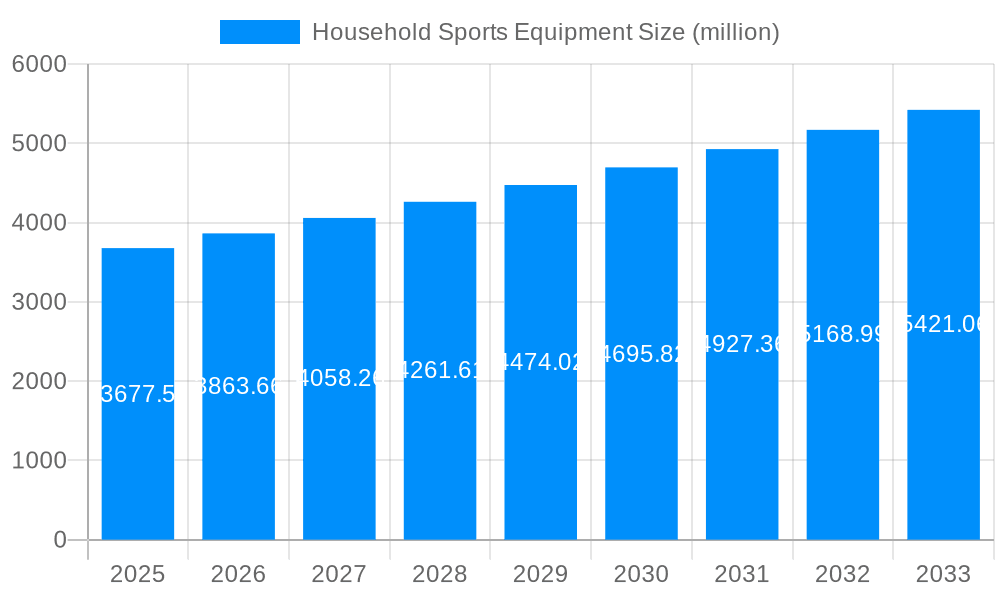

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Sports Equipment?

The projected CAGR is approximately 4.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Household Sports Equipment

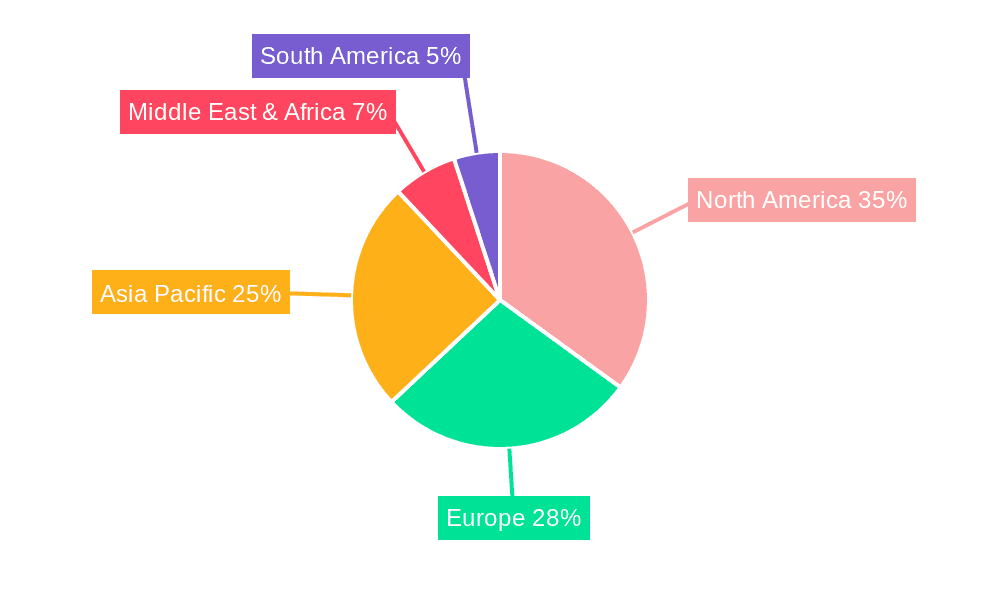

Household Sports EquipmentHousehold Sports Equipment by Type (Treadmill, Rowing Machine, Elliptical Trainer, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

