1. What is the projected Compound Annual Growth Rate (CAGR) of the Ibudilast?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ibudilast

IbudilastIbudilast by Type (Purity 97%, Purity 98%, Purity 99%, Others, World Ibudilast Production ), by Application (Pharmaceutical, Scientific Research, Others, World Ibudilast Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

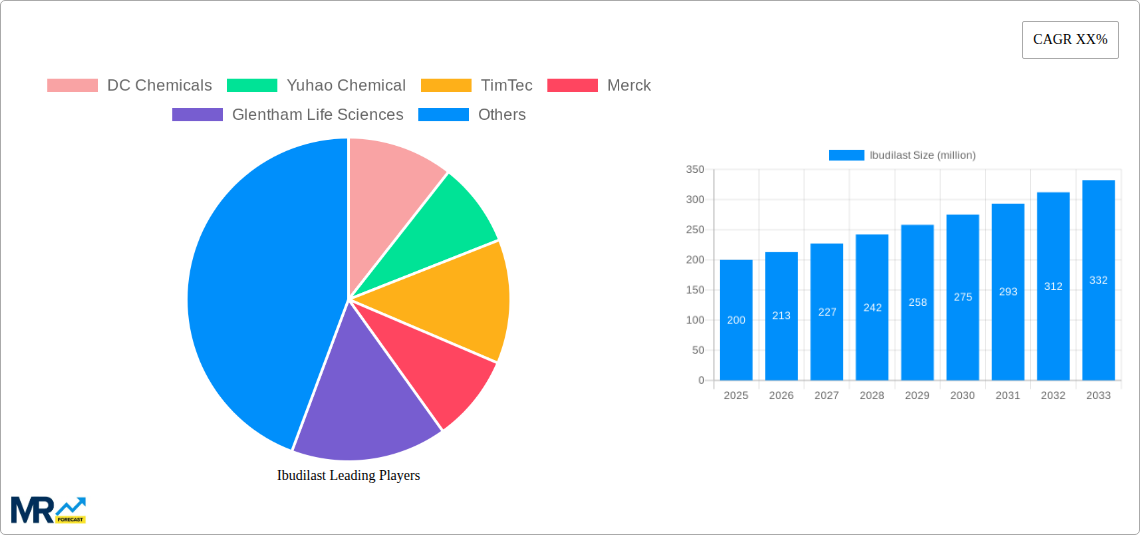

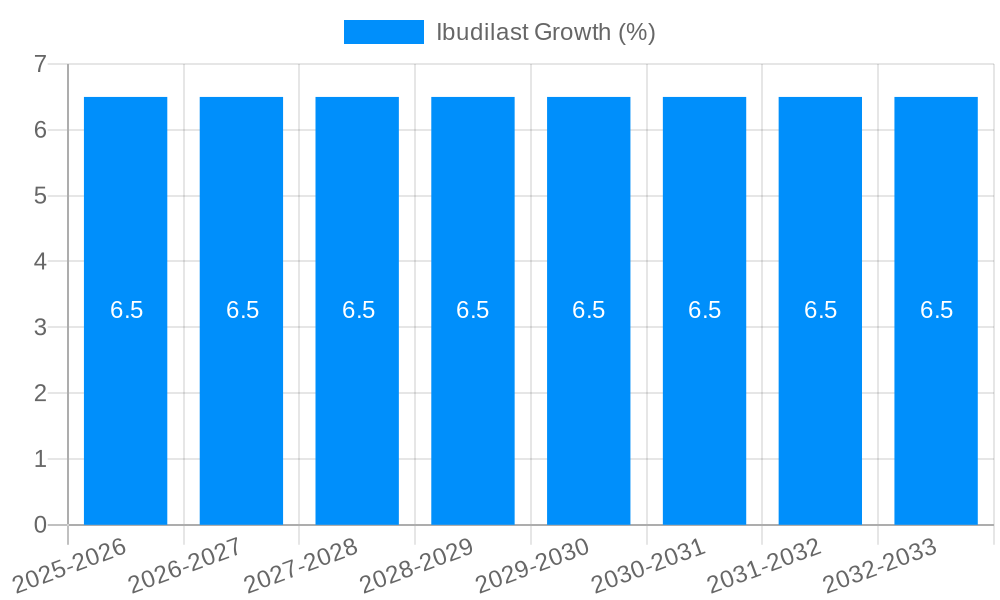

The global Ibudilast market is poised for significant expansion, projected to reach approximately USD 200 million by 2025 and experiencing robust growth at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily fueled by the escalating demand in pharmaceutical applications, particularly for its neuroprotective and anti-inflammatory properties that are being explored for a range of neurological disorders. The increasing prevalence of conditions like Multiple Sclerosis (MS) and Parkinson's disease, coupled with ongoing research into novel therapeutic uses, are key drivers propelling market growth. Furthermore, the growing application in scientific research for understanding inflammatory pathways and drug discovery further contributes to market traction. The market is segmented by purity levels, with Purity 99% currently holding a dominant share due to its stringent requirements in pharmaceutical formulations, followed by Purity 98% and Purity 97%. However, the "Others" category, encompassing emerging purity grades and research-grade Ibudilast, is expected to witness substantial growth as research progresses.

