1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydroxy Acids in Cosmetics?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hydroxy Acids in Cosmetics

Hydroxy Acids in CosmeticsHydroxy Acids in Cosmetics by Application (Facial Cleanser, Facial Mask, Essence, Facial Toner, Face Cream, Body Lotion, Hair Care, Others, World Hydroxy Acids in Cosmetics Production ), by Type (Alpha Hydroxy Acids, Beta Hydroxy Acids, World Hydroxy Acids in Cosmetics Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

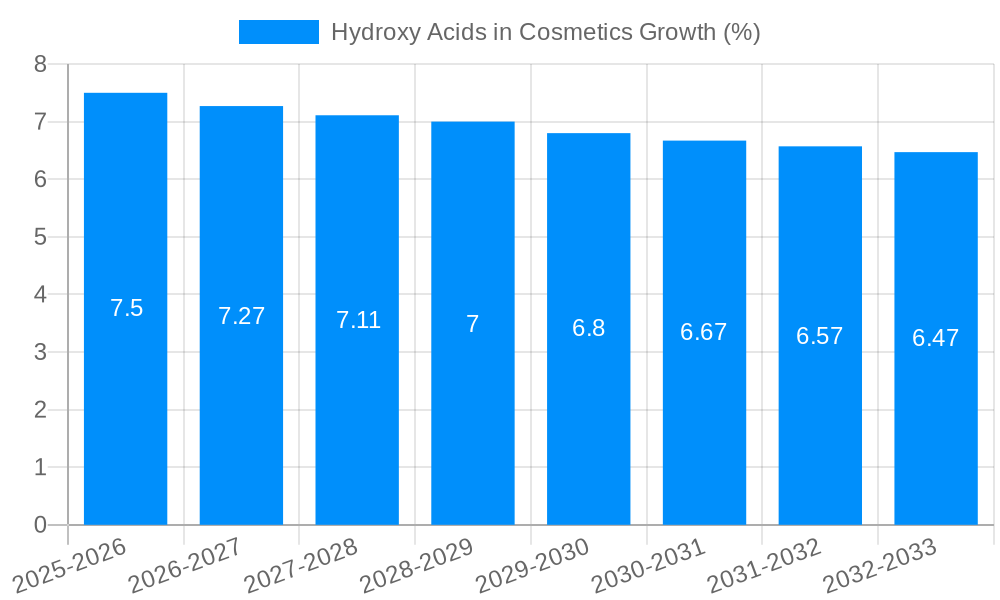

The global Hydroxy Acids (HA) in cosmetics market is experiencing robust growth, driven by increasing consumer awareness of skincare benefits and the rising demand for natural and effective cosmetic ingredients. The market, segmented by application (facial cleansers, masks, toners, creams, lotions, hair care, and others) and type (Alpha Hydroxy Acids (AHAs) and Beta Hydroxy Acids (BHAs)), is projected to maintain a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). The prevalence of acne, hyperpigmentation, and aging concerns fuels the demand for HA-based products. AHAs, like glycolic and lactic acid, are popular for exfoliation and brightening, while BHAs, such as salicylic acid, are favored for treating acne and reducing oiliness. The market's growth is further propelled by advancements in HA formulations, resulting in gentler yet effective products catering to diverse skin types and concerns. Key players are focusing on innovation and expanding product portfolios to capitalize on this expanding market, leading to increased competition and a diverse range of options for consumers.

