1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Store Retail Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In-Store Retail Packaging

In-Store Retail PackagingIn-Store Retail Packaging by Type (Rigid Plastic Packing, Soft Plastic Packing, Paper Packing), by Application (Food Industry, Personal Care, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

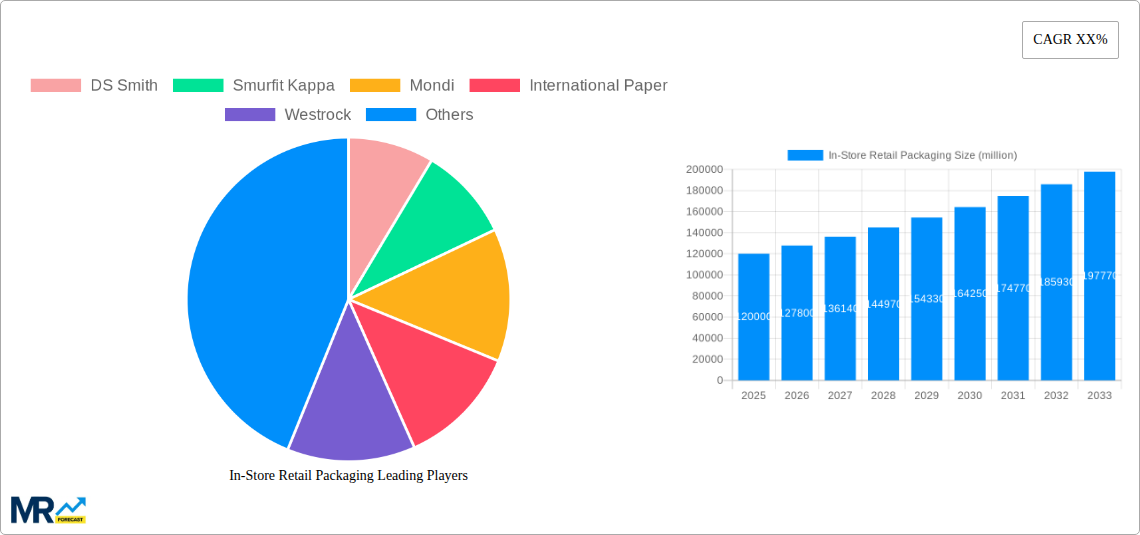

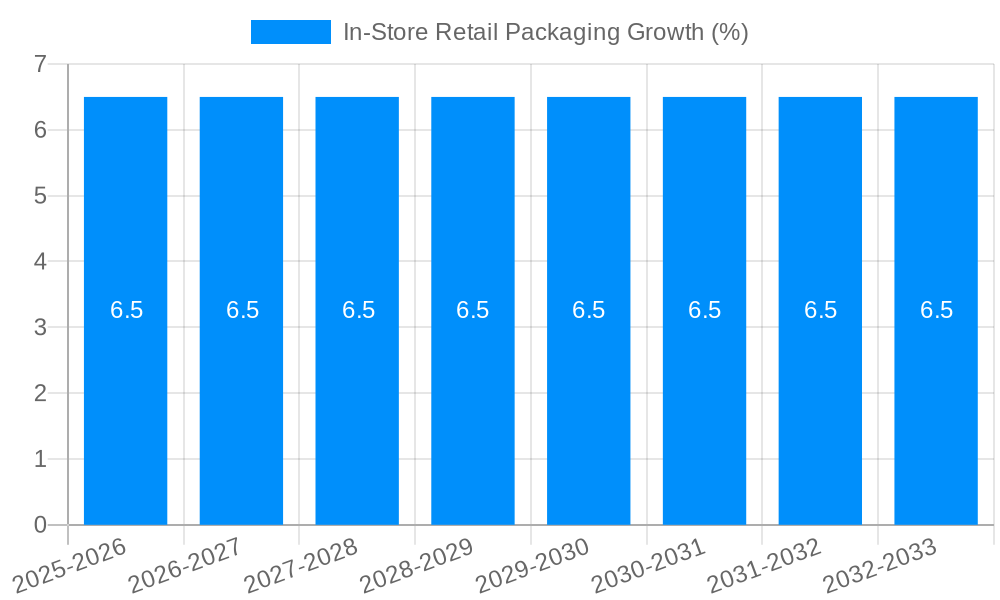

The In-Store Retail Packaging market is projected to reach a significant valuation of approximately USD 120 billion by 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for visually appealing and functional packaging that enhances the in-store customer experience. Factors such as the rise of e-commerce influencing traditional retail strategies, the growing emphasis on brand differentiation, and the need for sustainable packaging solutions are key drivers. The market is experiencing a strong trend towards premiumization, with brands investing in innovative designs and materials to capture consumer attention on crowded retail shelves. Furthermore, the convenience offered by well-designed retail packaging in facilitating product handling and display is a crucial element contributing to market growth.

