1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Lithium Battery Reciprocating Saws?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Household Lithium Battery Reciprocating Saws

Household Lithium Battery Reciprocating SawsHousehold Lithium Battery Reciprocating Saws by Type (18V, 20V, Others, World Household Lithium Battery Reciprocating Saws Production ), by Application (Online Channel, Offline Channel, World Household Lithium Battery Reciprocating Saws Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

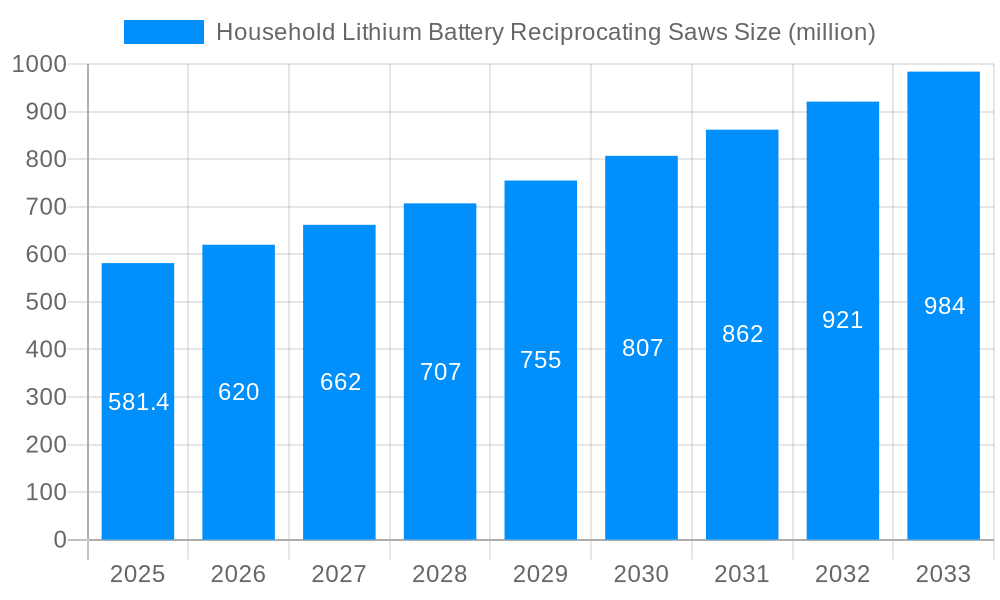

The global market for household lithium battery reciprocating saws is experiencing robust growth, driven by increasing demand for cordless power tools in DIY and home improvement projects. The market, valued at $581.4 million in 2025, is projected to exhibit a significant Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, the rising preference for lightweight, portable, and convenient cordless tools over their corded counterparts is a major catalyst. Lithium-ion battery technology advancements, leading to longer runtimes and faster charging times, further enhance user experience and drive adoption. Secondly, the increasing availability of these saws through both online and offline retail channels expands market reach and accessibility. Furthermore, the rising disposable income in developing economies is contributing to higher demand, particularly in regions like Asia Pacific. However, factors such as fluctuating raw material prices and intense competition among numerous established and emerging players could pose challenges to market growth. The segment breakdown reveals that 18V and 20V models are the most popular, reflecting the industry standard for cordless power tool voltage. The online channel is gaining traction, mirroring the overall e-commerce boom in the tools and equipment sector.

