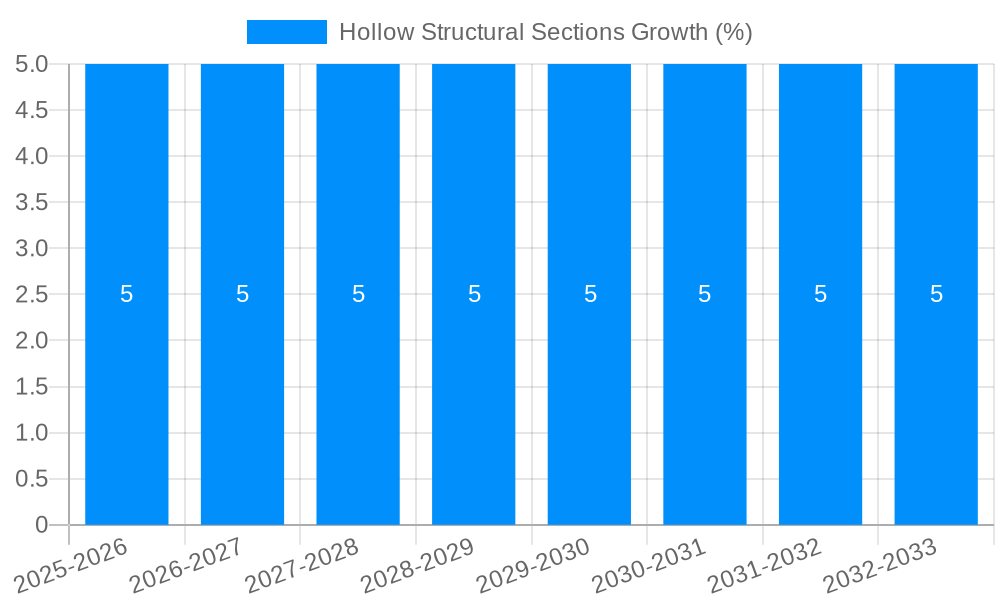

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hollow Structural Sections?

The projected CAGR is approximately 5.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hollow Structural Sections

Hollow Structural SectionsHollow Structural Sections by Type (Square, Rectangular, Round, Others), by Application (Building, Bridge, Infrastructure, Mechanical Equipment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

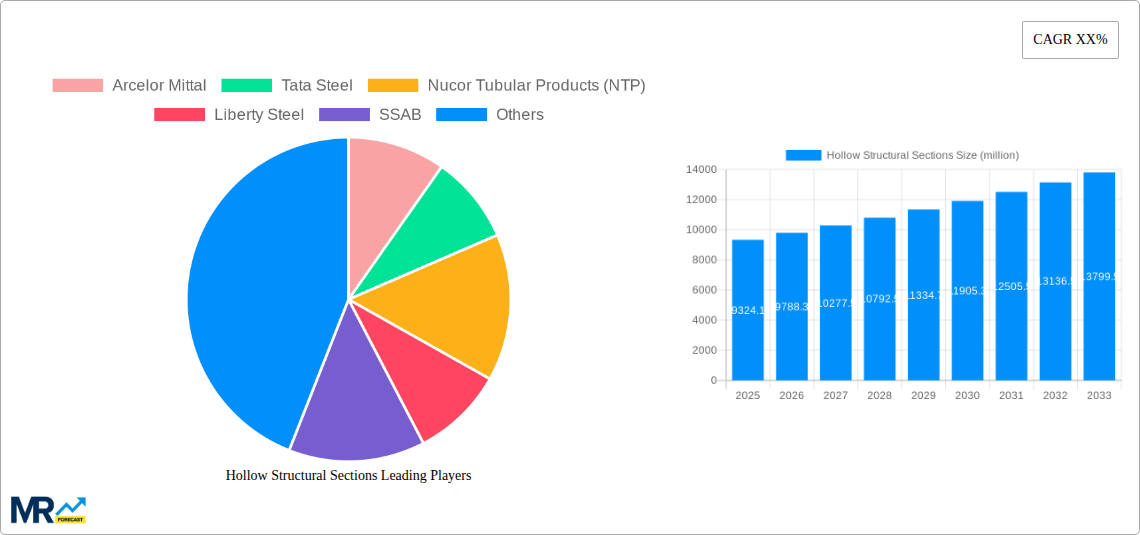

The global Hollow Structural Sections (HSS) market, valued at approximately $10.32 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction industry, particularly in developing economies experiencing rapid urbanization, significantly boosts demand for HSS in building frameworks, bridges, and infrastructure projects. Furthermore, the increasing adoption of HSS in mechanical equipment manufacturing, owing to its high strength-to-weight ratio and versatility, contributes to market growth. Technological advancements in HSS production, leading to improved efficiency and cost-effectiveness, also play a crucial role. While material price fluctuations and potential supply chain disruptions pose some challenges, the long-term outlook for the HSS market remains positive, supported by sustained infrastructure development globally and the expanding application base.