The market segments highlight a dynamic landscape where both rigid and soft plastic packaging hold substantial shares, driven by their versatility and cost-effectiveness. However, there's a discernible shift towards paper-based packaging due to increasing environmental consciousness and regulatory pressures promoting sustainable alternatives. The Food Industry and Personal Care segments represent the largest application areas, benefiting from continuous product innovation and consumer demand for safe, attractive, and convenient packaging. Major players like DS Smith, Smurfit Kappa, and Mondi are at the forefront, actively investing in research and development to introduce eco-friendly solutions and advanced packaging technologies. Challenges such as volatile raw material prices and stringent environmental regulations could pose restraints, but the overall market outlook remains positive, underscored by ongoing innovation and strategic collaborations across the value chain.

Here is a unique report description on In-Store Retail Packaging, incorporating your specified requirements:

The in-store retail packaging market is experiencing a transformative period, driven by evolving consumer preferences, increasing sustainability mandates, and the ongoing digital integration into physical retail spaces. Over the historical period from 2019 to 2024, the market witnessed a steady upward trajectory, largely fueled by the burgeoning e-commerce sector’s influence on traditional retail presentation and the growing demand for visually appealing and functional packaging. By the base year of 2025, the market is projected to have reached significant volume, with estimates suggesting a global consumption exceeding 5,200 million units for various in-store retail packaging solutions. Looking ahead to the forecast period of 2025-2033, analysts predict continued robust growth, with cumulative unit sales potentially reaching a staggering 45,000 million units.

Key market insights reveal a pronounced shift towards sustainable materials. Consumers are increasingly making purchasing decisions based on a brand's environmental footprint, pushing manufacturers to prioritize recyclable, biodegradable, and compostable packaging. This has led to a surge in demand for innovative paper-based solutions, offering a compelling alternative to traditional plastics. Furthermore, the rise of premiumization in retail is evident in packaging design, with a greater emphasis on sophisticated aesthetics, tactile finishes, and interactive elements that enhance the unboxing experience, even for products purchased directly in-store. Digital integration is also playing a crucial role; augmented reality (AR) enabled packaging, QR codes linking to product information or promotions, and smart packaging solutions designed to track inventory or monitor product integrity are becoming more prevalent. The study period from 2019-2033 encapsulates these dynamic shifts, highlighting the market's adaptability and its response to both consumer pressures and technological advancements. The estimated year of 2025 serves as a critical juncture, reflecting current market realities and setting the stage for future innovations.

The in-store retail packaging market is experiencing substantial growth propelled by a confluence of powerful drivers. Foremost among these is the increasing consumer awareness and demand for sustainable packaging solutions. As environmental concerns become more pronounced, shoppers actively seek out products with eco-friendly packaging, compelling brands to invest in recyclable, compostable, and biodegradable materials. This trend is not merely an ethical consideration; it's a significant purchasing influencer. Secondly, the ever-evolving retail landscape, characterized by a blend of online and offline shopping experiences (omnichannel retail), necessitates packaging that not only protects products but also enhances brand visibility and appeal at the point of purchase. The in-store experience is increasingly being curated, and packaging is an integral part of that sensory journey. Thirdly, technological advancements are revolutionizing packaging capabilities. Innovations in material science, printing technologies, and smart packaging solutions are enabling more engaging, informative, and functional packaging designs. This includes advancements in anti-counterfeiting measures, personalized packaging, and packaging that actively communicates product information or usage instructions. Finally, the growth of key end-use industries, such as the food and beverage and personal care sectors, directly translates into increased demand for their respective retail packaging needs, ensuring a consistent and substantial market volume.

Despite its robust growth, the in-store retail packaging market faces several significant challenges and restraints that temper its expansion. A primary concern is the increasing cost of raw materials. Fluctuations in the prices of paper pulp, plastics, and other essential components can significantly impact manufacturing costs and, consequently, the final price of packaging, potentially affecting profit margins for both manufacturers and retailers. Secondly, stringent and evolving regulatory landscapes across different regions pose a considerable hurdle. Governments are increasingly implementing regulations related to packaging waste, single-use plastics, and recyclability standards, requiring manufacturers to adapt their operations and product lines, which can be costly and time-consuming. Thirdly, the complexity of the global supply chain can lead to disruptions and delays. Geopolitical events, logistical bottlenecks, and material shortages can impede the consistent availability of packaging materials, impacting production schedules and delivery timelines. Furthermore, consumer resistance to certain packaging types, even if economically viable, can act as a restraint. For instance, while some consumers advocate for plastic reduction, others may prioritize the perceived hygiene or durability of plastic packaging for certain applications, creating a market segmentation challenge. Finally, the high investment required for advanced sustainable technologies can be a barrier for smaller players, potentially leading to market consolidation and limiting innovation from emerging companies.

