1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial and Institutional Fragrances?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial and Institutional Fragrances

Industrial and Institutional FragrancesIndustrial and Institutional Fragrances by Type (Edible Flavors, Inedible Flavors, World Industrial and Institutional Fragrances Production ), by Application (Household Cleaning Products, Personal Care Products, Air Care Products, Others, World Industrial and Institutional Fragrances Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

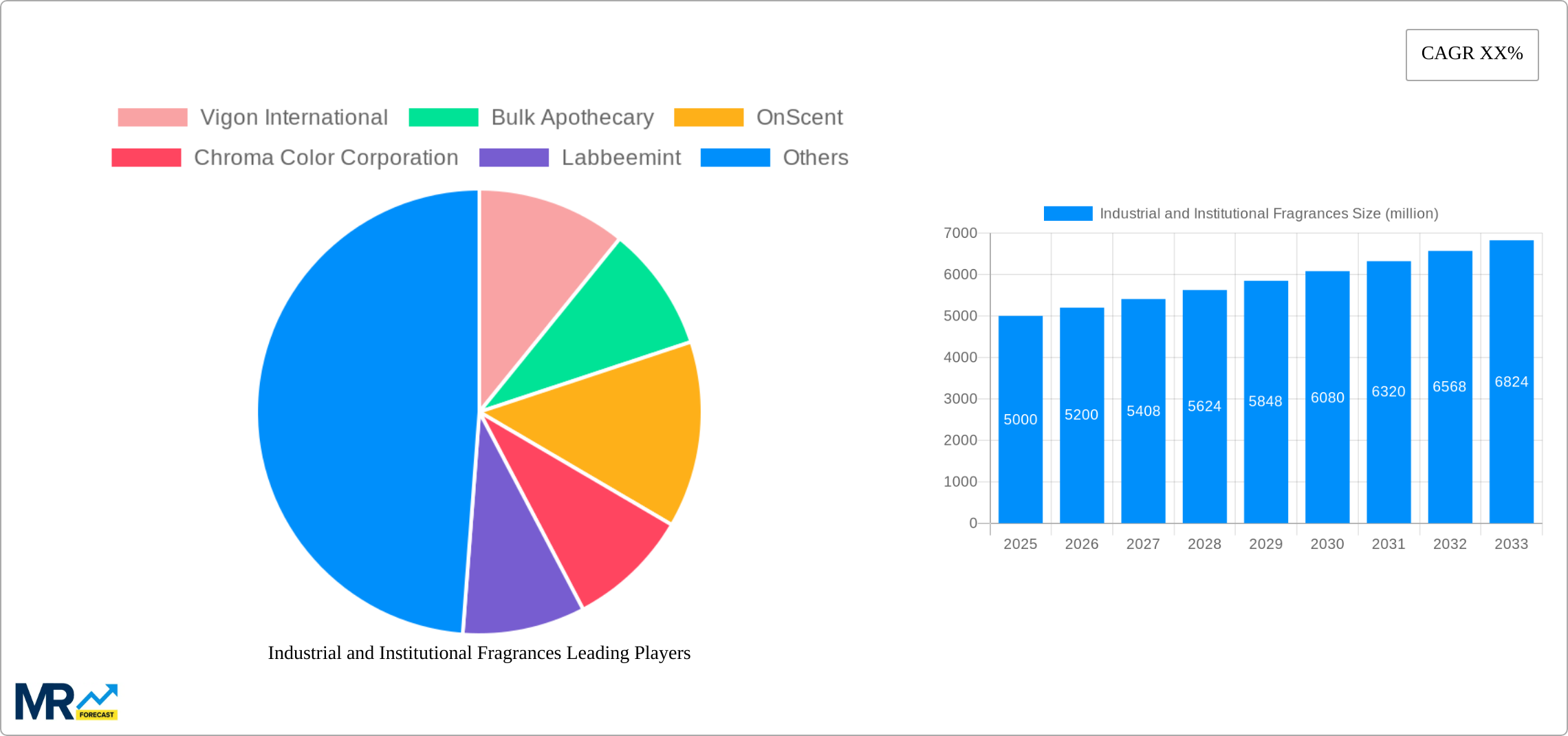

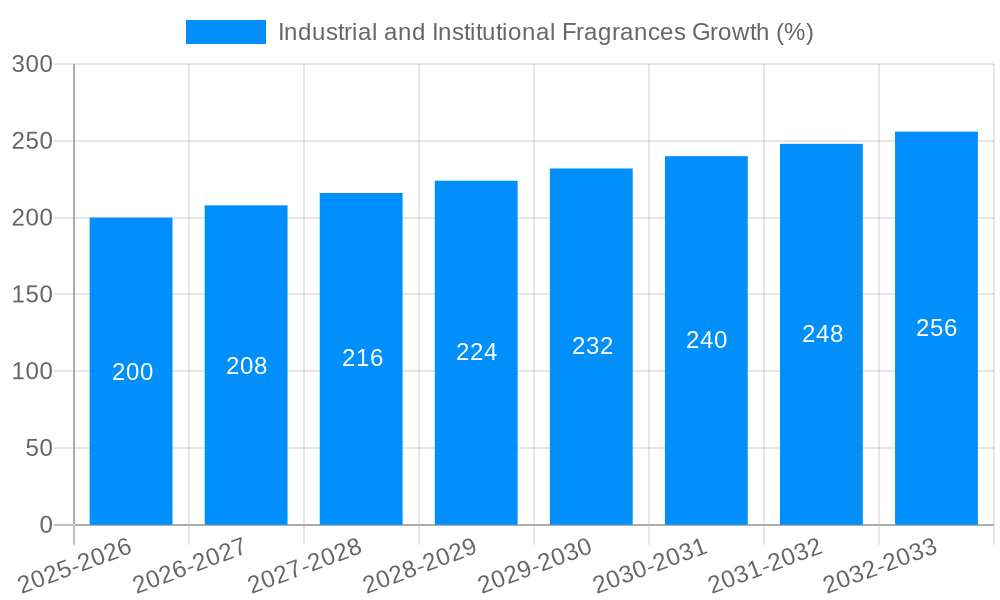

The industrial and institutional fragrances market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's expansion is fueled by several key factors, including the rising consumer preference for aesthetically pleasing and hygienically clean environments in commercial spaces. This translates into higher demand for fragrances in cleaning products, air fresheners, and personal care items used in institutions like hospitals, hotels, and offices. Furthermore, the growing awareness of the importance of brand identity and sensory marketing is driving the adoption of signature fragrances to enhance the customer experience and create a memorable brand association. Technological advancements in fragrance formulation, enabling the creation of longer-lasting, more sustainable, and customized scents, are also contributing to market growth. While precise figures for market size and CAGR are unavailable, a reasonable estimation based on industry trends suggests a market size of approximately $5 billion in 2025, exhibiting a CAGR of around 4-5% over the forecast period (2025-2033). This projection incorporates factors like increasing disposable incomes in developing economies, coupled with rising urbanization, which boost demand for fragrance products across various applications. However, regulatory scrutiny regarding the environmental impact of certain fragrance ingredients poses a restraint, pushing manufacturers towards developing eco-friendly alternatives.

