1. What is the projected Compound Annual Growth Rate (CAGR) of the Incandescent Track Lighting?

The projected CAGR is approximately 7.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Incandescent Track Lighting

Incandescent Track LightingIncandescent Track Lighting by Type (Halogen Track Lighting, Conventional Track Lighting), by Application (Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

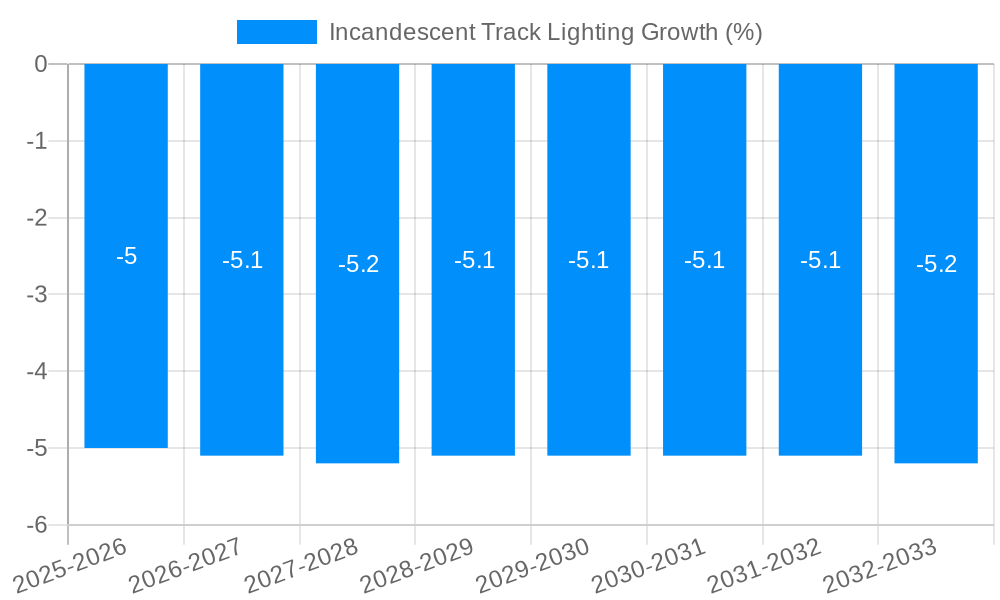

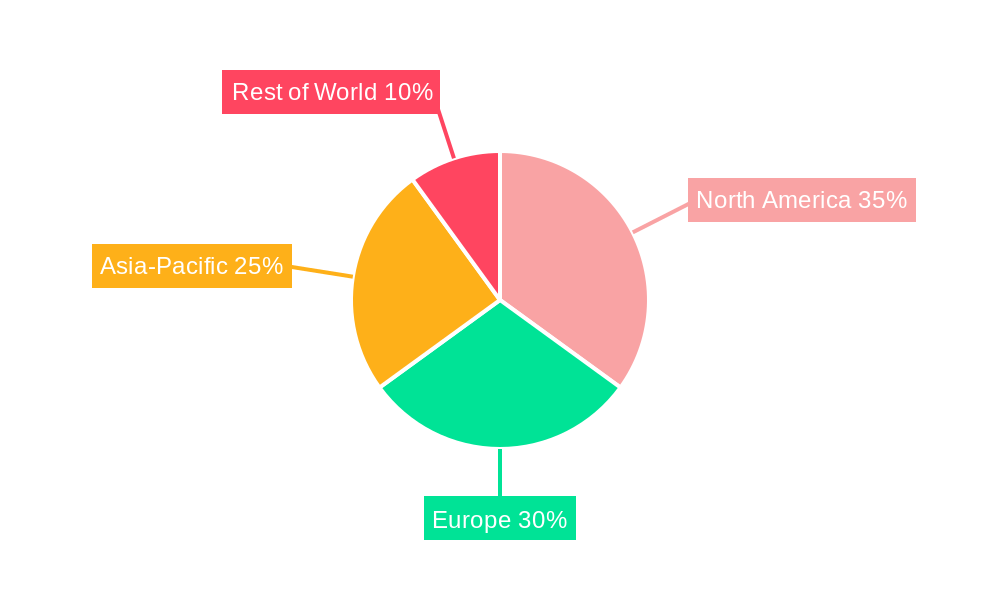

The incandescent track lighting market, while facing decline due to energy efficiency regulations and the rise of LED alternatives, still holds a niche segment within the broader track lighting industry. The provided data indicates a total track lighting market size of $2762 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.4%. While the exact market share of incandescent track lighting is unavailable, we can reasonably estimate its presence based on market trends. Considering the ongoing shift towards energy-efficient lighting solutions, incandescent track lighting likely represents a smaller, shrinking portion of the overall market. This segment is primarily driven by aesthetic preferences for the warm light emitted by incandescent bulbs and a resistance to change among some consumers and businesses. However, stricter energy regulations and increasing awareness of the environmental impact of incandescent bulbs are significant restraints. The market is segmented by type (halogen and conventional incandescent) and application (residential and commercial), with commercial applications potentially representing a larger share due to the continued use in certain settings where the warm light and dimmability are valued. Key players like Philips Lighting, Acuity Brands, and Hubbell likely offer incandescent track lighting options alongside their more dominant LED offerings. The geographic distribution mirrors the broader track lighting market, with North America and Europe likely holding the largest market shares initially, though growth in Asia-Pacific regions could accelerate as infrastructure development continues. The forecast period of 2025-2033 suggests a continued, albeit slow, growth driven by replacement demand in existing installations, particularly in regions with less stringent energy regulations.

