1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Hearing Protection Devices?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Hearing Protection Devices

Industrial Hearing Protection DevicesIndustrial Hearing Protection Devices by Type (Earplugs, Earmuffs and Hearing Bands, Others, World Industrial Hearing Protection Devices Production ), by Application (Construction, Manufacturing, Defense and Law Enforcement, Oil and Gas, Aviation & Airport, Fire Protection, Mining, Others, World Industrial Hearing Protection Devices Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

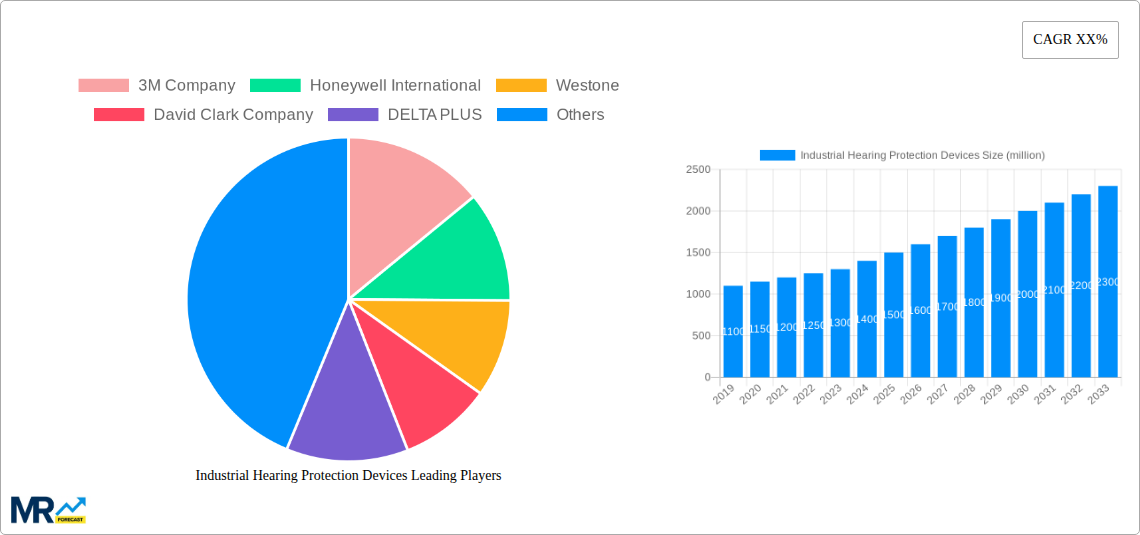

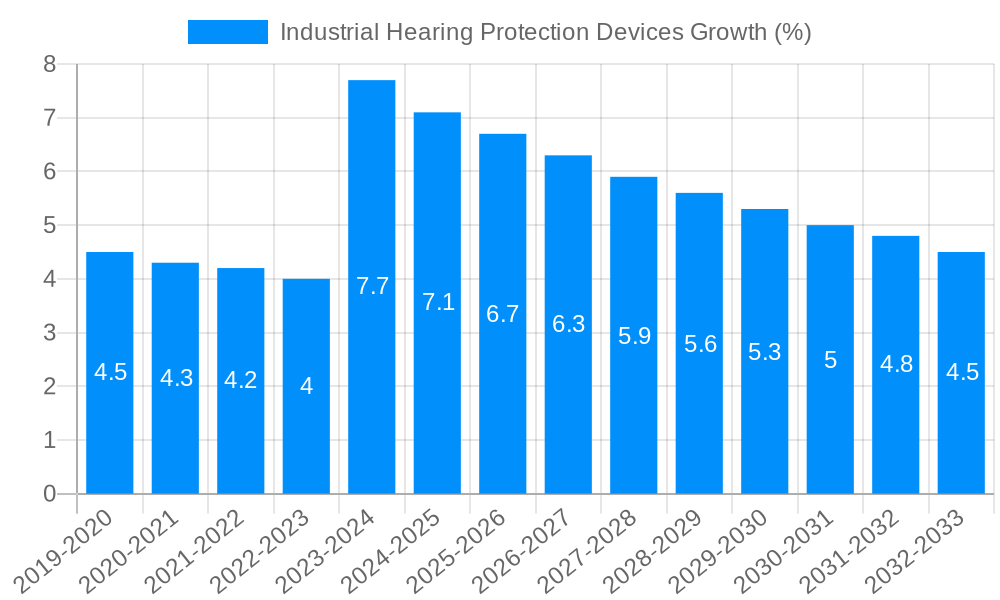

The global industrial hearing protection devices market is experiencing robust growth, projected to reach an estimated market size of approximately $1,500 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of around 6.5% expected to persist through 2033. This expansion is primarily driven by increasing awareness of occupational health and safety regulations worldwide, particularly in industries such as manufacturing, construction, and mining, where prolonged exposure to high noise levels poses significant risks to workers' hearing. Government mandates and stringent compliance requirements are compelling businesses to invest in advanced hearing protection solutions, thereby fueling market demand. Furthermore, the growing adoption of sophisticated and comfortable hearing protection devices, including advanced earplugs, earmuffs, and communication-enabled hearing protection systems, is also contributing to market expansion. These innovations not only offer superior noise reduction but also enhance worker productivity and communication in noisy environments, aligning with industry trends towards more integrated safety solutions.