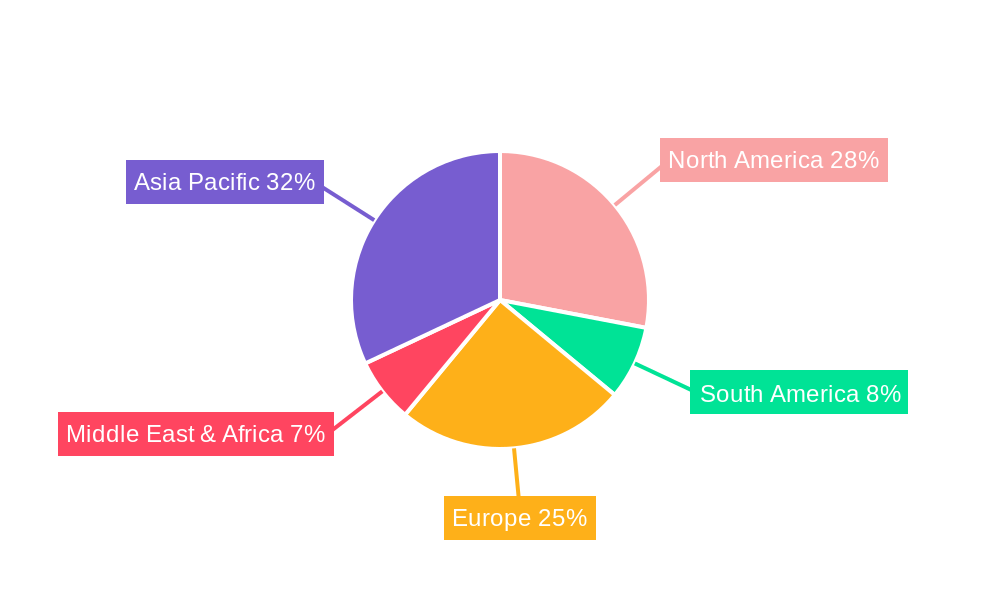

The Paper Packing segment, particularly within the Food Industry application, is poised for significant dominance in the global in-store retail packaging market, with Asia Pacific emerging as the leading geographical region during the forecast period of 2025-2033.

Paper Packing Segment Dominance:

Food Industry Application Dominance:

Asia Pacific Region Dominance:

By 2025, the Paper Packing segment, especially for the Food Industry, is projected to represent a substantial portion of the overall in-store retail packaging market volume, estimated to be around 2,800 million units. The Asia Pacific region is anticipated to account for over 35% of this global demand, driven by the factors outlined above. By the end of the forecast period in 2033, this segment is expected to have reached cumulative sales exceeding 20,000 million units, with Asia Pacific continuing its lead.

Several key factors are acting as catalysts for growth in the in-store retail packaging industry. The persistent and growing consumer demand for sustainable and eco-friendly packaging is a primary driver, pushing innovation in recyclable and biodegradable materials. Furthermore, the increasing importance of the in-store customer experience and the rise of premiumization are compelling brands to invest in packaging that enhances visual appeal and brand perception at the point of sale. Technological advancements in material science, printing, and smart packaging solutions are enabling more functional, interactive, and informative packaging designs, further stimulating market expansion.

This report provides an exhaustive analysis of the in-store retail packaging market, covering the period from 2019 to 2033, with a detailed focus on the base year of 2025. It delves into critical market dynamics, including emerging trends, driving forces, and significant challenges. The report offers granular insights into market segmentation by packaging type (Rigid Plastic Packing, Soft Plastic Packing, Paper Packing) and application (Food Industry, Personal Care, Other). It highlights dominant regions and segments, backed by robust market data, including projected unit volumes, with the Paper Packing segment within the Food Industry and the Asia Pacific region identified as key growth areas. Furthermore, the report examines key growth catalysts, leading industry players, and significant past and projected developments, offering a comprehensive understanding of the market's trajectory and future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DS Smith, Smurfit Kappa, Mondi, International Paper, Westrock, STI Group, C&B Display Packaging, Pratt Industries, Weedon Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "In-Store Retail Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In-Store Retail Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.