1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Smart LED Light Bulb?

The projected CAGR is approximately 14.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Smart LED Light Bulb

Home Smart LED Light BulbHome Smart LED Light Bulb by Type (Bluetooth, WiFi, Others, World Home Smart LED Light Bulb Production ), by Application (Online Sales, Offline Sales, World Home Smart LED Light Bulb Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

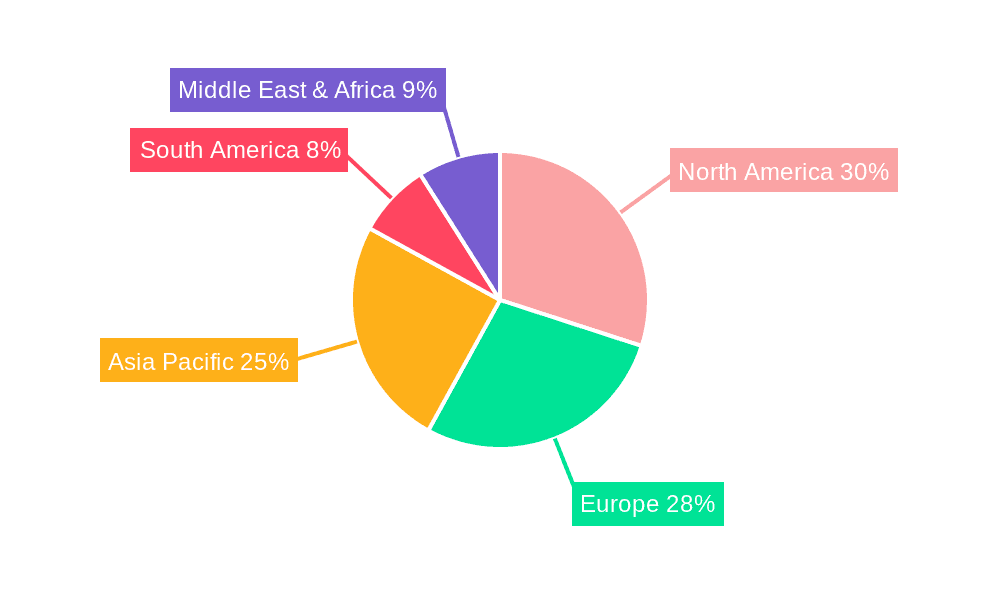

The global smart LED light bulb market is projected for significant expansion, driven by widespread smart home technology adoption, a growing emphasis on energy efficiency, and the demand for personalized home lighting solutions. Key growth drivers include seamless integration with voice assistants like Alexa and Google Assistant, the proliferation of smart home ecosystems such as Apple HomeKit and Samsung SmartThings, and advanced features like color customization, automated scheduling, and energy monitoring. While upfront costs for smart bulbs may exceed traditional options, long-term energy savings and enhanced user experience are propelling demand. North America and Europe currently dominate the market due to high smart home penetration and disposable income, with robust growth anticipated in the Asia-Pacific region, particularly China and India, attributed to urbanization and increasing internet access. Market restraints include initial cost, cybersecurity concerns, and potential interoperability issues across platforms. However, continuous technological advancements and price reductions are expected to overcome these challenges, fostering sustained market growth.