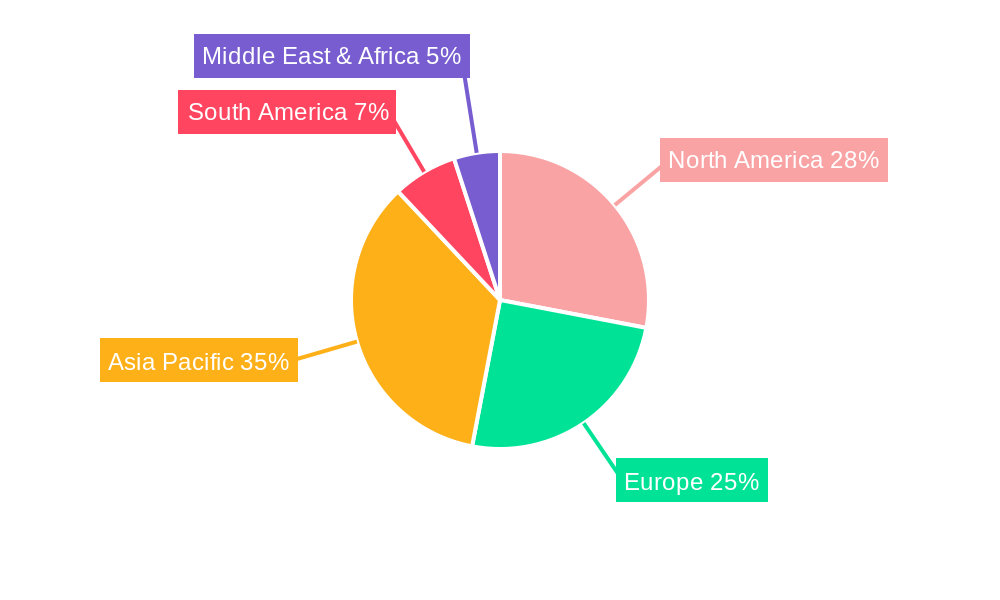

The Ibudilast market is characterized by a dynamic competitive landscape with key players like DC Chemicals, Yuhao Chemical, Merck, and MedChemExpress (MCE) actively engaged in production and supply. The Asia Pacific region, particularly China and India, is emerging as a crucial hub for Ibudilast production and consumption, owing to the presence of a strong chemical manufacturing base and increasing R&D investments. North America and Europe remain significant markets, driven by well-established pharmaceutical industries and a high incidence of neurological diseases. Emerging economies in these regions are expected to contribute to the overall market expansion. Despite the positive outlook, potential restraints include stringent regulatory hurdles for new drug approvals and the high cost associated with advanced research and development. Nevertheless, the sustained investment in research for novel applications and the growing awareness of Ibudilast's therapeutic potential are expected to outweigh these challenges, ensuring continued market growth.

This comprehensive report delves into the dynamic Ibudilast market, offering an in-depth analysis of trends, driving forces, challenges, and future prospects. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages historical data from 2019-2024 to provide robust insights. We will examine the global production and application landscape, focusing on key segments and the pivotal role of various purity levels and application areas. This report is an invaluable resource for stakeholders seeking to understand the intricate nuances and future trajectory of the Ibudilast industry, including its significant production volumes in the millions.