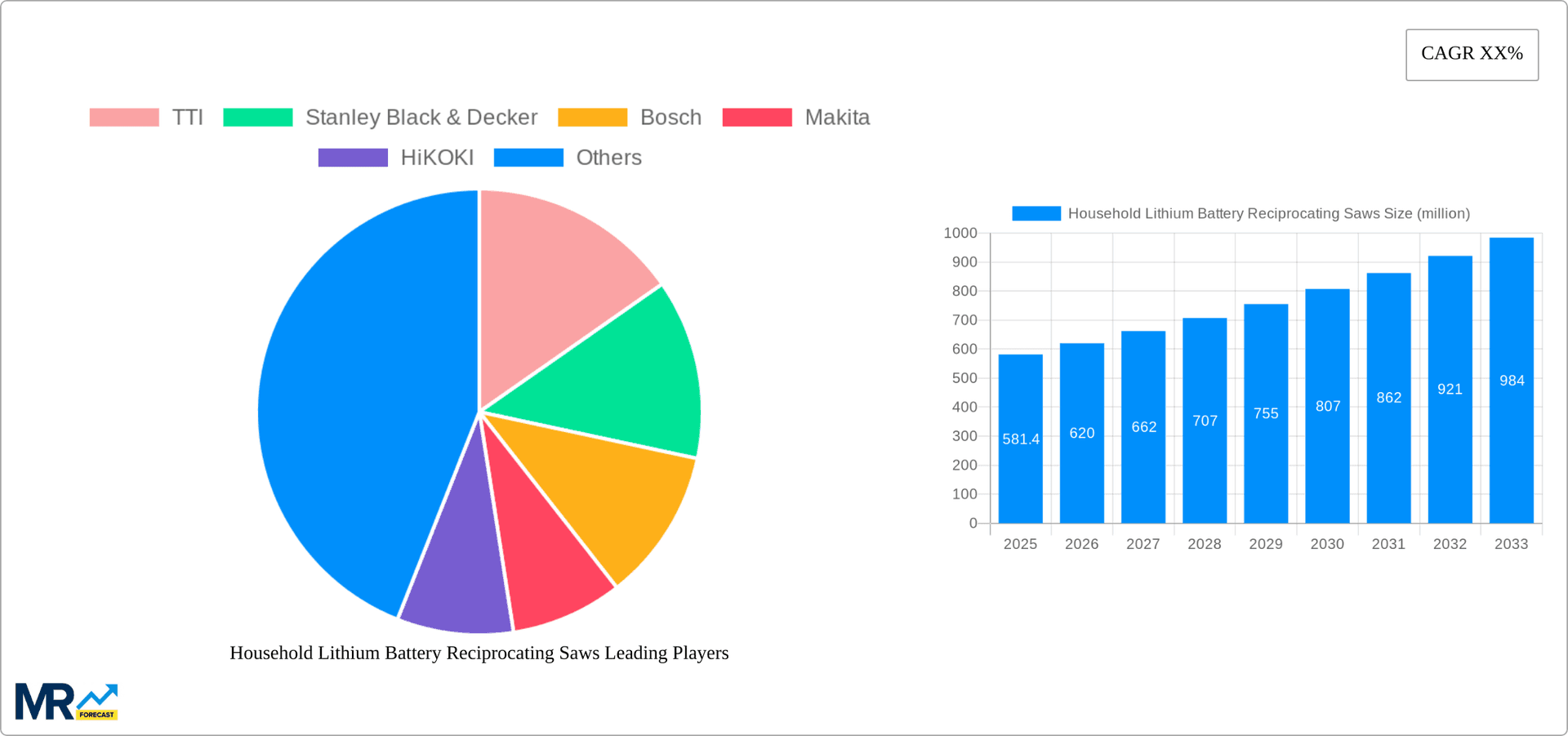

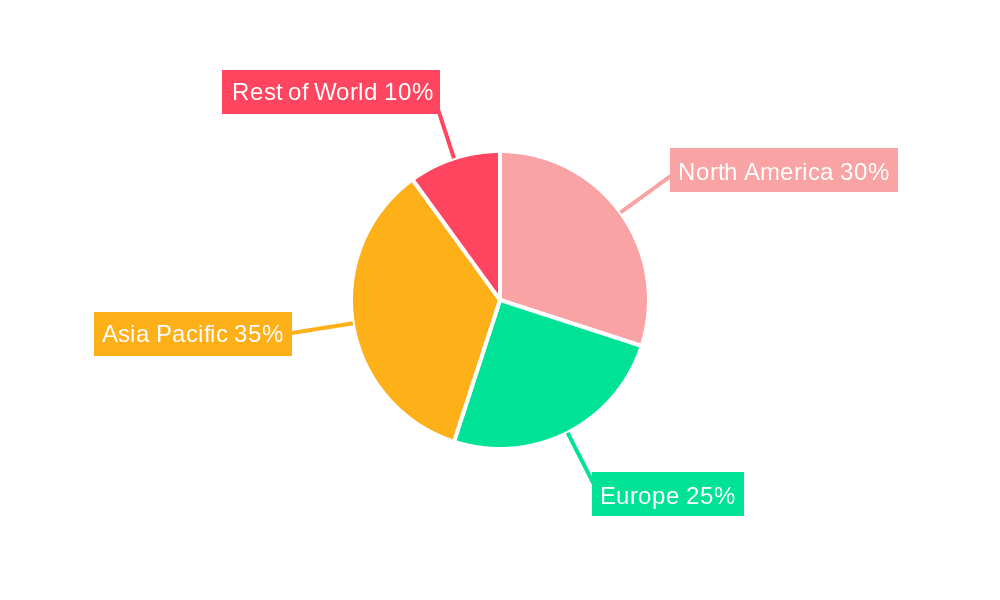

The competitive landscape is highly fragmented, with both global giants like TTI, Stanley Black & Decker, Bosch, and Makita, and regional players competing for market share. These companies are focusing on innovation, developing advanced features such as improved blade designs, increased cutting capacity, and enhanced safety features to maintain a competitive edge. Regional market analysis indicates strong performance in North America and Europe, driven by high DIY activity and early adoption of advanced technology. However, Asia Pacific, specifically China and India, presents a vast growth opportunity due to burgeoning middle classes and rising construction activity. The market's future trajectory appears positive, with ongoing technological advancements and growing consumer preference for cordless tools likely to fuel sustained expansion throughout the forecast period, though market participants should closely monitor raw material price fluctuations and evolving consumer preferences.

The global household lithium battery reciprocating saw market is experiencing robust growth, projected to reach several million units by 2033. Analysis from the 2019-2024 historical period reveals a steady upward trajectory, fueled by several key factors. The increasing popularity of DIY home improvement projects, coupled with the convenience and power offered by cordless lithium-ion technology, has significantly boosted demand. Consumers are increasingly opting for lightweight, portable, and easily maneuverable tools, making reciprocating saws a preferred choice for various tasks ranging from demolition work to precise cutting. The market has witnessed a shift towards higher voltage batteries (18V and 20V models are particularly popular), enabling improved performance and longer run times. Furthermore, the rise of online retail channels has expanded market accessibility, contributing to the overall growth. Manufacturers are continuously innovating, introducing features like improved blade designs, enhanced safety mechanisms, and ergonomic improvements to cater