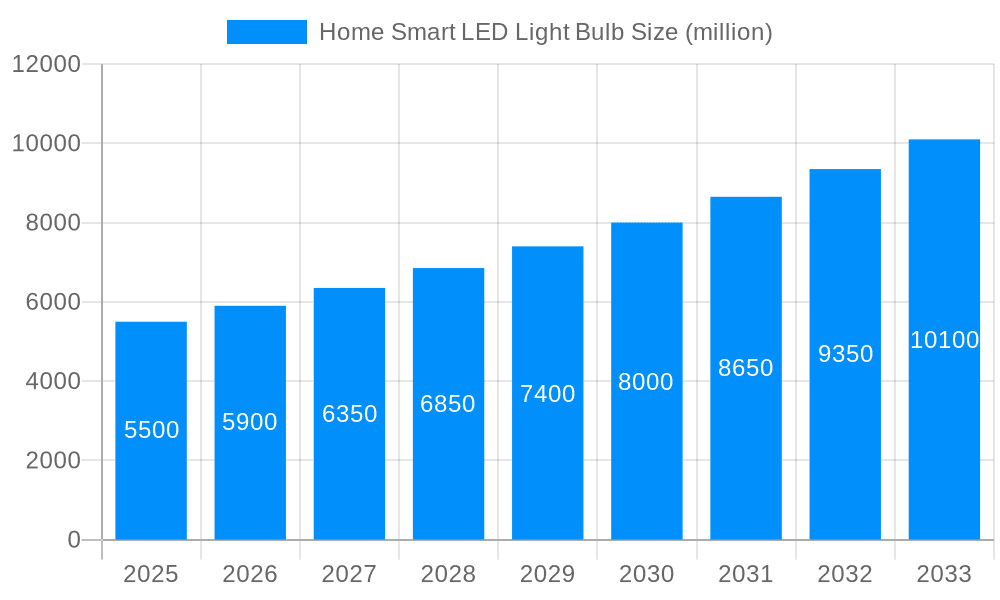

The competitive environment features established lighting leaders such as Signify (Philips Hue), GE Lighting, and Osram, alongside smart home specialists including Sengled, Yeelight, and Govee. Companies are focusing on product innovation, strategic alliances, and targeted marketing to secure market share. Segmentation by connection type (Bluetooth, Wi-Fi) and sales channel (online, offline) reveals critical consumer insights. The forecast period of 2025-2033 indicates a positive trajectory, with continued expansion fueled by innovation, heightened consumer awareness, and expanding smart lighting applications in residential settings. Addressing consumer concerns regarding cost, security, and interoperability will be crucial for successful integration into the broader smart home ecosystem. The global home smart LED light bulb market is estimated at $21.13 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 14.9%.

The global home smart LED light bulb market is experiencing explosive growth, projected to reach multi-million unit sales by 2033. Driven by increasing consumer adoption of smart home technology and the inherent energy efficiency and cost savings of LEDs, this sector shows significant promise. The historical period (2019-2024) witnessed a steady climb in adoption, with the base year of 2025 marking a significant inflection point. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) significantly above the average for consumer electronics, propelled by several key factors. The market is evolving beyond simple on/off control, integrating features like color temperature adjustment, scene setting, voice control integration with platforms like Alexa and Google Assistant, and even integration with other smart home devices for automated responses based on occupancy or time of day. This trend towards enhanced functionality is a primary driver of market expansion. Moreover, the growing awareness of energy conservation and the decreasing cost of smart LED bulbs are making them increasingly accessible to a broader consumer base. The shift from traditional incandescent and CFL lighting continues at pace, with smart LEDs offering a compelling upgrade path. Competition is fierce, with established lighting companies and emerging tech firms vying for market share through product innovation and strategic partnerships. This competition benefits the consumer, driving down prices and improving the quality and features available in smart LED bulbs across all price points. This dynamic market is poised for considerable expansion in the coming years, driven by technological advancements and evolving consumer preferences.

Several factors are fueling the rapid expansion of the home smart LED light bulb market. Firstly, the increasing affordability of smart home technology makes these bulbs accessible to a wider consumer base. As production scales up, economies of scale lower manufacturing costs, leading to more competitive pricing. Secondly, the growing popularity of smart home ecosystems is a significant driver. Consumers are increasingly integrating multiple smart devices, and smart bulbs are a natural addition to this interconnected landscape. Seamless integration with voice assistants like Amazon Alexa and Google Assistant significantly enhances user experience, simplifying control and expanding functionality. Thirdly, energy efficiency continues to be a key selling point. Smart LEDs consume significantly less energy than traditional lighting solutions, leading to substantial long-term cost savings for consumers and contributing to broader environmental sustainability goals. Finally, the ease of installation and use of these bulbs is a compelling factor for adoption. Many smart bulbs are directly compatible with existing light fixtures, requiring minimal technical expertise for installation. These combined factors contribute to a robust and expanding market with significant growth potential throughout the forecast period.