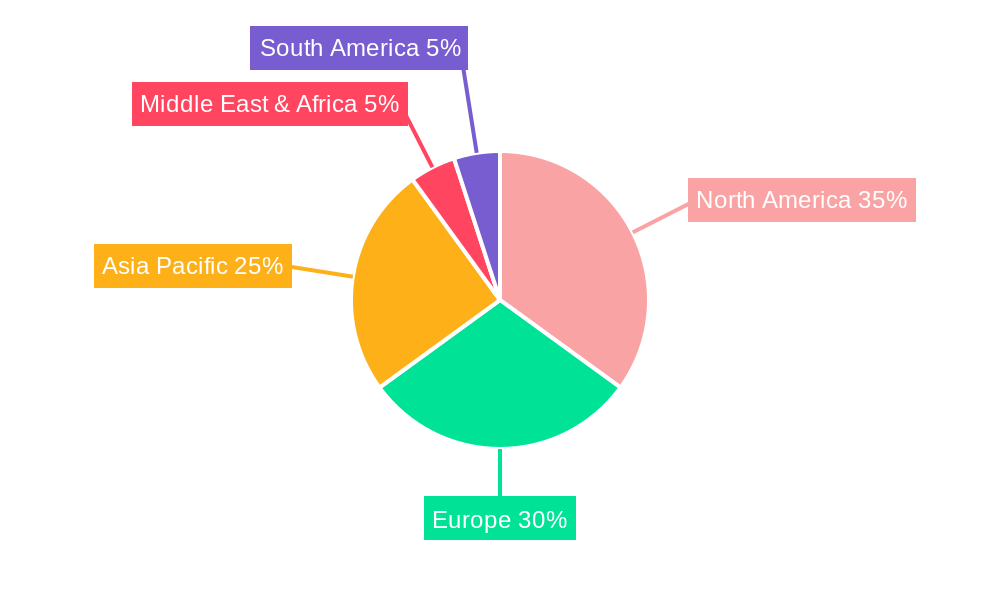

The market is segmented by type (edible and inedible flavors) and application (household cleaning, personal care, air care, and others). The inedible flavor segment dominates, driven largely by its use in cleaning and air care products. Geographically, North America and Europe currently hold significant market shares, owing to established consumer preferences and a well-developed infrastructure. However, Asia-Pacific is poised for substantial growth due to rapid economic development and increasing consumer spending. Key players in the market, including Vigon International, Symrise, and Takasago International Corporation, are leveraging their established brand reputation and extensive product portfolios to maintain a competitive edge. The competitive landscape is characterized by both large multinational corporations and smaller specialized firms. The future of the market hinges on continued innovation, the development of sustainable fragrance solutions, and adapting to evolving consumer preferences and regulatory requirements.

The industrial and institutional fragrances market, valued at XXX million units in 2025, is poised for significant growth during the forecast period (2025-2033). Driven by increasing consumer demand for aesthetically pleasing and functionally effective products across various sectors, the market exhibits a dynamic interplay of trends. A notable shift is towards natural and sustainable fragrance ingredients, reflecting growing consumer awareness of environmental and health concerns. This trend is pushing manufacturers to explore and incorporate plant-based extracts, essential oils, and bio-derived chemicals, leading to the development of "clean" and "green" fragrance formulations. Simultaneously, the demand for customized fragrance solutions is escalating, with businesses seeking unique scents to differentiate their brands and enhance consumer appeal. This necessitates greater flexibility and innovation from fragrance manufacturers, who are responding by offering tailored blends and sophisticated fragrance design services. Furthermore, the market is witnessing the incorporation of advanced technologies, such as artificial intelligence and data analytics, to optimize fragrance development, improve production efficiency, and personalize consumer experiences. This technological integration is streamlining processes and improving the overall quality and consistency of industrial and institutional fragrances. The growing focus on safety and regulatory compliance is also shaping the market landscape, with manufacturers proactively complying with stringent regulations regarding ingredient safety and labeling transparency. This comprehensive approach, encompassing sustainability, customization, technology, and safety, is driving the market’s steady and robust growth trajectory.

Several key factors are fueling the expansion of the industrial and institutional fragrances market. Firstly, the rising disposable incomes in developing economies are increasing consumer spending on products requiring fragrances, like household cleaners and personal care items. This heightened purchasing power fuels demand across various application segments. Secondly, the burgeoning global population, coupled with a rising preference for enhanced living standards, contributes to a greater demand for products incorporating fragrances to improve ambiance and hygiene. This surge in demand directly translates into increased consumption of industrial and institutional fragrances. Moreover, the expanding hospitality and healthcare sectors are significant contributors to market growth. Hotels, hospitals, and other institutions rely heavily on fragrances to create pleasant environments, thereby driving demand for specific fragrance profiles. Finally, the sustained growth of the e-commerce sector is also a positive influence. Online retailers frequently market and sell products based on their aroma, stimulating higher fragrance demand for a wide array of items. This multi-faceted growth, fueled by economic progress, population growth, sectorial expansions, and e-commerce advancements, underscores the market's strong prospects for the years to come.

