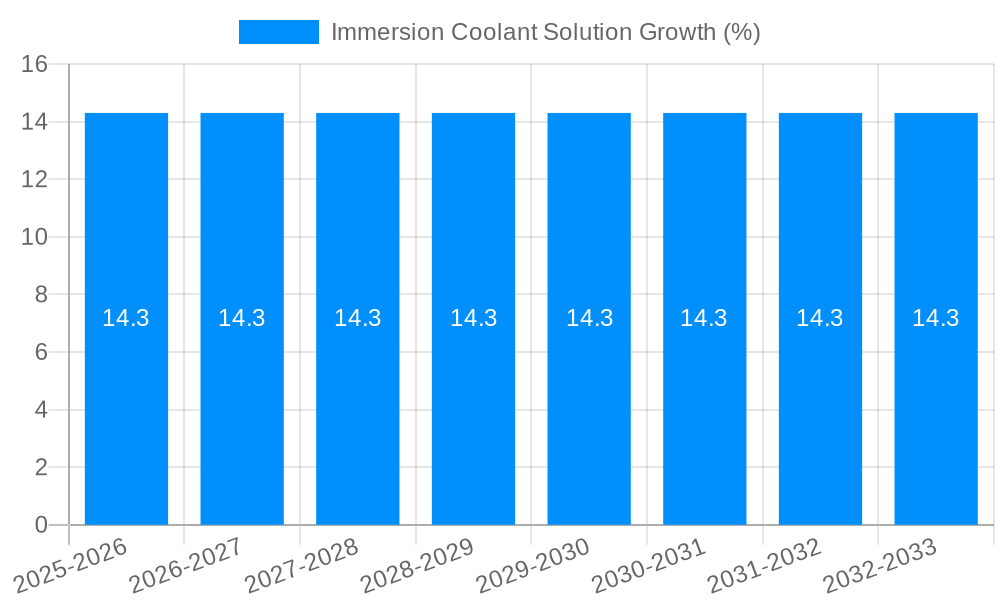

1. What is the projected Compound Annual Growth Rate (CAGR) of the Immersion Coolant Solution?

The projected CAGR is approximately 14.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Immersion Coolant Solution

Immersion Coolant SolutionImmersion Coolant Solution by Type (Hydrocarbon, Fluorocarbon, Other), by Application (Data Center, Virtual Currency Miner, Power Device, Lithium Battery, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

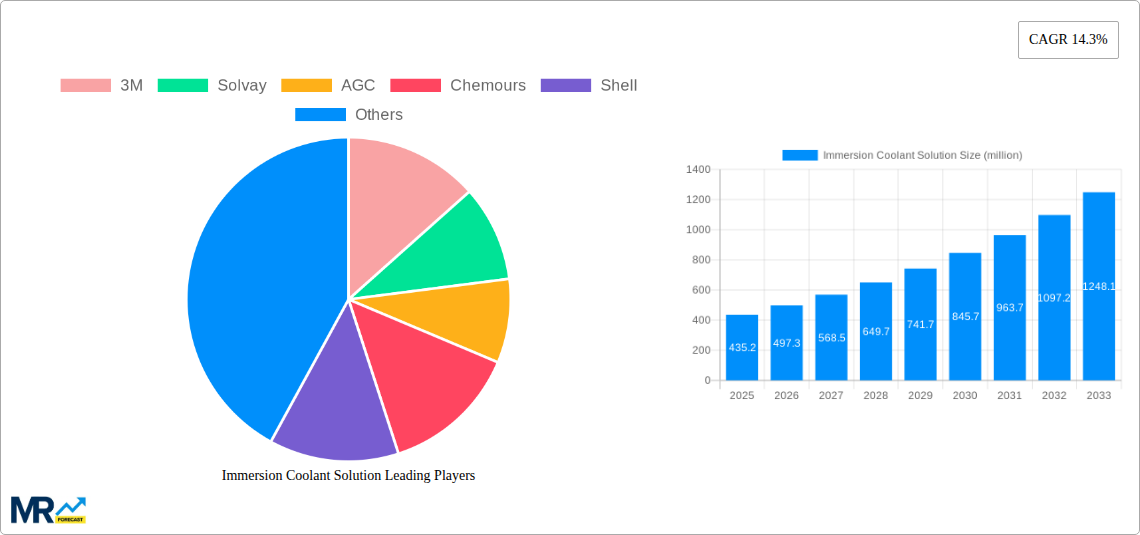

The global Immersion Coolant Solution market is poised for substantial growth, projected to reach a significant valuation by 2033. Driven by the escalating demand for advanced cooling technologies in high-performance computing and the burgeoning digital economy, the market is experiencing a robust Compound Annual Growth Rate (CAGR) of 14.3%. This growth is primarily fueled by the indispensable role of immersion coolants in optimizing the thermal management of critical infrastructure like data centers and virtual currency mining operations, where efficient heat dissipation is paramount for performance and longevity. The increasing power density of modern electronics, coupled with the growing awareness of energy efficiency, further propels the adoption of these sophisticated cooling solutions. Emerging trends such as the development of more sustainable and environmentally friendly coolant formulations, alongside the integration of these solutions into advanced power devices and lithium batteries for electric vehicles and energy storage, are expected to create new avenues for market expansion.

