1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Furniture Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Furniture Rental

Home Furniture RentalHome Furniture Rental by Type (Bed Frames, Couches, Dining Room Tables, Others), by Application (E Commerce, Brick and Mortar), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

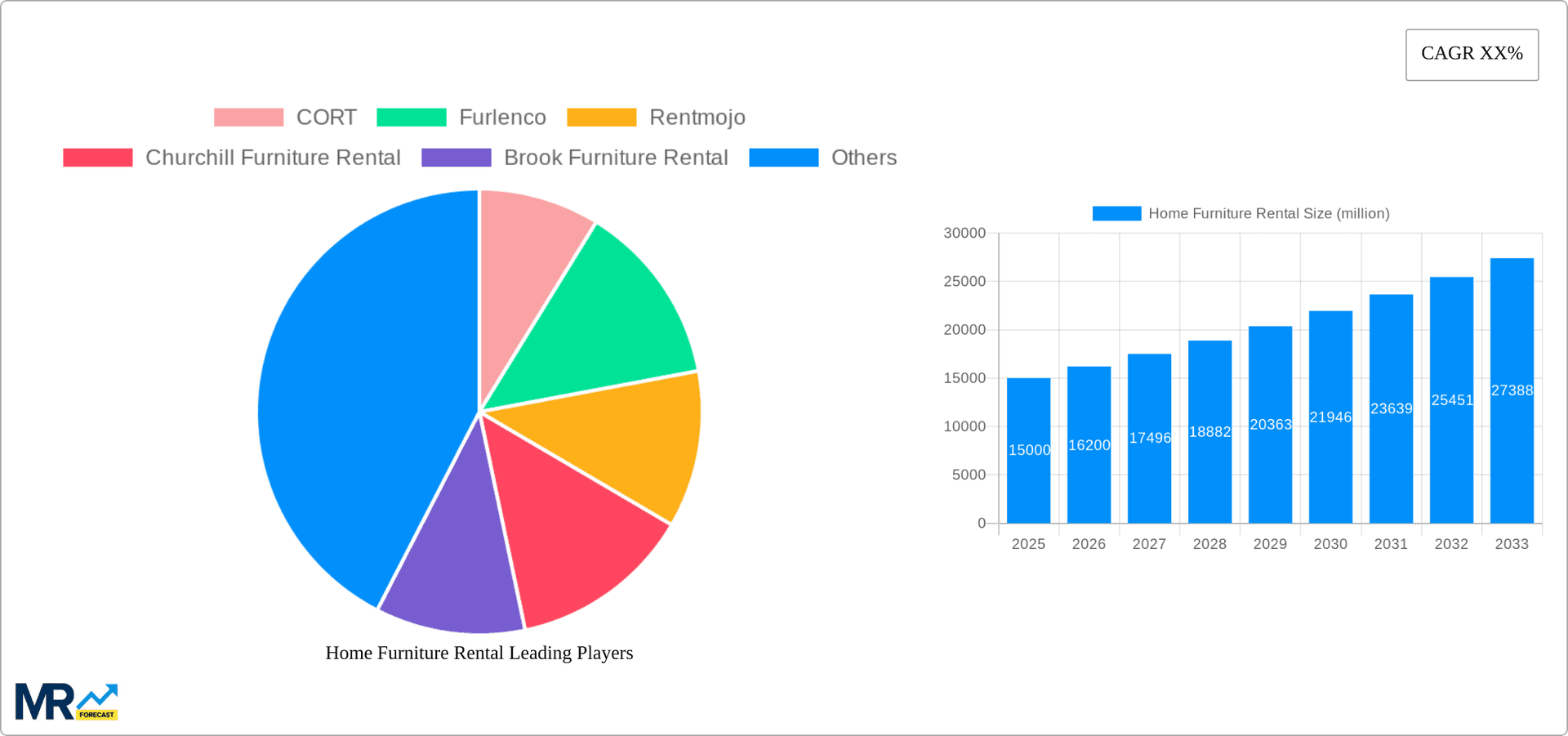

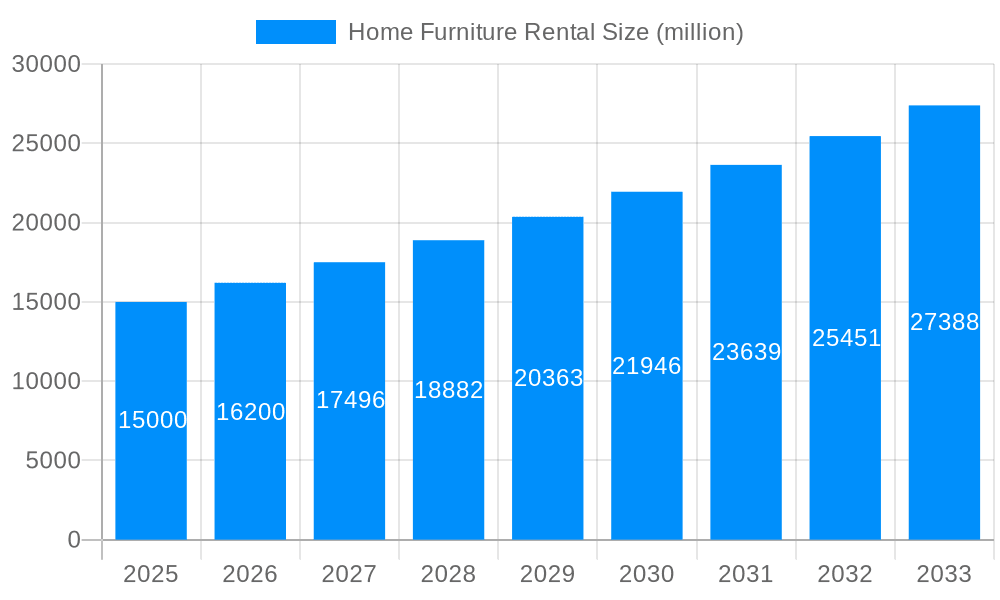

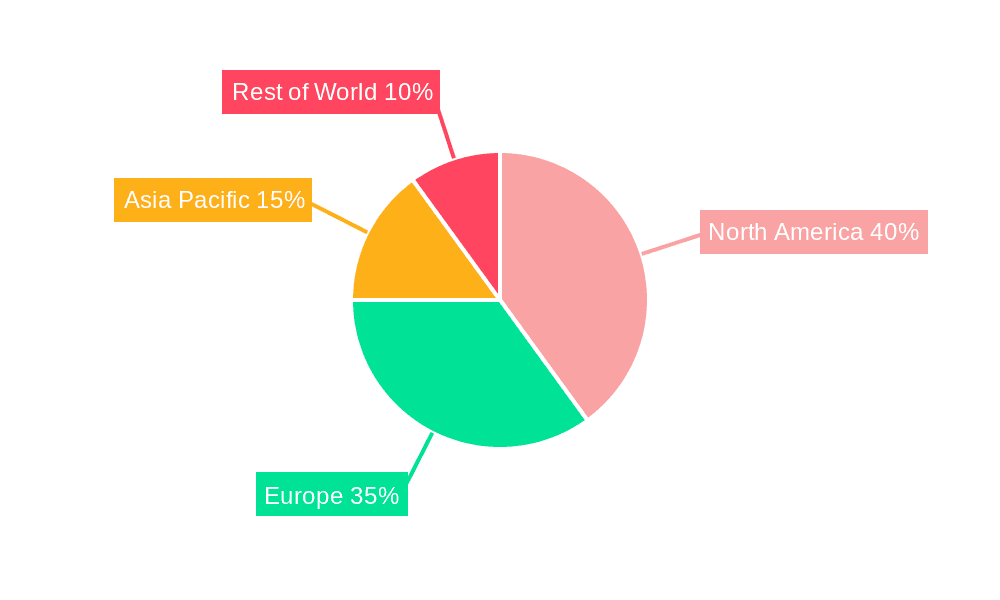

The global home furniture rental market is experiencing robust growth, driven by evolving consumer preferences, increased urbanization, and the rise of flexible living arrangements. The market, encompassing rentals of bed frames, couches, dining room tables, and other furniture items through both e-commerce and brick-and-mortar channels, is estimated to be valued at $15 billion in 2025. A Compound Annual Growth Rate (CAGR) of 8% is projected from 2025 to 2033, indicating substantial market expansion over the forecast period. Key drivers include the increasing preference for short-term leases and the convenience of renting furniture, particularly among young professionals and renters in urban areas. The growth is further fueled by the rise of furniture rental subscription services offering convenient and flexible options compared to traditional purchasing models. This trend reduces upfront costs and allows consumers to easily upgrade or change furniture as their needs evolve. While the market faces restraints such as the potential for damage and wear and tear on rented items, as well as competition from traditional furniture retailers, these challenges are being mitigated by robust rental agreements and innovative inventory management systems employed by major players like CORT, Furlenco, and