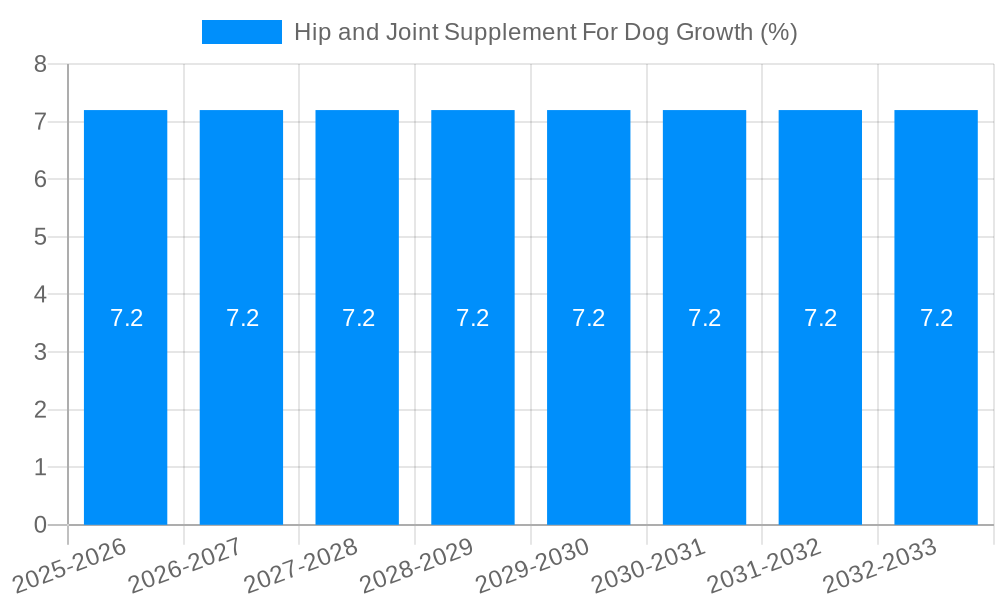

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hip and Joint Supplement For Dog?

The projected CAGR is approximately 7.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hip and Joint Supplement For Dog

Hip and Joint Supplement For DogHip and Joint Supplement For Dog by Type (Biscuits, Soft Treats, Chewable Tablets, Others), by Application (Adult Dog, Puppy), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

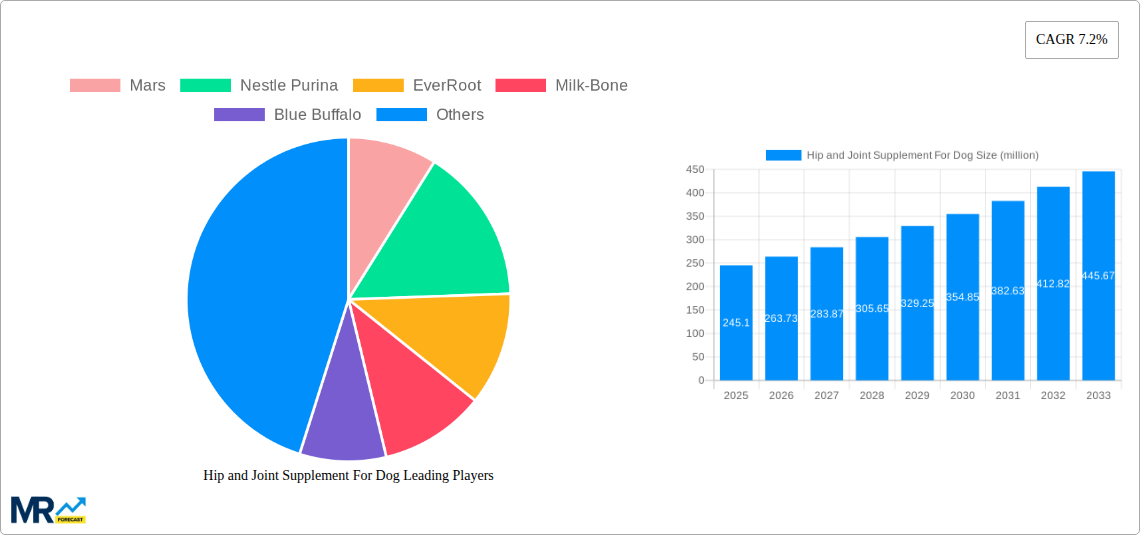

The global Hip and Joint Supplement for Dogs market is experiencing robust growth, projected to reach an estimated USD 245.1 million in 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 7.2% over the forecast period of 2025-2033, indicating a dynamic and expanding industry. A primary driver of this growth is the escalating pet humanization trend, where owners increasingly view their canine companions as integral family members and are willing to invest in their health and well-being. This translates into a greater demand for preventative and therapeutic supplements aimed at maintaining mobility and alleviating discomfort associated with aging, breed predispositions, or injuries. The rising awareness among pet owners about the benefits of joint supplements, coupled with the availability of diverse product formulations catering to specific needs, further propels market penetration.