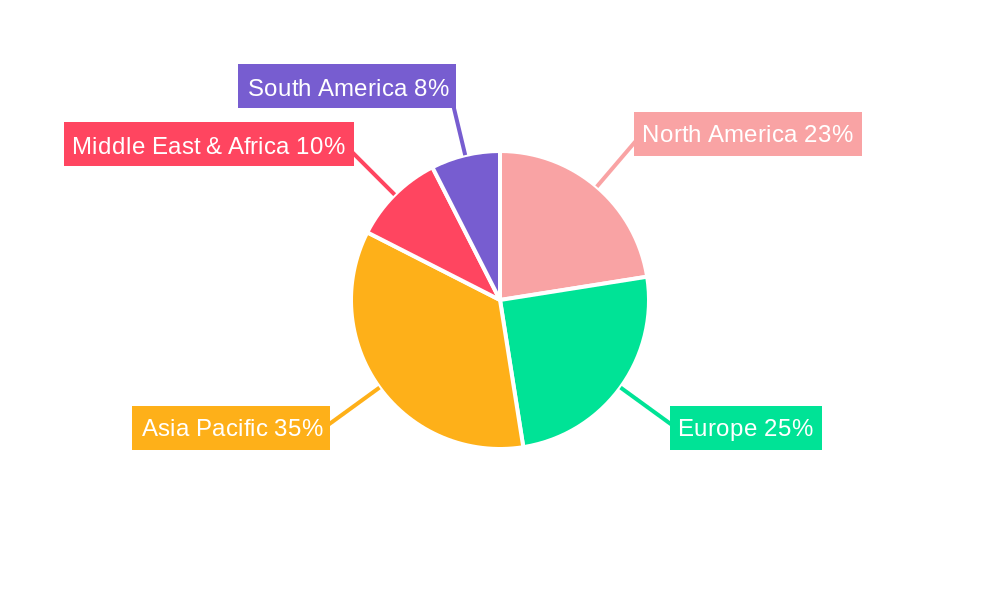

Segment-wise analysis reveals that rectangular and square HSS sections dominate the market due to their widespread use in construction applications. However, the round HSS segment is also experiencing significant growth due to increasing use in mechanical equipment and pipeline infrastructure. Geographically, Asia-Pacific, particularly China and India, are major consumers of HSS, driven by massive infrastructure projects and industrial development. North America and Europe also represent substantial markets, though their growth rates are expected to be slightly moderated compared to Asia-Pacific. The competitive landscape is characterized by a mix of large multinational corporations and regional players, with intense competition based on price, quality, and innovation. The market is anticipated to witness further consolidation through mergers and acquisitions in the coming years.

The global hollow structural sections (HSS) market exhibits robust growth, driven by escalating construction activities worldwide and increasing demand across diverse sectors. Over the study period (2019-2033), the market witnessed a significant expansion, with the consumption value exceeding several billion units. The base year 2025 saw an estimated consumption value of X million units, projected to further increase to Y million units by 2033. This growth is largely attributed to the inherent advantages of HSS, such as high strength-to-weight ratio, superior durability, and ease of fabrication, making them a preferred choice for various applications. The market is characterized by diverse product types, including square, rectangular, round, and other specialized sections, each catering to specific needs. Rectangular HSS, due to their versatility and design flexibility, currently hold a dominant market share, followed closely by square HSS. The construction sector remains the primary consumer of HSS, with significant contributions from building projects (residential and commercial), bridge construction, and infrastructure development. However, expanding applications in mechanical equipment and other specialized industries are steadily increasing market diversification and overall consumption. The forecast period (2025-2033) anticipates continued growth, fueled by infrastructure development initiatives in emerging economies and the increasing adoption of HSS in high-rise buildings and complex structures. The historical period (2019-2024) provides a valuable benchmark for understanding the market's trajectory and anticipating future trends. Competitive intensity is high, with several major players shaping the market dynamics through strategic expansions, technological advancements, and product diversification.