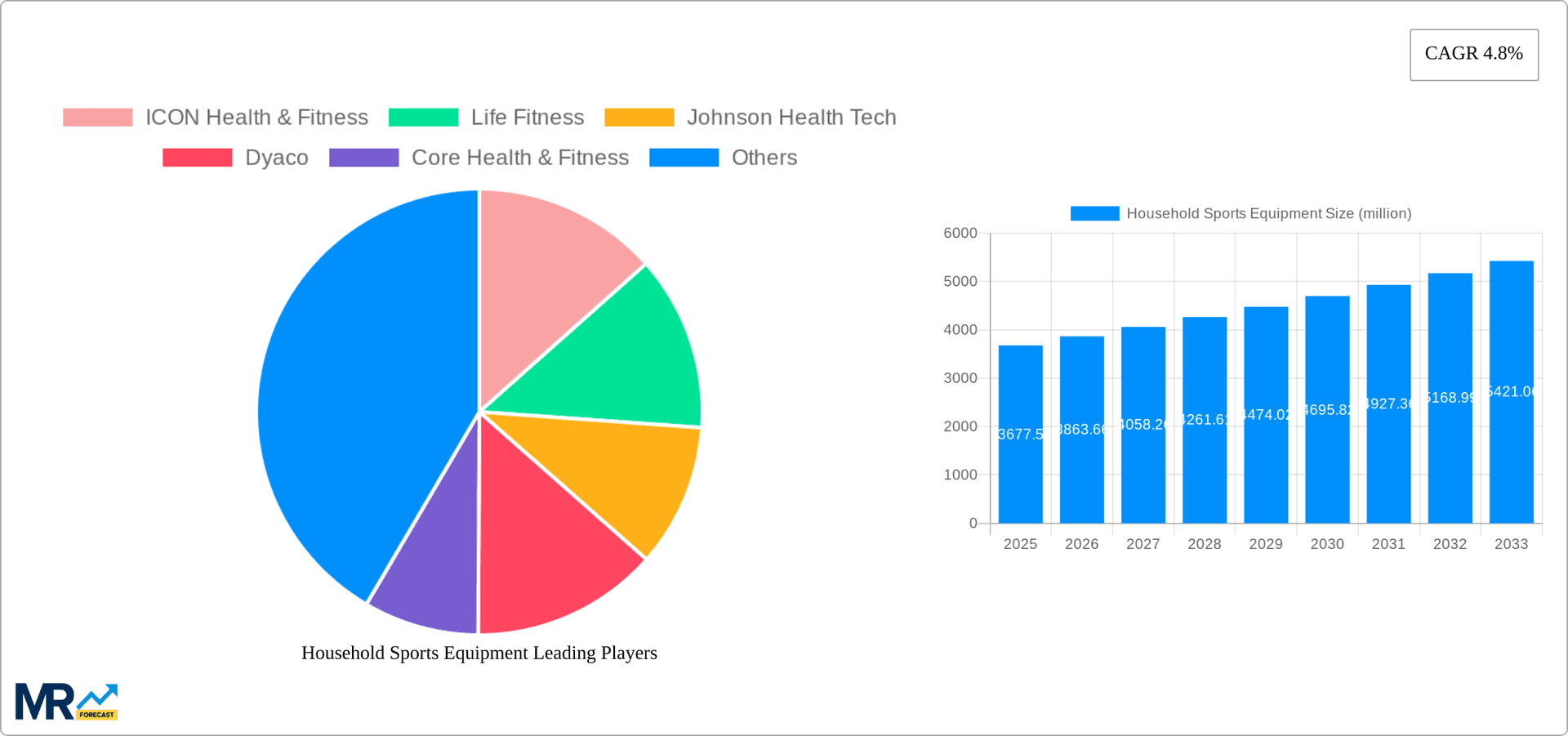

The global household sports equipment market, valued at $3677.5 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing health consciousness among consumers, coupled with the rising prevalence of sedentary lifestyles and related health issues, fuels demand for home fitness solutions. The convenience of working out at home, eliminating travel time and gym membership costs, further enhances market appeal. Technological advancements, such as interactive fitness apps and smart home integration features in equipment like treadmills and elliptical trainers, are significantly impacting consumer preference and driving premium segment growth. The market is segmented by equipment type (treadmills, rowing machines, elliptical trainers, and others) and sales channels (online and offline). While treadmills currently dominate the market share, the popularity of versatile equipment like elliptical trainers and rowing machines is steadily increasing, driven by their low-impact nature and full-body workout potential. The online sales channel is witnessing exponential growth, facilitated by e-commerce platforms and convenient home delivery, offering increased accessibility to a wider customer base. Geographical expansion, particularly in developing economies with rising disposable incomes and increasing awareness of fitness, presents significant growth opportunities. Competitive intensity is high, with established players like ICON Health & Fitness and Life Fitness vying for market share with emerging brands focusing on innovative products and digital integration. However, factors such as fluctuating raw material prices and the potential for economic downturns pose challenges to sustained market growth. The forecast period of 2025-2033 anticipates a continued upward trend, fueled by evolving consumer preferences and technological innovations within the industry.

The market's growth trajectory is expected to be influenced by several trends. The increasing integration of technology into home fitness equipment, like smart features and fitness app connectivity, enhances the user experience and drives higher adoption rates. This is complemented by the growing popularity of online fitness classes and virtual coaching, creating a synergistic effect that fosters user engagement and adherence to fitness routines. Sustainability is also emerging as a key concern; consumers are increasingly seeking eco-friendly materials and energy-efficient products. This will push manufacturers to incorporate sustainable practices into their production processes and product design. Furthermore, the rising popularity of home gyms, facilitated