Rentmojo. The market segmentation, with bed frames and couches being significant contributors, along with strong presence in North America and Europe, showcases the breadth and potential for further expansion across diverse geographical regions and product categories. Future growth will likely be influenced by technological advancements, such as improved online platforms and streamlined delivery services. The development of sustainable and environmentally conscious furniture rental practices will also play a significant role in shaping the market's future trajectory.

The North American market holds a significant share, benefiting from a high density of urban populations and a strong adoption of subscription-based services. Europe follows closely, driven by similar trends in major cities like London, Paris, and Berlin. The Asia-Pacific region shows immense growth potential due to its large and rapidly growing urban populations, though the market is currently at a relatively nascent stage compared to North America and Europe. This untapped potential, along with the ongoing expansion of e-commerce infrastructure and growing disposable income in developing economies within the region, presents substantial opportunities for growth. Key players are focusing on innovative business models, strategic partnerships, and targeted marketing campaigns to capitalize on these opportunities and enhance market penetration. Further research should investigate the impact of macroeconomic factors, changing lifestyles, and technological innovations on the overall market trajectory.

The home furniture rental market is experiencing significant growth, driven by evolving consumer preferences and economic factors. The market size, currently estimated at several billion dollars, is projected to reach tens of billions of dollars by 2033. This robust expansion reflects a shift away from traditional homeownership models and a growing preference for flexible, subscription-based services. The historical period (2019-2024) saw steady growth, accelerated by the pandemic-induced surge in remote work and relocation. The base year of 2025 reveals a consolidated market landscape, with key players solidifying their positions and smaller players facing increased competition. The forecast period (2025-2033) anticipates continued expansion, fueled by factors such as increasing urbanization, rising rental costs, and the growing popularity of the sharing economy. This report analyzes market trends across various segments, including bed frames, couches, dining room tables, and other furniture categories. The analysis further differentiates between e-commerce and brick-and-mortar distribution channels, offering a comprehensive understanding of market dynamics. This dynamic market exhibits a notable preference for convenience and affordability, with consumers increasingly valuing the flexibility of renting over purchasing furniture, particularly among younger demographics. The market also shows the growing significance of environmentally conscious consumption, as renting reduces the overall environmental impact compared to constant purchasing and disposal of furniture. The analysis further dives into the impact of technological advancements on rental platforms and consumer experience, revealing a preference towards user-friendly mobile applications and seamless delivery services. Finally, the study pinpoints regional variations in adoption rates and consumer behavior, providing actionable insights for industry stakeholders.