Several factors contribute to the significant growth of the hollow structural sections market. The burgeoning construction industry globally, driven by urbanization and infrastructure development, is a primary growth driver. Governments worldwide are investing heavily in infrastructure projects, including roads, bridges, and railways, which significantly increases demand for HSS. The inherent strength and lightweight nature of HSS contribute to cost savings in material usage and transportation, making them economically attractive for large-scale construction projects. Furthermore, the ease of fabrication and welding of HSS simplifies construction processes, reducing project timelines and labor costs. The increasing adoption of HSS in high-rise buildings and complex architectural structures also contributes to market growth. HSS's ability to withstand high loads and resist seismic forces makes them ideal for these applications. Beyond construction, the expanding manufacturing sector, particularly in automotive, machinery, and energy, fuels the demand for HSS in mechanical equipment and industrial applications. Technological advancements in HSS manufacturing processes have also played a role, leading to improved quality, higher precision, and enhanced performance characteristics. Finally, the growing awareness of sustainable construction practices further supports the adoption of HSS due to their recyclability and potential for reducing environmental impact compared to other materials.

Despite the significant growth potential, the hollow structural sections market faces certain challenges. Fluctuations in raw material prices, primarily steel, significantly impact the production cost and profitability of HSS manufacturers. Steel prices are influenced by global market dynamics, economic conditions, and geopolitical factors, creating uncertainty for businesses. Furthermore, intense competition among numerous HSS manufacturers globally leads to price pressures and reduced profit margins. The market is characterized by a wide range of players, both large multinational corporations and smaller regional producers, creating a competitive landscape. Stringent safety and quality standards necessitate significant investments in manufacturing facilities and quality control measures, adding to operational costs. Moreover, the transportation and handling of HSS can be challenging due to their size and weight, leading to logistical complexities and increased transportation costs, especially for long-distance shipments. Finally, the potential for corrosion in certain environments necessitates the use of protective coatings, which adds to the overall cost of the product and may affect the overall budget for various projects.

Segments:

Rectangular HSS: This segment holds the largest market share due to its versatility in design and applications. Its adaptability to various structural configurations makes it the preferred choice for many construction and industrial projects. The projected growth rate for rectangular HSS is significantly higher than other types, indicating a continuing dominance in the market.

Building Applications: The construction industry is the primary consumer of HSS, and within this, the building segment constitutes the most significant portion of the market. The increasing construction of high-rise buildings and large-scale commercial projects fuels this segment’s considerable growth.

Regions/Countries:

China: China's massive infrastructure development projects and rapid urbanization drive significant demand for HSS. The country's robust steel production capacity further strengthens its position as a key market.

India: India's expanding construction and industrial sectors, fueled by economic growth, contribute significantly to the increased demand for HSS. Similar to China, India's robust infrastructure development projects create substantial opportunities for HSS manufacturers.

United States: The US market benefits from a strong construction sector and the presence of several major HSS producers. Investment in infrastructure modernization and ongoing residential construction continue to drive demand.

Paragraph: The rectangular HSS segment is projected to maintain its market dominance throughout the forecast period due to its design flexibility and versatility. Among regions, China, India, and the United States are expected to remain key markets, driven by substantial infrastructure projects, robust economic growth, and strong construction activity. The combined effect of high demand in these regions and the increasing preference for rectangular HSS positions these segments at the forefront of the global market, exhibiting the highest growth rate and consumption value.

Several factors are accelerating the growth of the HSS industry. Firstly, government initiatives focusing on infrastructure development and sustainable construction practices are boosting demand. Secondly, the rising adoption of HSS in high-rise buildings and complex structures, due to their strength and design flexibility, contributes to market expansion. Thirdly, technological advancements in HSS manufacturing, leading to higher precision and improved quality, enhance market competitiveness. Finally, the increasing use of HSS in various industrial applications beyond construction further drives market growth.

This report provides a comprehensive analysis of the global hollow structural sections market, covering market size, segmentation, trends, growth drivers, challenges, and key players. The report offers detailed insights into the historical, current, and future market dynamics, including detailed forecasts up to 2033. It also provides in-depth analysis of regional and country-level market trends, allowing businesses to make informed strategic decisions. The report includes a competitive landscape analysis, profiling key players in the market and their respective strategies. This provides a holistic understanding of the industry's current state and its projected future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Arcelor Mittal, Tata Steel, Nucor Tubular Products (NTP), Liberty Steel, SSAB, CELSA Group, APL Apollo, Nippon Steel, Tianjin Yuantai Derun Pipe, Tianjin Youfa International, Nakajima Steel Pipe (NSP), Stalatube, Viohalco, Changsha Hunan Steel, Bull Moose Tube (Caparo), Qatar Steel, Nova Steel, Handan Zhengda Steel Pipe (ZDP), Welded Tube, Maruichi Leavitt Pipe & Tube, Atlas Tube (Zekelman Industries), JF Engineering Products, HISTEEL, Alpine Pipe, Barrett Steel, TSI Metal Industries, Tianjin Baode Steel Pipe, Jindal Steel Tubes, Intercom Group, Hebei Metal Trading.

The market segments include Type, Application.

The market size is estimated to be USD 10320 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hollow Structural Sections," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hollow Structural Sections, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.