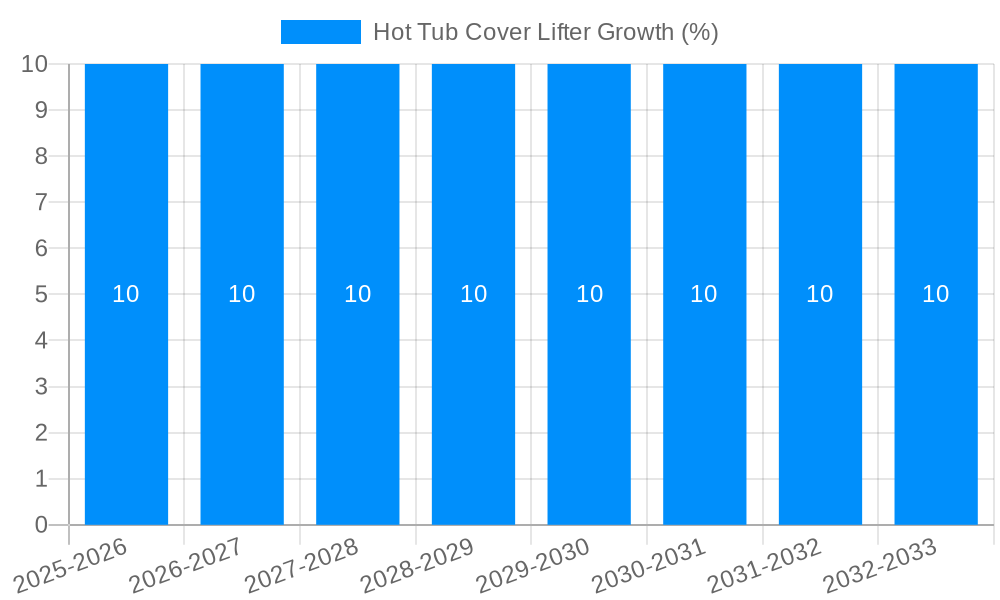

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hot Tub Cover Lifter?

The projected CAGR is approximately 6.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hot Tub Cover Lifter

Hot Tub Cover LifterHot Tub Cover Lifter by Type (Side Mount, Bottom Mount, Top Mount), by Application (Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global hot tub cover lifter market is experiencing robust growth, projected to reach a market size of $158.5 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.9%. This growth is fueled by several key factors. Firstly, the increasing popularity of hot tubs and spas, driven by rising disposable incomes and a focus on wellness and relaxation, significantly boosts demand for convenient and efficient cover lifters. Secondly, technological advancements resulting in lighter, more durable, and user-friendly lifter designs are attracting a wider consumer base. Thirdly, the expanding residential construction sector in key regions like North America and Europe contributes to heightened demand. Finally, the market benefits from a growing awareness of the ergonomic benefits offered by these lifters, reducing the physical strain of manually handling heavy hot tub covers.