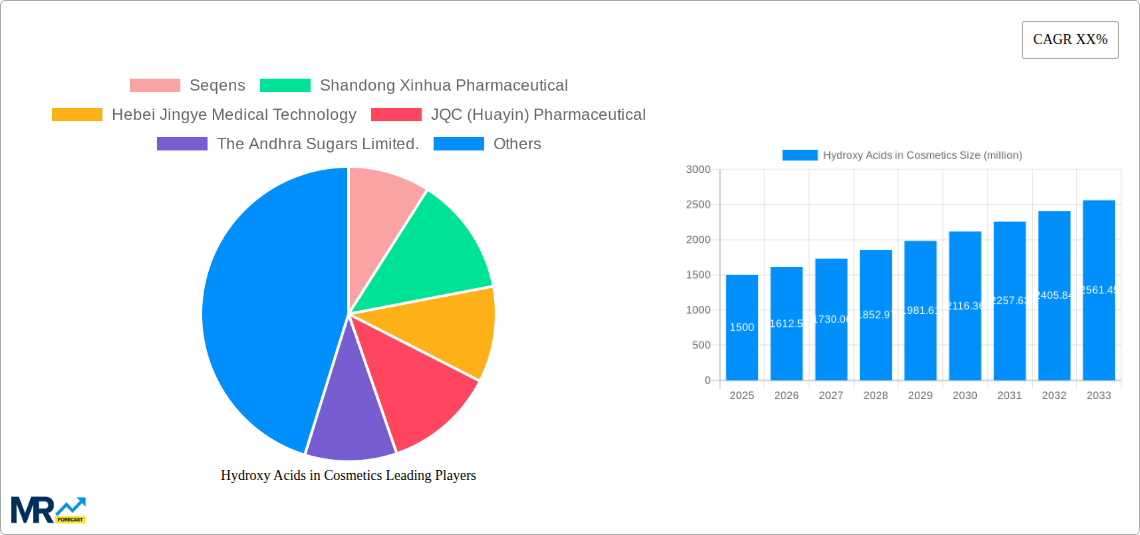

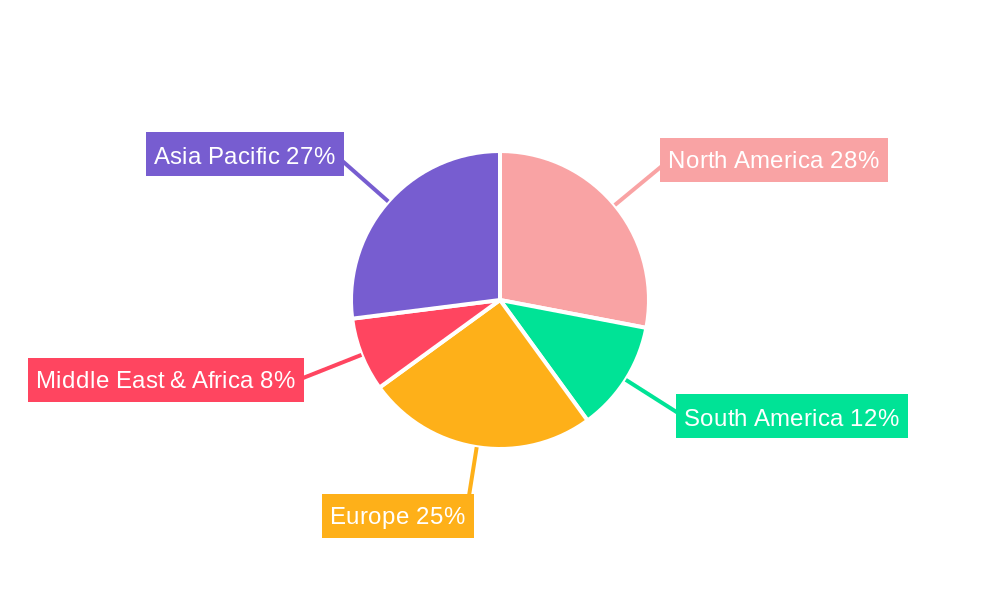

Significant regional variations exist. North America and Europe currently hold a substantial market share, owing to high consumer spending on premium skincare and established cosmetic industries. However, the Asia-Pacific region, particularly China and India, is anticipated to witness rapid growth due to rising disposable incomes, increasing beauty consciousness, and a burgeoning middle class. While challenges like potential skin irritation from improper usage and stringent regulatory requirements exist, the overall outlook for the HA in cosmetics market remains positive. The ongoing development of sustainable and ethically sourced HA ingredients further enhances the market's growth trajectory. The market is expected to reach a value exceeding $X Billion by 2033 (Note: A precise value cannot be provided without the original market size data; however, a logical estimation can be made based on a reasonable CAGR and current market data from reputable sources).

The global hydroxy acids (HA) in cosmetics market is experiencing robust growth, driven by increasing consumer awareness of skincare benefits and the rising demand for effective anti-aging and acne-treating products. The market, valued at approximately $XXX million in 2024, is projected to reach $YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This surge is fueled by several factors, including the escalating popularity of natural and organic cosmetics, coupled with the proven efficacy of HAs in improving skin texture and reducing blemishes. The market shows a strong preference towards Alpha Hydroxy Acids (AHAs) due to their established reputation and widespread availability. However, Beta Hydroxy Acids (BHAs), particularly salicylic acid, are also gaining traction owing to their unique ability to penetrate pores and combat acne effectively. The market is witnessing innovation in product formulations, with a notable shift towards multi-functional products incorporating HAs alongside other active ingredients like vitamins and antioxidants. This trend reflects the consumer preference for streamlined skincare routines and products offering comprehensive benefits. Furthermore, the growing prevalence of online retail channels provides increased accessibility to a wider range of HA-based products, contributing to market expansion. The increasing adoption of sophisticated marketing strategies by major players further boosts market penetration and consumer awareness. Geographic distribution reveals strong growth in both developed and developing economies, with Asia-Pacific and North America leading the charge, driven by rising disposable incomes and increasing focus on personal care. The market is also witnessing the emergence of niche players focusing on specialized formulations catering to particular skin types and concerns, contributing to market diversification. Looking forward, the continued emphasis on scientific research and development of innovative HA-based formulations will further solidify the market's trajectory towards sustained growth in the coming years.