The future of incandescent track lighting is projected to be one of gradual decline. While the market will likely continue to exist for the foreseeable future, its share will diminish steadily due to the aforementioned pressures. Companies offering incandescent options are likely focusing on maintaining their existing customer base and offering premium, higher-quality products to justify the higher energy consumption and cost compared to LED alternatives. Growth will likely be concentrated in specific niches, such as high-end residential settings where the aesthetic appeal outweighs the energy efficiency concerns, and in certain commercial settings where energy costs are less of a primary concern than the specific lighting quality offered. Technological advancements in incandescent bulbs themselves are unlikely to significantly impact market growth due to their inherent limitations concerning energy efficiency. Therefore, strategic market adaptation will be crucial for players within this segment, focusing on premiumization, targeted marketing, and perhaps integration with smart home systems for enhanced user control.

The incandescent track lighting market, while facing pressure from more energy-efficient alternatives, retains a niche presence, particularly in specific applications and aesthetic preferences. The market, valued at approximately 20 million units in 2024, is expected to experience a period of moderate decline during the forecast period (2025-2033). This contraction is primarily driven by stringent energy regulations globally promoting LED and other energy-saving lighting solutions. However, the market is not expected to disappear entirely. A segment of consumers and businesses continue to favor the warm, aesthetically pleasing light produced by incandescent bulbs, valuing this characteristic over energy efficiency considerations. This preference is particularly pronounced in certain design-focused sectors such as high-end residential settings, boutique hotels, and restaurants aiming for a specific ambiance. The declining market share is not uniform across all segments. Halogen track lighting, with its brighter output and longer lifespan than standard incandescent, may experience a slightly slower decline compared to conventional incandescent track lighting. Furthermore, geographical variations exist. Regions with less stringent energy regulations or those with a stronger preference for traditional aesthetics may witness a less pronounced downturn. The competitive landscape is characterized by a mix of established players and smaller niche manufacturers catering to specialized markets. Key players are strategically adapting to market shifts by diversifying their product portfolios, incorporating smart features, and focusing on specialized segments to maintain their market share. The overall trend suggests a gradual but persistent reduction in market size, driven by technological advancements and environmental concerns. However, the inherent aesthetic appeal of incandescent lighting ensures its continued, albeit diminished, relevance.