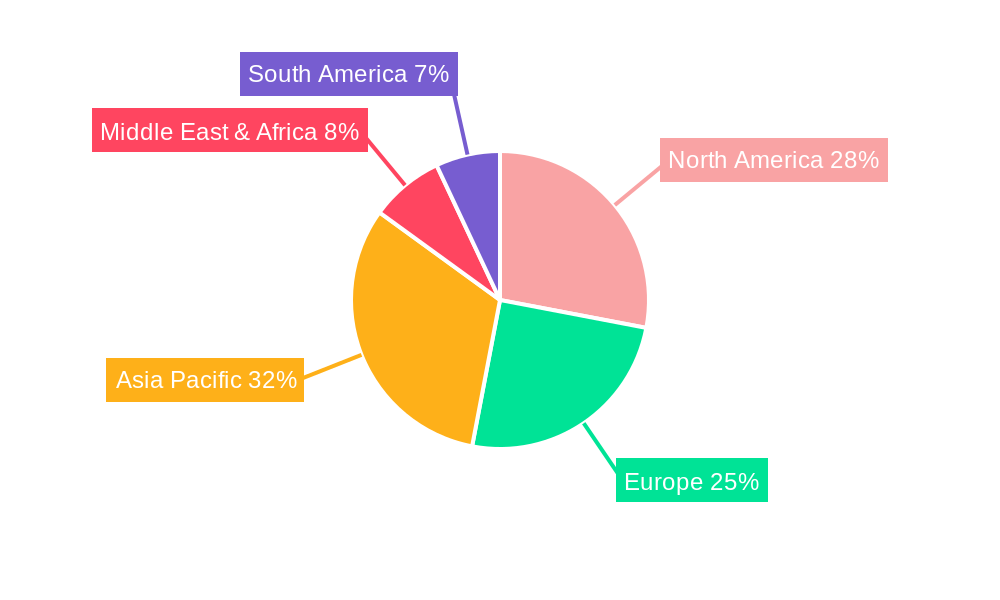

Despite the positive growth trajectory, certain factors may present challenges. The initial cost of some high-performance industrial hearing protection devices could be a restraint for small and medium-sized enterprises. However, the long-term benefits of reduced hearing loss claims and improved worker well-being are increasingly outweighing these upfront costs. Key market players like 3M Company, Honeywell International, and MSA Safety are actively engaged in research and development, introducing innovative products that cater to diverse industrial needs. The Asia Pacific region, particularly China and India, is emerging as a significant growth engine due to rapid industrialization and increasing investments in worker safety. The defense and law enforcement sectors also represent a substantial application segment, driven by the need for specialized hearing protection in tactical and operational environments. The market is characterized by a competitive landscape with a focus on product innovation, strategic partnerships, and geographical expansion to capture emerging opportunities.

This comprehensive report delves into the global Industrial Hearing Protection Devices (IHPDs) market, providing an in-depth analysis of its dynamics, trends, and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders. The historical period of 2019-2024 is meticulously examined to establish baseline performance and identify key evolutionary patterns.

The report meticulously segments the market by Type into Earplugs, Earmuffs, Hearing Bands, and Others, and by Application into critical sectors such as Construction, Manufacturing, Defense and Law Enforcement, Oil and Gas, Aviation & Airport, Fire Protection, Mining, and Others. Furthermore, it analyzes the global production landscape of IHPDs, highlighting key manufacturing hubs and their contributions to the overall market volume, which is projected to reach tens of millions of units annually during the forecast period.

The global Industrial Hearing Protection Devices (IHPDs) market is experiencing a significant upward trend, driven by an ever-increasing awareness of occupational health and safety regulations worldwide. The proactive approach of governments and regulatory bodies in mandating the use of hearing protection in high-noise environments has become a primary catalyst. This heightened regulatory scrutiny is not just about compliance; it's about a fundamental shift in employer responsibility towards safeguarding employee well-being, thereby reducing long-term healthcare costs associated with noise-induced hearing loss (NIHL). The market is witnessing a substantial surge in the adoption of advanced IHPDs, moving beyond basic passive protection to include intelligent solutions. This includes devices with active noise cancellation, sound amplification for communication in noisy settings, and even IoT-enabled solutions for monitoring usage and effectiveness. The increasing complexity of industrial operations, particularly in sectors like manufacturing and oil & gas, which often involve prolonged exposure to hazardous noise levels, further amplifies the demand for reliable and effective hearing protection. Technological advancements are continuously shaping product innovation, leading to lighter, more comfortable, and user-friendly designs that encourage consistent wearability. This focus on user experience is crucial, as compliance is directly linked to how readily workers embrace and utilize these protective devices. The projected market size, measured in millions of units, underscores the scale of this global adoption. The historical period of 2019-2024 has laid the groundwork, showcasing a steady growth, and the base year of 2025 stands as a pivotal point for projecting continued expansion in the coming years. The estimated year of 2025 further solidifies this outlook, indicating robust market performance. The forecast period of 2025-2033 is expected to witness sustained growth, propelled by these converging factors of regulatory mandates, technological evolution, and a deepening understanding of the detrimental effects of occupational noise exposure.