by the availability of compact and modular equipment, caters to the demand for personalized and convenient fitness solutions. Conversely, potential restraints include the relatively high initial investment cost of high-end equipment, which could limit accessibility for price-sensitive consumers. Nevertheless, the long-term health benefits associated with home fitness and the continuous advancements in technology are anticipated to outweigh these limitations, fostering continued growth and expansion of the household sports equipment market in the coming years.

The global household sports equipment market experienced significant growth between 2019 and 2024, driven primarily by increasing health consciousness, the rise of home fitness, and technological advancements. The market witnessed a surge in demand during the pandemic as gyms and fitness centers closed, forcing consumers to seek alternatives for maintaining their fitness routines at home. This trend led to a substantial increase in sales of treadmills, elliptical trainers, and rowing machines, among other equipment. However, post-pandemic, while the market saw some normalization, the growth trajectory continued, albeit at a more moderate pace. This sustained growth reflects a lasting shift in consumer behavior, with many individuals preferring the convenience and privacy of home workouts. The integration of technology, such as fitness apps and smart home connectivity, has further enhanced the appeal of home fitness equipment. Manufacturers are responding to this by incorporating advanced features such as interactive screens, personalized workout programs, and heart rate monitoring into their products. The market is also seeing a rise in more compact and space-saving equipment, catering to consumers with limited living space. The increasing popularity of online fitness classes and virtual training programs has also contributed to the market's expansion, creating a symbiotic relationship between technology and fitness equipment. The market is expected to continue its expansion throughout the forecast period (2025-2033), fueled by ongoing trends and the development of innovative products. The estimated market value in 2025 is projected to reach several billion dollars, with continued growth anticipated through 2033. This growth will be driven by a combination of factors, including the ongoing popularity of home fitness, technological advancements, and the increasing focus on overall health and well-being. Competition among manufacturers is intensifying, leading to the introduction of innovative and feature-rich products designed to appeal to a diverse range of consumers.