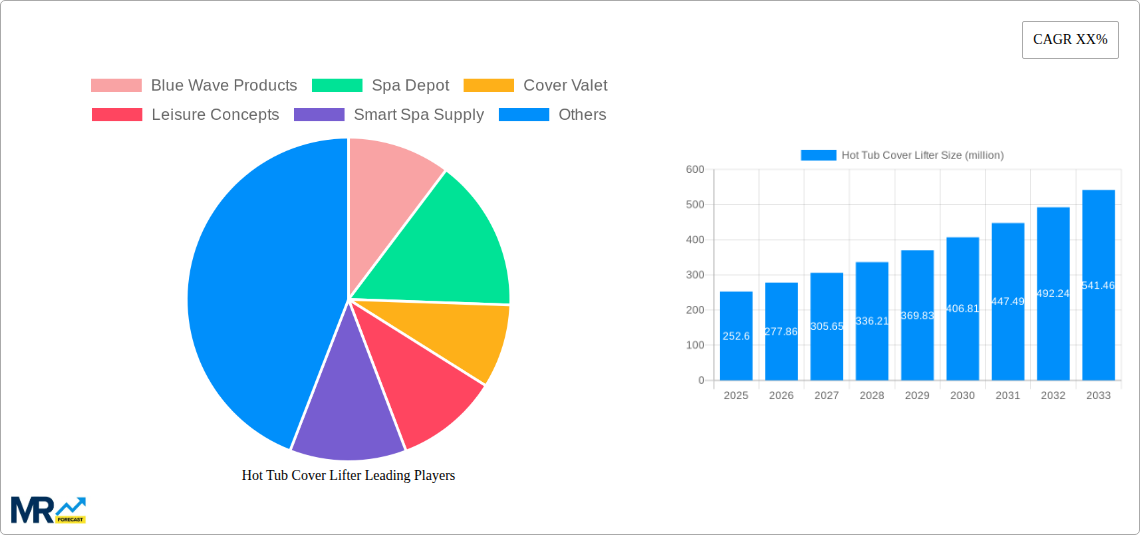

However, the market also faces certain restraints. High initial investment costs associated with purchasing a hot tub cover lifter can deter some consumers, especially those with limited budgets. Furthermore, the market's growth is somewhat dependent on the overall performance of the hot tub and spa market itself. Any slowdown in the broader industry would likely impact the demand for accessory products such as lifters. Despite these challenges, market segmentation presents growth opportunities. The residential segment currently dominates, but the commercial sector, including hotels, resorts, and spas, is expected to witness significant growth driven by operational efficiency improvements. Different lifter types, such as side-mount, bottom-mount, and top-mount, cater to specific installation needs and preferences, contributing to market diversification. The competitive landscape is relatively fragmented, with several key players including Blue Wave Products, Spa Depot, and Watkins Manufacturing Company, contributing to innovation and market penetration.

The global hot tub cover lifter market is experiencing robust growth, projected to reach multi-million unit sales by 2033. This expansion is driven by several factors, including the increasing popularity of hot tubs for both residential and commercial use. The convenience and safety offered by automated cover lifters are significant selling points, particularly for consumers seeking a more effortless hot tub ownership experience. Over the historical period (2019-2024), the market witnessed a steady rise in demand, fueled by technological advancements leading to improved lifter designs and increased affordability. The estimated year 2025 shows a notable increase in sales compared to the base year, reflecting the growing market acceptance and the successful integration of cover lifters into new hot tub installations and retrofits. The forecast period (2025-2033) projects continued, substantial growth, particularly within the residential segment, driven by rising disposable incomes and an increasing focus on wellness and relaxation at home. This trend is also strengthened by the expanding availability of diverse lifter types catering to various hot tub sizes and configurations. Furthermore, the market is seeing increased innovation, with manufacturers introducing smart features such as remote control capabilities and improved safety mechanisms. This technological evolution is shaping the future of the hot tub cover lifter market and contributing to its continued success. The competitive landscape is characterized by both established players and emerging businesses, each vying for market share through product innovation and effective marketing strategies. The study period (2019-2033) thus reveals a market evolving significantly towards a user-friendly, technologically advanced, and widely accessible product landscape.

The surging demand for hot tub cover lifters is fueled by several key factors. Firstly, the increasing prevalence of hot tubs in both residential and commercial settings is a major driver. As more people invest in hot tubs for relaxation and therapeutic benefits, the demand for convenient and safe cover lifting solutions naturally increases. Secondly, technological advancements have led to the development of more efficient, user-friendly, and durable cover lifters. These improvements, including easier installation, enhanced safety features, and the integration of smart technology, significantly boost consumer appeal. The rising disposable incomes in several key markets worldwide also contribute to the increased affordability of hot tub cover lifters, making them accessible to a broader consumer base. Furthermore, the growing awareness of the health benefits associated with hot tub use, coupled with the increasing focus on wellness and self-care, plays a significant role in driving demand. Finally, the growing number of spa and wellness centers, resorts, and hotels incorporating hot tubs into their amenities is also propelling the growth of the commercial segment of the market, creating a significant demand for robust and reliable cover lifters designed for high-frequency use. These combined factors create a powerful synergy driving the sustained expansion of the hot tub cover lifter market.

Despite the positive growth trajectory, the hot tub cover lifter market faces certain challenges. One key restraint is the relatively high initial cost of these lifters, which can deter some potential buyers, especially those on a tighter budget. This price sensitivity is particularly pronounced in emerging markets with lower disposable incomes. Another challenge lies in the potential for mechanical malfunctions or wear and tear over time, requiring maintenance or repairs. The complexity of installation can also pose a hurdle, requiring specialized skills or professional assistance, adding to the overall expense. Moreover, the market faces competition from cheaper, less efficient manual lifting methods, which may appeal to consumers prioritizing affordability over convenience. Furthermore, concerns regarding safety and durability, especially in high-use commercial settings, are crucial considerations. The risk of injury from malfunctioning lifters can negatively impact consumer confidence. Addressing these concerns through robust quality control, improved designs, and clear safety guidelines is essential for sustaining market growth. Finally, the reliance on a relatively small number of major players in the market could lead to price fixing or supply chain disruptions.