to evolving consumer preferences and professional demands within the household sector. The market's segmentation by voltage (18V, 20V, and others) reflects consumer choices and technological advancements, while the division between online and offline sales channels reveals the dynamic distribution landscape. Future trends suggest a continued focus on improving battery technology, expanding product features, and refining distribution networks to cater to a growing, diverse customer base. Competitive landscape analysis reveals significant players vying for market share through product innovation and aggressive marketing strategies, further impacting market growth. The overall picture indicates sustained and significant expansion in the global household lithium battery reciprocating saw market throughout the forecast period (2025-2033).

Several key factors are driving the growth of the household lithium battery reciprocating saws market. The increasing prevalence of DIY home improvement projects, fueled by readily available online tutorials and the desire for personalized home spaces, significantly boosts demand. Cordless technology offers unparalleled convenience compared to corded alternatives, eliminating the limitations of power cord length and allowing for greater maneuverability in confined spaces. The continuous advancements in lithium-ion battery technology lead to longer run times, increased power output, and lighter weight tools, making them more appealing to a wider range of users. The expansion of online retail channels provides greater accessibility to a broader customer base, while aggressive marketing campaigns by manufacturers enhance brand awareness and product visibility. The versatility of reciprocating saws, suitable for various tasks including cutting wood, metal, and plastic, contributes to their wider adoption. Finally, competitive pricing strategies from manufacturers and the availability of affordable, high-quality products further fuel market expansion. These factors synergistically contribute to the robust growth observed and projected in the global household lithium battery reciprocating saw market.