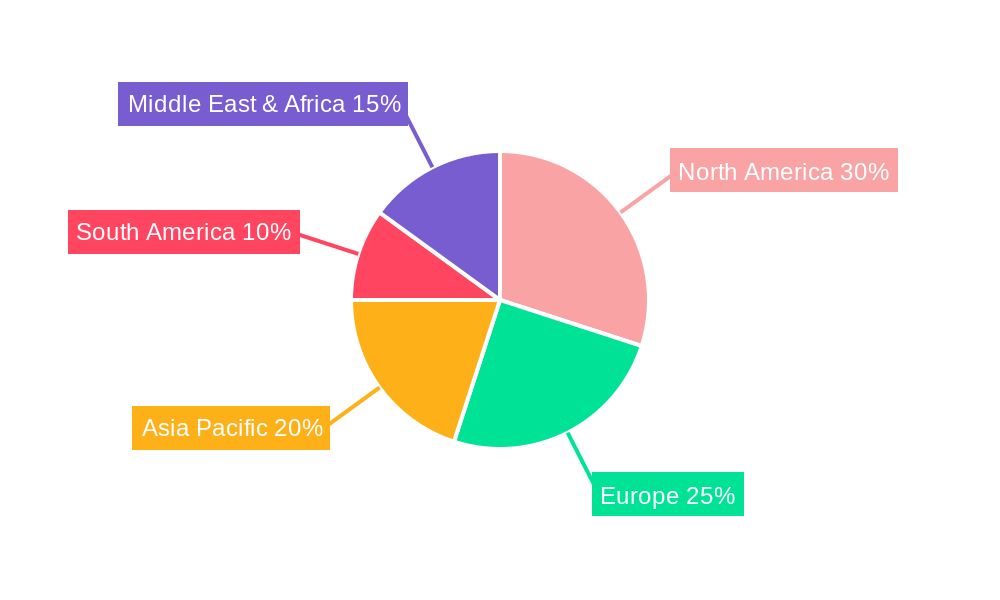

The market is segmented by product type, with Biscuits and Soft Treats likely holding a significant share due to their palatability and ease of administration, appealing to both dogs and owners. Chewable Tablets also represent a substantial segment, offering precise dosages and specific active ingredients. The application landscape is dominated by Adult Dogs, as this demographic is more prone to joint issues. However, the Puppy segment is also demonstrating considerable growth potential as owners seek to establish strong joint health from an early age. Geographically, North America is expected to lead the market, driven by high disposable incomes, a large pet population, and a proactive approach to pet healthcare. The Asia Pacific region is poised for significant expansion, attributed to a rapidly growing pet ownership base and increasing consumer spending on premium pet products. Key players like Mars, Nestle Purina, and Blue Buffalo are actively innovating, expanding their product portfolios, and focusing on strategic partnerships to capture market share in this thriving sector.

Here's a unique report description for a Hip and Joint Supplement for Dogs market report, incorporating your specified elements:

The global Hip and Joint Supplement for Dog market is experiencing robust and sustained growth, driven by an intensifying pet humanization trend and increasing owner awareness regarding canine health and longevity. XXX, the market is projected to witness a significant upward trajectory, with a projected market valuation reaching over $3,000 million by the end of the forecast period in 2033. This expansion is underpinned by several key insights. Firstly, the rising prevalence of age-related joint issues and orthopedic conditions in dogs, mirroring human aging patterns, is compelling owners to proactively invest in preventative and therapeutic solutions. This shift from a reactive to a proactive approach to pet healthcare is a monumental trend. Secondly, the burgeoning e-commerce landscape has democratized access to a wider array of specialized pet supplements, allowing consumers to easily research and purchase products from both established global players and emerging niche brands. This accessibility has fueled market penetration, especially in regions with a strong digital infrastructure. Thirdly, there's a discernible move towards premiumization, with pet owners increasingly willing to spend on high-quality, scientifically formulated supplements that offer superior efficacy and are made with natural, traceable ingredients. This includes a growing demand for supplements that address not just mobility but also overall well-being. Furthermore, the continuous innovation in product formulations, such as palatable chewables and easily digestible soft treats, is enhancing consumer adoption and adherence. The market is also seeing a growing interest in breed-specific or condition-specific formulations, catering to a more personalized approach to canine joint health. The historical period (2019-2024) laid a strong foundation for this growth, with a consistent upward trend, and the estimated year of 2025 is anticipated to be a pivotal point for sustained acceleration, setting the stage for the extensive forecast period of 2025-2033. The industry is evolving beyond basic glucosamine and chondroitin, incorporating novel ingredients like MSM, hyaluronic acid, and omega-3 fatty acids, further differentiating products and attracting a discerning customer base.

