1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Vehicle Infotainment Device Chips?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In-Vehicle Infotainment Device Chips

In-Vehicle Infotainment Device ChipsIn-Vehicle Infotainment Device Chips by Type (High-Performance Chips, Mid-Range Chips, Entry-Level Chips, World In-Vehicle Infotainment Device Chips Production ), by Application (Commercial Vehicles, Passenger Vehicles, World In-Vehicle Infotainment Device Chips Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

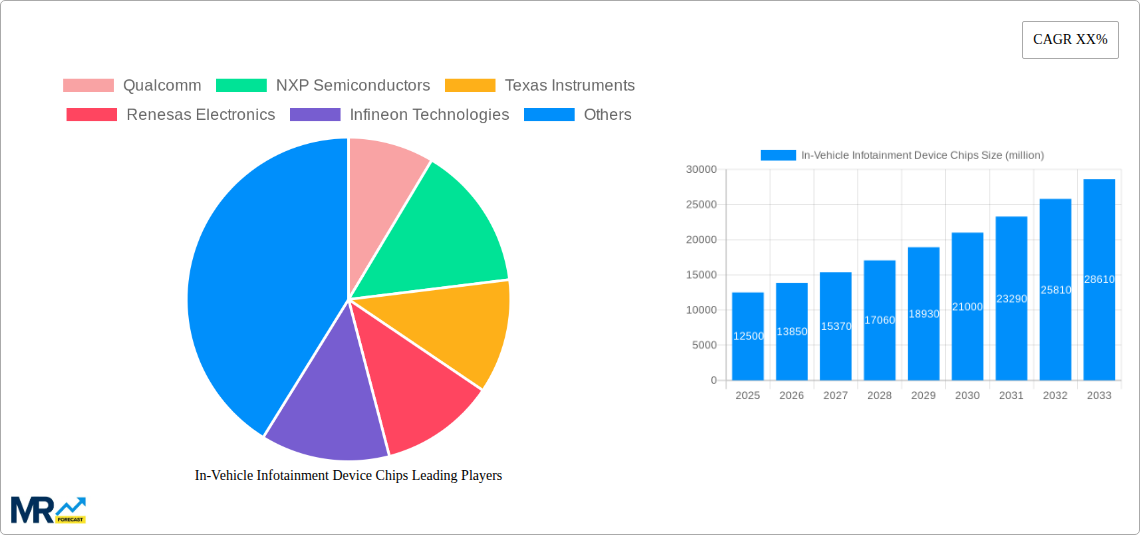

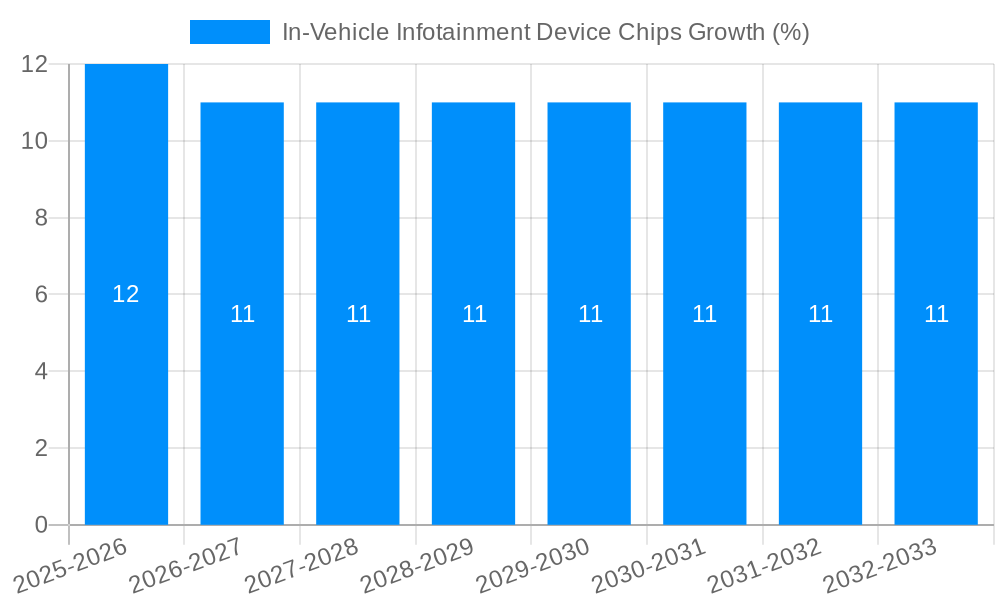

The global In-Vehicle Infotainment (IVI) Device Chips market is projected to experience substantial growth, reaching an estimated market size of $12,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12% expected to propel it to over $22,000 million by 2033. This robust expansion is primarily driven by the escalating consumer demand for advanced in-car connectivity, sophisticated entertainment systems, and the increasing integration of AI-powered features within vehicles. The rising adoption of semi-autonomous and autonomous driving technologies further necessitates more powerful and specialized chips capable of processing vast amounts of data for navigation, driver assistance, and real-time communication. Key industry players like Qualcomm, NXP Semiconductors, and Texas Instruments are at the forefront, investing heavily in research and development to deliver high-performance chips that cater to the evolving needs of the automotive sector. The market is segmented into High-Performance, Mid-Range, and Entry-Level chips, with High-Performance chips experiencing the most significant surge due to their capability to support complex functionalities and premium user experiences in both commercial and passenger vehicles.

The forecast period, from 2025 to 2033, will likely witness a strong emphasis on miniaturization, power efficiency, and enhanced security features in IVI chips. Emerging trends include the adoption of automotive-grade System-on-Chips (SoCs) that integrate multiple functions, the growing influence of 5G connectivity for seamless data transfer and over-the-air updates, and the development of specialized processors for advanced driver-assistance systems (ADAS) and augmented reality (AR) displays. While the market presents a promising outlook, certain restraints such as the volatile semiconductor supply chain, increasing component costs, and stringent regulatory compliances for automotive electronics could pose challenges. However, strategic collaborations between chip manufacturers and automotive OEMs, coupled with continuous innovation in chip architecture and manufacturing processes, are expected to mitigate these challenges and sustain the market's upward trajectory across major regions including Asia Pacific, North America, and Europe.

This report provides an in-depth analysis of the global In-Vehicle Infotainment (IVI) device chips market, spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period covers 2019-2024. We will delve into production volumes in millions of units, examine key industry players, and analyze market segmentation by chip type and vehicle application.