Despite promising growth prospects, the industrial and institutional fragrances market faces certain challenges. Stringent regulations regarding fragrance ingredients and their potential impact on human health and the environment pose significant hurdles. Manufacturers are required to meet rigorous safety and labeling standards, increasing production costs and complexities. Furthermore, fluctuations in raw material prices, particularly for natural ingredients, present a significant risk to profitability and price stability. The availability and sourcing of these raw materials, especially sustainably-sourced options, can be unpredictable, creating operational uncertainties. Competition in the market is also fierce, with both established players and new entrants vying for market share. Maintaining a competitive edge necessitates constant innovation, the development of unique fragrance profiles, and the ability to adapt quickly to shifting consumer preferences. Lastly, concerns regarding the potential for allergic reactions or sensitivities to certain fragrance components remain a key consideration, demanding careful formulation and labeling practices. Addressing these challenges requires strategic planning, careful risk management, and a proactive approach to adapting to the evolving regulatory and market landscape.

The household cleaning products application segment is projected to dominate the industrial and institutional fragrances market throughout the forecast period. This dominance stems from the increasing demand for hygiene and aesthetically pleasing cleaning products globally. Consumers are increasingly willing to pay a premium for products that not only clean effectively but also leave a pleasant fragrance, driving the demand for higher-quality fragrances within this segment.

North America: This region is expected to maintain a significant market share due to strong consumer spending on household products and a well-established fragrance industry. Innovation and the presence of major fragrance manufacturers further contribute to this region's dominance.

Europe: Stringent regulations related to fragrance ingredients influence product development and formulation, requiring manufacturers to adapt and innovate within the boundaries of compliance. The region’s focus on sustainability and eco-friendly products is also shaping its fragrance market.

Asia-Pacific: The region's burgeoning middle class and rapid economic growth are fueling a substantial increase in demand for various household products, including cleaning agents. This increasing demand translates directly into a higher need for industrial and institutional fragrances.

The large population and increasing disposable incomes in Asia-Pacific, coupled with rising awareness of hygiene and a preference for enhanced home environments, contribute significantly to the region's growth. However, varying levels of regulatory frameworks across different nations in Asia-Pacific create diverse market dynamics. While North America and Europe maintain a focus on natural and sustainable fragrances, the Asia-Pacific market experiences diverse trends, influenced by a combination of factors encompassing price sensitivity, product preference, and regional regulatory environments. This intricate interplay shapes the specifics of the fragrance market's growth trajectory across these significant geographical regions.

The industrial and institutional fragrances industry is experiencing robust growth propelled by several key catalysts. Firstly, the rising demand for enhanced product aesthetics across diverse sectors, from cleaning products to personal care, fuels the need for sophisticated fragrances. Secondly, increasing consumer awareness of the psychological impact of scent and its ability to create positive experiences in various environments drives demand further. Finally, technological advancements in fragrance creation and delivery systems are enabling the development of more innovative and effective fragrance solutions, further stimulating market growth.

This report provides a detailed analysis of the industrial and institutional fragrances market, offering insights into market trends, driving forces, challenges, key players, and future growth prospects. The comprehensive coverage encompasses historical data (2019-2024), base year estimates (2025), and future projections (2025-2033), providing a complete overview of this dynamic industry. The report is designed to be a valuable resource for businesses, investors, and researchers seeking to understand and navigate the complexities of this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vigon International, Bulk Apothecary, OnScent, Chroma Color Corporation, Labbeemint, ITD Inc, Alpha Aromatics, Symrise, Hem Incense, Takasago International Corporation, VSAResources, Zep Inc, Arylessence, Belle-Aire Creations, Chemia Corporation, Aeroscena, Atlanta Fragrance, Intercontinental Fragrances.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Industrial and Institutional Fragrances," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial and Institutional Fragrances, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.