Several potent driving forces are fueling the expansion of the Hip and Joint Supplement for Dog market. The most significant contributor is the ever-increasing pet humanization phenomenon, where dogs are viewed as integral family members. This profound emotional connection translates into a willingness among owners to invest substantially in their pets' health and well-being, mirroring the healthcare choices they make for themselves. Consequently, proactive and preventative healthcare, including joint supplements, has become a cornerstone of responsible pet ownership. Another crucial driver is the growing awareness and education surrounding canine joint health. Veterinary professionals and pet health advocates are actively promoting the benefits of early intervention for conditions like osteoarthritis and hip dysplasia, educating owners about the long-term advantages of supplementation. This increased knowledge empowers pet parents to make informed decisions. Furthermore, the aging pet population is a substantial factor. As veterinary care advances and nutrition improves, dogs are living longer, healthier lives, which unfortunately increases the likelihood of age-related joint issues. This demographic shift directly boosts the demand for supplements designed to manage pain, improve mobility, and enhance the quality of life for senior dogs. The development of innovative and palatable product formats also plays a vital role, making it easier for owners to administer supplements consistently and ensuring better compliance.

Despite the promising growth, the Hip and Joint Supplement for Dog market is not without its challenges and restraints. One significant hurdle is the lack of stringent regulatory oversight for dietary supplements in many regions. This can lead to variability in product quality, efficacy, and labeling accuracy, making it difficult for consumers to discern between reputable and less trustworthy brands. This regulatory ambiguity can also foster skepticism and hesitation among some pet owners. Another challenge is the perceived high cost of premium joint supplements. While owners are increasingly willing to spend, budget constraints can still be a limiting factor for a segment of the market, especially in price-sensitive economies. The availability of counterfeit or substandard products in the market further exacerbates this issue, potentially harming pets and eroding consumer trust in the entire category. Furthermore, educating pet owners about the proper usage and expected outcomes of joint supplements remains an ongoing effort. Misconceptions about instant results or overreliance on supplements without addressing underlying issues can lead to disappointment and reduced repeat purchases. The competition from generic or over-the-counter pain relief medications for dogs, while not always directly comparable in terms of long-term joint health benefits, can also present a challenge by offering a seemingly cheaper or more immediate solution for some owners. Finally, supply chain disruptions and ingredient sourcing complexities, amplified by global events, can impact product availability and manufacturing costs, posing a restraint on consistent market supply.

The Hip and Joint Supplement for Dog market is poised for dominance by specific regions and product segments, showcasing distinct growth patterns within the projected market valuation of over $3,000 million by 2033.

Dominant Region/Country:

Dominant Segment:

The interplay between these dominant regions and segments, fueled by the overall market growth driven by pet humanization and increased health awareness, paints a clear picture of where the Hip and Joint Supplement for Dog market will see the most significant activity and revenue generation through 2033.

Several potent growth catalysts are propelling the Hip and Joint Supplement for Dog industry forward. The escalating pet humanization trend, where dogs are treated as family members, is the primary catalyst, driving owners to invest more in their pets' health and longevity. This is complemented by increasing veterinary recommendations and owner education regarding the benefits of early intervention for joint health issues. The aging global pet population, leading to a rise in age-related mobility problems, directly translates into higher demand for effective supplements. Furthermore, continuous product innovation in terms of palatability, efficacy, and natural ingredient inclusion is enhancing consumer adoption and satisfaction.

This comprehensive report offers an in-depth analysis of the Hip and Joint Supplement for Dog market, providing invaluable insights for stakeholders. It meticulously examines market size and trends, projecting valuations to exceed $3,000 million by 2033. The report details the driving forces behind this growth, including pet humanization, increased health awareness, and an aging pet population, while also addressing the challenges such as regulatory ambiguity and cost perceptions. Key regional and segment analyses highlight the dominant markets and product types, offering strategic guidance. Furthermore, it identifies significant growth catalysts and provides a detailed overview of leading industry players and their recent developments, ensuring readers have a holistic understanding of the current landscape and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.2%.

Key companies in the market include Mars, Nestle Purina, EverRoot, Milk-Bone, Blue Buffalo, VetIQ, JPK Nutri, maxxipaws, Unicharm, OSCAR Pet Foods, Affinity Petcare, MoonShine, Yantai China Pet Foods, GREENIES, Wagg, Petpal Tech, DogKind, Pet Treats, Pet Chews, .

The market segments include Type, Application.

The market size is estimated to be USD 245.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Hip and Joint Supplement For Dog," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hip and Joint Supplement For Dog, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.