1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Generation by Water Electrolysis?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hydrogen Generation by Water Electrolysis

Hydrogen Generation by Water ElectrolysisHydrogen Generation by Water Electrolysis by Type (Alkaline Water Electrolysis, Proton Exchange membrane (PEM) Electrolysis), by Application (New Energy Vehicles, Research Institutions, Emergency Response System), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

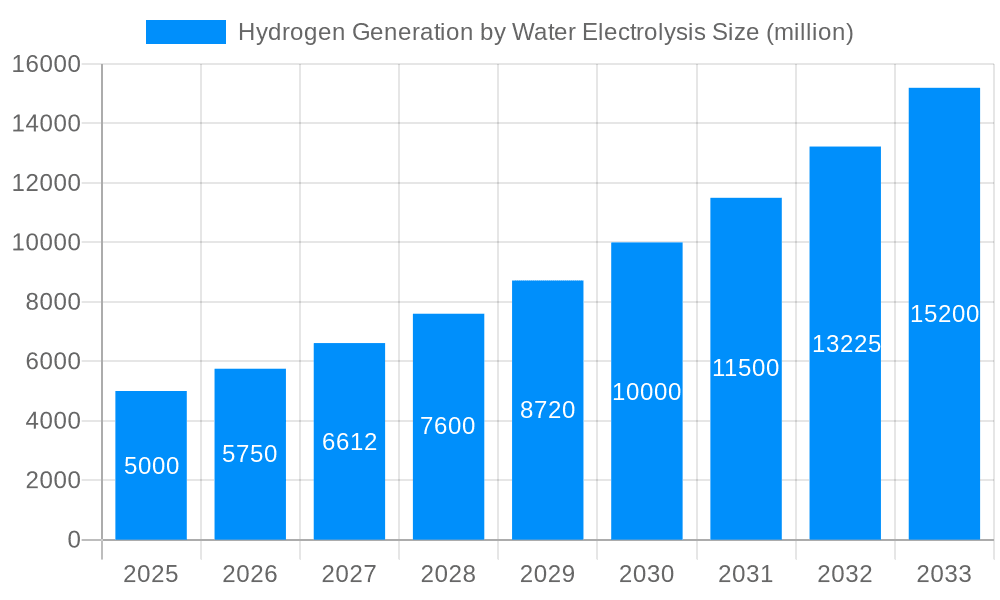

The global hydrogen generation by water electrolysis market is experiencing robust growth, driven by the increasing demand for clean energy and the global push towards decarbonization. The market, estimated at $5 billion in 2025, is projected to witness a significant Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $15 billion by 2033. This growth is fueled by several key factors, including the burgeoning renewable energy sector, supportive government policies promoting green hydrogen production, and the rising adoption of hydrogen fuel cell vehicles. The expansion of the new energy vehicle (NEV) market is a significant driver, creating a substantial demand for hydrogen as a clean fuel source. Furthermore, research institutions and emergency response systems are increasingly utilizing hydrogen generated through electrolysis, contributing to market expansion. The market is segmented by type (alkaline water electrolysis, proton exchange membrane (PEM) electrolysis) and application (NEVs, research institutions, emergency response systems), with PEM electrolysis gaining traction due to its higher efficiency and potential for large-scale deployment. However, high initial capital costs associated with electrolysis systems and the dependence on renewable electricity sources for sustainable hydrogen production pose significant challenges to market growth.

