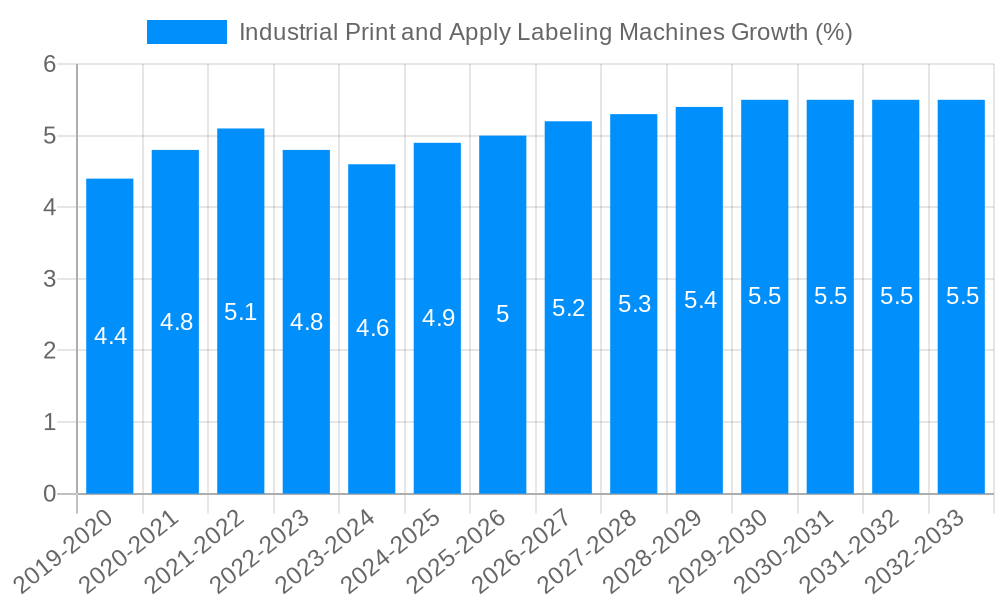

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Print and Apply Labeling Machines?

The projected CAGR is approximately 5.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Print and Apply Labeling Machines

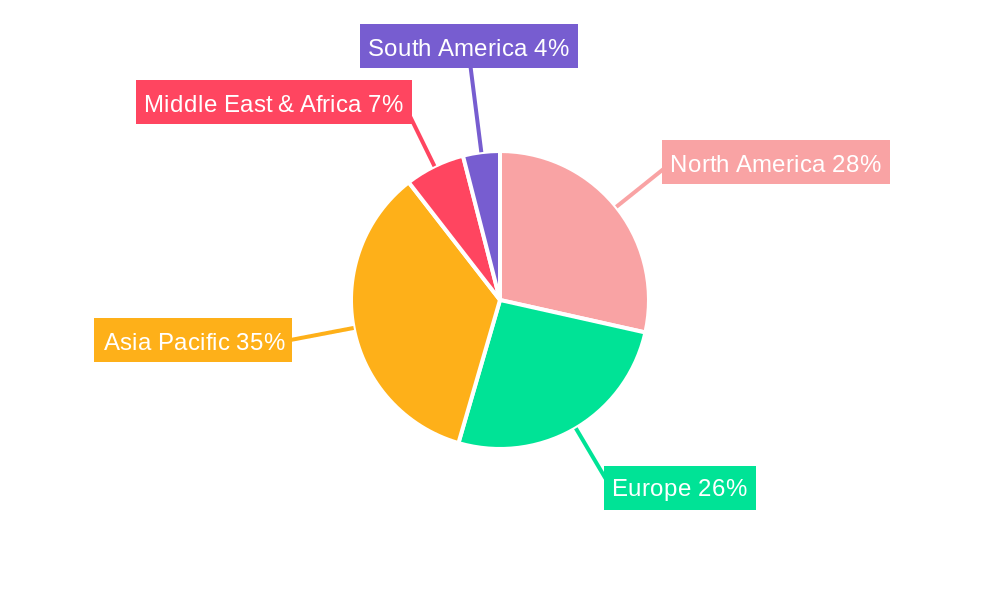

Industrial Print and Apply Labeling MachinesIndustrial Print and Apply Labeling Machines by Type (Print and Apply Labeling Machines, Consumables), by Application (Food and Beverage, Pharmaceutical and Healthcare, Construction and Chemicals, Electronics, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

