1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Gym and Fitness Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Gym and Fitness Equipment

Home Gym and Fitness EquipmentHome Gym and Fitness Equipment by Type (Aerobic Fitness Equipment, Rehabilitation Fitness Equipment, Strength Fitness Equipment, Others), by Application (Indoor, Outdoor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

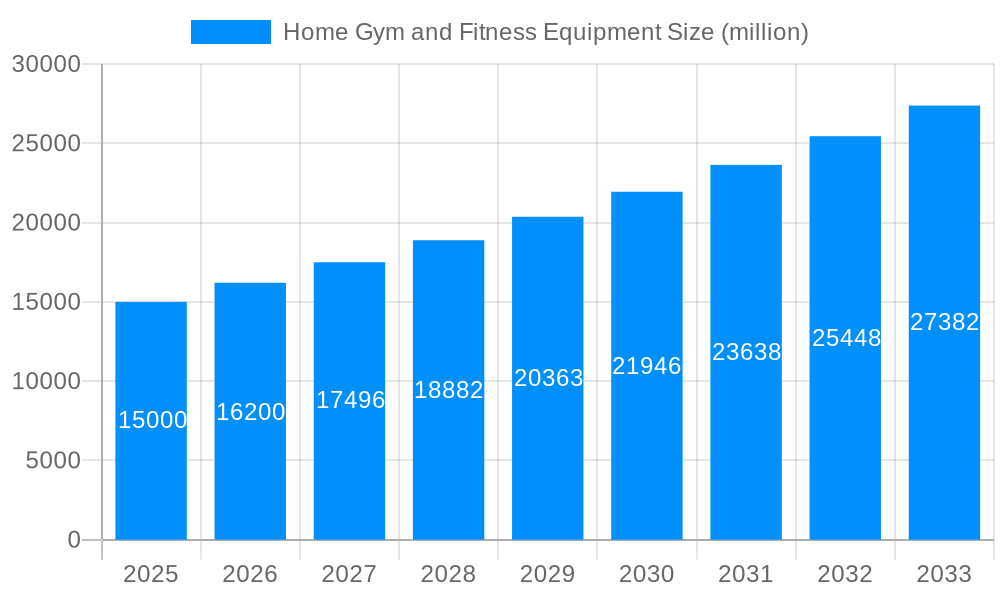

The global home gym and fitness equipment market is experiencing robust growth, driven by increasing health consciousness, the rising prevalence of sedentary lifestyles, and a growing preference for convenient at-home workouts. The market, estimated at $15 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching approximately $28 billion by 2033. This growth is fueled by several key factors. Technological advancements, such as interactive fitness apps and smart home gym equipment, enhance user engagement and provide personalized workout experiences. Furthermore, the increasing affordability of home fitness equipment, coupled with broader internet access and digital marketing, makes these products accessible to a wider consumer base. The market segmentation reveals strong demand across various equipment types, with strength training equipment and aerobic fitness equipment holding significant shares, catering to diverse fitness goals. The home segment, driven by convenience and cost savings, surpasses outdoor fitness equipment demand.

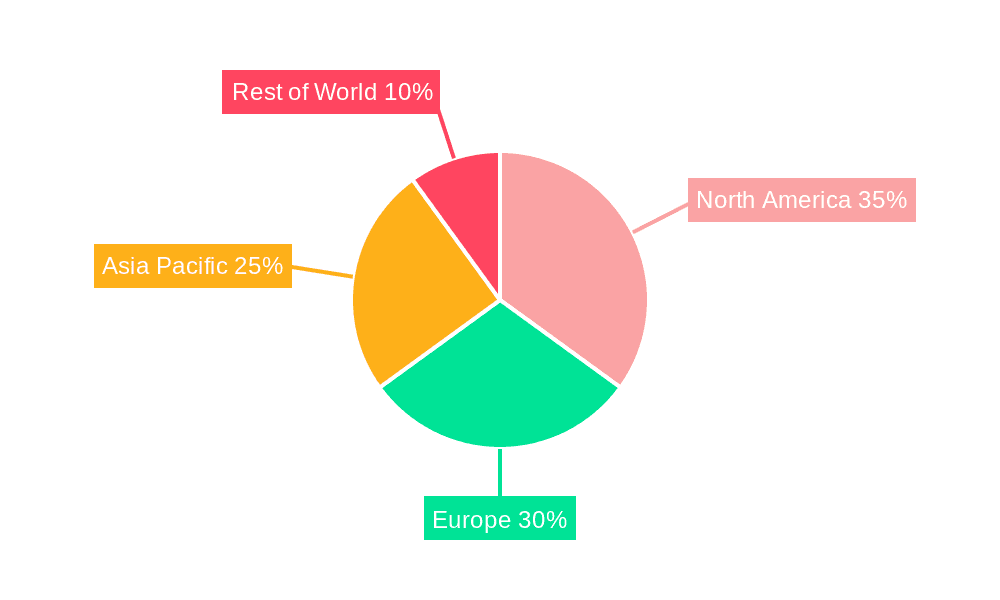

While the market enjoys significant tailwinds, certain restraints exist. Supply chain disruptions and fluctuations in raw material prices continue to pose challenges. Additionally, competition among established brands and new entrants necessitates continuous product innovation and effective marketing strategies. The market's regional distribution reflects established trends, with North America and Europe holding substantial market share due to higher disposable incomes and greater awareness of health and wellness. However, the Asia-Pacific region is poised for significant growth, fueled by rising middle-class populations and increasing health awareness in countries like India and China. This presents lucrative opportunities for businesses to capitalize on this expanding market. Understanding consumer preferences, adapting to technological advancements, and addressing supply chain concerns will be crucial for sustained success in this dynamic market.