Several key factors are driving the growth of the home furniture rental market. Firstly, the rising cost of homeownership and increasing rental costs are pushing consumers to explore more affordable alternatives. Renting furniture allows individuals to furnish their homes without the significant upfront investment required for purchasing. Secondly, the increasing popularity of the sharing economy and subscription-based services aligns perfectly with the convenience and flexibility offered by furniture rental. Consumers appreciate the ease of accessing furniture on demand, without the hassle of assembly, transportation, and disposal. Thirdly, the growing urban population, especially in densely populated areas, finds furniture rental a practical solution due to limited storage space and ease of mobility. The ability to easily change furniture according to changing needs or lifestyles is a significant draw. Fourthly, demographic shifts, with millennials and Gen Z exhibiting a stronger preference for renting over owning, are significantly impacting market growth. These younger generations value flexibility and experiences over material possessions, driving demand for rental services. Finally, environmental concerns are also contributing to the market's growth as renting promotes a circular economy, minimizing waste and reducing the environmental impact associated with furniture production and disposal. These combined factors indicate a sustained upward trajectory for the home furniture rental sector.

Despite the significant growth potential, the home furniture rental market faces several challenges. One major constraint is the potential for damage or wear and tear to rented furniture, leading to increased costs for repair or replacement. Implementing robust damage assessment and insurance policies are crucial to mitigate this risk. Another challenge lies in maintaining the quality and aesthetic appeal of rented furniture to compete with the wide variety available for purchase. Regular maintenance, cleaning, and efficient inventory management are necessary to ensure high-quality offerings. Logistics and delivery also pose a significant challenge, particularly for larger and bulkier furniture items. Efficient delivery networks and cost-effective transportation solutions are essential to satisfy customer expectations. Competition from established furniture retailers and emerging players also presents an ongoing hurdle. Differentiation through superior customer service, flexible rental options, and innovative technology are necessary to maintain a competitive edge. Finally, fluctuating material costs and supply chain disruptions can impact the rental business's profitability and operational efficiency, requiring agile inventory management and strategic sourcing. Addressing these challenges is critical to realizing the market's full growth potential.

The North American market, particularly the United States, is currently a dominant player in the home furniture rental market, showcasing high adoption rates and a mature consumer base familiar with the convenience of renting. However, emerging markets in Asia and Europe are showing significant growth potential due to increasing urbanization and changing consumer lifestyles. Within the segments, the "Couches" segment is projected to dominate due to its high demand and relatively high rental price points, contributing significantly to overall market revenue. E-commerce platforms are also expected to lead in terms of application, offering greater convenience and accessibility for consumers, resulting in increased market penetration.

The paragraph below further explains why Couches and E-Commerce are dominant: Couches are a staple in any home, requiring frequent replacement or upgrades, making renting an attractive proposition. The e-commerce application offers unparalleled convenience, enabling consumers to browse and select furniture from the comfort of their homes, completing the entire process online, from selection to delivery and returns. This streamlined experience contributes greatly to the segment’s market share, especially amongst younger demographics who value convenience and digital transactions.

Several factors are catalyzing growth in the home furniture rental industry. The increasing adoption of flexible living arrangements, coupled with the rising costs of homeownership and traditional furniture purchases, is significantly contributing to market expansion. Furthermore, the rising popularity of subscription-based services and the convenience they offer aligns perfectly with consumer demand for hassle-free furniture acquisition. Finally, growing environmental consciousness and the desire to minimize waste are driving adoption of sustainable furniture rental alternatives.

This report provides a comprehensive analysis of the home furniture rental market, offering a detailed overview of market size, growth trends, key players, and future projections. The research delves into various market segments and applications, providing insights into regional variations and emerging trends. The report also analyzes the competitive landscape, highlighting the strategies employed by major players and identifying opportunities for new entrants. The information presented in this report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CORT, Furlenco, Rentmojo, Churchill Furniture Rental, Brook Furniture Rental, American Furniture Rentals, Arenson, JMT, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Home Furniture Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Furniture Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.