The In-Vehicle Infotainment (IVI) device chip market is experiencing a period of dynamic transformation, driven by an ever-increasing consumer demand for connected and sophisticated in-car experiences. XXX projects that global IVI device chip production will witness a robust expansion, with an estimated X million units in 2025, escalating to a substantial Y million units by 2033. This growth is underpinned by several key trends. Firstly, the relentless pursuit of enhanced user experience is pushing the boundaries of what IVI systems can offer. Consumers are no longer satisfied with basic radio and navigation; they expect seamless integration of their digital lives, including advanced multimedia capabilities, sophisticated voice assistants, and personalized content delivery. This necessitates the adoption of higher-performance chips capable of handling complex processing, graphics rendering, and AI-driven features. Secondly, the democratization of advanced features across vehicle segments is a significant trend. While premium vehicles historically led the way in IVI innovation, there's a clear upward trajectory of advanced features filtering down into mid-range and even entry-level vehicles. This is fueled by evolving consumer expectations and automotive manufacturers' strategies to differentiate their offerings across their entire model lineups. Consequently, while high-performance chips will continue to see strong demand, the mid-range and entry-level segments are poised for significant volume growth, driven by their inclusion in a wider array of vehicle types. The increasing complexity and sophistication of IVI systems also bring about a greater emphasis on power efficiency and thermal management. Chip manufacturers are investing heavily in developing solutions that offer superior performance without compromising on energy consumption or generating excessive heat, a critical factor in the confined and sensitive automotive environment. Furthermore, the integration of advanced driver-assistance systems (ADAS) functionalities within the IVI domain is gaining momentum. As vehicles become more autonomous, the IVI system acts as a central hub for processing sensor data and providing intuitive interfaces for drivers to interact with these advanced systems. This convergence further fuels the demand for more powerful and versatile IVI chips. The ongoing evolution of connectivity standards, including 5G integration and improved Wi-Fi capabilities, is also a crucial trend, enabling faster data transfer and richer online services within the vehicle. This necessitates chips that are capable of supporting these next-generation communication protocols, paving the way for a truly connected automotive ecosystem. The industry is also witnessing a growing interest in specialized IVI chips that offer specific functionalities, such as dedicated audio processing units or advanced AI accelerators, catering to the nuanced requirements of different IVI applications.