The home gym and fitness equipment market experienced significant growth during the study period (2019-2024), driven by several factors. The COVID-19 pandemic acted as a major catalyst, forcing widespread gym closures and prompting consumers to invest in home fitness solutions. This trend, initially fueled by necessity, transitioned into a sustained preference for at-home workouts, fostering a preference for convenience and personalized fitness routines. The market witnessed a surge in demand for diverse equipment, ranging from simple dumbbells and resistance bands to sophisticated smart fitness equipment integrated with virtual workout platforms. This diversification reflects a shift towards more holistic and inclusive fitness approaches. While strength training equipment remained a dominant segment, a notable increase in the adoption of aerobic fitness equipment, such as treadmills, stationary bikes, and ellipticals, was observed. The market’s expansion also saw the integration of technology, with smart home gyms and fitness apps playing a growing role in personalized training and tracking fitness progress. This technological integration enhances user experience and improves the effectiveness of home workout routines. Furthermore, the increasing health consciousness among consumers and the rising prevalence of chronic diseases are driving the demand for home fitness solutions, allowing individuals to maintain their health and well-being within the comfort of their homes. Market projections for the forecast period (2025-2033) indicate continued growth, albeit at a potentially slower pace than the exceptionally high growth rates observed during the pandemic years. The market is expected to surpass several million units in sales by 2033, showcasing the enduring appeal of home fitness options. The estimated market value in 2025 is expected to reach several million dollars, reflecting the sustained demand for diverse home fitness equipment.

Several factors are propelling the growth of the home gym and fitness equipment market. Firstly, the increasing awareness of the importance of health and wellness is driving individuals to invest in home fitness solutions to maintain their physical and mental well-being. The rising prevalence of lifestyle-related diseases further fuels this demand. Secondly, the convenience and flexibility offered by home gyms are significant driving forces. Working out at home eliminates the need for travel, gym memberships, and adherence to fixed schedules, leading to greater adherence to fitness routines. Thirdly, the affordability of various home fitness options makes them accessible to a broader consumer base. A wide range of products, catering to different budgets and fitness levels, ensures that home fitness is no longer the exclusive domain of the wealthy. Technological advancements, including the integration of smart technology and virtual fitness platforms, are further enhancing the appeal and effectiveness of home workouts. These technologies provide personalized training plans, track progress, and offer interactive workout experiences. Finally, the increasing urbanization and space constraints in many cities encourage the adoption of compact and space-saving home fitness equipment, meeting the demands of modern living.

Despite the significant growth potential, the home gym and fitness equipment market faces several challenges. Firstly, intense competition among numerous brands, including both established players and new entrants, puts pressure on pricing and profit margins. Maintaining a competitive edge requires continuous innovation and effective marketing strategies. Secondly, the durability and quality of equipment can be a concern, particularly with budget-friendly options. Negative reviews related to product quality can significantly impact consumer trust and brand reputation. Thirdly, space constraints in many homes can limit the type and size of equipment that can be purchased. This necessitates the development of more compact and versatile fitness solutions. Furthermore, maintaining motivation and consistency with home workouts can be challenging for some individuals, potentially hindering long-term success. The lack of personal guidance and the potential for injuries from improper use of equipment are other noteworthy challenges. Finally, the increasing popularity of other fitness approaches, such as outdoor activities and group classes, poses a challenge to the sustained dominance of home gym equipment.

The North American market is expected to dominate the home gym and fitness equipment market in the forecast period. This is primarily due to the high disposable income of consumers, growing awareness of health and fitness, and the early adoption of innovative fitness technologies. The European market is anticipated to experience strong growth, driven by similar factors but at a slightly slower pace compared to North America. Within segments, strength training equipment is projected to maintain its leading position, benefiting from consistent demand for muscle building and overall fitness improvement. This segment is further subdivided into several subcategories including weights, weight benches, resistance bands and power racks, all of which contribute significantly to the overall market growth. The indoor application segment will continue to be dominant due to its convenience and versatility. The ease of incorporating fitness routines into daily schedules within the confines of one's home makes this segment particularly attractive.

The substantial growth predicted for these regions and segments underscores the continuing trend of increasing demand for home fitness solutions. The rising awareness of health and wellness, coupled with the benefits of convenience, personalized training, and technological integration are key drivers of market dominance.

The home gym and fitness equipment industry is propelled by several factors. Increasing health consciousness among consumers, coupled with a rise in sedentary lifestyles, fuels the demand for home-based fitness solutions. The convenience of home workouts, eliminating commutes and rigid gym schedules, contributes significantly to the sector's growth. Furthermore, technological advancements, including smart home gyms and fitness tracking apps, offer personalized training experiences and enhance user engagement, thus driving market expansion.

This report provides a comprehensive analysis of the home gym and fitness equipment market, covering market size, trends, growth drivers, challenges, leading players, and future projections. It provides detailed insights into various segments, including equipment types (aerobic, strength training, rehabilitation), application (indoor, outdoor), and key geographic regions. The report's detailed analysis allows for informed decision-making and strategic planning for stakeholders across the value chain. The forecast period covers 2025-2033, offering valuable insights into the future trajectory of the market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include REP Fitness, Weider, Best Fitness, Body Champ, Iron Company, Technogym, Body-Solid, Gold's Gym, LifeSpan Fitness, Powerline, Life Fitness, Valor Fitness, Bowflex, Meerut Gym, Marcy, Total Gym, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Home Gym and Fitness Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Gym and Fitness Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.