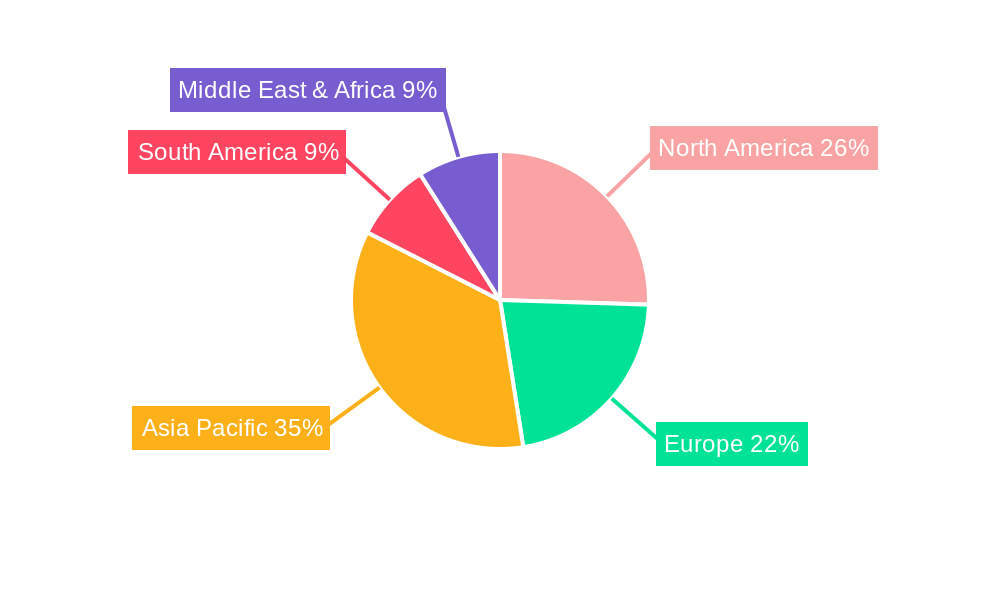

While the market exhibits strong upward momentum, certain factors could influence its trajectory. The initial capital investment required for implementing immersion cooling systems, along with potential concerns regarding coolant handling and disposal, represent key restraints that may temper widespread adoption in some segments. However, ongoing research and development efforts are focused on mitigating these challenges by creating more cost-effective and user-friendly solutions. Furthermore, the increasing regulatory focus on environmental sustainability is likely to encourage the development and use of bio-based or less hazardous coolant options, aligning with global green initiatives. Key players in the market, including industry giants like 3M, Solvay, and Chemours, alongside specialized manufacturers such as Engineered Fluids and Capchem, are actively investing in innovation and strategic partnerships to capitalize on the dynamic market landscape and address the evolving needs of diverse applications. The Asia Pacific region, particularly China, is expected to emerge as a dominant force due to its rapidly expanding digital infrastructure and manufacturing capabilities.

The immersion coolant solution market is experiencing a significant surge, driven by the escalating demand for advanced cooling technologies across various high-performance computing applications. Our comprehensive analysis, covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, reveals a market poised for substantial expansion. The global immersion coolant solution market size, currently valued in the tens of millions, is projected to reach hundreds of millions by the end of the study period. This growth is intrinsically linked to the burgeoning digital economy, where the need for efficient thermal management is paramount. The sheer volume of data generated and processed daily necessitates cooling solutions that can handle the intense heat generated by densely packed electronic components. The market is observing a diversification in coolant types, with ongoing research and development yielding novel formulations that offer improved dielectric properties, thermal conductivity, and environmental sustainability.

Furthermore, the increasing adoption of immersion cooling in sectors beyond traditional data centers is a key trend. Virtual currency mining operations, which rely on powerful, continuously running hardware, are increasingly turning to immersion cooling for its superior efficiency and operational cost savings compared to air cooling. Similarly, the rapid advancements in power devices, particularly in the electric vehicle and renewable energy sectors, are creating a new frontier for immersion coolant solutions. These applications often involve high power densities and operate in demanding environments, making robust and efficient cooling indispensable. The landscape is also being shaped by evolving industry standards and regulations concerning environmental impact and energy efficiency, pushing manufacturers to innovate with greener and more sustainable coolant options. This dynamic environment, characterized by rapid technological evolution and expanding application footprints, is fueling robust market expansion, with projected market values in the millions set to multiply in the coming decade.

