically formulated infant formulas, further stimulating demand for high-quality infant formula oils. The evolving regulatory landscape, while stringent, also acts as a catalyst by emphasizing safety and efficacy, pushing manufacturers to invest in superior ingredients and production processes.

Despite the promising growth trajectory, the infant formula oil market is not without its significant hurdles and constraints. Foremost among these is the intense scrutiny and stringent regulatory framework governing infant formula production worldwide. These regulations, while essential for consumer safety, can be complex and costly to navigate, potentially slowing down product development and market entry for new players. Supply chain volatility and the sourcing of high-quality, specialized oils present another considerable challenge. Fluctuations in the availability and price of key raw materials, such as palm oil derivatives or specific vegetable oils, can impact production costs and profit margins. Moreover, the persistent public perception that breast milk is the optimal nutrition source, coupled with occasional negative publicity surrounding infant formula safety incidents, can create consumer apprehension and influence purchasing decisions. The highly competitive nature of the market, with established global players and numerous regional manufacturers, intensifies price pressures and necessitates continuous innovation to maintain market share. Lastly, the increasing demand for organic and sustainably sourced ingredients, while a growth opportunity, also adds complexity to sourcing and certification processes, potentially limiting scalability for some manufacturers.

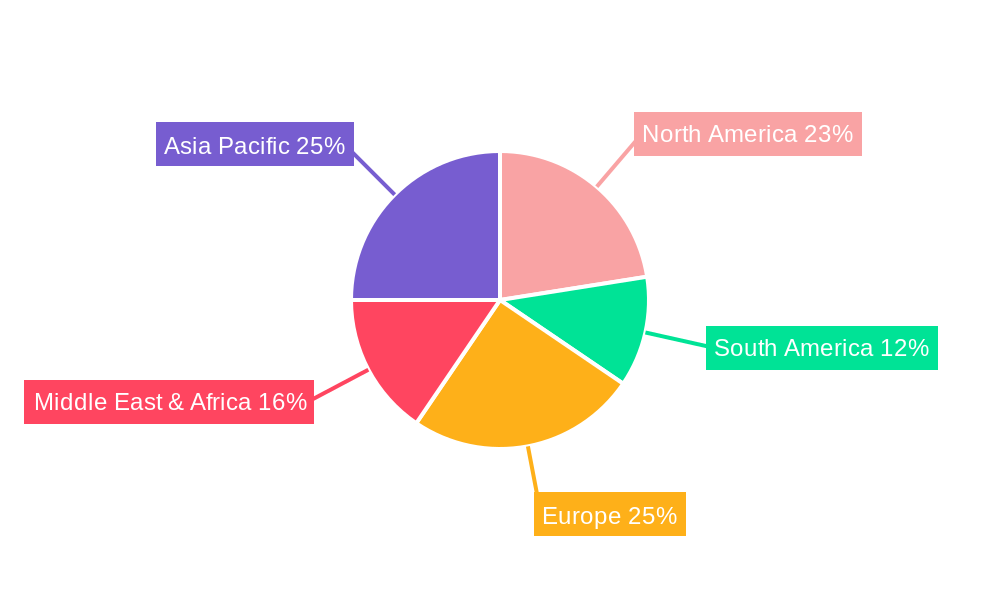

The global infant formula oil market is characterized by a dynamic interplay of regional dominance and segment leadership, with a clear indication that Asia-Pacific is poised to be a key region driving significant market share and volume throughout the Study Period (2019-2033). This dominance is underpinned by a confluence of factors including a large and growing infant population, increasing disposable incomes, and a rising awareness among parents regarding the importance of specialized infant nutrition. Countries such as China, India, and Southeast Asian nations are at the forefront of this growth, with a substantial demand for both general and specialized infant formula oils. The 0-6 Months Baby segment, by virtue of being the initial and most critical phase of infant nutrition, will continue to command a substantial portion of the market. However, the 6-12 Months Baby and 12-36 Months Baby segments are projected to witness more rapid growth rates, as parents seek to maintain optimal nutrition as their infants transition through developmental stages and begin consuming solid foods.

Within this broad regional and segment analysis, the OPO Fat segment is emerging as a significant growth catalyst and a key indicator of market sophistication. The growing understanding of its physiological benefits, such as improved fat digestion, calcium absorption, and potential contributions to gut health and bone development, is driving its adoption at an accelerated pace. Manufacturers are increasingly incorporating OPO fat into their premium formulations, recognizing its value proposition for parents seeking to alleviate common infant digestive issues like colic and constipation. The projected volume for OPO fat is expected to reach several hundred million units, making it a substantial segment within the broader infant formula oil market. The Asia-Pacific region, with its vast population and burgeoning middle class, is a primary driver of this OPO fat demand. Parents in these regions are becoming more receptive to scientifically advanced ingredients that offer tangible benefits for their infants' well-being.

In addition to Asia-Pacific, North America and Europe will continue to be significant markets, characterized by high per capita consumption and a strong emphasis on premium and specialized products. Here, the focus is often on trace mineral fortification, specific fatty acid profiles, and hypoallergenic formulations, all of which rely on advanced infant formula oils. The 12-36 Months Baby segment in these developed regions is also experiencing robust growth as parents extend the use of formula for toddlers, seeking continued nutritional support. The overall market value is expected to reach tens of billions of dollars by the end of the forecast period, with the strategic importance of specialized oils like OPO fat only set to increase as nutritional science continues to advance and parents demand the best for their children. The competitive landscape, involving major players like AAK, Bunge Loders Croklaan, and Advanced Lipids, will be crucial in shaping the availability and innovation within these key segments and regions.

The infant formula oil industry's growth is being significantly catalyzed by evolving nutritional science and increasing parental awareness of the long-term health benefits of optimal early nutrition. The demand for scientifically validated ingredients that mimic breast milk's complex lipid profiles, such as OPO Fat, is a major driver. Technological advancements in fat processing and structuring allow for the creation of specialized oils with enhanced digestibility and bioavailability, directly addressing common infant digestive issues and promoting better nutrient absorption. Furthermore, rising disposable incomes in emerging economies are enabling a larger consumer base to access premium infant formula products, thereby expanding the market for high-quality oils. The consistent global birth rate also provides a foundational demand for infant nutrition products.

This comprehensive report delves deep into the intricate landscape of the infant formula oil market, offering invaluable insights for stakeholders. It meticulously analyzes market dynamics, including segmentation by type (e.g., OPO Fat, Other Oils and Fats) and by infant age group (0-6 Months Baby, 6-12 Months Baby, 12-36 Months Baby). The study encompasses a robust Study Period (2019-2033), anchored by a thorough Base Year (2025) and an extended Forecast Period (2025-2033), building upon detailed analysis of the Historical Period (2019-2024). Key drivers, such as increasing parental demand for premium, scientifically formulated products, and restraints, like stringent regulations and supply chain complexities, are thoroughly examined. The report identifies dominant regions and segments poised for substantial growth, providing a roadmap for strategic decision-making. With a focus on innovation and emerging trends, this report equips businesses with the knowledge to navigate this vital sector and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.2%.

Key companies in the market include AAK, Bunge Loders Croklaan, Advanced Lipids, Wilmar(Yihai Kerry), GrainCorp Foods, Danisco/DuPont, Fuji Oil Holdings, Stepan International, .

The market segments include Type.

The market size is estimated to be USD 5660.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Infant Formula Oil," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Infant Formula Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.