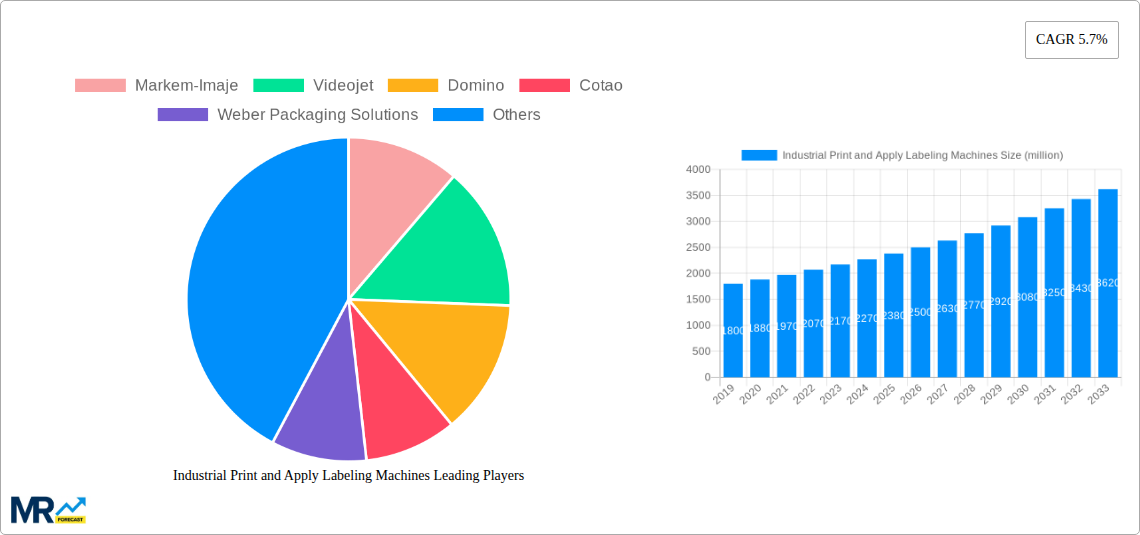

The global Industrial Print and Apply Labeling Machines market is projected for robust expansion, valued at an estimated USD 2,194 million in the base year of 2025. This growth is fueled by a Compound Annual Growth Rate (CAGR) of 5.7% anticipated throughout the forecast period of 2025-2033. Key drivers for this expansion include the escalating demand for enhanced supply chain traceability, stringent regulatory compliance mandates across various industries, and the continuous pursuit of operational efficiency and automation in manufacturing processes. The increasing adoption of sophisticated labeling technologies that offer real-time data capture, variable printing capabilities, and integration with enterprise resource planning (ERP) systems are further propelling market penetration. Furthermore, the growing complexity of product portfolios and the need for detailed product information on labels, including batch numbers, expiry dates, and origin details, are creating significant opportunities for market players.

The market segmentation reveals a dynamic landscape. The "Print and Apply Labeling Machines" segment is expected to dominate, driven by advancements in printing speeds, accuracy, and connectivity features. Within consumables, high-quality label stocks and inks are crucial for ensuring durability and legibility. Key application industries such as Food and Beverage and Pharmaceutical and Healthcare are leading the charge in adoption due to their critical need for accurate product identification, recall management, and compliance with health and safety regulations. While the market enjoys strong growth prospects, potential restraints such as the high initial investment cost of advanced machinery and the evolving landscape of digital labeling solutions could present challenges. However, strategic innovation in cost-effective solutions and a focus on the unique requirements of diverse industrial segments will be vital for sustained market leadership.

Here's a report description on Industrial Print and Apply Labeling Machines, incorporating your specific requests:

This comprehensive report delves into the dynamic global market for Industrial Print and Apply Labeling Machines, offering an in-depth analysis of trends, drivers, challenges, and future projections. Spanning the historical period from 2019 to 2024 and extending to a forecast period of 2025-2033, with a base year of 2025, this report provides actionable insights for stakeholders seeking to capitalize on growth opportunities. We meticulously examine the market's evolution, anticipating a significant global volume exceeding 5 million units by the forecast year.

XXX This report highlights a discernible trend towards increased automation and smart integration within the industrial print and apply labeling machines market. As businesses across various sectors continue to prioritize efficiency, traceability, and compliance, the demand for sophisticated labeling solutions is escalating. A key insight reveals a growing preference for high-speed, multi-line print and apply systems that can handle a diverse range of label sizes and materials with unparalleled accuracy. The adoption of Industry 4.0 principles is profoundly shaping this landscape, leading to the integration of IoT capabilities, cloud connectivity, and advanced data analytics within these machines. This allows for real-time monitoring, remote diagnostics, and predictive maintenance, ultimately minimizing downtime and optimizing operational efficiency. Furthermore, the report identifies a strong surge in demand for sustainable labeling solutions. Manufacturers are actively seeking machines that can efficiently apply labels made from recycled or biodegradable materials, aligning with global environmental regulations and consumer preferences. The development of energy-efficient print engines and reduced waste in the labeling process are also becoming critical considerations. The market is also witnessing a steady rise in demand for customized labeling solutions, catering to specific application requirements within niche industries. This includes machines designed for harsh environments, extreme temperatures, or the intricate labeling of irregular product shapes. The increasing sophistication of printing technologies, such as thermal transfer and direct thermal printing, coupled with advancements in applicator mechanisms, are enabling faster, more precise, and more versatile labeling operations. The shift towards e-commerce and the subsequent rise in direct-to-consumer shipping have also contributed to the demand for flexible and high-throughput labeling systems capable of handling smaller batch sizes and personalized product identification. Overall, the industrial print and apply labeling machines market is characterized by a relentless pursuit of enhanced productivity, data integrity, and sustainability, driven by technological innovation and evolving industry demands.