The trajectory of the immersion coolant solution market is being propelled by a confluence of powerful forces, fundamentally reshaping the thermal management landscape. At its core, the exponential growth in data generation and processing is a primary catalyst. The insatiable demand for cloud computing, artificial intelligence, and big data analytics necessitates the deployment of increasingly dense and powerful server architectures. Traditional air cooling methods are reaching their limitations in effectively dissipating the substantial heat generated by these high-performance components, leading to thermal throttling, reduced lifespan, and increased energy consumption. Immersion cooling, by directly submerging hardware in a non-conductive fluid, offers a vastly superior heat transfer mechanism, enabling higher component densities and sustained peak performance.

The relentless pursuit of energy efficiency is another significant driver. As data centers and other computing facilities strive to reduce their operational expenditure and carbon footprint, immersion cooling presents a compelling solution. By more effectively removing heat, it minimizes the need for energy-intensive cooling infrastructure like CRAC units and chillers, leading to substantial energy savings. The rise of virtual currency mining, characterized by its energy-intensive hardware, has also become a crucial market segment, with immersion cooling offering the most viable and cost-effective method for managing the thermal loads of these operations. Furthermore, advancements in the performance and efficiency of power devices, essential for electric vehicles, renewable energy storage, and high-power electronics, are creating a parallel demand for advanced cooling solutions that immersion coolants are uniquely positioned to meet. This synergistic interplay of technological necessity and economic imperative is underpinning the market's impressive growth.

Despite its compelling advantages, the immersion coolant solution market faces several inherent challenges and restraints that temper its otherwise explosive growth. One of the most significant hurdles remains the initial capital investment. The transition to immersion cooling often requires a substantial upfront expenditure for specialized tanks, pumps, fluid management systems, and modifications to existing infrastructure. This can be a deterrent for smaller enterprises or those with budget constraints, especially when compared to the perceived lower initial cost of upgrading air cooling systems.

Another crucial concern revolves around fluid management and maintenance. While immersion coolants offer superior thermal performance, their handling, replenishment, and disposal require specialized protocols and trained personnel. Any leakage or contamination can lead to costly repairs and downtime, necessitating stringent maintenance procedures. The technical expertise and training gap within the industry is also a factor; widespread adoption requires a workforce proficient in the installation, operation, and troubleshooting of immersion cooling systems. Furthermore, while environmental regulations are pushing towards greener solutions, the environmental impact of certain coolant formulations, particularly older generations of fluorocarbons, can still be a point of contention, leading to scrutiny and potential restrictions. Lastly, compatibility concerns with existing IT hardware and the perceived risk of damage to sensitive components, although largely mitigated by advanced dielectric fluids, can still create a psychological barrier for some potential adopters.

The immersion coolant solution market is poised for significant dominance by specific regions and segments, driven by a confluence of technological adoption, infrastructure development, and economic drivers.

Dominant Segments:

Dominant Regions/Countries:

The synergy between these dominant segments and regions is creating a powerful market dynamic. As data centers in North America and China continue to expand and demand higher performance, the need for advanced coolant solutions like fluorocarbons and increasingly sophisticated hydrocarbon alternatives will intensify. This mutual reinforcement is expected to shape the market's trajectory significantly, contributing to its multi-million dollar valuation and continued expansion throughout the forecast period.

The immersion coolant solution industry is experiencing robust growth propelled by several key catalysts. The insatiable demand for high-performance computing, driven by AI, machine learning, and big data analytics, is a primary engine. As component densities increase, traditional cooling methods become inadequate, making immersion cooling a necessity for sustained performance and longevity. Furthermore, the global push for energy efficiency and sustainability in data centers and other high-power applications significantly favors immersion cooling due to its inherent energy savings. The expanding market for electric vehicles and renewable energy storage systems also presents a substantial growth opportunity, as these applications require advanced thermal management for their power electronics.

This report provides an unparalleled and in-depth analysis of the global immersion coolant solution market. Spanning the historical period of 2019-2024 and extending to a comprehensive forecast through 2033, with 2025 as the base and estimated year, it delves into every facet of this dynamic industry. The report meticulously examines market size, projected to be in the millions, and its growth trajectory, offering granular insights into trends, drivers, and challenges. It dissects the competitive landscape, highlighting key players and their strategies, while also chronicling significant technological advancements and their implications. The report further offers an exhaustive segmentation by coolant type (hydrocarbon, fluorocarbon, other) and application (data center, virtual currency miner, power device, lithium battery, other), providing a detailed understanding of demand dynamics across diverse sectors and regions. This comprehensive approach ensures stakeholders have the critical intelligence needed to navigate the evolving immersion coolant solution market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.3%.

Key companies in the market include 3M, Solvay, AGC, Chemours, Shell, Honeywell, Engineered Fluids, Capchem, Zhejiang Noah Fluorochemical, M&I Materials Ltd, Dongguan Meide New Materials, .

The market segments include Type, Application.

The market size is estimated to be USD 435.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Immersion Coolant Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Immersion Coolant Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.