Several key factors are driving the expansion of the hydroxy acids in cosmetics market. Firstly, the increasing consumer awareness regarding skincare benefits and the desire for effective anti-aging solutions are significantly boosting the demand for HA-infused products. Consumers are actively seeking products that address specific skin concerns, such as wrinkles, acne, hyperpigmentation, and uneven skin tone, which HAs effectively tackle. Secondly, the rising popularity of natural and organic cosmetics has created a receptive market for HA products, given their natural origin and proven efficacy. This preference for natural ingredients aligns with the growing consumer consciousness about environmentally friendly and sustainable practices within the beauty industry. Furthermore, the continuous advancements in cosmetic formulation technologies are leading to the development of more effective and sophisticated HA-based products. This includes the incorporation of HAs in various product formats, including serums, creams, lotions, and cleansers, thereby catering to diverse consumer needs and preferences. The increasing accessibility of these products through e-commerce platforms is further propelling market growth, while targeted marketing campaigns are enhancing consumer awareness and driving product adoption. Finally, the scientific community's ongoing research into the benefits of HAs and the publication of supporting studies are building consumer confidence and solidifying the market position of HA-based cosmetic products.

Despite the promising growth outlook, the hydroxy acids in cosmetics market faces several challenges. One major hurdle is the potential for skin irritation and sensitivity associated with the use of HAs, particularly at high concentrations or for individuals with sensitive skin. This necessitates careful formulation and clear product labeling, including recommendations for patch testing before widespread application. Furthermore, the market is characterized by intense competition, with numerous players vying for market share. This requires companies to constantly innovate, improve product quality, and develop effective marketing strategies to stand out in a crowded marketplace. Another challenge stems from fluctuating raw material prices and the potential impact of regulatory changes and safety standards. Variations in raw material costs can affect production costs and profitability, necessitating prudent supply chain management and risk mitigation strategies. Furthermore, ensuring consistent product quality and preventing counterfeiting are crucial to maintain consumer trust and prevent reputational damage. The market also faces the challenge of educating consumers on the correct usage of HA-based products, emphasizing the importance of sun protection and gradual introduction to avoid potential adverse effects. Addressing these challenges requires proactive measures, including stringent quality control, robust supply chain management, and targeted consumer education initiatives.

The North American region is expected to dominate the hydroxy acids in cosmetics market throughout the forecast period (2025-2033). This dominance is attributed to several factors:

Within the segments, the Facial Cleanser segment demonstrates significant growth potential. The increasing awareness of the importance of cleansing as a fundamental skincare step, coupled with the efficacy of HAs in gentle yet effective cleansing without stripping the skin of its natural oils, contributes to this dominance.

Additionally, Alpha Hydroxy Acids (AHAs) dominate the market in terms of type. Their established efficacy, widespread availability, and relatively lower cost compared to BHAs contribute to their market leadership.

The hydroxy acids in cosmetics industry's growth is fueled by several catalysts, including rising consumer awareness of skincare benefits, increasing demand for effective anti-aging and acne treatments, the growing popularity of natural and organic cosmetics, and continuous advancements in cosmetic formulation technologies. These factors collectively drive market expansion and the adoption of HA-based products across various applications.

This report provides a comprehensive analysis of the hydroxy acids in cosmetics market, covering market trends, driving forces, challenges, key players, and future growth prospects. The detailed segmental analysis and regional breakdown offer valuable insights for businesses operating within this dynamic and rapidly expanding sector. The forecast period provides a clear projection of market growth, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Seqens, Shandong Xinhua Pharmaceutical, Hebei Jingye Medical Technology, JQC (Huayin) Pharmaceutical, The Andhra Sugars Limited., Zhenjiang Gaopeng Pharmaceutical, Nanjing Chinafirst Chemical.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hydroxy Acids in Cosmetics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hydroxy Acids in Cosmetics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.