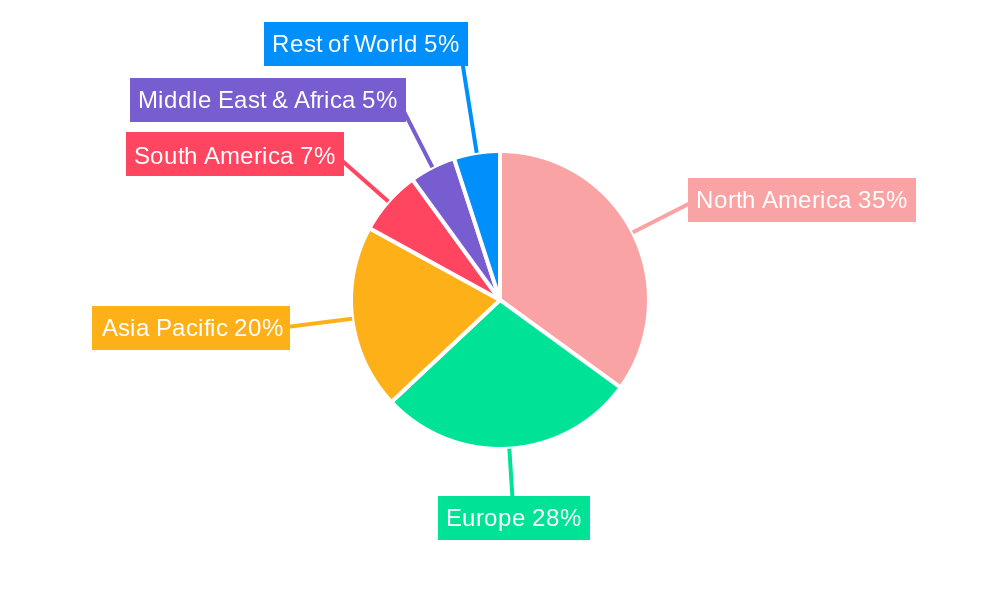

The residential segment within North America is projected to dominate the hot tub cover lifter market throughout the forecast period.

North America (particularly the USA and Canada): High rates of hot tub ownership, strong disposable incomes, and a preference for convenience-driven products make this region a key market driver. The established infrastructure for hot tub distribution and installation also contributes to this dominance.

Europe: While exhibiting significant growth, Europe's market share lags slightly behind North America due to comparatively lower hot tub ownership rates and a more fragmented market structure. However, increasing awareness of wellness benefits and rising disposable incomes are fueling gradual growth in this region.

Asia-Pacific: The Asia-Pacific region shows considerable growth potential. Increasing urbanization and a growing middle class with rising disposable incomes are driving demand, however, the market remains relatively nascent compared to North America and Europe, presenting significant opportunities for expansion.

Residential Segment: The overwhelming majority of hot tub cover lifters are purchased for residential use. This is primarily due to the increasing emphasis on personal wellness and relaxation in homes. The convenience and ease of use offered by automated lifters significantly enhances the hot tub experience for homeowners.

Side Mount Lifters: This type of lifter often offers a more streamlined design and is particularly suitable for smaller spa models and those where space may be limited. Its popularity is contributing significantly to the overall market growth.

The combination of high demand in the residential segment, particularly in North America, along with the growing popularity of side mount lifters, positions these segments as the dominant forces shaping the hot tub cover lifter market's trajectory in the coming years. Market players are actively capitalizing on this trend by developing innovative products specifically tailored to the preferences of these key customer segments.

Several factors are accelerating growth within the hot tub cover lifter industry. Firstly, the rise in popularity of smart home technology fuels demand for integrated and automated hot tub accessories, including remote-controlled cover lifters. Secondly, the growing focus on convenience and ease of use, particularly amongst aging populations, drives the adoption of automated systems over manual lifting methods. Finally, manufacturers are investing in improved designs and materials that enhance durability and safety, further boosting consumer confidence and driving sales.

The hot tub cover lifter market demonstrates significant growth potential, driven by the increasing popularity of hot tubs, technological advancements leading to improved product design and ease of use, and rising disposable incomes globally. The focus on convenience, safety, and smart home integration further reinforces this positive trend, ensuring that the market will continue its expansion throughout the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.9%.

Key companies in the market include Blue Wave Products, Spa Depot, Cover Valet, Leisure Concepts, Smart Spa Supply, SpaEase, Cover Butler, Outdoor Solutions, Ultralift, Watkins Manufacturing Company, MySpaCover, Blue Whale Spa, Guangzhou Taisheng Sanitary Ware Technology Co.,Ltd, The Cover Guy, Covers for Tubs, Hangzhou Proway Import & Export Co., Ltd., Arctic Spas, .

The market segments include Type, Application.

The market size is estimated to be USD 158.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hot Tub Cover Lifter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hot Tub Cover Lifter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.