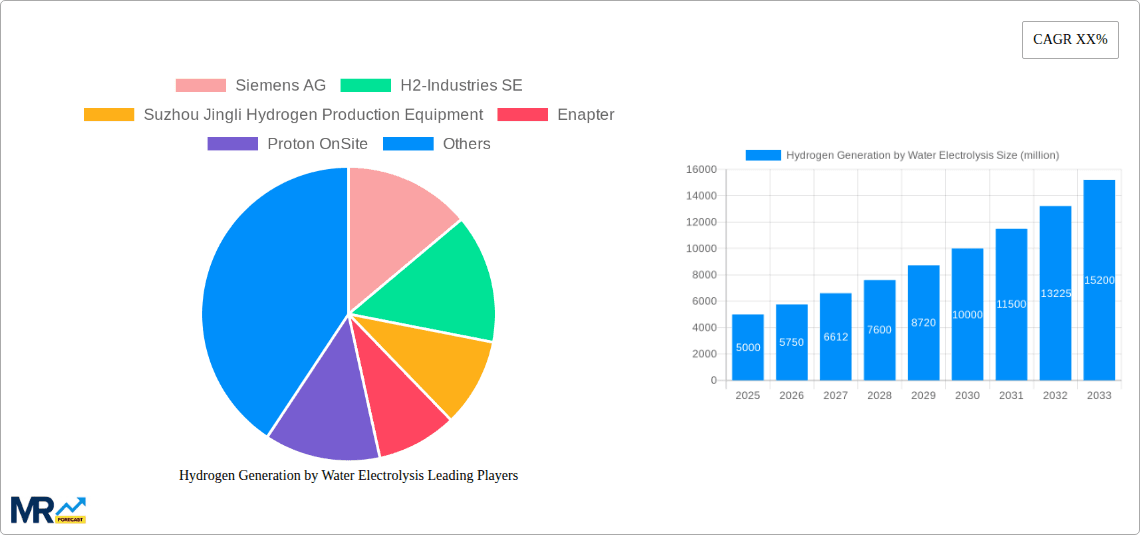

Despite these challenges, technological advancements, decreasing costs of renewable energy, and increasing economies of scale are expected to mitigate these restraints in the coming years. The market is geographically diverse, with North America and Europe leading the charge due to established renewable energy infrastructure and supportive policies. Asia-Pacific is also witnessing rapid growth, fueled by strong government support and substantial investments in hydrogen energy infrastructure. The competitive landscape features both established players like Siemens AG and Nel Hydrogen, and emerging companies specializing in innovative electrolysis technologies. Continuous innovation in electrolysis technology, coupled with increasing government incentives and industry collaborations, will further accelerate the growth trajectory of the hydrogen generation by water electrolysis market in the forecast period.

The global hydrogen generation by water electrolysis market is experiencing a period of significant growth, driven by the increasing demand for clean energy and the global push towards decarbonization. Over the study period (2019-2033), the market has witnessed a substantial upswing, with the global consumption value exceeding tens of millions of units by 2025. This upward trajectory is projected to continue throughout the forecast period (2025-2033), fueled by substantial investments in renewable energy infrastructure and supportive government policies. The market is characterized by technological advancements in both alkaline water electrolysis (AWE) and proton exchange membrane (PEM) electrolysis, each catering to specific application needs and scales. While AWE dominates the current market share due to its maturity and cost-effectiveness for large-scale applications, PEM electrolysis is rapidly gaining traction due to its higher efficiency and suitability for smaller, decentralized systems. The overall market is segmented based on the diverse applications of green hydrogen, including transportation (particularly new energy vehicles), stationary power generation, industrial processes, and research institutions. The historical period (2019-2024) showed considerable market expansion, laying the foundation for the exponential growth anticipated in the coming years. By 2033, the market is expected to reach hundreds of millions of units in consumption value, demonstrating the transformative potential of this technology in the global energy transition. The estimated year 2025 serves as a crucial benchmark, reflecting the market's maturation and preparation for sustained, high-growth expansion in the subsequent years. This growth is further amplified by the growing awareness of climate change and the urgent need to reduce carbon emissions, making green hydrogen production a critical component of a sustainable energy future. The base year, 2025, marks a pivotal point where the market achieves significant scale and momentum, setting the stage for accelerated development and market penetration in the years to come. The diverse applications of hydrogen and ongoing technological advancements continue to drive investment and innovation within this rapidly expanding sector.

Several key factors are driving the growth of the hydrogen generation by water electrolysis market. Firstly, the escalating global concerns about climate change and the urgent need to reduce greenhouse gas emissions are creating a strong impetus for the adoption of clean energy technologies. Green hydrogen, produced through water electrolysis powered by renewable energy sources, is emerging as a crucial solution for decarbonizing various sectors, from transportation to industrial processes. Government regulations and supportive policies, including substantial financial incentives and ambitious renewable energy targets, are further stimulating market growth. Many countries are implementing policies that favor the adoption of hydrogen technology, making it a more economically viable option. Moreover, technological advancements in electrolysis systems, particularly improvements in efficiency and cost-effectiveness, are enhancing the competitiveness of green hydrogen compared to traditional methods of hydrogen production. The development of more efficient and durable electrolyzers, coupled with declining manufacturing costs, is opening up new market opportunities. Furthermore, the growing demand for hydrogen in diverse applications, including fuel cell vehicles, industrial processes, and energy storage, is fueling market expansion. As the adoption of fuel cell electric vehicles (FCEVs) increases, so too will the demand for green hydrogen to power them. Finally, increasing investments in research and development are further pushing the boundaries of electrolysis technology, leading to innovations that enhance performance and reduce costs. This overall synergy of environmental urgency, supportive policies, technological advancement, and increasing demand is propelling the market towards substantial growth.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of hydrogen generation by water electrolysis. One major challenge is the relatively high capital cost of electrolysis systems, particularly for large-scale deployments. The initial investment required for setting up electrolysis plants can be substantial, potentially acting as a barrier for smaller companies or developing economies. Furthermore, the energy efficiency of electrolysis systems remains a crucial consideration. While significant progress has been made in improving efficiency, losses during the electrolysis process can impact the overall cost-effectiveness of green hydrogen production. The availability and reliability of renewable energy sources for powering electrolyzers also present a challenge. The intermittent nature of renewable sources, such as solar and wind power, requires robust energy storage solutions or grid integration strategies to ensure a consistent supply of hydrogen. Infrastructure limitations for hydrogen storage, transportation, and distribution pose another significant challenge. The lack of a well-established hydrogen infrastructure in many parts of the world can limit the widespread adoption of electrolysis technology. Finally, the production of oxygen as a byproduct of electrolysis needs careful management, as its efficient capture and use or safe disposal is crucial. Addressing these challenges through technological innovation, policy support, and strategic infrastructure development is essential for realizing the full potential of hydrogen generation by water electrolysis.