Despite the strong growth trajectory, the household lithium battery reciprocating saw market faces certain challenges. The fluctuating prices of raw materials, particularly lithium and other essential components, can impact manufacturing costs and profitability. Intense competition among numerous established and emerging players leads to price wars and pressure on profit margins. Ensuring the safety and durability of the tools is crucial, as malfunctions can result in injury or damage. Maintaining a balance between affordability and high-quality performance remains a constant challenge for manufacturers. The market also faces the threat of counterfeit products that can compromise quality and safety. Furthermore, environmental concerns related to battery disposal and recycling require manufacturers to adopt sustainable practices and comply with increasingly stringent regulations. Addressing these challenges effectively is crucial for sustained and responsible growth in this dynamic market.

The 18V segment currently holds a dominant position in the market, driven by its balance of power, runtime, and affordability. This segment appeals to a broad range of DIY enthusiasts and professionals seeking a robust yet manageable tool. While 20V models are gaining traction, offering enhanced power, the 18V segment's established market presence and wider availability contribute to its continued dominance. The "Others" segment, encompassing lower and higher voltage options, represents a niche market catering to specific needs. Regarding sales channels, the offline channel (retail stores, home improvement centers) still holds a significant share due to the tangible nature of the product and the opportunity for hands-on experience. However, the online channel is growing rapidly, benefiting from the convenience and wider product selection it offers. Geographically, North America and Europe are major markets due to high levels of DIY participation and a strong consumer base. However, Asia-Pacific, particularly China, is emerging as a significant growth area driven by rising disposable incomes and a growing interest in home improvement. These trends suggest that a multi-pronged strategy focusing on the 18V segment, leveraging both online and offline channels, and targeting key regions such as North America, Europe, and the rapidly developing Asia-Pacific market, will be vital for market success.

The ongoing advancements in lithium-ion battery technology, leading to improved power, longer runtimes, and lighter weight tools, are a major catalyst for market growth. Coupled with this is the increasing adoption of innovative features such as improved blade designs and enhanced safety mechanisms, enhancing the overall appeal and usability of these saws. The expanding availability of online retail channels widens market reach and drives sales, while increasing consumer interest in DIY projects further fuels demand. The introduction of competitively priced, high-quality products makes them accessible to a broader consumer base. This confluence of technological, distributional, and consumer-driven factors creates a powerful synergistic effect, propelling significant growth in the household lithium battery reciprocating saws market.

This report provides a comprehensive overview of the household lithium battery reciprocating saws market, encompassing historical data, current market conditions, and future projections. It offers detailed analysis of market trends, driving forces, challenges, and growth catalysts. A competitive landscape analysis identifies key players and their strategic initiatives, while segmentation by voltage, sales channel, and region provides a granular understanding of market dynamics. The report also incorporates valuable insights on significant developments within the sector, allowing stakeholders to make informed decisions and capitalize on emerging opportunities within this rapidly evolving market. The forecast period extends to 2033, offering a long-term perspective on market growth and development.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TTI, Stanley Black & Decker, Bosch, Makita, HiKOKI, Hilti, Snap-on Incorporated, Dongcheng, Festool, CHERVON, Jiangsu Jinding, Positec Group, Zhejiang Boda Industrial, Total Tools, Kimo Tools, Ingco Curacao, WEN Products, Greenworks, .

The market segments include Type, Application.

The market size is estimated to be USD 581.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Household Lithium Battery Reciprocating Saws," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Household Lithium Battery Reciprocating Saws, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.