The exponential growth of the In-Vehicle Infotainment (IVI) device chips market is propelled by a confluence of powerful driving forces, primarily centered around evolving consumer expectations and technological advancements within the automotive industry. The paramount driver is the burgeoning demand for a seamless, personalized, and connected in-car digital experience. Consumers, accustomed to sophisticated smartphones and smart home devices, now expect their vehicles to offer similar levels of functionality and integration. This translates to a desire for advanced multimedia capabilities, intuitive user interfaces, robust connectivity options, and the ability to access and control their digital lives from within the car. Automotive manufacturers, recognizing this shift, are increasingly prioritizing IVI systems as a key differentiator and a crucial element in attracting and retaining customers. This has led to a continuous arms race in developing more advanced and feature-rich IVI systems, thereby directly stimulating the demand for sophisticated and powerful IVI chips. Furthermore, the increasing complexity of vehicle architectures and the trend towards software-defined vehicles are significantly boosting the need for integrated and high-performance IVI chips. These chips are no longer just responsible for audio and navigation; they are becoming central processing units for a wide array of vehicle functions, including connectivity, digital cockpits, and even aspects of ADAS. The integration of artificial intelligence (AI) and machine learning (ML) into IVI systems, for applications like voice assistants, predictive maintenance, and personalized recommendations, is another major catalyst. These AI-driven features require substantial processing power, driving the demand for advanced SoCs (System-on-Chips) with integrated AI accelerators. Moreover, the growing adoption of Over-The-Air (OTA) updates for IVI systems and vehicle software allows manufacturers to continuously improve and add new features. This necessitates chips that are capable of supporting these software-centric updates and future-proofing the in-car experience, further fueling the demand for cutting-edge silicon.

Despite the robust growth trajectory, the In-Vehicle Infotainment (IVI) device chips market is not without its inherent challenges and restraints. A primary concern revolves around the increasing complexity and development costs associated with designing and manufacturing these advanced chips. The integration of multiple functionalities, the need for high processing power, and stringent automotive safety and reliability standards necessitate extensive research, development, and rigorous testing, leading to significant financial investments for chip manufacturers. This complexity also extends to software development and integration, where ensuring seamless compatibility and functionality across diverse vehicle platforms and operating systems can be a formidable task. Another significant challenge is the stringent regulatory landscape and long product lifecycles in the automotive industry. IVI chips must adhere to rigorous safety, emissions, and cybersecurity regulations, which can extend development timelines and add to production costs. Furthermore, the automotive industry's traditionally long product lifecycles mean that chip manufacturers must design solutions that remain relevant and performant for many years, making it challenging to anticipate future technological shifts and avoid obsolescence. Supply chain disruptions and geopolitical uncertainties also pose a persistent threat to the market. The semiconductor industry is highly susceptible to global events, from natural disasters to trade disputes, which can lead to material shortages, increased component costs, and production delays. The automotive sector's reliance on just-in-time manufacturing makes it particularly vulnerable to these disruptions. The ever-increasing demand for cybersecurity is another critical restraint. As IVI systems become more connected and handle sensitive user data, the risk of cyberattacks escalates. Developing chips with robust built-in security features and ensuring their ongoing protection against evolving threats is a complex and ongoing challenge. The intense competition within the semiconductor industry also puts pressure on pricing and profit margins. Chip manufacturers must constantly innovate and optimize their production processes to remain competitive while meeting the demanding cost targets set by automotive OEMs. Lastly, the environmental impact of electronics manufacturing and disposal is an emerging concern, pushing for more sustainable production methods and longer product lifecycles, which can add to design and operational complexities.