The global Ibudilast market is poised for significant expansion, driven by an increasing understanding of its therapeutic potential and a growing demand across diverse applications. During the historical period of 2019-2024, the market witnessed steady growth, fueled by early research and initial commercialization efforts. Projections indicate that this upward trajectory will accelerate through the forecast period of 2025-2033. The estimated production in the base year of 2025 is expected to reach several million units, a figure projected to climb significantly by the end of the forecast period. A key trend emerging is the rising demand for higher purity grades, particularly Purity 99%, as pharmaceutical and advanced scientific research applications become more sophisticated. While Purity 97% and Purity 98% will continue to hold a substantial market share, the premium segment is expected to grow at a faster pace. "Others" within the type segment, encompassing custom synthesis and specialized formulations, will also play a crucial role in catering to niche research requirements. The pharmaceutical application segment is anticipated to remain the dominant force, driven by ongoing clinical trials and the potential for new indications. However, the scientific research segment is expected to exhibit robust growth, as Ibudilast's unique pharmacological properties make it a valuable tool for investigating various biological pathways, including neuroinflammation and neuroprotection. This burgeoning interest in fundamental research is projected to contribute millions in demand. The "Others" application segment, which could include areas like diagnostics or specialized industrial uses, is also expected to see incremental growth. The overall market sentiment is optimistic, with continuous innovation and the exploration of new therapeutic avenues underpinning these positive trends. The production of Ibudilast, currently in the millions, is expected to be a significant contributor to the global chemical and pharmaceutical landscape over the next decade. The market's evolution is characterized by a blend of established applications and the emergence of novel uses, all contributing to a promising outlook.

The Ibudilast market is propelled by a confluence of powerful factors, primarily stemming from its established efficacy in treating specific neurological conditions and its emerging potential in a broader spectrum of therapeutic areas. The primary driver is its recognized utility as a treatment for cerebrovascular disorders and its anti-inflammatory properties, which have led to its widespread adoption in certain geographical regions. Furthermore, ongoing scientific investigations are continuously uncovering new applications for Ibudilast. Its role as a potent inhibitor of phosphodiesterase (PDE) enzymes, particularly PDE4 and PDE10, positions it as a promising therapeutic candidate for neurodegenerative diseases like Multiple Sclerosis (MS), Amyotrophic Lateral Sclerosis (ALS), and Parkinson's disease. Clinical trials exploring these new indications are generating substantial interest from both the pharmaceutical industry and the scientific research community. This burgeoning research activity, in turn, is creating a sustained demand for Ibudilast, especially for higher purity grades required for precise experimental outcomes. The increasing global prevalence of neurological disorders also acts as a significant underlying driver, creating a perpetual need for effective treatment options. As populations age and the incidence of these conditions rises, the demand for drugs like Ibudilast is set to escalate. Moreover, advancements in drug delivery systems and a better understanding of Ibudilast's pharmacokinetics are further enhancing its therapeutic appeal, paving the way for more targeted and effective treatments and consequently boosting its production in the millions.

Despite the promising growth trajectory, the Ibudilast market encounters several challenges and restraints that could temper its expansion. One of the most significant hurdles is the stringent regulatory landscape surrounding pharmaceutical approvals. Gaining approval for new indications or in new geographical markets requires extensive and costly clinical trials, which can be a protracted and uncertain process. This regulatory complexity can slow down the market penetration of Ibudilast for its novel applications. Furthermore, while Ibudilast has established therapeutic uses, the competition from alternative treatments and emerging drug candidates for neurological disorders poses a considerable restraint. The development of new and more effective therapies could potentially cannibalize market share. The cost of production, particularly for high-purity grades, can also be a limiting factor, especially for research-oriented applications where budget constraints are common. While production is in the millions, optimizing cost-effectiveness without compromising quality remains a key challenge for manufacturers. Side effects associated with Ibudilast, although generally well-tolerated, can also deter some patients and prescribers, especially if more favorable safety profiles are offered by competing drugs. Intellectual property issues and patent expirations can also create uncertainties within the market, potentially impacting pricing strategies and investment in new research and development. Finally, the reliance on specific raw material suppliers and potential supply chain disruptions can affect production volumes and pricing, further contributing to market volatility.

The Ibudilast market is projected to be dominated by several key regions and segments, each contributing significantly to global production and consumption.

Dominant Regions:

Asia Pacific: This region, particularly China and India, is expected to be a powerhouse in Ibudilast production. The presence of numerous chemical manufacturers, including Yuhao Chemical, Hairui Chemical, and BLD Pharmatech, coupled with competitive manufacturing costs, positions the Asia Pacific as a leading supplier of both raw materials and finished Ibudilast products, contributing to the millions in global output. The growing pharmaceutical industries in these countries, coupled with increasing healthcare expenditure and a focus on generic drug manufacturing, further bolster this dominance. Their capacity to produce large volumes of Ibudilast at competitive prices makes them pivotal players.

North America: While production might be more specialized, North America, especially the United States, will be a significant driver of demand. This is attributed to its advanced pharmaceutical research infrastructure, leading research institutions, and a high prevalence of neurological disorders. The presence of companies like Merck and MedChemExpress (MCE), which focus on high-purity compounds for scientific research and clinical development, ensures a strong demand for Ibudilast, particularly in the higher purity segments. The robust funding for medical research in this region fuels the scientific research application.