Despite the overall decline, several factors contribute to the continued, albeit limited, demand for incandescent track lighting. Firstly, the superior color rendering index (CRI) of incandescent bulbs compared to some LEDs creates a warmer, more appealing light for many consumers. This is particularly important in settings where accurate color representation is crucial, such as art galleries or jewelry stores. Secondly, the immediate and consistent light output of incandescent bulbs, without the warm-up time associated with some other technologies, remains advantageous in certain applications. The instantly available light is also more predictable than LED in certain situations. Thirdly, the lower initial cost of incandescent bulbs compared to high-quality LEDs, can be a deciding factor for budget-conscious consumers or businesses, especially in smaller projects. Finally, a certain degree of brand loyalty and preference for the traditional aesthetic of incandescent lighting persists among a segment of the market. These factors, while not powerful enough to drive significant market growth, combine to sustain a niche market for incandescent track lighting. The market's future trajectory will depend on the balancing of these factors against growing environmental concerns and stricter energy regulations.

The primary challenge facing the incandescent track lighting market is the overwhelming shift towards energy-efficient alternatives. Stringent energy regulations worldwide are steadily phasing out incandescent lighting due to its low energy efficiency and high energy consumption. This results in increased costs for consumers and businesses. The growing awareness of environmental sustainability further fuels the demand for LED and other eco-friendly lighting options. Furthermore, the relatively short lifespan of incandescent bulbs compared to LEDs translates to higher replacement costs and more frequent maintenance. This is a significant drawback for commercial applications prioritizing cost-effectiveness and reduced downtime. The limited dimming capabilities of some incandescent bulbs compared to the advanced dimming options offered by LEDs also present a challenge. Moreover, the market faces increasing competition from other types of track lighting systems, including LED and halogen options, which offer improved energy efficiency and performance. These factors cumulatively contribute to a shrinking market for incandescent track lighting.

While the overall incandescent track lighting market is declining, certain segments and regions demonstrate more resilience than others.

Segment: Halogen track lighting maintains a relatively stronger position than standard incandescent track lighting due to its improved lifespan and brighter output, partially offsetting the energy efficiency concerns.

Application: The commercial sector, particularly in specialized applications like high-end restaurants and boutique hotels where ambiance and aesthetics are paramount, retains a higher demand for incandescent track lighting compared to other sectors.

Geographical Considerations: While precise data varies, it is likely that regions with less stringent energy regulations or a stronger preference for traditional aesthetics may show slower decline rates. This might include certain areas of the developing world or regions with less emphasis on energy conservation policies. However, even in these regions, the global trend toward energy efficiency is gradually influencing the market. The future will likely see a continued market contraction in all regions and segments, with the rate of decline varying according to local factors.

Despite the overall market decline, niche applications requiring specific aesthetic qualities or prioritizing traditional lighting styles could spur localized growth pockets. Also, if the cost of energy-efficient alternatives increases significantly, it could potentially lead to a short-term resurgence in demand for cheaper incandescent solutions, although this is unlikely to be a sustained trend. A focus on premium, high-quality incandescent bulbs emphasizing longer lifespans or unique design elements could also help slow down market decline.

This report provides a detailed analysis of the incandescent track lighting market, encompassing historical data (2019-2024), current market estimations (2025), and future projections (2025-2033). It examines market trends, driving forces, challenges, and key players in detail, offering insights into the declining market share and the enduring niche applications of this lighting technology. The report also provides region-specific analyses, segment-wise breakdowns, and an exploration of potential future developments within the industry. This comprehensive analysis aims to provide businesses and stakeholders with a clear understanding of the dynamics of the incandescent track lighting market and its potential future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.4%.

Key companies in the market include Philips Lighting, Acuity Brands, Hubbell, Eglo, ITAB, Eaton, Endo Lighting, WAC Lighting, Intense Lighting, AFX INC, Nora Lighting, AIXEN LITE, Jesco Lighting, Satco, LBL Lighting, Rayconn, Kehei Lighting.

The market segments include Type, Application.

The market size is estimated to be USD 2762 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Incandescent Track Lighting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Incandescent Track Lighting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.