1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Tall Oil Fatty Acid?

The projected CAGR is approximately 3.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Tall Oil Fatty Acid

Industrial Tall Oil Fatty AcidIndustrial Tall Oil Fatty Acid by Type (Type I, Type II, Type III), by Application (Alkyd Resins, Dimer Acids, Lubricant Additives, Soaps & Detergents, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

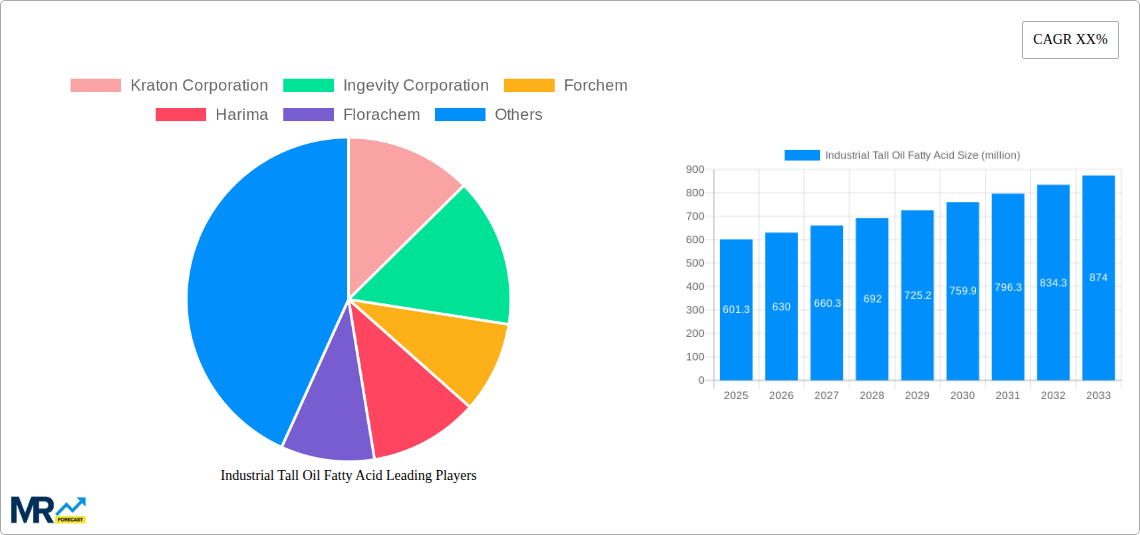

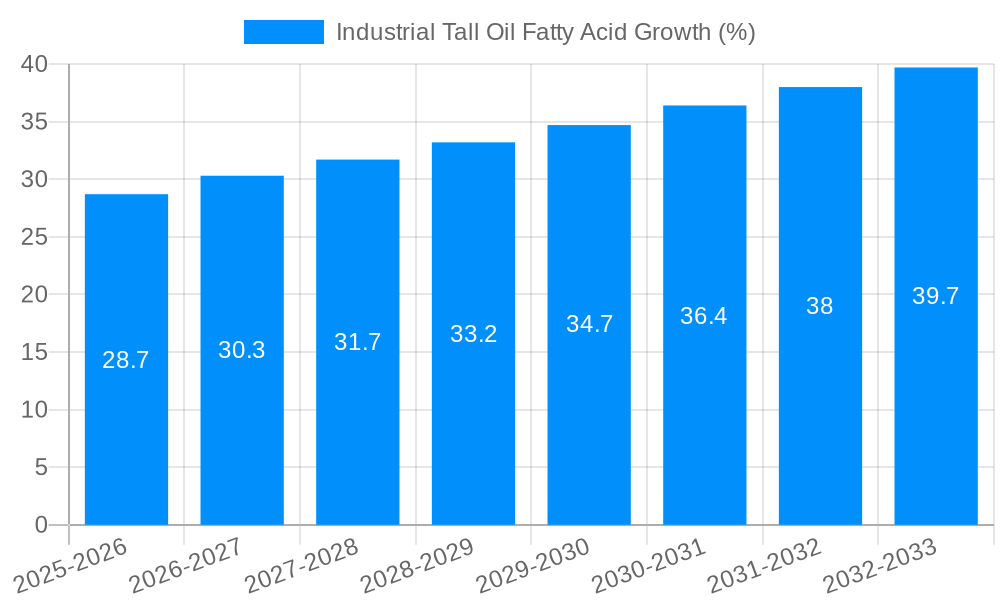

The global Industrial Tall Oil Fatty Acid market is poised for steady expansion, projected to reach a market size of $474.3 million with a Compound Annual Growth Rate (CAGR) of 3.4% between 2025 and 2033. This growth is primarily driven by the increasing demand from key application segments such as alkyd resins, where its use in paints and coatings continues to be robust. The versatility of tall oil fatty acids also fuels their adoption in dimer acids, lubricants, and soaps and detergents, underscoring their importance as a sustainable and cost-effective oleochemical. Furthermore, growing environmental consciousness and the push towards bio-based materials are expected to bolster the market's upward trajectory. Leading companies like Kraton Corporation, Ingevity Corporation, and Harima are actively investing in research and development to enhance product offerings and expand their market reach, contributing to the overall market dynamism.