The industrial print and apply labeling machines market is experiencing robust growth, largely propelled by the escalating need for product traceability and supply chain visibility. In an era where counterfeiting and product recalls are significant concerns, accurately and reliably labeling every item is paramount. This necessity is particularly acute in the Food and Beverage and Pharmaceutical and Healthcare sectors, where stringent regulatory requirements mandate detailed product information and batch tracking. The continuous expansion of e-commerce platforms globally also acts as a significant growth driver. With the surge in online retail, businesses require efficient and high-volume labeling solutions to manage the increased dispatch of goods, often involving personalized shipments. Furthermore, the relentless pursuit of operational efficiency and cost reduction within manufacturing industries is a key propellant. Print and apply labeling machines automate the complex process of printing variable data (like expiry dates, batch codes, and barcodes) and applying it consistently to products, reducing manual labor, minimizing errors, and accelerating production lines. Advancements in automation and robotics are also synergistically fueling this market, with print and apply systems being increasingly integrated into fully automated production lines, further enhancing speed and accuracy.

Despite the promising growth trajectory, the industrial print and apply labeling machines market faces several inherent challenges and restraints. A primary concern is the significant upfront capital investment required for acquiring advanced print and apply systems, which can be a deterrent for small and medium-sized enterprises (SMEs) with limited budgets. The complexity of some of these machines also necessitates specialized training for operation and maintenance, leading to additional costs and potential skill shortages. Furthermore, the market is subject to fluctuating raw material costs, particularly for consumables like labels, ribbons, and inks. Any significant price volatility can impact the overall cost of ownership for businesses, potentially slowing down adoption rates. The rapid pace of technological evolution also presents a challenge, as businesses need to continually invest in upgrades and new equipment to remain competitive, leading to potential obsolescence of existing machinery. Ensuring regulatory compliance across diverse geographical regions, each with its own labeling standards and mandates, adds another layer of complexity and can necessitate customized machine configurations. Finally, the environmental impact of label production and disposal is gaining increasing scrutiny, pushing manufacturers to develop more sustainable solutions, which can be a complex and costly undertaking.

The Food and Beverage segment is poised to dominate the industrial print and apply labeling machines market, driven by an unyielding demand for traceability, safety, and consumer information.

Food and Beverage: The Dominant Force

Geographic Dominance: Asia Pacific Leading the Charge

The confluence of stringent safety regulations, evolving consumer expectations, and the sheer volume of production within the Food and Beverage sector, coupled with the robust manufacturing expansion and growing consumer markets in the Asia Pacific region, positions both as key drivers of the industrial print and apply labeling machines market. The demand for accurate, efficient, and compliant labeling solutions within this segment and geography is projected to outpace other areas, significantly influencing global market dynamics. The volume of print and apply labeling machines utilized in this segment globally is estimated to exceed 3 million units within the forecast period.

The industrial print and apply labeling machines industry is experiencing accelerated growth due to several key catalysts. The increasing emphasis on supply chain transparency and product traceability across all industries, driven by regulatory mandates and consumer demand, is a primary growth driver. Advancements in automation and robotics are further propelling adoption as these machines become integral components of smart manufacturing lines. The expanding e-commerce landscape, with its demand for rapid and accurate order fulfillment, necessitates efficient labeling solutions. Moreover, the development of more sophisticated printing technologies and user-friendly interfaces is lowering barriers to adoption and enhancing operational capabilities for a wider range of businesses.

This report offers a holistic view of the industrial print and apply labeling machines market, providing detailed analysis of market size, share, and forecast volumes, projected to exceed 5 million units globally by the forecast year. It meticulously dissects key market trends, including the drive towards automation, smart connectivity, and sustainable labeling practices. The report identifies and elaborates on the primary growth catalysts, such as the increasing demand for traceability, the expansion of e-commerce, and advancements in manufacturing technologies. Furthermore, it thoroughly examines the challenges and restraints that could impact market growth, including capital investment, technological complexity, and raw material costs, ensuring a balanced perspective for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include Markem-Imaje, Videojet, Domino, Cotao, Weber Packaging Solutions, Arca Etichette, Pro Mach, CAB, Evolabel, Novexx, Label Aire, Etipack, Logopal, Espera-Werke, Guangdong Gosunm, XRH, ALTECH, Quadrel Labeling Systems, Avery Dennison.

The market segments include Type, Application.

The market size is estimated to be USD 2194 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Industrial Print and Apply Labeling Machines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Print and Apply Labeling Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.