The robust growth of the Industrial Hearing Protection Devices (IHPDs) market is primarily fueled by a confluence of powerful driving forces. Foremost among these is the increasing stringency of occupational health and safety regulations enacted by governments globally. These regulations, which mandate the use of appropriate hearing protection in environments exceeding prescribed noise levels, directly translate into a consistent demand for IHPDs. Furthermore, growing employer responsibility and liability for employee well-being plays a crucial role. Companies are increasingly recognizing the long-term costs associated with noise-induced hearing loss, including compensation claims, reduced productivity, and potential legal repercussions, leading them to proactively invest in protective measures. The rising awareness among workers about the risks of NIHL and its irreversible consequences is another significant driver. Educated employees are more likely to demand and utilize hearing protection, contributing to higher adoption rates. Technological advancements are also a key propellant, with manufacturers continuously innovating to produce more comfortable, effective, and user-friendly devices. This includes the development of advanced materials, customizable fits, and integrated features like communication systems, which enhance both protection and usability. Finally, the expansion of key end-use industries such as construction, manufacturing, and oil & gas, which are inherently prone to high noise exposure, directly contributes to the burgeoning demand for IHPDs.

Despite the promising growth trajectory, the Industrial Hearing Protection Devices (IHPDs) market encounters several significant challenges and restraints that can impede its full potential. A primary obstacle is inadequate compliance and enforcement in certain regions and industries. Even with regulations in place, inconsistent enforcement can lead to a lax attitude towards the mandatory use of hearing protection, especially in smaller enterprises or less regulated sectors. The lack of comfort and user acceptance remains a persistent issue. Many workers find traditional earplugs and earmuffs uncomfortable for prolonged wear, leading to improper usage or complete avoidance. This can stem from poor fit, heat buildup, or interference with communication. The cost factor can also be a restraint, particularly for small and medium-sized enterprises (SMEs) with limited budgets, who may opt for cheaper, less effective alternatives or delay necessary upgrades. Furthermore, the prevalence of counterfeit and substandard products in the market poses a significant risk, undermining the credibility of legitimate manufacturers and potentially exposing workers to inadequate protection. The rapid pace of technological change can also present a challenge, requiring continuous investment in research and development to stay competitive, which can be difficult for smaller players. Finally, resistance to change and ingrained workplace habits can hinder the adoption of new or improved hearing protection solutions.

The global Industrial Hearing Protection Devices (IHPDs) market is poised for significant dominance by specific regions and segments, driven by a combination of regulatory frameworks, industrial activity, and technological adoption.

Dominant Segments:

Type: Earplugs

Application: Manufacturing

Application: Construction

Dominant Regions/Countries:

North America (United States & Canada):

Europe (Germany, United Kingdom, France):

Asia Pacific (China, India, Japan):

The synergy between these dominant segments and regions, supported by substantial production capacity in millions of units, will define the landscape of the global Industrial Hearing Protection Devices market throughout the study period.

Several key factors are acting as significant growth catalysts for the Industrial Hearing Protection Devices (IHPDs) industry. The relentless push for stricter occupational health and safety regulations globally is paramount, mandating the use of hearing protection in noisy environments. This is complemented by an escalating awareness among both employers and employees regarding the irreversible consequences of noise-induced hearing loss, fostering a proactive safety culture. Technological advancements are continuously introducing more comfortable, effective, and feature-rich IHPDs, enhancing user acceptance and compliance. Furthermore, the expansion and modernization of key industrial sectors such as manufacturing, construction, and oil & gas, which are inherently prone to high noise levels, directly translate into increased demand.

This report offers a holistic view of the Industrial Hearing Protection Devices (IHPDs) market, leaving no stone unturned. It meticulously analyzes market size and volume projections, with estimated figures in the millions of units for the forecast period. The report dissects market segmentation by type (earplugs, earmuffs, hearing bands, others) and application (construction, manufacturing, defense, oil & gas, aviation, mining, etc.), providing granular insights into segment-specific growth drivers and challenges. It further scrutinizes global production capabilities and regional market dynamics, highlighting dominant geographies and countries. Industry developments, technological innovations, and emerging trends are thoroughly examined to offer a forward-looking perspective.

This comprehensive coverage ensures that stakeholders gain a profound understanding of the current market landscape and the factors that will shape its future trajectory from 2019 to 2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 3M Company, Honeywell International, Westone, David Clark Company, DELTA PLUS, MSA Safety, MOLDEX-MTERIC, Tasco Corporation, Hellberg Safety, Sensear, Radians, Protective Industrial Products.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial Hearing Protection Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Hearing Protection Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.