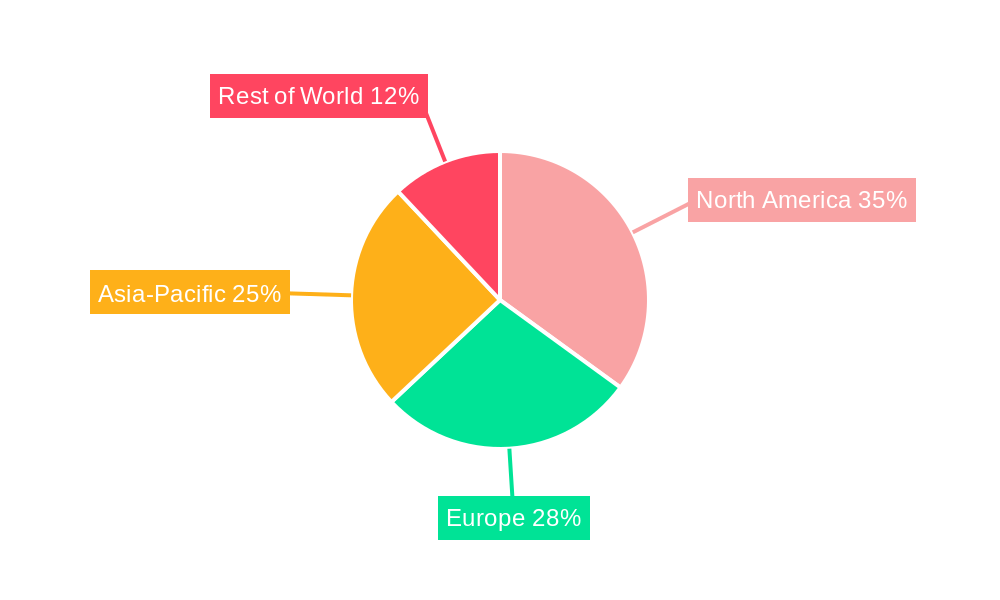

The market's expansion is further supported by evolving industry trends, including the development of higher-purity tall oil fatty acid grades for specialized applications and advancements in fractionation technologies to improve yield and quality. Geographically, the Asia Pacific region, particularly China and India, is anticipated to witness significant growth due to rapid industrialization and burgeoning manufacturing sectors. However, challenges such as price volatility of crude tall oil, the primary feedstock, and the availability of competing bio-based and petroleum-derived alternatives may present headwinds. Nevertheless, the inherent sustainability and performance benefits of industrial tall oil fatty acids are expected to outweigh these restraints, ensuring continued market penetration across diverse industrial applications.

This comprehensive report delves into the dynamic global Industrial Tall Oil Fatty Acid (TOFA) market, meticulously analyzing trends, drivers, challenges, and growth opportunities from the historical period of 2019-2024 through to the projected forecast period of 2025-2033, with a base year estimation of 2025. The market is poised for substantial expansion, with estimated revenues projected to reach $X.XX billion by 2033. This analysis offers in-depth insights into the competitive landscape, key regional influences, and evolving application demands, providing strategic intelligence for stakeholders navigating this critical sector.

The Industrial Tall Oil Fatty Acid market is experiencing a significant transformation, characterized by a growing demand for sustainable and bio-based chemical intermediates. XXX reveals key market insights that underscore this evolution. The increasing adoption of TOFA as a renewable alternative to petroleum-based feedstocks in various industrial applications, including alkyd resins, dimer acids, lubricant additives, and soaps & detergents, is a primary trend. This shift is driven by mounting environmental regulations and a broader corporate commitment to sustainability initiatives across industries. The market is witnessing a steady rise in demand for higher purity TOFA grades, particularly Type I and Type II, as manufacturers seek optimized performance characteristics for their end products. Geographical shifts are also evident, with emerging economies in Asia Pacific demonstrating robust growth potential, fueled by expanding manufacturing bases and increasing consumer demand for goods derived from TOFA. Furthermore, innovation in processing technologies is enhancing TOFA yield and quality, contributing to its competitive edge. The forecast period is expected to see a consolidated market structure, with strategic partnerships and mergers and acquisitions playing a crucial role in shaping the competitive dynamics. The overall market size is projected to experience a Compound Annual Growth Rate (CAGR) of Y.YY% between 2025 and 2033, signifying a healthy and sustainable growth trajectory. The current market value in the base year of 2025 is estimated at $Z.ZZ billion.