The global hydrogen generation by water electrolysis market is characterized by diverse regional growth patterns. Several key regions are poised for significant market expansion:

Europe: With strong government support for renewable energy and a proactive push towards decarbonization, Europe is expected to be a leading market for hydrogen electrolysis, particularly in Germany, the Netherlands, and the UK. Significant investments in renewable energy projects and supportive policies are driving the adoption of hydrogen technologies across various sectors.

Asia-Pacific: The region is witnessing rapid growth driven by the increasing demand for energy in rapidly developing economies such as China, Japan, and South Korea. These countries are making substantial investments in hydrogen infrastructure and technologies to meet their growing energy needs.

North America: The United States is experiencing a surge in interest in hydrogen as part of a broader national strategy to reduce emissions. Several states are implementing policies to promote the use of hydrogen in transportation and other sectors.

Dominant Segments:

PEM Electrolysis: The PEM electrolysis segment is expected to witness faster growth compared to AWE, due to its higher efficiency, faster response times, and suitability for smaller, decentralized systems. This makes it particularly appealing for applications where space is limited, or rapid response is needed, such as in backup power systems or certain industrial settings.

New Energy Vehicles (NEVs): The growing adoption of fuel cell electric vehicles (FCEVs) is significantly driving the demand for green hydrogen, making the NEV segment a crucial growth driver for the market. As the automotive industry transitions towards cleaner transportation solutions, the demand for hydrogen to power FCEVs is expected to rise dramatically.

Industrial Applications: Various industrial processes, including ammonia production, steelmaking, and chemical manufacturing, require significant amounts of hydrogen. The adoption of green hydrogen produced via water electrolysis is steadily growing in these sectors as companies seek ways to reduce their environmental impact.

In summary, the interplay of these regional and segmental growth factors indicates a diverse and dynamic market, with continued expansion expected across all major segments in the coming years. The adoption of hydrogen technologies is no longer merely an aspirational goal but a rapidly unfolding reality, significantly shaping the energy landscape.

Several factors act as catalysts for accelerating growth within the hydrogen generation by water electrolysis industry. The most significant is the continuous decline in the cost of renewable energy sources, such as solar and wind power, making green hydrogen production increasingly competitive. Technological advancements are steadily improving the efficiency and reducing the cost of electrolyzers themselves. Furthermore, supportive government policies and incentives are actively encouraging the development and deployment of hydrogen technologies through targeted funding, tax breaks, and regulatory frameworks that prioritize the transition to green hydrogen. The increasing awareness of climate change and its devastating consequences is driving a global commitment to decarbonization, significantly boosting the demand for green hydrogen solutions.

This report provides a comprehensive overview of the hydrogen generation by water electrolysis market, encompassing historical data, current market trends, and future projections. It offers deep insights into the key driving forces, challenges, and growth opportunities within the sector, including detailed analysis of major players and significant technological developments. The report also provides a detailed regional and segmental breakdown, allowing for a thorough understanding of the market dynamics across various geographical locations and applications. The projected growth figures and consumption values provide a clear picture of the immense potential of this technology in the global energy transition. The information provided is crucial for stakeholders in the energy sector, investors, policymakers, and anyone seeking to understand the future of clean energy.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Siemens AG, H2-Industries SE, Suzhou Jingli Hydrogen Production Equipment, Enapter, Proton OnSite, Giner, Ionomr Innovations, Tianjin Mainland Hydrogen Equipment, Chunhua Hydrogen Technology, Cummins, Yangzhou Zhongdian Hydrogen Production Equipment, Industrie De Nora S.p.A., McPhy Energy S.A., Shandong Saikesaisi Hydrogen Energy, Teledyne Energy Systems, Gaztransport & Technigaz, ITM Power, Toshiba, Elchemtech, Nel Hydrogen.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hydrogen Generation by Water Electrolysis," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hydrogen Generation by Water Electrolysis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.