Several key factors are driving the growth of the household sports equipment market. The rising global prevalence of lifestyle diseases such as obesity and cardiovascular conditions is pushing individuals towards adopting healthier lifestyles, with home fitness playing a crucial role. The convenience and flexibility of home workouts are particularly attractive to busy individuals and those with limited mobility. Technological advancements have significantly enhanced the appeal of home fitness equipment, with smart features like interactive displays, personalized training programs, and data tracking adding value and engagement. The affordability of various equipment types has also contributed to increased adoption, with a wide range of options available at different price points. Furthermore, the growing popularity of online fitness platforms and virtual coaching has created a more comprehensive and accessible home workout experience. The COVID-19 pandemic acted as a catalyst, accelerating the shift towards home fitness and establishing a lasting preference for home-based workouts among many consumers. Government initiatives promoting health and wellness, coupled with rising disposable incomes in several regions, also contribute to the market's expansion. Finally, the increasing availability of financing options for high-end equipment further facilitates the purchase decision for consumers.

Despite the positive growth trajectory, the household sports equipment market faces several challenges. One significant constraint is the high initial investment cost associated with purchasing high-quality equipment, which can be a barrier for many consumers. Competition among manufacturers is intense, leading to price wars and pressure on profit margins. The market is also susceptible to technological advancements, with newer technologies constantly emerging and rendering older equipment obsolete. Maintaining the novelty and engagement of home workouts can be a challenge, leading to potential equipment underutilization and declining customer interest. Furthermore, the market's growth depends heavily on evolving consumer preferences and trends in fitness and wellness, presenting a degree of unpredictability. Storage space limitations in urban environments can also hinder the adoption of bulky equipment. Finally, ensuring the quality and durability of the equipment is crucial, as substandard products can lead to negative experiences and damage brand reputation. Addressing these challenges will require manufacturers to focus on innovation, affordability, and customer engagement to maintain the market's robust growth.

The North American and European markets currently represent significant shares of the global household sports equipment market, driven by high disposable incomes, a strong focus on health and wellness, and the early adoption of technological advancements. However, Asia-Pacific is poised for substantial growth in the coming years, fueled by rising disposable incomes, increasing health consciousness, and a growing urban population.

Dominant Segments:

In-depth Analysis:

The North American market benefits from a strong culture of fitness and a high level of disposable income, making it a prime market for high-quality and technologically advanced equipment. European countries follow a similar trend, although with some regional variations in terms of consumer preferences and adoption rates. The rapid growth in the Asia-Pacific region, specifically in countries like China and India, is propelled by a burgeoning middle class with rising disposable incomes and increasing awareness of health and fitness. This region presents significant untapped potential for growth in the household sports equipment market. The online sales segment’s dominance is attributed to the convenience factor, wider product selection, and competitive pricing found online. This contrasts with offline sales, which often face constraints such as limited space for display and higher overhead costs for retailers. The convergence of online and offline sales strategies is increasingly adopted by many manufacturers to capitalize on the strengths of both channels.

Several factors are propelling growth in the household sports equipment industry. Technological innovations such as virtual reality integration, AI-powered coaching, and personalized workout programs enhance the user experience and foster engagement. The rise of connected fitness applications and subscriptions provides users with a more complete and effective workout experience, motivating adherence to fitness routines. The increasing accessibility of financing options and flexible payment plans reduces the financial barrier to entry for consumers, allowing more individuals to invest in home fitness equipment. The ongoing trend of prioritizing health and wellness, coupled with the convenience and privacy offered by home workouts, significantly drives demand for household sports equipment.

This report provides a comprehensive analysis of the household sports equipment market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market trends, driving forces, challenges, and key players, offering a detailed understanding of the industry's dynamics. The report segments the market by equipment type (treadmill, rowing machine, elliptical trainer, others), sales channel (online, offline), and geographic region, providing granular insights into market performance and growth potential. The analysis includes detailed profiles of leading companies, evaluating their market strategies, product offerings, and competitive landscape. This information is invaluable for businesses, investors, and researchers seeking to understand and participate in the rapidly evolving household sports equipment market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.8%.

Key companies in the market include ICON Health & Fitness, Life Fitness, Johnson Health Tech, Dyaco, Core Health & Fitness, Peloton, Technogym, Precor, Sole Fitness, Shanxi Orient, SportsArt, BH Fitness, LifeCORE Fitness, WaterRower, TRUE Fitness, Shuhua Sports, WNQ Fitness, Impulse, YIJIAN, Good Family, .

The market segments include Type, Application.

The market size is estimated to be USD 3677.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Household Sports Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Household Sports Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.