The Industrial Tall Oil Fatty Acid (TOFA) market is propelled by a confluence of powerful forces, primarily centered around the global imperative for sustainability and the inherent advantages offered by this bio-based chemical. The increasing stringency of environmental regulations worldwide, coupled with a growing consumer preference for eco-friendly products, is a significant driver. Industries are actively seeking to reduce their carbon footprint and reliance on finite fossil fuels, making TOFA an attractive and viable alternative. Furthermore, the inherent versatility of TOFA, derived from crude tall oil a byproduct of the Kraft pulping process in the paper industry, allows its utilization across a broad spectrum of applications, from coatings and adhesives to personal care products and lubricants. This wide applicability ensures sustained demand and market resilience. The cost-effectiveness of TOFA, particularly when compared to some petroleum-derived counterparts, further enhances its appeal, especially in price-sensitive markets. Advancements in refining and processing technologies have also played a crucial role in improving the purity and performance characteristics of TOFA, making it suitable for even more demanding applications and expanding its market reach. The projected growth of downstream industries such as construction, automotive, and personal care will continue to fuel the demand for TOFA.

Despite its promising growth trajectory, the Industrial Tall Oil Fatty Acid (TOFA) market faces several challenges and restraints that could temper its expansion. The inherent volatility in the supply of crude tall oil, which is directly linked to the production volumes of the pulp and paper industry, poses a significant risk. Fluctuations in this feedstock supply can lead to price instability and impact the overall availability of TOFA. Additionally, the quality and composition of crude tall oil can vary depending on the wood source, pulping process, and geographical location, which can affect the consistency and performance of the derived TOFA. Competition from alternative bio-based and petroleum-derived fatty acids, as well as other chemical intermediates, remains a persistent challenge. These alternatives may offer specific performance advantages or more stable supply chains in certain applications, creating competitive pressures for TOFA. Furthermore, the development and adoption of new, more efficient, or cost-effective technologies in downstream applications could potentially reduce the demand for TOFA. Stringent regulatory hurdles in certain regions concerning the processing, handling, and end-of-life disposal of chemicals can also present challenges for market participants. Finally, while TOFA is considered sustainable, the environmental impact of the pulp and paper industry itself, including issues like deforestation and water usage, can be a point of scrutiny and may necessitate further lifecycle assessments and improvements.

The global Industrial Tall Oil Fatty Acid (TOFA) market is characterized by regional dynamics and segment specific dominance.

Dominant Regions:

Dominant Segment - Application: Alkyd Resins

The Alkyd Resins segment is anticipated to be a dominant force within the Industrial Tall Oil Fatty Acid market, both in terms of volume and value.

The Industrial Tall Oil Fatty Acid industry is poised for accelerated growth, fueled by several key catalysts. The escalating global commitment to sustainability and the circular economy is a paramount driver, prompting industries to favor bio-based and renewable raw materials like TOFA over fossil fuel-derived alternatives. This trend is further amplified by increasing regulatory pressures and consumer demand for eco-friendly products. Innovations in processing technologies are enhancing TOFA yield, purity, and performance, making it a more attractive and versatile ingredient for a wider range of applications. Furthermore, the expanding use of TOFA in emerging economies, driven by industrialization and a growing middle class, presents significant untapped market potential.

This report offers a comprehensive deep dive into the global Industrial Tall Oil Fatty Acid (TOFA) market, providing an exhaustive analysis of its multifaceted landscape. It meticulously examines historical trends, current market dynamics, and future projections, encompassing a study period from 2019 to 2033 with a detailed forecast from 2025 to 2033, anchored by a base year estimation of 2025. The report dissects the market by product type (Type I, Type II, Type III) and application segments (Alkyd Resins, Dimer Acids, Lubricant Additives, Soaps & Detergents, Others), offering granular insights into their respective growth trajectories and market shares. Furthermore, it scrutinizes key industry developments, regional market analyses, and a detailed competitive landscape featuring leading players. This comprehensive approach ensures stakeholders are equipped with the essential intelligence to navigate the evolving TOFA market successfully.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.4%.

Key companies in the market include Kraton Corporation, Ingevity Corporation, Forchem, Harima, Florachem, Lascaray, Segezha Group, Ilim Group, Pine Chemical Group, Songchuan Pine Chemical, Sha Xian Jin Long Spices Chemical, Anhui Refind Fat&oil, .

The market segments include Type, Application.

The market size is estimated to be USD 474.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial Tall Oil Fatty Acid," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Tall Oil Fatty Acid, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.