Despite the substantial growth potential, several challenges hinder the widespread adoption of smart LED light bulbs. One significant constraint is the initial investment cost. While the long-term energy savings are significant, the upfront cost of purchasing smart bulbs can be a barrier for budget-conscious consumers. Furthermore, concerns about data security and privacy are increasingly relevant. Consumers are rightfully wary about the potential for data breaches and the collection of personal information through connected devices. Another factor is the complexity of setting up and managing smart home ecosystems. While advancements have simplified the process, integrating multiple devices and troubleshooting technical issues can be daunting for some users. Finally, interoperability between different smart home platforms remains a challenge. Consumers may face compatibility issues when mixing bulbs and other devices from different manufacturers, leading to frustration and hindering wider adoption. Addressing these concerns through enhanced security measures, user-friendly interfaces, and improved interoperability will be crucial for unlocking the full potential of the home smart LED light bulb market.

The North American and European markets are currently leading the adoption of smart LED light bulbs, driven by higher disposable incomes and early adoption of smart home technologies. However, the Asia-Pacific region is expected to witness substantial growth in the coming years, driven by increasing urbanization, rising disposable incomes, and growing awareness of smart home technologies.

Segment Domination: The WiFi segment is expected to dominate the market. While Bluetooth offers advantages in terms of simpler setup and lower power consumption for individual bulbs, WiFi connectivity enables more sophisticated functionalities like remote control from anywhere with an internet connection, integration with multiple devices and voice assistants, and access to more advanced features through mobile applications. The ability to create complex lighting scenarios and automate routines based on time, location, or other smart home events makes WiFi-enabled bulbs highly desirable for users seeking a truly integrated smart home experience.

Production: Global production of smart LED light bulbs is projected to increase dramatically, reaching multi-million units annually within the forecast period. This increase reflects the expanding market demand and the continued scaling up of production capacities by major manufacturers.

Application: Online sales are becoming an increasingly significant channel for the distribution of smart LED light bulbs. The convenience of online purchasing, coupled with the availability of extensive product information and user reviews, encourages consumers to opt for online channels. However, offline sales still hold significant relevance, particularly for consumers who prefer to see and test products before purchasing.

The home smart LED light bulb industry's growth is fueled by decreasing prices, increasing energy efficiency concerns, and the expanding integration into broader smart home ecosystems. Technological advancements are also driving innovation, leading to improved functionalities such as advanced color-changing capabilities, customizable light patterns, and seamless integration with other smart home devices. These factors, combined with rising consumer awareness and a desire for improved energy efficiency and personalized home environments, create a highly favorable environment for continued market expansion.

This report provides a detailed analysis of the global home smart LED light bulb market, encompassing historical data, current market trends, and future projections. The report covers key market segments, including different bulb types, sales channels, and geographic regions. It also analyzes the competitive landscape, identifies key players, and explores the major growth catalysts and challenges impacting the industry. The insights provided in this report offer a comprehensive understanding of this rapidly evolving market and are valuable for businesses seeking to make informed decisions about investment, product development, and market entry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.9%.

Key companies in the market include Signify, GE Lighting, Feit Electric, OSRAM(AMS), Sengled, Cree, Ilumi Solutions, Yeelight, TCP Lighting, Huawei, Revogi, Govee, Kasa Smart.

The market segments include Type, Application.

The market size is estimated to be USD 21.13 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Home Smart LED Light Bulb," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Smart LED Light Bulb, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.