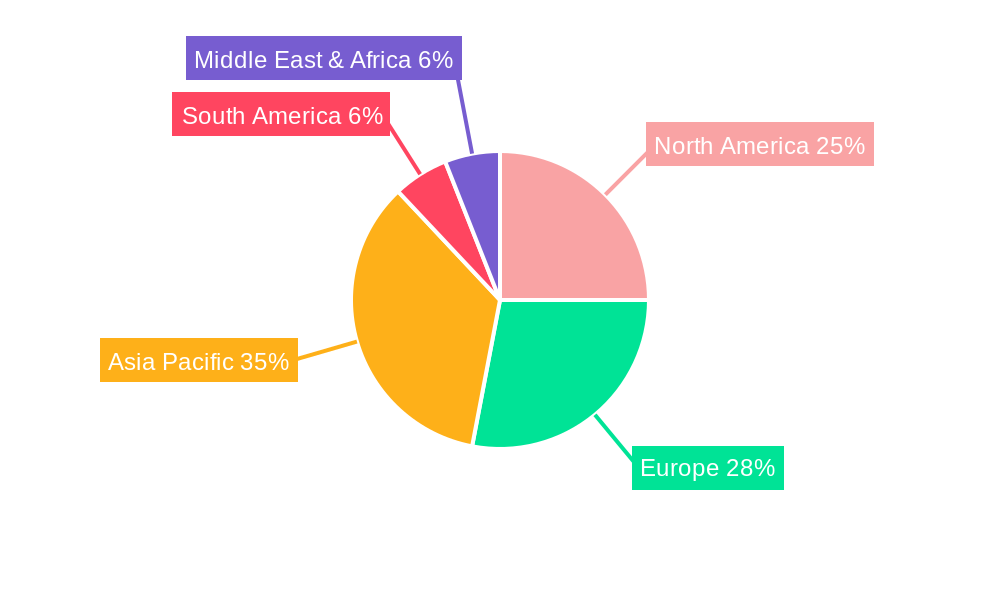

The In-Vehicle Infotainment (IVI) device chips market is characterized by strong regional dynamics and a segmented approach based on chip performance and vehicle application. In terms of regional dominance, Asia Pacific is poised to emerge as a leading force in both production and consumption of IVI device chips. This leadership is driven by several key factors. Firstly, the region is home to some of the world's largest automotive manufacturing hubs, including China, Japan, South Korea, and India. These countries are not only significant producers of vehicles but also major consumers of advanced automotive technologies, including sophisticated IVI systems. The sheer volume of passenger vehicle production in Asia Pacific, coupled with a growing middle class with increasing disposable income and a strong appetite for technologically advanced vehicles, fuels a substantial demand for IVI chips. China, in particular, stands out due to its aggressive push towards smart mobility and its substantial domestic automotive market. The rapid adoption of connected car technologies, the proliferation of EVs, and the government's supportive policies for the semiconductor and automotive industries further solidify China's position as a dominant player. Furthermore, many of the world's leading consumer electronics manufacturers are based in Asia Pacific, which brings a wealth of semiconductor design and manufacturing expertise to the region, benefiting the IVI chip sector. The region's robust manufacturing infrastructure and established supply chains for electronic components also contribute to its dominance in production volumes.

When considering segments, the Passenger Vehicles segment is projected to dominate the In-Vehicle Infotainment Device Chips market. This dominance is a direct consequence of the sheer volume of passenger vehicles produced and sold globally. Passenger cars, from entry-level hatchbacks to premium sedans and SUVs, are increasingly equipped with advanced IVI systems as a standard feature or a desirable upgrade. The evolving consumer expectations for in-car connectivity, entertainment, navigation, and advanced driver-assistance interfaces are primarily concentrated within the passenger vehicle segment.

Several key growth catalysts are fueling the expansion of the In-Vehicle Infotainment (IVI) device chips industry. The relentless pursuit of enhanced user experience, driven by consumer demand for seamless connectivity and personalized digital interactions within vehicles, is a primary catalyst. The integration of advanced AI and machine learning capabilities for features like sophisticated voice assistants and predictive functionalities further propels demand. The increasing adoption of Over-The-Air (OTA) updates for IVI systems allows for continuous feature enhancements, necessitating powerful and adaptable chip architectures. Moreover, the growing electrification of vehicles, with EVs often incorporating advanced infotainment and connectivity as a key selling point, acts as a significant growth driver.

This comprehensive report offers a deep dive into the global In-Vehicle Infotainment (IVI) device chips market, providing invaluable insights for stakeholders. It meticulously analyzes production volumes in millions of units, tracks the evolution of key industry players, and dissects market segmentation across various chip types and vehicle applications. The study period from 2019-2033, with a base year of 2025, ensures a robust historical perspective and accurate future projections. The report examines the intricate interplay of driving forces and challenges, offering a balanced view of the market's potential and its hurdles. Furthermore, it identifies pivotal regions and segments poised for significant growth, providing strategic direction for market participants. The report also highlights crucial growth catalysts and provides a detailed overview of the leading companies and their significant developments within the sector. This detailed coverage equips businesses with the strategic intelligence needed to navigate the dynamic IVI chip landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Qualcomm, NXP Semiconductors, Texas Instruments, Renesas Electronics, Infineon Technologies, MediaTek, Allwinner Technology, HiSilicon, STMicroelectronics, ON Semiconductor.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "In-Vehicle Infotainment Device Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In-Vehicle Infotainment Device Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.