Europe: European countries, with their well-established pharmaceutical sectors and stringent quality control standards, will also play a crucial role. Countries like Germany, the United Kingdom, and Switzerland will see significant demand driven by their healthcare systems and active research communities. Companies like Tokyo Chemical Industry (TCI) and Glentham Life Sciences contribute to the supply of high-quality Ibudilast for research and niche pharmaceutical applications. The strong emphasis on drug innovation and the pursuit of treatments for unmet medical needs in Europe will sustain market growth.

Dominant Segments:

Application: Pharmaceutical: This segment is undeniably the leading force in the Ibudilast market. Its established use in treating cerebrovascular disorders and the promising results from ongoing clinical trials for conditions like Multiple Sclerosis ensure a sustained and growing demand. The development of new drug formulations and the exploration of novel therapeutic pathways for neurological diseases will continue to drive the pharmaceutical application of Ibudilast, contributing significantly to its production in the millions. The ongoing investment in pharmaceutical R&D and the pursuit of innovative treatments for a wide array of neurological conditions solidify this segment's dominance.

Type: Purity 99%: The demand for Ibudilast with Purity 99% is expected to witness the most significant growth within the "Type" segment. As scientific research becomes more precise and pharmaceutical applications demand higher levels of purity to ensure efficacy and minimize potential side effects, Purity 99% Ibudilast will become increasingly sought after. This premium segment is crucial for advanced research, drug development, and the manufacturing of sensitive pharmaceutical formulations. While Purity 97% and Purity 98% will maintain substantial market presence due to their cost-effectiveness for certain applications, the growth trajectory of Purity 99% signifies a trend towards higher quality standards in the Ibudilast market, contributing to specialized, high-value production.

Application: Scientific Research: The scientific research segment, while currently smaller than the pharmaceutical segment, is poised for substantial growth. Ibudilast's complex mechanism of action, particularly its role as a PDE inhibitor, makes it an invaluable tool for researchers investigating neuroinflammation, neuroprotection, and other intricate biological processes. The increasing focus on understanding the underlying mechanisms of neurological diseases and developing novel therapeutic strategies will fuel the demand for Ibudilast in academic and industrial research laboratories globally. This segment’s expansion will be driven by the need for high-purity compounds for experimental use, further supporting the growth of the Purity 99% segment.

The interplay between these regions and segments, driven by ongoing research and development and an increasing global need for effective neurological treatments, will shape the future landscape of the Ibudilast market, with production volumes consistently in the millions.

The Ibudilast industry is fueled by several key growth catalysts. Firstly, the expanding pipeline of clinical trials investigating its efficacy in treating a wider range of neurological conditions, such as Multiple Sclerosis and neuroinflammatory diseases, is a significant driver. Secondly, increasing investment in pharmaceutical R&D, particularly in the field of neuroscience, creates a sustained demand for Ibudilast as a research tool and potential therapeutic agent. Furthermore, the growing global prevalence of neurological disorders, coupled with an aging population, amplifies the need for effective treatment options. Finally, advancements in manufacturing technologies that enhance purity and reduce production costs, while maintaining volumes in the millions, will also contribute to market expansion.

The Ibudilast market features a diverse range of key players, from large chemical conglomerates to specialized research chemical suppliers. These companies are instrumental in the production and distribution of Ibudilast across various purity grades and for diverse applications. The leading entities in this sector include:

The Ibudilast sector has witnessed several pivotal developments that have shaped its trajectory:

This report provides a holistic overview of the Ibudilast market, encompassing its intricate dynamics from production to application. It meticulously analyzes market trends, identifies the primary drivers of growth, and thoroughly examines the challenges and restraints that may impede expansion. The report also pinpoints the key regions and segments poised for dominance, offering strategic insights into their market influence. Furthermore, it highlights the crucial growth catalysts propelling the industry forward and presents a comprehensive list of leading players actively shaping the market. Significant sector developments are also detailed to provide a historical and future perspective. The report's extensive coverage ensures that stakeholders gain a profound understanding of the Ibudilast market's present state and its promising future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DC Chemicals, Yuhao Chemical, TimTec, Merck, Glentham Life Sciences, Oakwood Products, Anward, Lancrix Chemicals, BLD Pharmatech, BOC Sciences, MedChemExpress (MCE), Combi-Blocks, Tokyo Chemical Industry (TCI), Hairui Chemical.

The market segments include Type, Application.

The market size is estimated to be USD 9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ibudilast," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ibudilast, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.